Weekly Institutional Insights: Market Braces for Volatility as U.S. Election Looms

Nov 4, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Market Vulnerability Amid Election Uncertainty

As November begins, markets supported by dovish central banks and declining inflation are showing increasing vulnerability. Tech earnings, previously a key driver of growth, have become inconsistent, leading to a decline in the Nasdaq-100 and disrupting a longstanding trend of simultaneous gains in equities and bonds. Investor anxiety is heightened due to uncertainties surrounding the upcoming U.S. presidential election and the Federal Reserve’s interest rate decisions, with a risk gauge from Bank of America reaching its highest level since the financial crisis.

Recent economic reports indicate robust growth in the U.S. economy, but inflation metrics have exceeded expectations, complicating the outlook. The S&P 500 has risen significantly this year, and historical indicators suggest that gains leading up to elections often favor the incumbent party. However, the resurgence of the "Trump trade," linked to rising odds for the Republican candidate, has led to increased volatility in Treasuries and equities, suggesting significant market implications depending upon election outcomes.

Investor positioning has shifted, with many reducing equity exposure and adjusting Treasury holdings ahead of a critical election week. Concerns remain that full control by either party could reignite inflation, potentially leading to a hawkish Fed response that would negatively impact risk assets.

Weekly Crypto Highlight — Factors Shaping Bitcoin’s Price Movement

Several key factors may be driving the current rally in Bitcoin. First, the anticipation surrounding the upcoming U.S. election is significant. The current administration has been regarded as largely “hostile” toward crypto, and a potential change in leadership could create a more favorable environment. Predictions from Polymarket suggest that a Trump victory is likely, which could serve as a bullish catalyst given his pro-crypto stance.

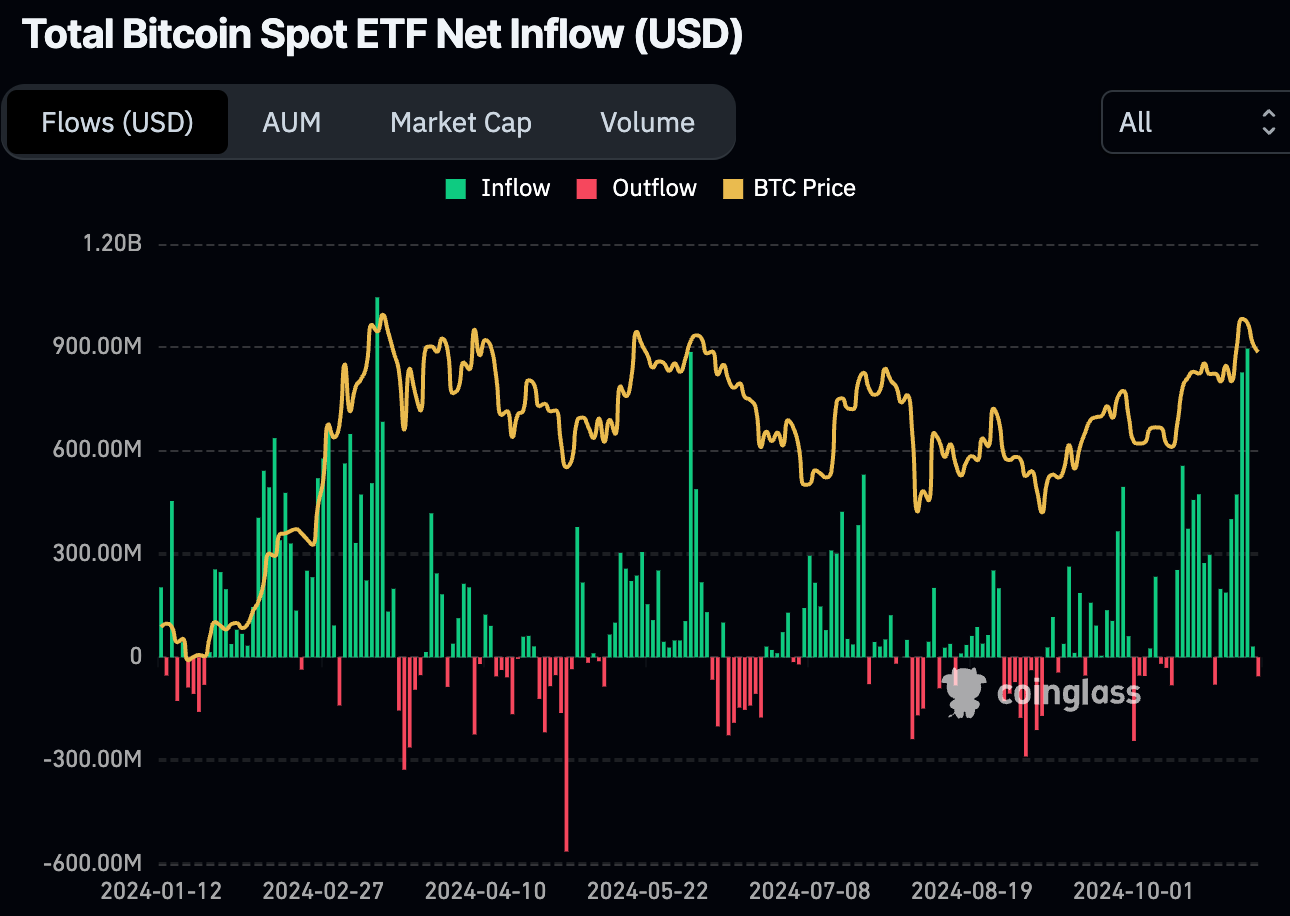

Source: CoinGlass

Additionally, recent market data supports this positive outlook. Since Oct 11, 2024, Bitcoin has experienced substantial inflows from Bitcoin Spot ETFs, as illustrated above. The options market also reflects optimism, with twice as many call options as put options set for Nov 8, 2024, indicating that traders expect a price increase.

Furthermore, BitMEX co-founder Arthur Hayes recently made a compelling case for Bitcoin, arguing that China’s strategy of printing yuan to recover from its property crisis will lead to increased investment in BTC, thus supporting a bullish outlook.

Lastly, MicroStrategy, led by Michael Saylor, is undertaking an aggressive "21/21 plan" to raise $42 billion over the next three years to purchase more Bitcoin. This strategy could create significant buying pressure in the market.

However, it's essential to maintain a balanced perspective. Concerns exist about a potential post-election sell-off; historically, major catalysts in crypto often lead to sell-the-news events.

Another bearish signal is the lack of retail participation in the market. Metrics indicate that Google search volumes for crypto-related terms haven’t increased, and social media engagement around Bitcoin and Ethereum has been trending downward.

Lastly, geopolitical tensions, particularly between Iran and Israel, could negatively impact prices for Bitcoin and other riskier assets. Speculation surrounding the potential sales of BTC by Mt. Gox adds to the uncertainty, but this is largely noise and not a significant concern.

Other Top Performing Tokens

Token | Catalyst |

Grass™ (GRASS) | GRASS surged 13.4% following the launch of Stage 2 of the Grass network. Read more here. |

Ondo Finance (ONDO) | ONDO surged 13.47% after Wellington and Ondo Finance boosted 24/7 liquidity for tokenized U.S. Treasury funds in the web3 push. Read more here. |

Sui Network (SUI) | SUI surged 10.2% after the launch of MLS QUEST, engaging fans with NFTs powered by Sui. Read more here. |