Weekly Institutional Insights: Microstrategy Included in Nasdaq-100, Adding Institutions’ Passive Exposure to Bitcoin

Dec 16, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

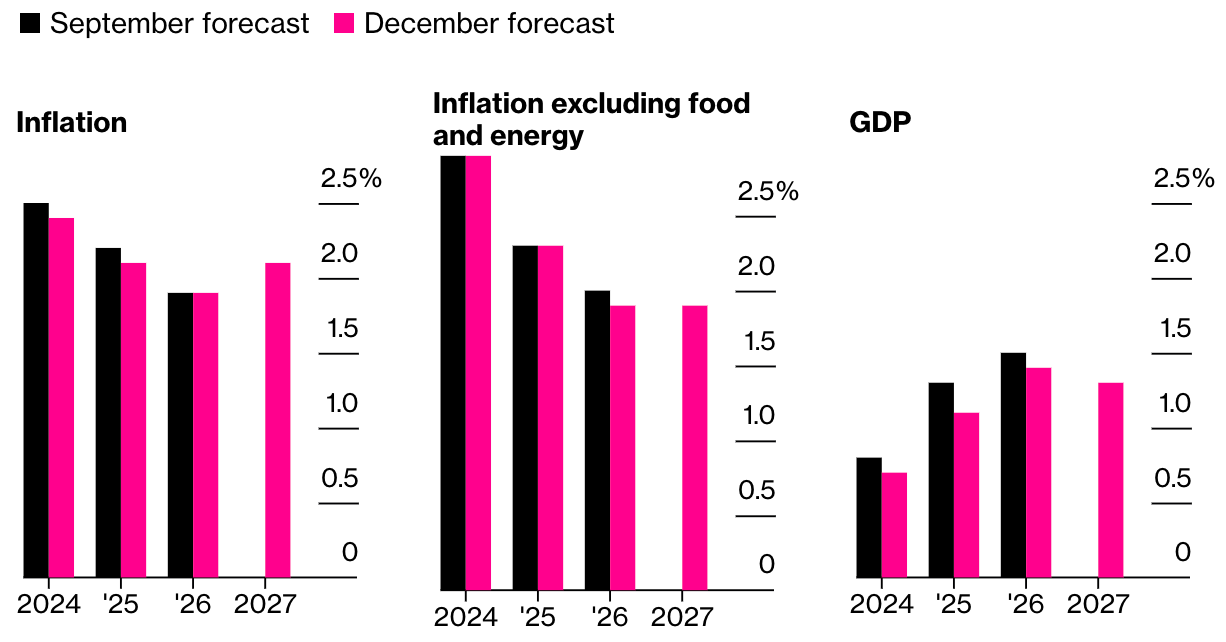

Weekly Highlight — Europe’s Stagnant Economy Spurs Further Rate Cuts

European Economic Data. Source: Bloomberg

European Central Bank (ECB) policymakers have indicated that further interest rate cuts are forthcoming. France’s François Villeroy de Galhau stated that investors' expectations for over 100 basis points (bps) of easing appear reasonable. He confirmed that there would be multiple rate cuts next year, aligning with market forecasts.

The ECB recently lowered borrowing costs for the fourth time this year, reflecting concerns over the eurozone’s economic outlook. Officials anticipate a quarter-point rate cut in both January and March 2025, adjusting the current rate of 3%.

Data showed stagnant industrial production in October, signaling challenges for the eurozone economy. Villeroy emphasized that the ECB remains above the neutral rate level, and indicated room for further adjustments. Other officials, including those from Estonia, Portugal and Spain, also foresee further borrowing cost reductions as the EU economy struggles to gain momentum.

Weekly Crypto Highlight — MicroStrategy Added to Nasdaq-100

MicroStrategy Inc., known for its significant investments in Bitcoin, is set to join the Nasdaq-100 Index (NDX®) , a move announced by Nasdaq Global Indexes. Alongside MicroStrategy, Palantir Technologies and Axon Enterprise will also be added, while Illumina, Supermicro and Moderna will be removed. These changes take effect on Dec 23, 2024.

MicroStrategy's inclusion marks a notable endorsement for its founder, Michael Saylor, whose unconventional approach has led to a 500% surge in the company’s share price this year. Starting as an enterprise analytics software provider, MicroStrategy shifted its focus to accumulating Bitcoin, which has substantially increased its market value to nearly $100 billion. However, this volatility poses potential risks to the Nasdaq-100, as the company's stock has fluctuated significantly compared to the NDX.

The announcement boosted Bitcoin's value by over 1%, indicating that MicroStrategy's Index membership could attract more institutional investment. Despite its stock gains, MicroStrategy reported a third consecutive quarterly loss, due to impairment charges on its Bitcoin holdings, alongside a 10% decline in software revenue.

Palantir, co-founded by billionaire Peter Thiel, is enjoying a 343% increase in stock value this year, driven by demand for its AI-driven data analysis tools. Meanwhile, Axon Enterprise, which produces Tasers and body cameras, has also seen a 150% rise in stock price, aided by its AI software innovations.

Inclusion in the Nasdaq-100 offers these companies increased visibility, liquidity and potentially a boost in stock prices, as significant funds must acquire shares of Index members. This reshuffling reflects broader trends in technology and investment, with the Nasdaq-100 up 30% this year, outperforming other major indices.

Other Top Performing Tokens

Token | Catalyst |

Aave (AAVE) | AAVE surged 17.1% following the anticipation of Aave V4, a modular hub-spoke design for enhanced scalability and yield. Read more here. |

Sui Network (SUI) | SUI surged 30.9% after Backpack announced a partnership with Sui to expand its crypto ecosystem. Read more here. |

Magic Eden (ME) | ME surged 36.93% following the launch of Magic Eden's ME token to boost cross-chain engagement and user rewards. Read more here. |