BNB Spot ETF: A new gateway as BNB Chain evolves

After the US Securities and Exchange Commission (SEC) approved spot exchange-traded fund (ETF) products based on Bitcoin (BTC) and Ethereum (ETH) in 2024, a flurry of new altcoin ETF applications emerged in early 2025. Many prominent asset management firms are vying for the approval of their ETF products, based on coins like XRP (XRP), Solana (SOL), Avalanche (AVAX) and others. Even some smaller-cap meme coins, specifically Pudgy Penguins' PENGU, have joined the SEC's ETF waiting list.

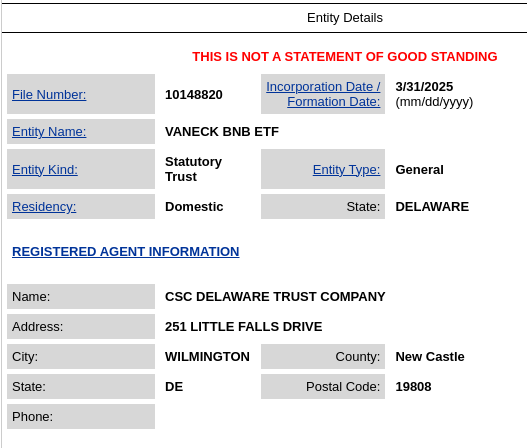

Given that most top cryptos already have their ETF applications filed with the country's financial regulator, it's little surprise that BNB Chain's BNB coin, the fifth-largest cryptocurrency by market capitalization, has joined the bandwagon. In late March 2025, the New York–based global investment management giant VanEck registered a trust entity named VanEck BNB ETF in the US state of Delaware. The registration is an early sign that the acclaimed investment manager is planning to lodge a BNB ETF application with the SEC.

If approved, it will be the first US-based BNB ETF product on the market, likely leading to significant growth within BNB Chain's already well-established ecosystem.

Key Takeaways:

A BNB Spot ETF is an exchange-traded fund product based on tracking the price of BNB coin, the native cryptocurrency of BNB Chain.

As of mid-April 2025, there's not yet an approved BNB ETF on the market. Investment management firm VanEck has recently registered a BNB ETF trust in the US state of Delaware, and plans to lodge a full application for the ETF's approval with the SEC.

What is a BNB Spot ETF?

On Mar 31, 2025, one of the leading asset managers in the world, VanEck, registered a trust named VanEck BNB ETF in the US state of Delaware. This is the strongest imaginable indicator that the company plans to subsequently launch an application with the SEC for the ETF’s approval. If approved by the regulator, the product will be the first spot ETF in the US to track BNB coin. As of the time of this writing (Apr 23, 2025), VanEck hasn't formally applied with the SEC, but this step is likely imminent.

Following the SEC filing, BNB coin will join a long list of other leading cryptocurrencies whose spot ETF applications have been lodged with the US regulator. Over the past few months, the SEC has received spot ETF applications for Solana, Cardano (ADA), Litecoin (LTC), XRP, Dogecoin (DOGE), Avalanche, Polkadot (DOT) and several other cryptos.

How would a BNB Spot ETF work?

The VanEck BNB Spot ETF will track BNB coin, allowing holders to invest in the asset without directly holding it. While BNB is among the most popular assets in the crypto market, many investors are eschewing it and other cryptocurrencies due to their unregulated nature. Upon approval, the ETF product would be available for trading on regulated stock exchanges.

The exact composition of a crypto ETF product is usually unknown before its application is filed with the SEC. Therefore, we can assume that at this stage the ETF will be based entirely upon tracking BNB coin. Any additional components, such as minor holdings of other assets such as cash equivalents, could theoretically be included, but this will only be known upon VanEck’s formal application to the SEC.

VanEck itself is among the leading ETF issuers in the finance industry and is a pioneer of crypto ETFs. The firm already offers approved Bitcoin ETFs and Ethereum ETFs, and has filed applications with the SEC for spot ETFs based on several other cryptocurrencies, including a Solana ETF and an Avalanche ETF.

Current landscape of BNB Spot ETFs

Currently, there’s no ETF in the US based on the BNB coin. In that respect, VanEck’s registration is the first serious effort to introduce such a product. Internationally, there is one exchange-traded product (ETP) that tracks BNB — the 21Shares Binance BNB ETP (ABNB), listed on the Swiss Stock Exchange. This ETP is offered by 21Shares, a leading digital asset management firm based in Zurich, Switzerland.

However, this product isn’t an ETF. ETPs are a broader category of exchange-traded instruments, of which ETFs are one type. ETPs may be based on various assets, such as stocks, bonds, commodities or cryptocurrencies. However, ETFs often offer better liquidity, lower fees and greater tax efficiency than other types of ETPs.

In short, despite the presence of the ABNB ETP on the market, the BNB ETF landscape remains an empty niche, as the 21Shares product isn’t a full-fledged ETF and has no regulatory approval in the US.

Current impact of BNB ETF applications on the crypto market

VanEck’s BNB ETF application — or, to be precise, its registration in Delaware — has so far had no immediate impact on the coin’s market price. In fact, BNB coin is currently trading at $615.68, barely different from its price of $600 in the early days of April when news of the ETF’s registration first surfaced.

BNB is a major cryptocurrency featuring at least one billion dollars in daily trading volumes. The news of VanEck's initiative is unlikely to seriously affect BNB’s price. However, if the ETF ultimately gains approval from the SEC, such a development may have a significant positive impact on the crypto's future price.

What will it mean if a Spot BNB ETF application is approved?

If the SEC approves the Spot BNB ETF, it will likely lead to higher demand for BNB coin — as demand from investors for the product rises, VanEck will need to source more BNB to back its ETF shares. This increased demand would push the price of BNB higher. As noted above, BNB is one of the market's largest cryptos and features substantial trading volumes. Therefore, it's unlikely that a Spot BNB ETF would cause drastic rises in the coin’s price. However, a certain positive price effect is a safe bet, and the magnitude of the effect will be directly related to the popularity of the ETF among investors.

Additionally, the ETF will improve the visibility of the BNB ecosystem, potentially leading to more decentralized applications (DApps) and projects launched on its blockchain.

The bottom line

If approved by the SEC, the Spot BNB ETF by VanEck would usher in a new era for the coin. For the first time ever, BNB as a financial asset would become available through the regulated environment of US stock exchanges. This would not only help support the coin’s price and expand the chain’s ecosystem, but would also be a major reputational gain for Binance, the world’s largest crypto exchange and the corporate entity behind BNB Chain.

Over the years, Binance has had its fair share of troubles and arguments with US regulators. A fully approved spot ETF based on Binance’s own coin would, therefore, send a signal to the crypto market that the major components of the Binance ecosystem — BNB crypto, BNB Chain’s blockchain and the Binance crypto exchange — aren’t as risky to deal with as some Americans may believe.

#LearnWithBybit