What Are Prediction Markets in Crypto?

As their name implies, crypto prediction markets allow you to make money by betting on future outcomes of various crypto events. In general, prediction markets are divided into two types: sports and non-sports (crypto falls into the category of non-sports-related prediction markets).

Unlike traditional prediction markets, crypto prediction markets leverage blockchain technology, so they’re decentralized, globally accessible and highly transparent, especially in terms of price discovery. While traditional prediction markets carry most of the volume in this niche, there’s a growing demand for crypto prediction markets as crypto’s market cap continues to grow rapidly.

Let's dig deeper into crypto prediction markets and learn how you can capitalize on them to make extra money.

Key Takeaways:

Crypto prediction markets provide platforms for you to wage bets on the outcome of various events using cryptocurrencies.

Notable crypto prediction markets, including Polymarket, Augur and Drift BET, feature user-friendly and affordable platforms.

What Are Prediction Markets?

Prediction markets are platforms that allow you to trade contracts based on the outcome of future events. They’re fueled by the probability of an event occurring. When a bet favors the participant, they’re rewarded for their correct prediction.

Prediction markets offer an exciting interplay of finance, human psychology and the theory of probability that can lead to lucrative gains.

These markets can be centralized or decentralized. The centralized ones (e.g., Betfair and PredictIt) are operated by a single entity, so you’re required to trust them with the payouts and fairness of the outcome. Their decentralized counterparts — crypto prediction markets — are powered by blockchain technology, which eliminates third parties, thereby ensuring transparency and fairness.

The key features of prediction markets are price probability, aggregated wisdom and incentives that are given to participants as motivation for placing bets on outcomes of events. Some of the events supported by prediction markets include outcomes in sports (game winners), politics (election results), finance (stock prices) and weather (temperatures).

Centralized vs. Decentralized Prediction Markets

Prediction markets are broadly divided into centralized or decentralized markets, each with unique benefits and challenges. The centralized types are governed by a single company that manages various aspects of the prediction process. However, decentralized prediction markets rely on smart contracts powered by blockchain technology to manage and facilitate the trades.

The key advantages of centralized markets are ease of use, better liquidity and quick dispute resolution. However, these centralized platforms also face challenges, such as government censorship, intermediary fees that eat into the payouts and the possibility of a single point of failure — especially in the event of a hack or technical outage.

On the other hand, decentralized prediction markets, such as Augur and Polymarket, have certain distinct benefits, such as censorship resistance, immutability, global access and lack of intermediaries. However, they also face challenges in the form of regulatory compliance, complexity of use and illiquidity due to low participation.

What Are Crypto Prediction Markets?

Crypto prediction markets are decentralized platforms for the forecasting of outcomes. They enable their participants to use cryptocurrencies in order to bet on the outcomes of future events. These markets are similar to futures markets, in which investors bet on the prices of assets based on the outcome of future events.

Central to crypto prediction markets is the use of blockchain technology, which ensures transparency, fairness and security. As such, they have three key components:

Smart contracts — These self-executing contracts are critical in creating and managing prediction markets in crypto. Thanks to smart contracts, there's no need for a central authority and/or middlemen. Based on predefined rules, these contracts automate the process of placing a bet, resolving outcomes and distributing rewards. They also allow funds to be held in escrow until the outcome has been verified.

Oracles — To complement smart contracts, oracles aggregate data by sourcing it from trusted platforms. This ensures a tamperproof and accurate outcome, especially if the oracles are decentralized, allowing them to source data from a wide variety of platforms.

Outcome tokens — These are the tradeable tokens used to predict outcomes. They facilitate the buying and trading of positions based on an outcome. These tokens enable price discovery, since they signify the probability assigned to the occurrence of an outcome. They can be redeemed by predictors whose outcomes turn out to be correct.

How Do Crypto Prediction Markets Work?

Crypto prediction markets employ a systematic interplay of market creation, trading, resolution and payouts. They’re banking on market sentiment to fuel the probability of an event taking place, which may favor or discredit the bet placed by a participant.

The first step in this process is creating a prediction market based on various parameters, which may include event description, possible outcomes (e.g., yes/no), expiration date and resolution source. Any user can create a prediction market based on a given event.

Once the market has been created, trading begins. Participants can buy and sell tokens representing the likelihood of an event occurring. For example, a token may initially trade at $0.50 for “Yes,” representing a 50% chance of the event occurring. If more people buy “Yes,” the token’s price can rise to $0.70, in this case representing a 70% probability that the event will take place.

After the trading is done, market resolution occurs based on the outcome. At this point, oracles issue the result on the blockchain. Smart contracts proceed to issue payouts based on the winning outcome. The tokens with the winning outcome can be redeemed for full value, while those that lost the prediction become worthless.

Crypto Prediction Market Mechanisms

Crypto prediction markets are governed by different market mechanisms that dictate their payout structures. Two commonly used prediction market mechanisms in the crypto space are the fixed payout and the pari-mutuel payout.

Fixed Payout

The fixed payout mechanism ensures a predefined payout for the winning outcome. Participants trade outcome tokens, and the market price reflects the probability of the event as estimated by traders. Traders buy or sell tokens that represent specific outcomes (e.g., "Yes" or "No").

Each token is priced between 0 and 1 (or $0 and $1), where the price reflects the perceived probability of the outcome. For example, if "Yes" tokens trade at $0.70, the market implies a 70% chance of that outcome.

At the event's conclusion, tokens for the correct outcome are redeemed for a fixed amount (e.g., $1 per token), while tokens for the incorrect outcome become worthless.

The advantage of this mechanism is that the payment structure is simple and predictable. Another benefit is that there's continual price discovery, since prices adjust dynamically to reflect market sentiment.

However, the fixed payout mechanism requires high liquidity to reflect the accuracy of probabilities. It also relies heavily upon oracles, which necessitates a high level of trust and accuracy in order to resolve the outcomes.

Pari-Mutuel Payout

In a pari-mutuel structure, payouts are determined by pooling all bets and redistributing the total amount to winners after the event. All bets for each possible outcome are pooled together.

After the event, the total pool (minus fees) is divided among those who predicted the correct outcome. Individual payouts are proportional to the amount wagered by each winner, as well as the pool size.

Some key advantages of this payout model are its dynamic payouts, efficient pricing and fair distribution of payouts. However, this structure isn’t beginner-friendly, due to its complexity and non-intuitive manner. Also, unlike the fixed payout, where rewards are predefined, the exact payout rewards are uncertain until after the event.

That said, the fixed payout mechanism is ideal for those looking for a simple and predictable way to enter prediction markets, while the pari-mutuel payout favors more advanced users, who appreciate dynamic odds and collective market intelligence.

Notable Crypto Prediction Markets

The crypto space has seen an influx of crypto prediction markets as more people continue to venture into this niche. Some of the notable crypto prediction platforms are as follows.

Polymarket

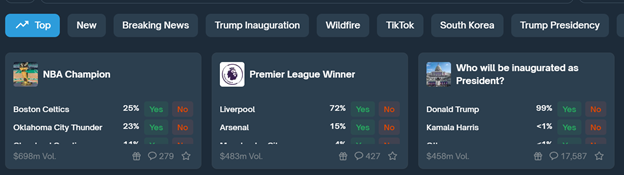

Considered one of the largest prediction markets, Polymarket provides a user-friendly and robust environment for participants to bet on real-world events using USDC. The platform offers a wide range of markets, including crypto, sports, politics, pop culture, business and Elon Musk's tweets. The platform is powered bythe Polygon network, which ensures secure, fast and low-cost betting transactions. It also has an active community of users, thereby ensuring high liquidity on the platform. Its user interface is beginner-friendly and simple to use.

Augur

Powered by Ethereum, Augur is one of the earliest decentralized crypto prediction markets in the space. Developed in 2014 by Forecast Foundation, and co-founded by Jack Peterson, Joey Krug and Jeremy Gardener, Augur has remained a top platform for wagering crypto-powered bets.

The native token for the Augur platform is REP, an ERC-20 token used to power the platform’s betting ecosystem via staking it to participate in the platform's reporting process. Meanwhile, ETH or DAI is used to bet on Augur.

Polkamarkets

Polkamarkets is a web3 prediction market designed to open the niche to everyone. It runs on three Ethereum-compatible blockchains: Polygon, Moonbeam and Moonriver. The quality of its markets is maintained by its native POLK token holders.

Hedgehog

Hedgehog is a Solana-based prediction market that offers its users a wide range of events to bet on. Since it's built on Solana, participants can enjoy secure, fast and low-cost transactions on a user-friendly platform. You need to connect a web3 wallet, such as Phantom or MetaMask, in order to use Hedgehog. It offers various types of prediction markets, such as, pooled markets, the Classic “Yes” or No” and parlays (in which you use parlay cards).

Drift

Drift is a Solana-based decentralized exchange (DEX) that launched BET (Bullish on Everything) crypto prediction markets in August 2024, ahead of the U.S. political elections in November 2024. The platform claims to be highly capital-efficient and is built on Solana. Its growing number of categories span crypto, culture and sports such as Formula 1® racing.

Since BET is built on top of the Drift protocol, market participants can also benefit from yield-generating activities as they place their bets. You can create “structured bets” on the platform by hedging against popular cryptocurrencies, such as Bitcoin.

To incentivize participation, BET has introduced a rewards system called FUEL. During promotional periods, users earn FUEL tokens for each trade, which can later be redeemed for prizes within the Drift and Solana ecosystems.

You can utilize over 30 cryptocurrencies supported by the platform, including USDC and SOL.

Closing Thoughts

Crypto prediction markets represent a fascinating evolution in the way we gather, interpret and act on collective knowledge. By leveraging blockchain technology, these platforms offer unparalleled transparency, decentralization and accessibility, empowering users worldwide to forecast outcomes in a trustless environment. With mechanisms like fixed payout and pari-mutuel payout, participants can choose structures that align with their preferences, balancing predictability and market efficiency.

The rise of platforms like Augur, Polymarket and Drift BET highlights the diverse approaches within this space, catering to a wide range of users, from casual bettors to sophisticated traders. Innovations such as low-cost transactions, multi-token support and integrated yield generation further enhance the appeal of these markets, making them more inclusive and dynamic.

However, challenges remain, including regulatory scrutiny, user adoption and ensuring fair market mechanics. As the sector matures, collaboration between platforms, regulators and communities will be critical to its long-term success.

Since crypto is inherently volatile and prediction markets are highly speculative in nature, it’s imperative to be aware of the associated risks and conduct proper research before participating in these markets.

#LearnWithBybit