Weekly Institutional Insights: Bitcoin Regains $68K as Unichain Launches

Oct 21, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

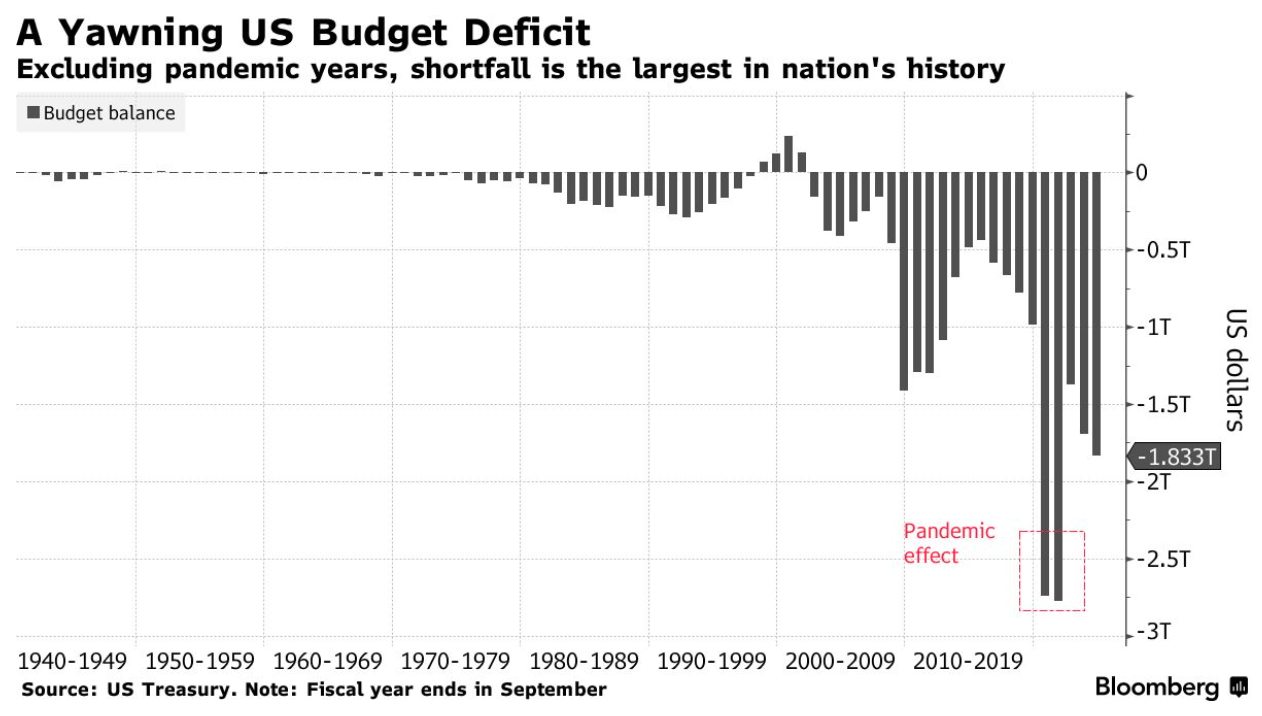

Macro Overview — U.S. Records $1.8 Trillion Deficit

Source: Bloomberg

In 2024, the U.S. government recorded a budget deficit of $1.83 trillion, the highest since the COVID-19 pandemic, marking an increase from $1.7 trillion in 2023. This rise was primarily driven by soaring debt interest costs, higher Social Security and defense spending spending, and the cancellation of the Biden administration's student debt relief plan. The deficit accounted for 6.4% of GDP, up from 6.2% the previous year. Social Security spending increased by $103 billion, due to a growing number of beneficiaries and cost-of-living adjustments, while defense spending rose by $50 billion. Interest payments surged by $254 billion to $1.1 trillion, the highest level since 1998, representing 3.93% of GDP.

Despite an 11% rise in revenues, fueled by stronger tax receipts, the deficit poses significant challenges for upcoming presidential candidates in a divided Congress, particularly regarding expiring tax cuts and the debt ceiling. Treasury Secretary Janet Yellen indicated that proposed budget changes aim to reduce the deficit by $3 trillion over time, primarily through tax increases on corporations and wealthy Americans. Economists anticipate continued debt growth under both major candidates, though potential relief may come as the Federal Reserve begins to lower borrowing costs.

Weekly Crypto Highlight — Unichain Might Create a Tailwind to UNI Holders

Uniswap recently launched Unichain, a new general-purpose Layer 2 solution on Optimism's Superchain, prompting significant discussion in the crypto community. Unichain aims to enhance the DeFi user experience by reducing transaction fees by about 95% and achieving rapid confirmation times of around 250 milliseconds, thanks to a new technology called Rollup-Boost. By establishing its own chain, Uniswap can exert greater control over its technology and potentially increase profitability, while also introducing a decentralized validation network that requires staking UNI, adding utility to the token.

Reactions to the launch have been mixed. Some observers have criticized the influx of new Layer 2 solutions, expressing concern that Uniswap's move could negatively impact Ethereum's ecosystem — particularly as it’s historically been a major gas burner. Others argue that Uniswap will continue to maintain substantial liquidity on Ethereum despite the launch. Additionally, Unichain is expected to be beneficial for Optimism's ecosystem, potentially contributing to revenue and liquidity.

While Uniswap dominates the decentralized exchange (DEX) market, its high market cap limits explosive growth potential. Analysts suggest that if Uniswap directs trading fees to UNI stakers, the token could see significant price increases, particularly around the upcoming mainnet and Uniswap v4 launch. However, it may be more suited as a long-term investment in Ethereum DeFi rather than a quick growth opportunity.

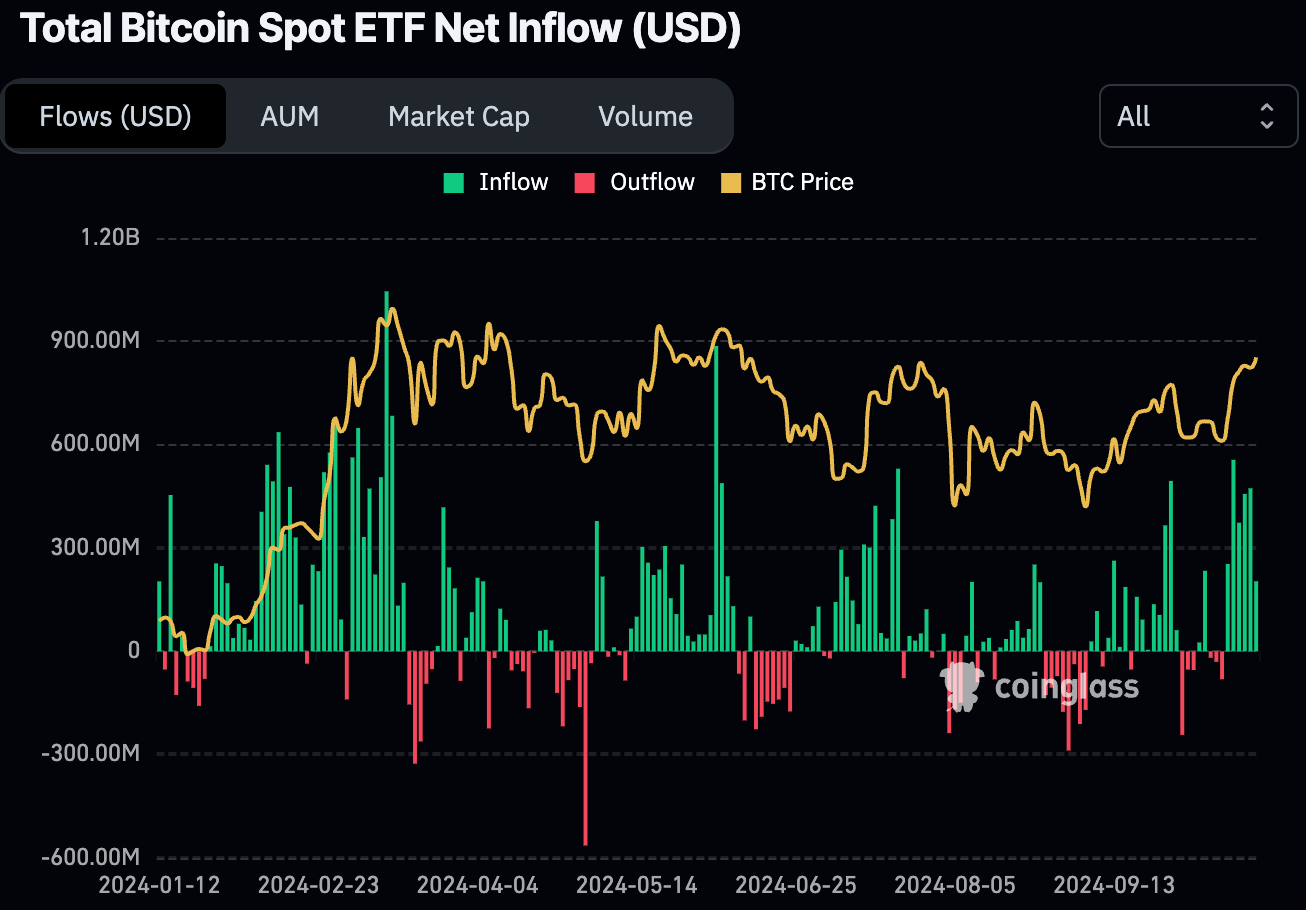

Bitcoin Spot ETF Flows

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Oct 18, 2024

Strong inflows into Bitcoin, reminiscent of activity seen in early 2024, have reignited optimism among investors and analysts, pushing the cryptocurrency toward a potential test of the $70,000 mark. This resurgence in inflows indicates renewed interest from retail and institutional investors, suggesting a healthy demand for Bitcoin amid a broader bullish sentiment in the market.

Other Top Performing Tokens

Token | Catalyst |

tomiNet (TOMI) | TOMI surged 28.0% following the tomi AMA highlights on web3 search, product updates and the vision for a decentralized internet. Read more here. |

Dogecoin (DOGE) | DOGE surged 6.5% following Elon Musk's "D.O.G.E." tweet. Read more here. |

Sonic Labs (FTM) | FTM surged 3.8% following the release of Sonic Labs' lite paper detailing the FTM migration and $S airdrop plans. Read more here. |