Ethereum Shanghai Upgrade: Can ETH Prices Soar Again?

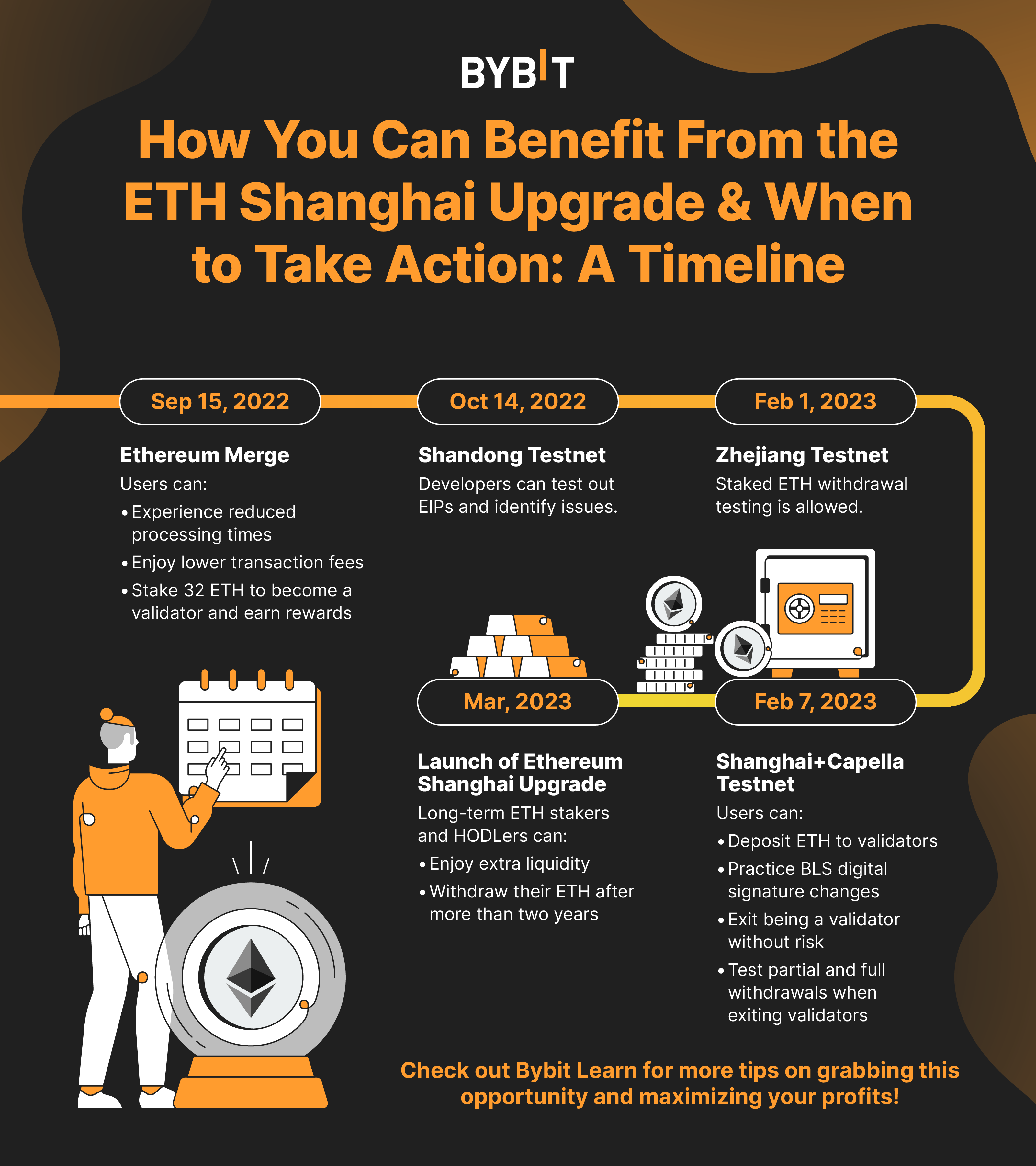

After the momentous Ethereum Merge was flawlessly executed on Sep 15, 2022, the crypto market buzzed with enthusiasm as everyone wondered what was next for Ethereum. Supposedly, Ethereum’s post Merge upgrade schedule was supposed to go along the lines of the Surge, Verge, Purge and Splurge. Recently, Ethereum’s core developers have decided to detour from their original roadmap plans.

Titled the Ethereum Shanghai upgrade, the plan is for developers to include multiple Ethereum Improvement Proposals (EIPs) that will minimize any delays before EIP-4844 launches. Curious about the EIPs that the upcoming Shanghai upgrade will include? Here’s how it’ll change Ethereum for the better in the long run.

What Is the Ethereum Shanghai Upgrade?

The Ethereum Shanghai network upgrade is the next major upgrade for the Ethereum network that core developers have chosen to work on before implementing upgrades related to the Surge. As the Surge is an upgrade path that improves the blockchain’s maximum transactions per second (TPS), Ethereum developers stated that the Shanghai upgrade will ensure minimal delays and issues as they prepare for the Surge upgrade.

Although the Ethereum Shanghai upgrade incorporates multiple EIPs, the headline improvement will be EIP-4895: Beacon Chain Push Withdrawals as Operations. In essence, the proposal grants validators the ability to withdraw staked ETH that’s been deposited into the Beacon Chain since December 2020, when the Beacon Chain was originally introduced. Ultimately, EIP-4895 plans to grant long-term ETH stakers and HODLers extra liquidity as they can finally withdraw their ETH after more than two years of staking with negligible gas fees.

Alongside EIP-4895 are a couple of other EIPs that are also planned to be implemented with the Ethereum Shanghai upgrade. These include:

- EIP-3860: Limit and Meter Initcode – The proposal limits the maximum size of initcode to 49152 and applies an extra 2 gas for every 32-byte chunk of initcode. This essentially solves out-of-gas exceptions on Ethereum.

- EIP-3855: PUSH0 Instruction – This EIP brings a new instruction for the EVM that helps shrink the size of smart contracts and optimizes the contract code.

- EIP-3651: Warm COINBASE – Not to be confused with the similarly named centralized cryptocurrency exchange, this proposal makes block building cheaper and allows for builder-proposer separation. In doing so, gas fees will be cut for network participants and traders using builders to execute their complex trades will no longer have to pay for failed transactions.

When Can Investors Unstake Their ETH?

Ethereum developers are currently planning a Q1 release, with the Shanghai Public Testnet expected to begin in February 2023. At the current rate of development, it seems that all is going according to plan as regular updates have stated March 2023 as the target release time frame.

Why Is Everyone Talking About the Ethereum Shanghai Upgrade?

If the Ethereum Shanghai upgrade is simply a precursor to the much more important Surge upgrade, the average investor might be wondering why there’s so much buzz with regard to its launch. To understand this, it’s key to first grasp what happened in the Ethereum community after the Merge was implemented.

The Issue of Staking ETH

Prior to the implementation of EIP-4895, participating in the staking of ETH was a one-way street. In order to secure an APY staking reward, users had to lock up their ETH for a specific amount of time. As part of the validating process, users had to minimally stake 32 ETH to participate.

For users with less available capital, they could opt for Staking as a Service options or Pooled Staking which streamlined the staking process and opened ETH staking to the masses. As staking ETH became easy and convenient for the average retail crypto investor, this led to the rise of popular staking platforms like Stakewise, Lido and Rocket Pool.

Ultimately, staking ETH was a calculated risk; stakers could earn extra yield at the downside of lowering their liquidity and exposing themselves to the dangers of counterparty risk. Despite not being able to withdraw ETH at the time, many investors took the Ethereum Foundation’s words to heart and trusted that in due time, they would be able to withdraw their deposited ETH from the Beacon Chain.

ETH FUD Arises But Is Quickly Resolved

With the Merge’s implementation, the Foundation began to publicly display a rough timeline that laid out when withdrawing ETH from the Beacon Chain would become possible. Unfortunately, somewhere down the line, these dates got shifted as developers became ambiguous about Ethereum Shanghai upgrade’s exact launch date. This became the basis of the FUD surrounding Ethereum as the Ethereum Foundation was publicly denounced for this shady, non-transparent decision.

To the relief of many ETH bulls and investors, the developers seemed to have pulled through and stuck to their originally planned timeline. The experimental testnet Shandong went live in October 2022 and quelled many rug pull fears as it successfully activated selected Shanghai-related EIPs without a hitch. With staked ETH levels approaching the 16 million mark, it’s safe to say staking ETH will only become more popular over time thanks to the withdrawal flexibility implemented by the Ethereum Shanghai upgrade.

Could ETH Price Soar Again?

Why ETH Could Rally

Staking is a key issue here when discussing the movement of ETH price. With the implementation of the Shanghai network upgrade, our bullish argument would be that we can expect more users to HODL and stake their ETH as adoption rises. This would drive Ethereum’s staking ratio up as users who were previously fearful because they could not withdraw their ETH can now proceed to enjoy additional yield without the downside of lower liquidity. In this regard, we can certainly expect ETH to rise in price as large-scale institutions buy and stake their ETH to earn a respectable APY of about 5% without sacrificing liquidity.

From lowered gas fees to fewer failed transactions, the upcoming Ethereum Shanghai upgrade fixes various nagging issues that have constantly affected users and developers. By getting these fixes in before the big EIP-4844: Proto Danksharding implementation, the Foundation ensures minimal delays as they prepare themselves to ship the Surge update.

Why ETH Could Crash

On the bearish side of things, the crypto market as a whole is still not out of the woods as big institutions continue to out themselves as victims of the Terra Luna and FTX contagion. Macroeconomic factors are also bearish as US inflation still remains far from its 2% target and the Federal Reserve continues to hike interest rates. These factors might pressure original ETH stakers from December 2020 to sell their staked ETH and gain more liquidity so the rest of their portfolio can stay afloat during the crypto bear market.

In anticipation of this, the Ethereum Foundation has set a hard limit of about 40,000 ETH that can be unlocked each day. This will hopefully ease the selling pressure and reduce short-term ETH volatility.

Ethereum Shanghai Network Upgrade Progress

Since testnet Shandong went live in late 2022, plenty of progress for the Ethereum Shanghai network upgrade has been made. These progress updates serve to show that the Ethereum Foundation is on track with its promised March network upgrade rollout.

Firstly, the team managed to copy the blockchain and create a shadow fork to begin the initial stages of testing the new EIPs in an isolated environment. The shadow fork proved a success as it immediately revealed minor glitches with Ethereum nodes that were making use of Geth execution client, the popular node software.

The latest progress update involves news of the latest Zhejiang testnet being launched. It serves to replace the Shandong testnet. This is because when Shandong was launched, it included several EIPs involving EVM Object Format (EOF) that will not be rolled out with the Shanghai network upgrade due to time and resource constraints.

Thus, the newest Zhejiang testnet seeks to allow for staked ETH withdrawal testing in a more accurate environment that places the Ethereum network under a similar load. Ideally, withdrawals for staked ETH should go off without a hitch as they're exposed to simulated network attacks and stress tests. According to Ethereum Foundation developer Parithosh Jayanthi, Zhejiang presents "a great opportunity for all tools to test out how they want to collect, display and use the withdrawal information.”

The Zhejiang testnet will be made available on Feb 1, 2023. Following this, the Shanghai+Capella testnet will be triggered six days later at epoch 1350. It's when users will be able to deposit ETH to validators on the testnet, practice Boneh–Lynn–Shacham (BLS) digital signature changes and exit without incurring any risk. On top of this, you'll also be able to convert 0x00 credentials to 0x01 and set a withdrawal address as you test partial and full withdrawals when exiting your validators.

How to Profit from the Ethereum Shanghai Upgrade

Thinking of how you can profit from the near-term volatility caused by Ethereum's Shanghai upgrade? Here are our thoughts on how you can long ETH in the event that ETH prices soar:

Optimal Bullish Strategy: Stop Market Leveraged Long Order

Firm believer of our bullish ETH thesis on how more long-term ETH investors might just buy and stake ETH because of the ability to finally withdraw their deposited ETH? Then consider our strategy of utilizing a stop market leveraged long order by buying the leveraged perpetual token ETH3L/USDT on Bybit.

To do so, simply sign up for a Bybit account before accessing the Spot Trading platform on Bybit and locating the ETH3L token. Once you’re in the trading interface, you’ll need to change your order type to Stop Market. This type of market order essentially helps you extract maximum short-term gains while limiting your maximum loss thanks to the stop-loss in place.

How to Execute This ETH Trade

Before inputting your price levels, it’s key to check for areas of strong buying and selling. You can then place price levels based on perceived support and resistance levels. These can vary based on your personal risk appetite as some price levels appear to be stronger than others.

Once you’ve funded your Bybit Spot Trading wallet with the necessary funds, you may proceed to input the fields present in your ETH3L leveraged token stop market order and submit the order to place your trade.

Trade Outcomes

Max profit: Difference between Entry - Exit before rebalancing

Max loss: Difference between Exit - Entry + Volatility Decay + Fees

Keen on reading up more about exact strategies on how you can trade with Spot and Derivative products on Bybit? Check out our guide on how to trade ETH post-merge.

The Bottom Line

For many ETH investors and traders, all eyes will be on its execution as the core developers seek to execute the Ethereum Shanghai upgrade in the smoothest possible manner. While this network upgrade might not be as pivotal as The Merge, it does lay the foundations for future upgrades.

By changing the way ETH staking works, the Ethereum Shanghai upgrade will impact how retail and institutional investors interact with ETH as they consider staking viable now that withdrawals from the Beacon Chain are possible. This ultimately paints a brighter future for Ethereum as a whole as it continues to prove itself as a viable blue chip crypto project. Who knows; in the long haul, Ethereum might even be able to threaten Bitcoin’s top spot on the market cap list and achieve the Flippening.