Weekly Institutional Insights: Sui Poised for Growth; U.S. Economy Driven by Productivity Growth

Dec 2, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — U.S. Economy Growth Driven by Improved Productivity

Source: Bloomberg

If U.S. economic growth is strong, why is the Federal Reserve considering interest rate cuts? This question was recently posed to Fed Chair Jerome Powell. Instead of focusing solely on the Fed's actions, we should explore the reasons behind the robust growth, and see how it can be sustained.

Real GDP is expected to exceed pre-pandemic levels for the second consecutive year. Typically, strong growth raises concerns about overheating, but inflation has actually fallen. Recent growth is largely due to increased productivity and a growing workforce, which are not inflationary and can help rebalance supply and demand.

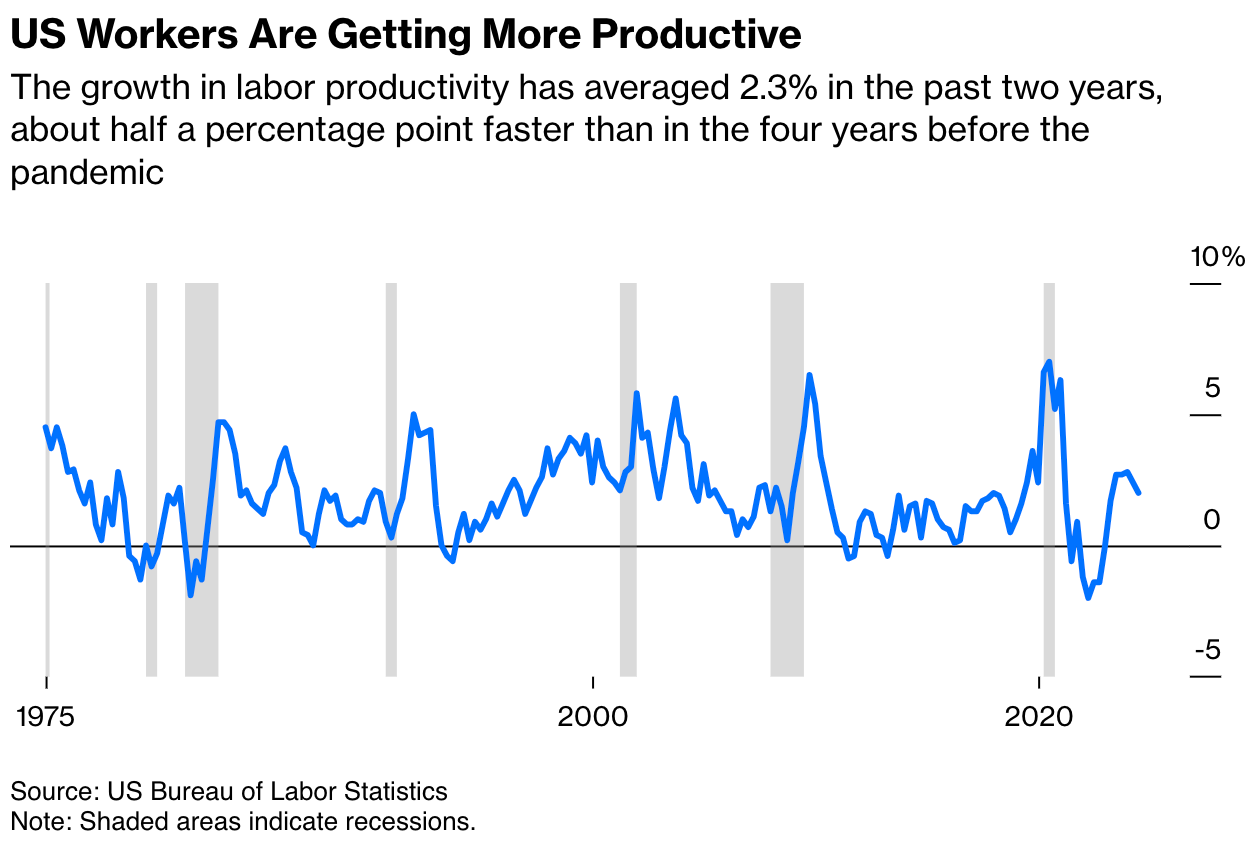

A significant factor behind this success is the rise in labor productivity, averaging 2.3% over the past two years — faster than the four years before the pandemic. This uptick is linked to a surge in new business applications, especially in the tech sector, as the pandemic's economic shifts and relief measures lowered barriers to entrepreneurship, particularly benefiting underrepresented groups.

The boost in productivity also reflects workers moving to roles better suited to their skills, a trend accelerated by the Great Resignation. This mobility has been essential for productivity gains, as higher job turnover correlates with increased business dynamism.

However, sustaining higher productivity is a challenge. The Fed must avoid overly restricting the economy, as high interest rates can deter investment in technology. Additionally, a gradual cooling of the labor market, with declining job quits, is concerning.

For policymakers, monitoring labor market dynamics and business formation is crucial. If these indicators decline, productivity and growth could wane. The U.S. economy has made significant progress, and maintaining this momentum is essential.

Weekly Crypto Highlight — Sui Is Poised for Growth

Bybit has released the Sui ecosystem report, with its key takeaways below. (Read the full report here.)

Performance Metrics: Sui has achieved impressive performance, processing over 297,000 transactions per second (TPS) while maintaining low latency. This positions it among the fastest blockchains available.

Market Growth: In 2024, Sui's market capitalization skyrocketed over 1,000%, reaching $9.5 billion and reflecting strong investor confidence and growing adoption.

DeFi Expansion: The total value locked (TVL) in Sui’s DeFi ecosystem has surpassed $1.5 billion, ranking it 11th among major blockchain networks and highlighting its rapid growth in decentralized finance.

Institutional Interest: The launch of the Grayscale Sui Trust has significantly increased institutional interest, resulting in an 89% price surge for the SUI token in Q3 2024, indicating its appeal to accredited investors.

Gaming Developments: Sui is making strides in the gaming sector, introducing the SuiPlay0X1 handheld gaming device and various web3 games, enhancing user engagement and expanding its ecosystem.

Developed by Mysten Labs, Sui is a Layer 1 proof of stake (PoS) blockchain launched on May 3, 2023. Its object-centric data model allows for parallel transaction processing, enhancing throughput and reducing latency. Its use of the Move programming language ensures resource safety through rigorous bytecode verification, mitigating common blockchain vulnerabilities.

Institutional Partnerships: Partnerships with firms like Copper and Zero Hash strengthen Sui’s infrastructure and credibility in the financial sector, enhancing its offerings in digital asset custody and transaction facilitation.

Growth in DeFi and Gaming: Sui’s DeFi sector is thriving, with leading protocols like NAVI and Scallop offering diverse financial services. In gaming, initiatives such as the SuiPlay0X1 device and various web3 projects bolster user engagement.

In summary, Sui is poised for continued growth, driven by technological innovations that are expanding its presence in both DeFi and gaming.

Other Top Performing Tokens

Token | Catalyst |

Virtuals Protocol (VIRTUAL) | VIRTUAL surged 53.6% following the launch of the $MUSIC token by Agentstarter, which features AI-driven music video capabilities and community-focused tokenomics. Read more here. |

Ethereum Name Service (ENS) | ENS surged 45.0% following the announcement of Namechain's vision for simplified, gas-free registration with faster transactions. Read more here. |

Sonic Labs (FTM) | FTM surged 9.9% following Sonic Labs' partnership with Octav for advanced on-chain financial management. Read more here. |