Weekly Institutional Insights: Tech Stocks Gain as Bitcoin Retreats

Oct 28, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Tech Stocks Notch Gains as ECB Heads for Larger Rate Cut in December

ECB President Christine Lagarde. Source: Bloomberg

On Friday, market performance faltered as bank stocks declined, notably New York Community Bancorp, which fell 8.3% due to a weak outlook, while Goldman Sachs and JPMorgan also experienced losses. Although the "Magnificent Seven" tech stocks showed significant gains, it wasn't enough to offset the overall market downturn.

In Europe, ECB President Christine Lagarde indicated that consumer price disinflation is progressing despite ongoing wage pressures. Following recent interest rate cuts, discussions are underway for potentially larger measures in December.

In geopolitical news, Russian President Putin stated there would be no concessions in the Ukraine war, possibly indicating increased confidence as Russian forces, reportedly aided by North Korea, continue their campaign. Meanwhile, the U.S. has signaled support to Saudi Arabia in the face of potential Iranian aggression, as Israel is engaged in ongoing conflicts in Gaza and Lebanon amid rising casualties.

Finally, the IMF raised its economic growth forecast for sub-Saharan Africa for next year, although it warned of uncertainties linked to social unrest in countries like Kenya, Nigeria and Ghana.

Weekly Crypto Highlight — Microsoft Shareholders Will Vote on Bitcoin Investment

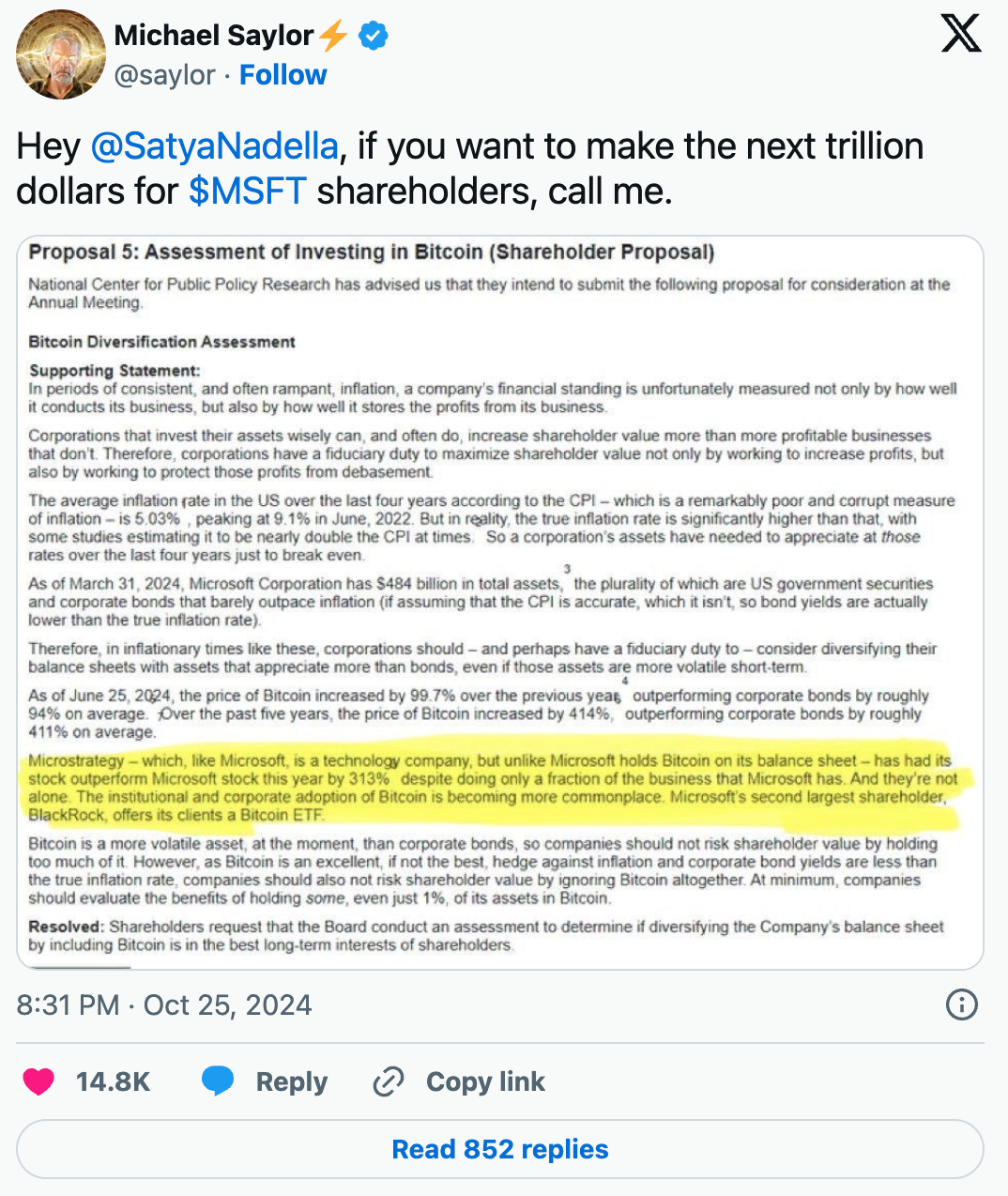

“Hey @SatyaNadella, if you want to generate the next trillion dollars for $MSFT shareholders, give me a call,” Michael Saylor, co-founder and executive chairman of MicroStrategy, stated, presenting a proposal highlighting MicroStrategy’s success in Bitcoin investments.

According to a document from the National Center for Public Policy Research (NCPPR), “MicroStrategy, like Microsoft, is a tech company, but unlike Microsoft, it holds Bitcoin on its balance sheet. This year, MicroStrategy's stock has outperformed Microsoft’s by 313%, despite conducting only a fraction of the business Microsoft does.” The document also notes that institutional and corporate adoption of Bitcoin is becoming increasingly common, citing that BlackRock, Microsoft’s second-largest shareholder, offers a Bitcoin ETF to its clients.

Microsoft has announced that its shareholders will vote on a Bitcoin investment proposal on December 10, although the board recommends voting against it. The proposal argues, “In inflationary times like these, corporations should — perhaps even have a fiduciary duty to — diversify their balance sheets with assets that appreciate more than bonds, even if those assets are more volatile.”

Saylor's push for Microsoft to invest in Bitcoin comes just days after he expressed his intention to donate his Bitcoin holdings to humanity. “I’m a single guy with no children — when I’m gone, I’m gone,” he told The New Zealand Herald. “Just like Satoshi left a million Bitcoin to the universe, I’m leaving whatever I have to civilization.”

Saylor also sparked controversy earlier this week by criticizing self-custodial wallets, which led him to clarify his stance after labeling some in the crypto community as “paranoid crypto-anarchists.” He later stated, “I support self-custody for those willing and able, the right to self-custody for all, and the freedom to choose the form of custody and custodian for individuals and institutions globally.” He emphasized that “#Bitcoin benefits from all forms of investment by all types of entities and should welcome everyone.”

Meanwhile, MicroStrategy continues to thrive in its ambition to become a “Bitcoin bank,” with its shares surpassing those of Microsoft as of Friday morning (Oct 25, 2024).

Bitcoin Spot ETF Flows

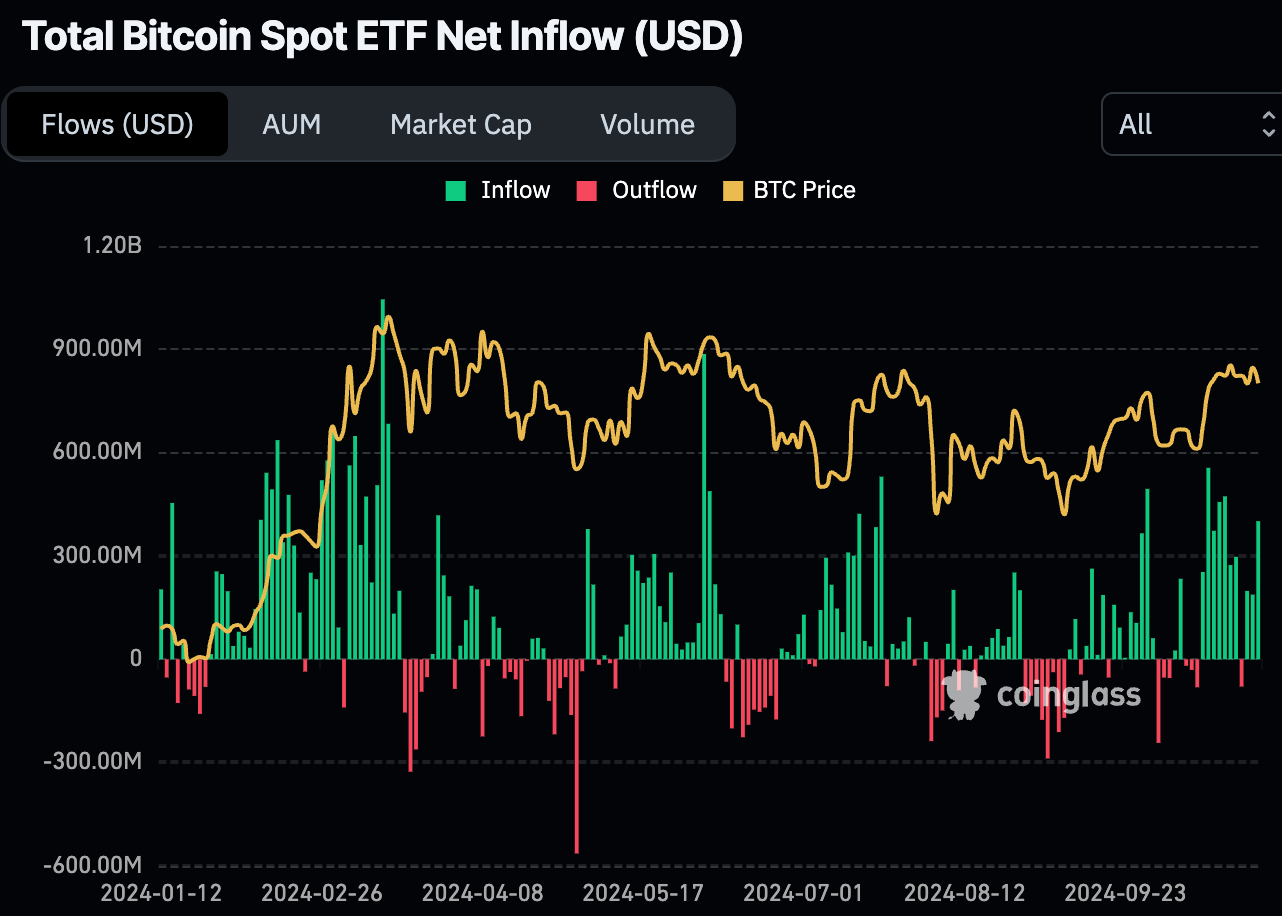

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Oct 25, 2024

Despite strong inflows in Bitcoin Spot ETFs, Bitcoin’s price retraced to $66K over the weekend.

Other Top Performing Tokens

Token | Catalyst |

Safe (SAFE) | SAFE surged 70.9% after the launch of Safe{Wallet}, enabling gasless multichain deployment across over 15 networks. Read more here. |

Jito (JTO) | JTO surged 10.2% following news that Jito had set a new fee record, while Temporal expanded its partnership to boost Solana staking. Read more here. |

Aptos (APT) | APT surged 11.6% after the celebration of Aptos's second birthday and its impressive milestones. Read more here. |