Weekly Institutional Insights — Markets Watch Out For September Fed Decision; Friend.Tech Rug Pull Rattled Market

Sep 16, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Concerns Over Rising Unemployment Boost Rate Cut Chance

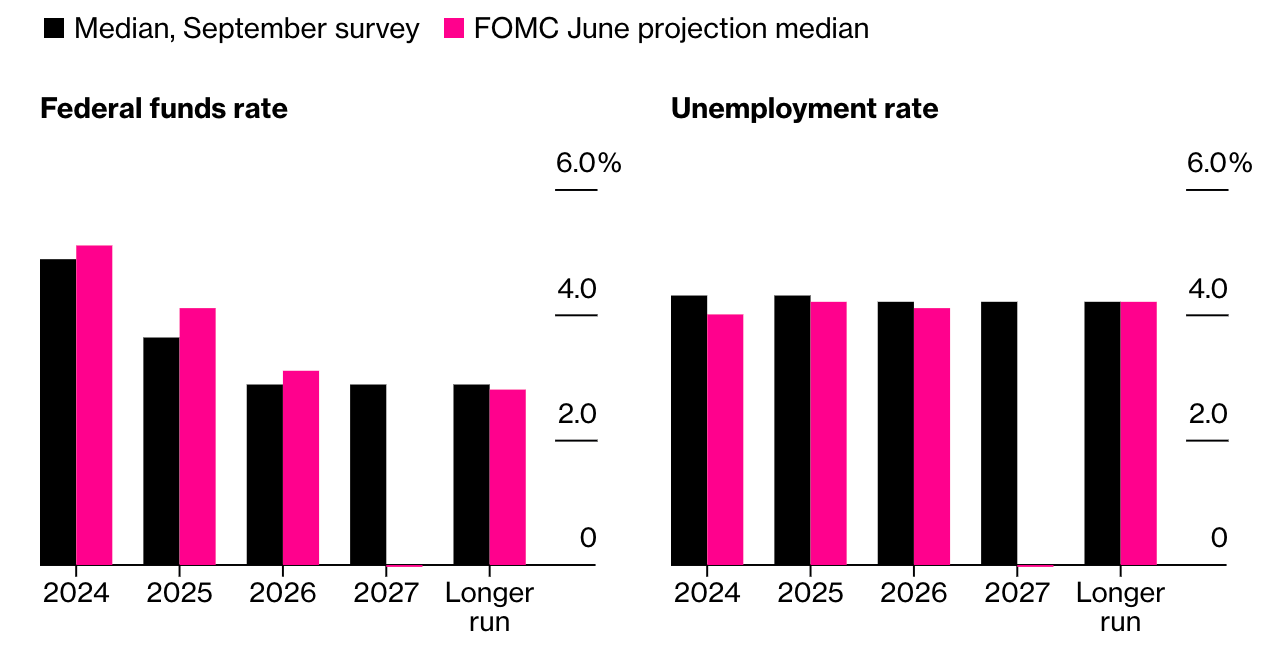

Source: Bloomberg

The Federal Reserve is expected to lower interest rates by a quarter of a point at its upcoming meeting on September 17–18, with additional cuts anticipated in November and December 2024. While traders predict a more aggressive full-percentage-point reduction, most economists advocate for a gradual approach, likely keeping rates between 3.5% and 3.75% by the end of next year.

Concerns over rising unemployment and a slowdown in hiring have strengthened the case for these cuts, with the median unemployment forecast increasing to 4.3% this year. Despite these worries, most economists believe the economy will continue to grow over the next year. Fed Chair Jerome Powell has indicated that rate cuts are likely, although he cautioned about potential inflation risks associated with lowering rates.

The term "gradual" as applied to rate cuts varies among economists. Most envision quarter-point reductions at each meeting. Some anticipate communication changes from the Fed, focusing on employment concerns and the possibility of future adjustments. Overall, the consensus points to a cautious yet proactive stance in response to economic indicators.

Weekly Crypto Highlight — Friend.Tech Rug Pull Allegation

Last year, friend.tech emerged as a groundbreaking SocialFi project, celebrated by influencers and heralded as a potential billion-dollar protocol. However, its team has just transferred control of its smart contracts to a null address, leading to concerns that it has abandoned the project by halting any further development.

Launched in August 2023 during a bear market, friend.tech quickly became the go-to decentralized application (DApp) on Base Chain. Users log in via their X accounts to buy and sell “keys” — akin to shares — that grant access to exclusive chats. The value of these keys stems from the potential to gain insider insights from keyholders.

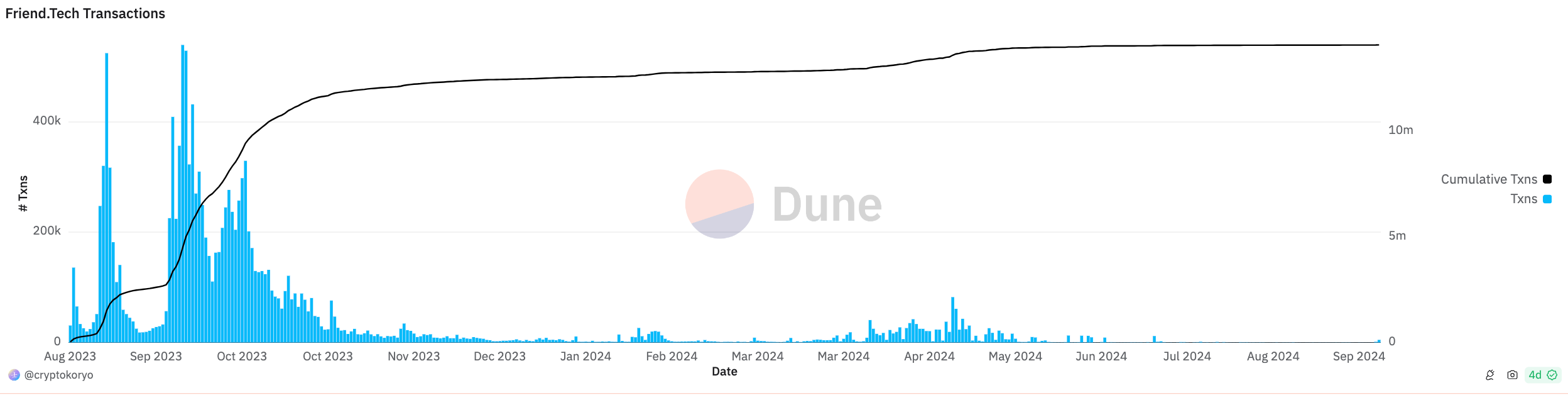

Friend.Tech daily transactions. Source: Dune @cryptokoryo

Despite a promising start, the project’s popularity waned after just three months. Daily new users dwindled to nearly zero, and transaction fees plummeted from $2 million to below $100. An initial surge occurred after the release of friend.tech V2, and after a community airdrop of FRIEND tokens, the excitement quickly faded.

Critics argue that the team’s decision to pocket around $52 million in fees, rather than reinvesting in the protocol, raises concerns about a potential rug pull. Ultimately, the rise and fall of friend.tech highlights the importance of incentives and sustainable practices in the cryptocurrency space.

On September 10, 2024, the friend.tech team addressed some concerns regarding their SocialFi app, clarifying that there are no plans to shut down the friend.tech website application.

The team emphasized that their recent actions only ensure that no further changes will be made to their fee structure on Layer 2 platform Base. They reassured users that these actions do not impact the app's functionality, stating that everything "remains the same."

Bitcoin Spot ETF Flows

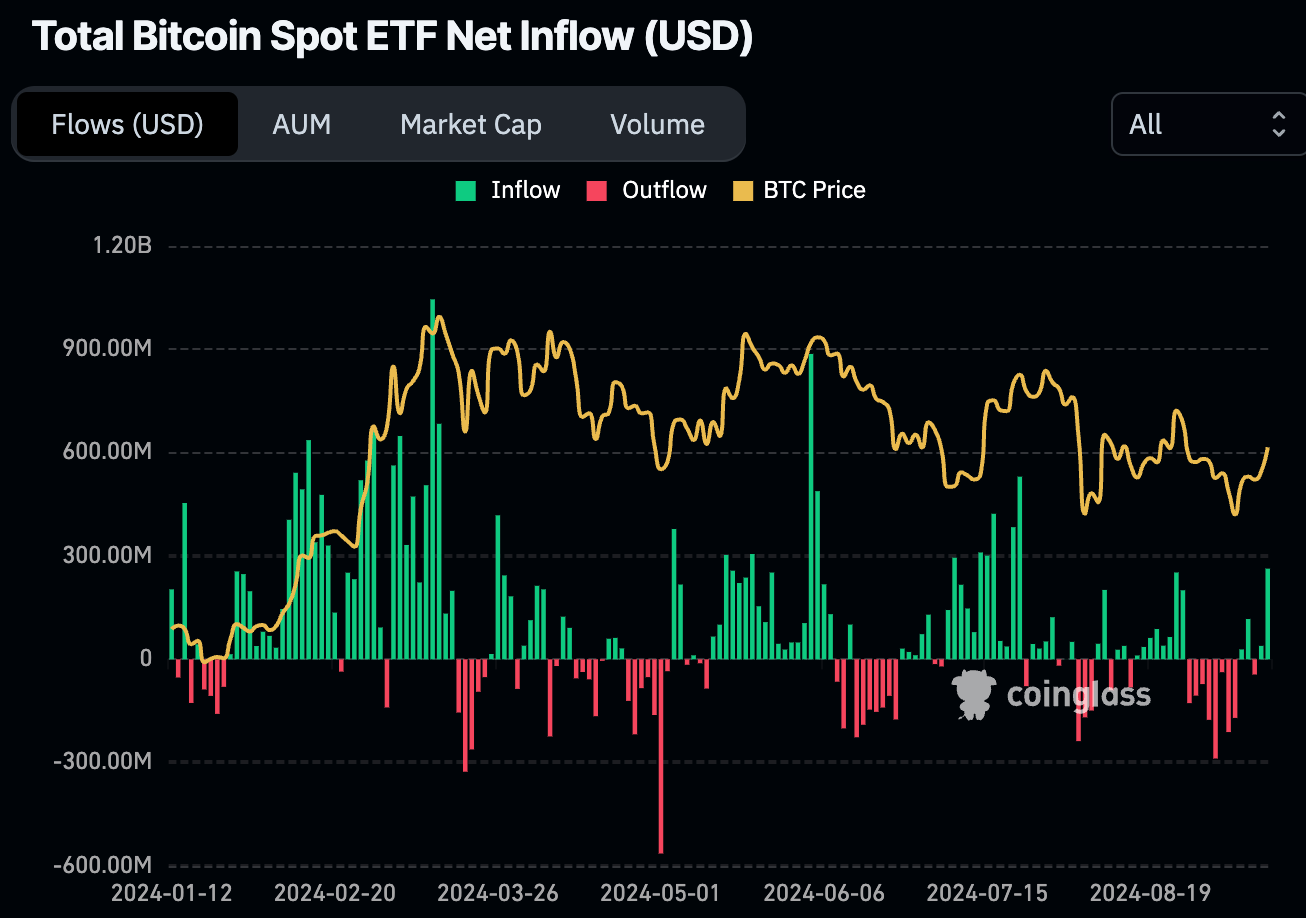

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Sep 13, 2024

Strong inflows into Bitcoin Spot ETFs on Friday collide with Bitcoin’s price surging above $60K. As Bitcoin surpasses the $60,000 threshold, it not only reflects a pivotal psychological barrier, but also rekindles discussions about potential future price targets. Analysts and investors are closely monitoring market trends and technical indicators, speculating as to whether this momentum can be sustained.

Other Top Performing Tokens

Token | Catalyst |

Ripple (XRP) | XRP surged 3.3% following Grayscale's launch of the XRP Trust, offering accredited investors exposure to the token. Read more here. |

EigenLayer (EIGEN) | EIGEN surged 7.15% following the launch of LayerAI's decentralized GPU computing for on-demand AI power. Read more here. |

Sonic Labs (FTM) | FTM surged 8.5% following the launch of Sonic Labs' testnet with 106 million transactions and a developer bounty program. Read more here. |