Weekly Institutional Insights: Bitcoin Reaches $100K, Altcoins Surge, U.S. Payroll Increases

Dec 9, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

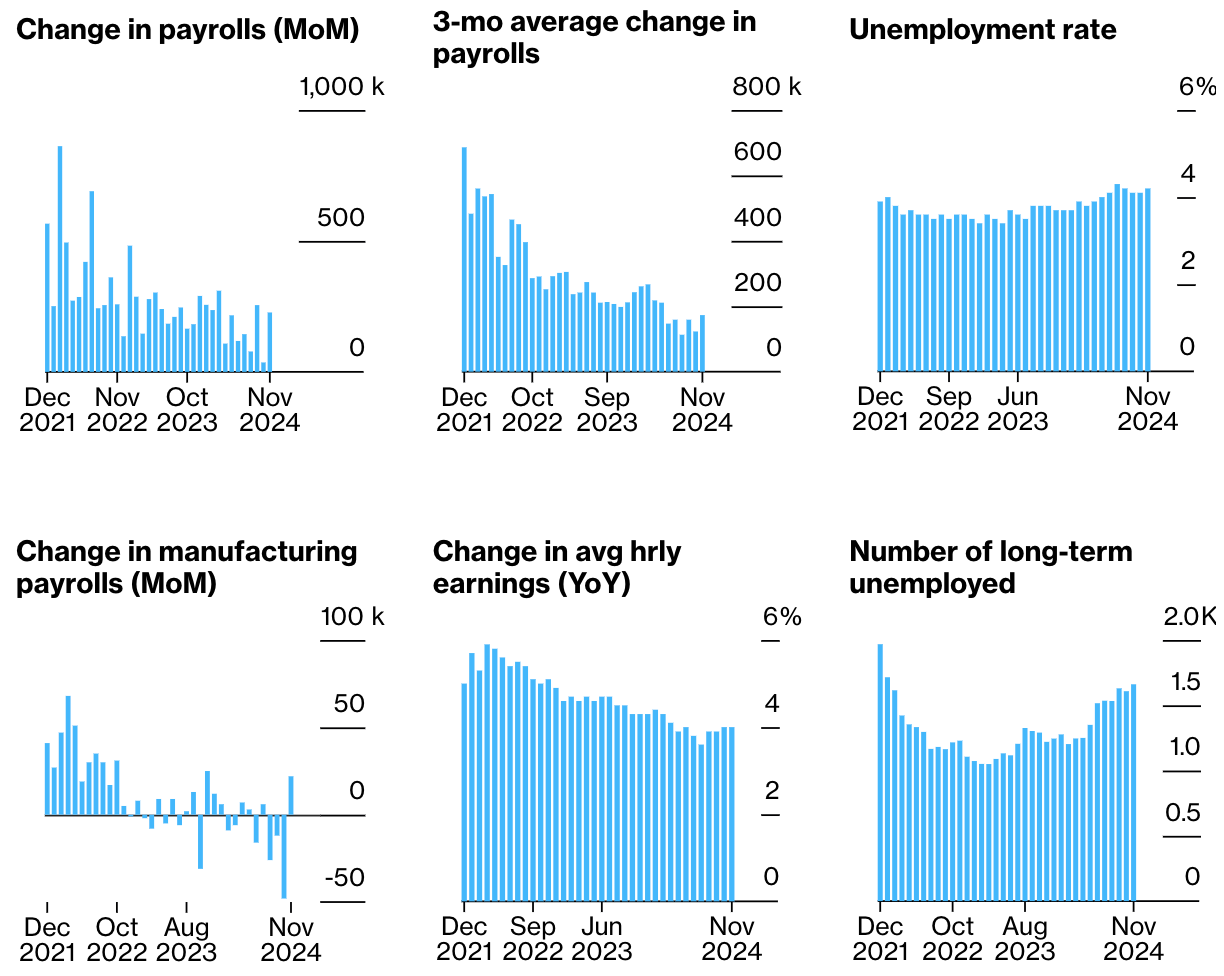

Weekly Highlight — U.S. Payroll Rebounds While Unemployment Increases

Source: Bloomberg

In November, U.S. hiring showed a notable increase, with nonfarm payrolls rising by 227,000, following a revised gain of 36,000 in October, which was affected by storms and strikes. Despite the growth in payrolls, the unemployment rate rose to 4.2%, indicating a cooling labor market rather than a significant decline. Average payroll growth over the past three months was 173,000, a decrease from earlier in the year, suggesting a moderation in hiring.

The uptick in the unemployment rate can be attributed to an increase in long-term joblessness, which is the highest it’s been in nearly three years. This has led traders to speculate that the Federal Reserve may consider another interest rate cut at its upcoming meeting from Dec 17–18, 2024. The data, adjusted for disruptions like the Boeing strike and hurricanes, supports the Fed's assessment that although the labor market remains solid, it’s less of a driver for inflation.

Fed Chair Jerome Powell has indicated that recent rate cuts aim to bolster the labor market, although some policymakers suggest a pause on further cuts may be needed, as the economy is showing resilience. The report highlights a mixed job landscape, as hiring has been strong in healthcare, hospitality and government, while retail has seen significant job losses.

The labor force participation rate fell to 62.5%, the lowest since May, and the number of people unemployed for over 27 weeks increased, reflecting longer job search times. Overall, while layoffs remain low, some major companies have announced head count reductions. Wage growth has stabilized, suggesting that demand for new hires is moderating.

Weekly Crypto Highlight — Retail Is Coming Back With Altcoins Surging, as Bitcoin Breaks $100K With Whales’ Accumulation

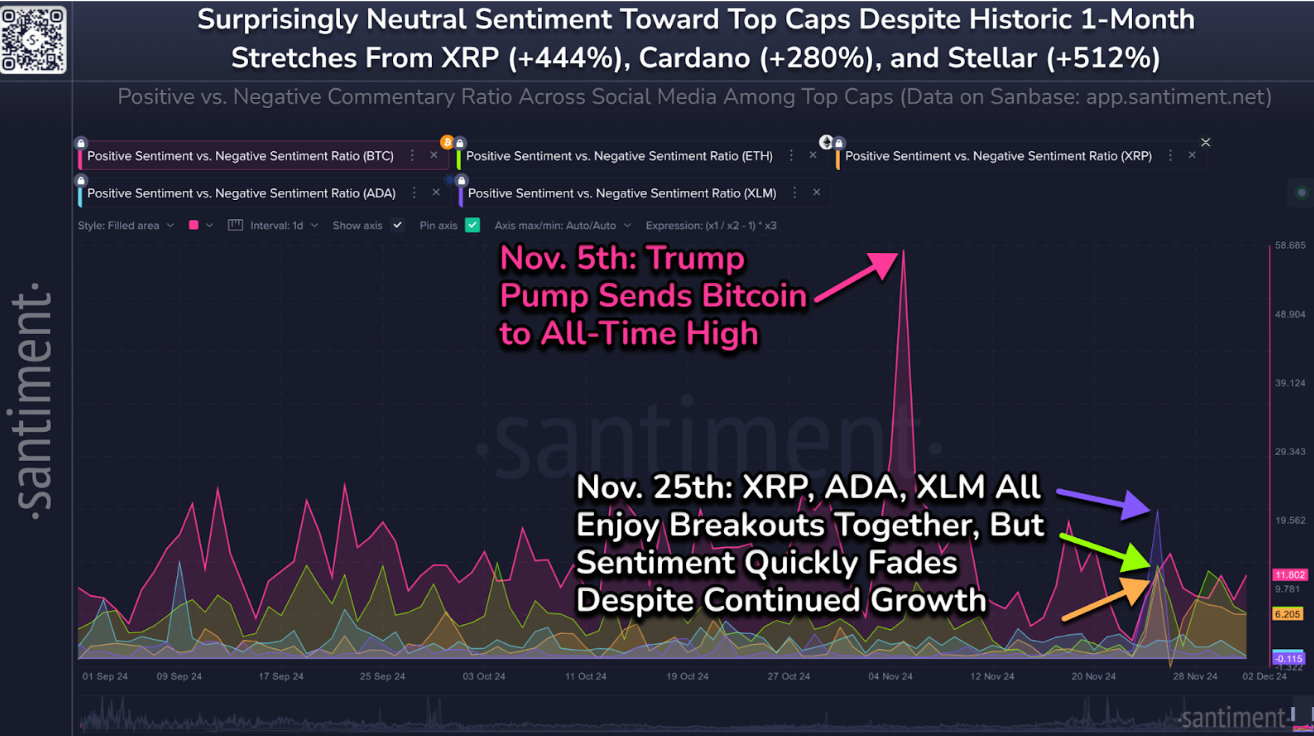

Token Sentiment Across Social Media. Sources: Bybit, Santiment

The cryptocurrency market is witnessing remarkable growth, particularly in major assets such as XRP, Cardano (ADA) and Stellar (XLM). XRP has surged by an impressive 444%, while ADA and XLM have seen increases of 280% and 512%, respectively. This surge is largely attributed to aggressive accumulation by whale investors and cautiously optimistic sentiment within the crypto community.

Whale activity plays a crucial role in shaping current market dynamics. Since mid-October 2024, whale wallets have accumulated a total of 91,856 BTC, significantly contributing to Bitcoin’s price increase. In contrast, there’s been a decline in stablecoin holdings among these wallets, indicating a strategic shift toward investing in more volatile cryptocurrencies rather than maintaining stable asset positions.

In addition to whale accumulation, the cryptocurrency landscape is evolving with several trends emerging. Interest in meme coins is waning as investors pivot toward more sustainable projects with long-term potential. This shift reflects a growing desire for robust investments instead of speculative plays.

The integration of AI into blockchain ecosystems is another transformative trend. AI agents are enhancing transaction processing efficiencies and supporting the development of virtual economies, creating new opportunities for innovation.

Moreover, hyperliquid token generation events (TGEs) are gaining traction. These innovative mechanisms improve liquidity and enhance the trading experience, addressing challenges that have historically plagued new tokens.

For more information, read here.

Other Top Performing Tokens

Token | Catalyst |

Render Network (RENDER) | RENDER surged 24.9% after Otoy unveiled OctaneRender 2026.1 Alpha, featuring experimental rendering technologies. Read more here. |

TRON DAO (TRX) | TRX surged 68.6% after TRON DAO was recognized for its Global Blockchain Innovation at Wiki Finance EXPO 2024. Read more here. |

Hedera Hashgraph (HBAR) | HBAR surged 59% following the announcement of Hedera and SEALSQ's collaboration seeking to revolutionize decentralized physical infrastructure networks. Read more here. |