How to Set Up a Cryptocurrency Wallet

Cryptocurrency wallets, such as a Bitcoin wallet, function quite differently from traditional cash wallets. For instance, crypto wallets have to account for the fact that all transactions are irreversible and stored entirely in the blockchain. To encrypt your transactions on the blockchain and keep them secure, you need a public and a private cryptography key. Wallets use both keys to access your digital currency.

This also begs the question: Is a crypto wallet more secure?

In this guide, we’ll cover different types of crypto wallets, how to set up a secure crypto wallet, and top crypto wallets to choose from. However, depending on your security and liquidity needs, some wallets may suit you better than others. We’ll pull out the top wallets from each category to point you in the right direction.

What Is a Crypto Wallet?

A crypto wallet stores both private and public cryptography keys used to interact with the blockchain network.

In simple terms, a crypto wallet is how you secure, store, and move your crypto from one place to another. The term is can be misleading since your currency is not actually kept in the wallet itself. However, your stored private key signs transactions, while your public key is used to receive funds and identify your account.

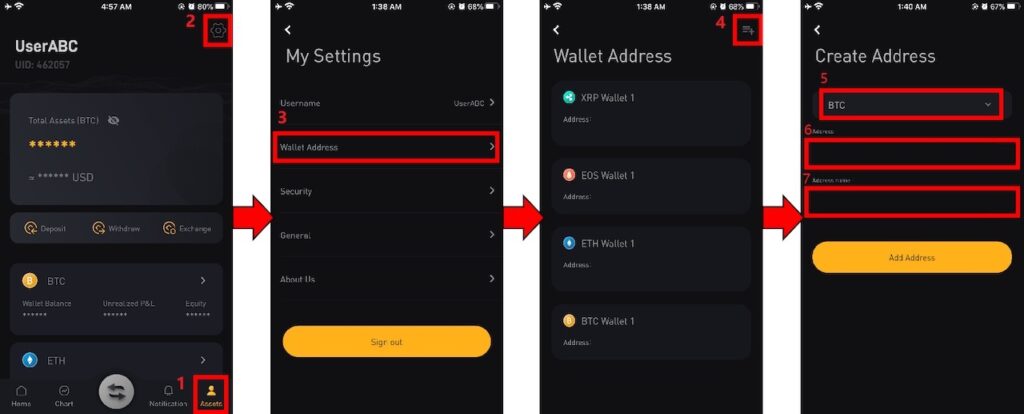

Crypto wallets have a user interface so you can check available funds, monitor past transactions, and identify security options.

For example, you can choose to deposit or withdrawl different digital assets including BTC, ETH, XRP and more on Bybit’s crypto wallet.

Choosing the Right Wallet

The type of crypto wallet you choose determines the safety, security, and liquidity of your funds. Depending on how you use your crypto — as an investment tool, for day trading, or as currency — some wallets will serve you better than others. Additionally, certain wallets are designed for specific digital currencies, while others can host hundreds of options.

Hardware Wallet

Image Source CC: Ledger Nano XHardware wallets are physical devices, similar to USB drives, that let you interact with the blockchain. Since data is stored offline, hardware wallets are considered “cold wallets” with the most secure form of storage.

Excellent for: Long-term investors; those interested in security; high-net-worth crypto users

Pros:

- Protection against computer viruses that target software wallets

- Open-source software (usually)

- Private keys, stored in a protected area, that can’t be transferred in plaintext

Cons:

- More expensive than other options

- Comes with a learning curve

The Ledger Nano X is a type of hardware wallet that’s become a bit of a “gold standard” in secured crypto transactions. It supports over 1,300 crypto assets, works on all major desktop and mobile systems, and comes with top-tier security. However, it’s not cheap — a single Ledger Nano X wallet can run up to $160–$200 each.

How to set up a hardware wallet:

- Decide on a hardware wallet. The two most well-known brands are Ledger and Trezor.

- Setup the software. Either Ledger or Trezor has their unique ways of setting up the wallet. All you need is to follow the step-by-step instruction. In case it doesn’t work, try contacting the helpline or look for their FAQ.

- Transfer crypto to your hardware wallet. These wallets usually only support the transfers of crypto-to-crypto.

Hosted Wallet/Hot Wallet

Hosted wallets, sometimes called hot wallets or cloud wallets, are the easiest beginner wallets to use because they require little to no additional effort. When you buy digital currency from a crypto exchange, the system automatically creates a wallet for you. This is the easiest version of a hosted wallet to use.

You can also transfer your crypto into an online wallet from a non-exchange service, like MyEtherWallet or Exodus. These tend to be more secure than an exchange-hosted wallet and are also available anywhere you can access the internet. However, the one drawback is you can’t access everything crypto has to offer.

Best for: Traders who are actively trading coins, users who deposit and withdraw frequently.

Pros:

- High liquidity for use on exchanges

- User-friendly and suitable for beginners

- Usually are free

Cons:

- Less secure than other options

- Exchanges can be hacked

- Non-exchange wallets are targets for phishing scams

- You either don’t own your private keys, or they’re stored on your computer

How to set up a hosted wallet:

- Choose a platform. Considers the ease of use, accessibility, compliance with financial regulations, and security.

- Create your account. Complete your KYC and set up two factor authentification (2FA).

Buy or transfer crypto. Most crypto platforms and exchanges allow you to buy crypto using a bank account or credit card. For example, you can buy crypto via XanPool or MoonPay on Bybit and it’ll be deposited in the hosted wallet.

Desktop Wallet

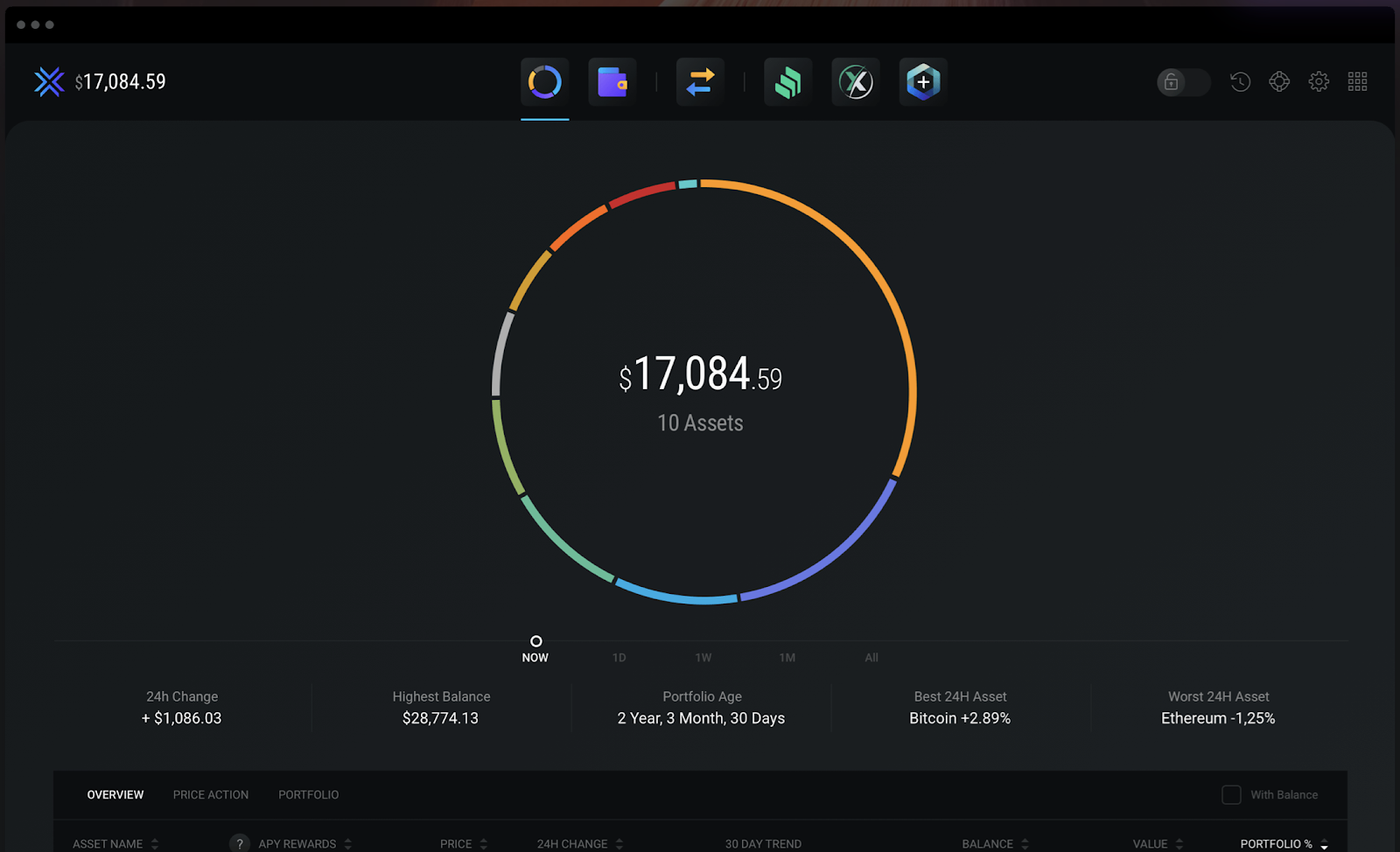

Image Source CC: exodus.comDesktop wallets, like hosted wallets, are a type of software wallet. They’re accessible through custom software tied to a specific coin (often developed by the same team).

Compared to other software wallets, desktop wallets offer the most security, though they’re not infallible.

Best for: Those who want both accessibility and security

Pros:

- Easier to use than hardware wallets

- Software is desktop accessible (i.e., no extra hardware required)

Cons:

- Less secure than a hardware wallet

- Need to ensure your desktop has comprehensive antivirus protection

Exodus is a highly rated desktop software wallet suitable for beginners, although Exodus has mobile and hardware crypto wallets as well. The Exodus desktop wallet supports over 135 crypto assets and a built-in exchange to trade crypto 24/7.

Mobile Wallet

Mobile wallets, like Mycelium for Bitcoin, are crypto wallets for mobile devices. These run on an app installed on your phone that allows you to send and receive crypto anytime, anywhere.

While mobile wallets do take security measures, they also store your private key in the app. This makes for ease of use — and a quick way to lose your crypto if your phone is hacked or stolen.

Best for: Heavy mobile users; those who want to buy and sell crypto on the go

Pros:

- Relatively secure

- Convenient to access from anywhere

Cons:

- Security means little if your phone is stolen

- Can still fall prey to hackers and malware

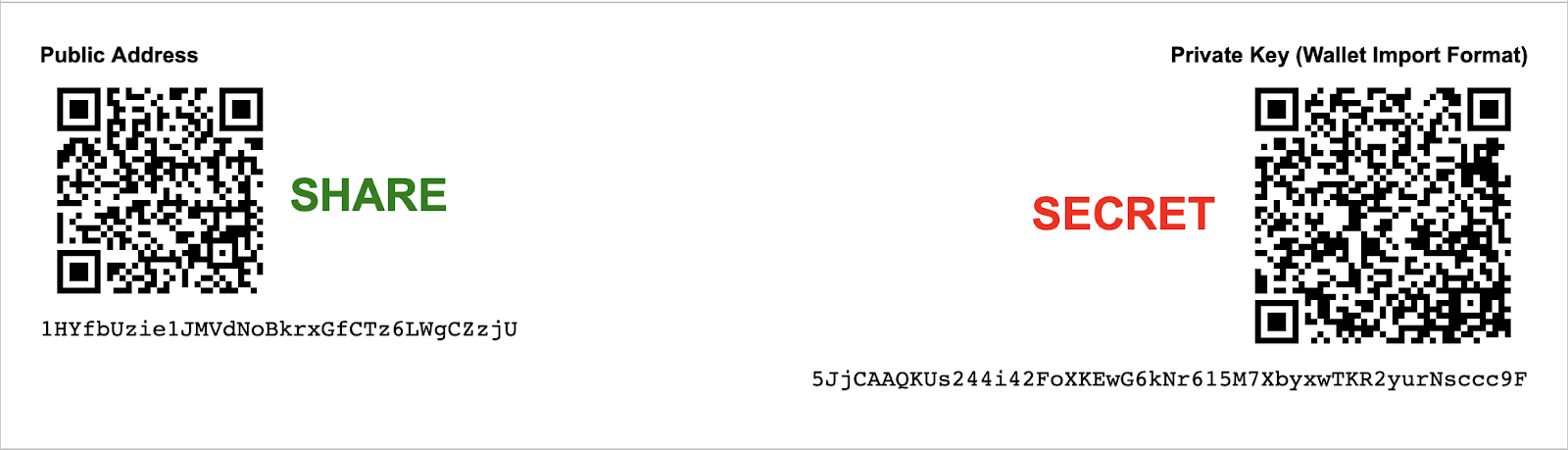

Paper Wallet

Image Source CC: WalletGenerator.netPaper wallets are “cold wallets” created when you store your private key in a secure, offline environment. This literally involves printing your private key onto a piece of paper. Ideally, you’d then store this piece of paper in a locked deposit box or safe.

Paper wallets are the least liquid but most secure (from hackers, anyway) form of crypto wallets. However, if you lose your paper wallet, it’s gone for good — so make two copies, just in case.

Best for: Those who need the utmost security from hackers

Pros:

- Most secure option from hackers and malware

Cons:

- Inconvenient; can still physically be stolen

- Requires a backup in case you lose a key

If you’re interested in adding a paper wallet for extra security, you can download WalletGenerator.net from GitHub to randomly generate your unique private and public keys. Just be sure that once you have your printed wallet (two copies just in case!), store each version in a safe, secure and in separate places.

How to set up a paper wallet:

- Select a trusted platform. They are completely offline, and it isn’t subject to hacking.

- Generate a paper wallet address. You can generate several wallets, but it’s best to start with one first.

- Printing the wallet address. Ensure your printer is private and does not connect to the internet to prevent your private keys from being exposed.

Always make double copies of the address and store it separately if you lost one and still have another.

Custodial vs. Non-Custodial Wallets

The difference between custodial and non-custodial wallets comes down to one simple question: Who is the custodian of your cryptocurrency, the person who holds your private keys — yourself or a third party?

For example, the hosted wallets offered by exchanges count as custodial wallets, because a third party maintains some level of access to your crypto. Hardware wallets, on the other hand, count as non-custodial wallets, since you’re the only one who can access your private keys.

Custodial wallet pros:

- Great for those with poor computer security

- Helpful if you’re prone to forgetting where your keys are

- Some offer returns on crypto savings

Custodial wallet cons:

- You don’t own your private keys

- Someone else holds your money — and some custodians have, in fact, stolen crypto

- Operates on a centralized network, eliminating a major selling point of cryptocurrency

Non-custodial wallet pros:

- You’re in complete control of your digital currency

- The ability to opt into different levels of security

Non-custodial wallet cons:

- Less liquidity than custodial wallets

- If you delete or lose your keys, you lose your cryptocurrency

- Interfaces require a learning curve

Tips to Keep Your Wallet Safe

The security of a cryptocurrency wallet depends on the type of wallet, the service provider, and (in the case of paper wallets and backups) your general forgetfulness. To keep your wallet(s) secure, set up fail-safes such as:

- Backing up your wallet using hardware or cold storage options (that aren’t connected to the internet)

- Store only small amounts of currency in hosted or desktop wallets for everyday use

- Keep your software up-to-date

- Install antivirus, anti-malware and anti-keylogger software on all devices that have access to your crypto wallet and private keys

- Set long, complex passwords

- Authorize two-factor authentication on any devices, websites or apps that have access to your cryptocurrency or private keys

Choose a Crypto Wallet That Works for You

Learning how to set up a crypto wallet is an essential part of owning cryptocurrency. After all, the entire ethos behind crypto is that you control your money, and no one else. That means that if your wallet is the most secure, it’s hard for anyone to skim your funds or seize your account.

Typically, the trade-off when choosing a wallet is between security and ease of use for beginners. Once you become comfortable, you’ll be able to choose the highest form of security.

Congratulations — you’ve just become your own bank, entirely responsible for your cryptocurrency holdings.