Weekly Institutional Insights — Bitcoin Fails to Climb Above $60K as Vitalik Buterin Expresses Concerns Over DeFi

Sep 2, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Market Watches Out for Upcoming August Job Report

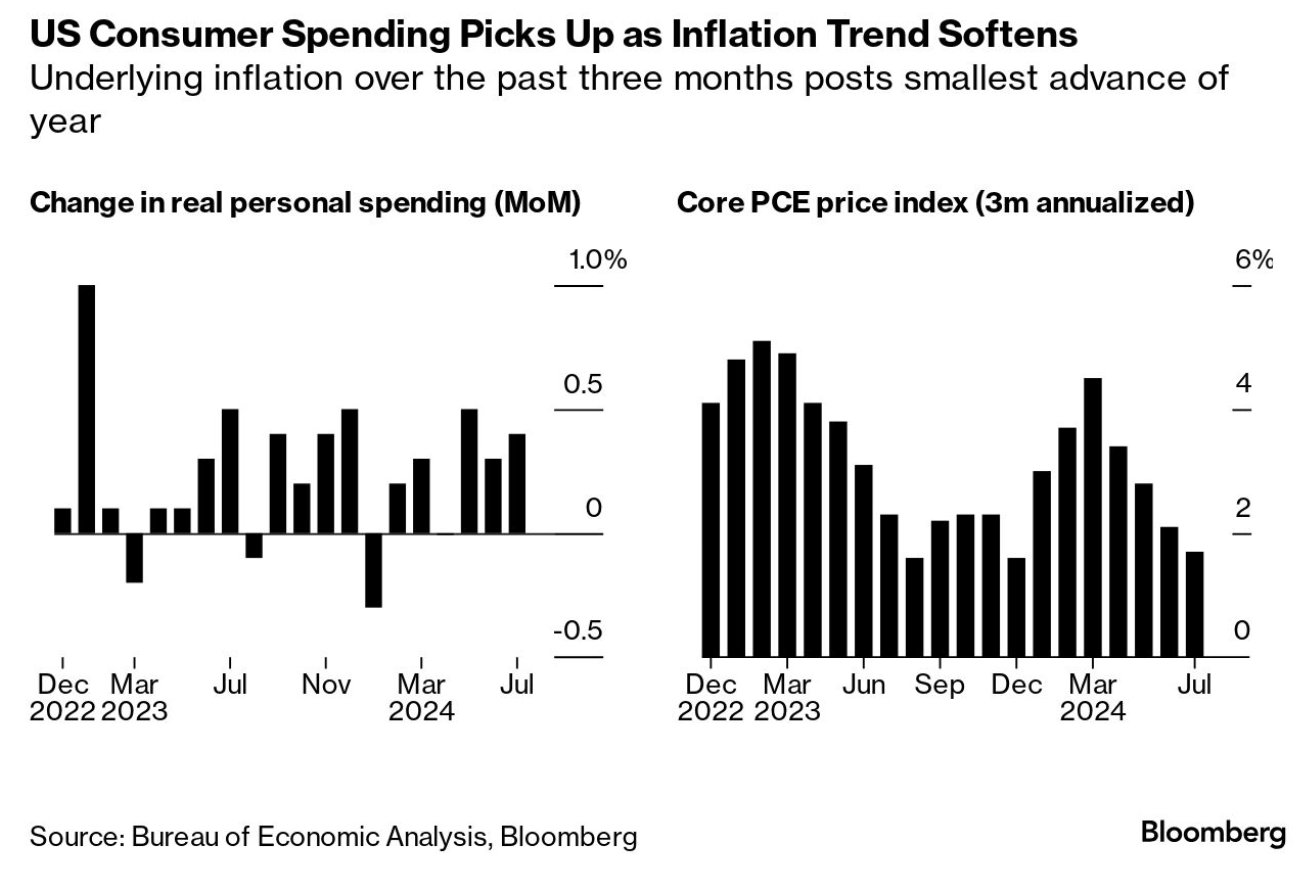

In recent years, a key truth about the U.S. economy is that consumers, who are crucial to its growth, continue to spend vigorously. As the pandemic recession transitioned into a recovering labor market, American spending — through online purchases and credit card swipes — has sustained economic expansion. With a potential Federal Reserve interest rate cut on the horizon, recent data indicates a decline in inflation and resilient consumer spending, despite rising borrowing costs. This scenario aligns with Fed Chair Jerome Powell’s hopes for a soft landing for the economy.

However, challenges remain. Income growth is sluggish, the job market is softening and the savings rate is decreasing, raising concerns about the sustainability of consumer spending. These factors suggest caution, especially after a tumultuous few years marked by recession fears.

Looking ahead, the upcoming jobs report will provide crucial insights into the labor market before the Fed's policy meeting. Meanwhile, the European Central Bank has already begun cutting rates, with euro-area inflation dropping to its lowest level since mid-2021. As noted by Allison Schrager in Bloomberg Opinion, it's time for the U.S. government to increase spending to foster economic growth, ensuring that the Fed isn't the sole driver of recovery.

Weekly Crypto Highlight — Vitalik Doesnt Like DeFi

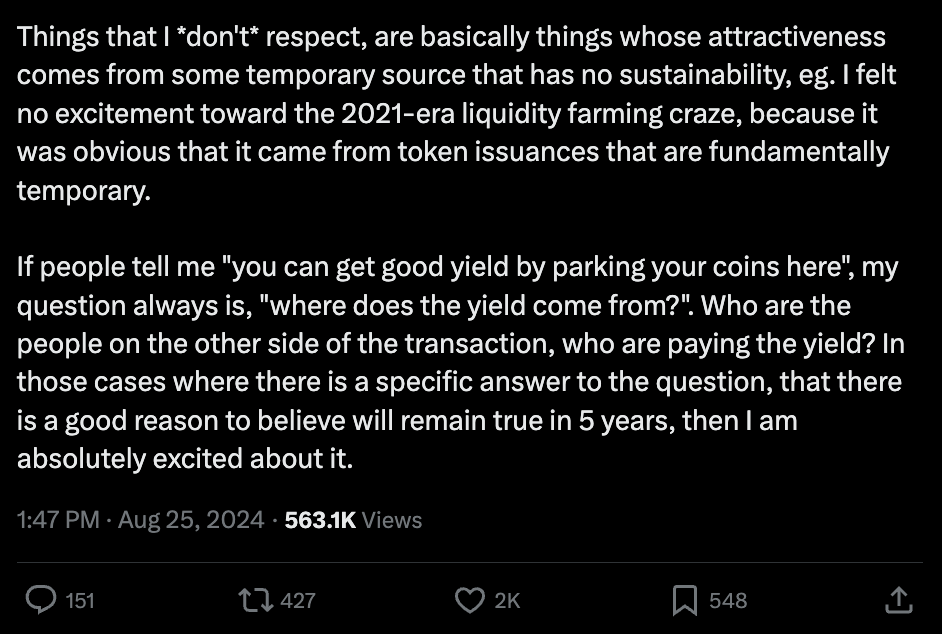

When Vitalik Buterin, Ethereum’s founder, expressed concerns on X about the sustainability of most decentralized finance (DeFi) projects, it sparked significant backlash within the community. He suggested that many DeFi protocols are self-referential and lack respectability, emphasizing that they should meet two key criteria: decentralization and sustainability. This criticism was particularly pointed toward practices such as 2021-era liquidity farming, which he deemed unsustainable due to token inflation.

Prominent figures in DeFi, such as Sam Kazemian of Frax Finance, voiced their disappointment, arguing that DeFi is crucial to Ethereum’s value (which exceeds $300 billion). Buterin’s stance implies that only decentralized exchanges (DEXs), stablecoins and platforms like Polymarket meet his standards, as many DeFi protocols exhibit centralization and lack ties to the real economy.

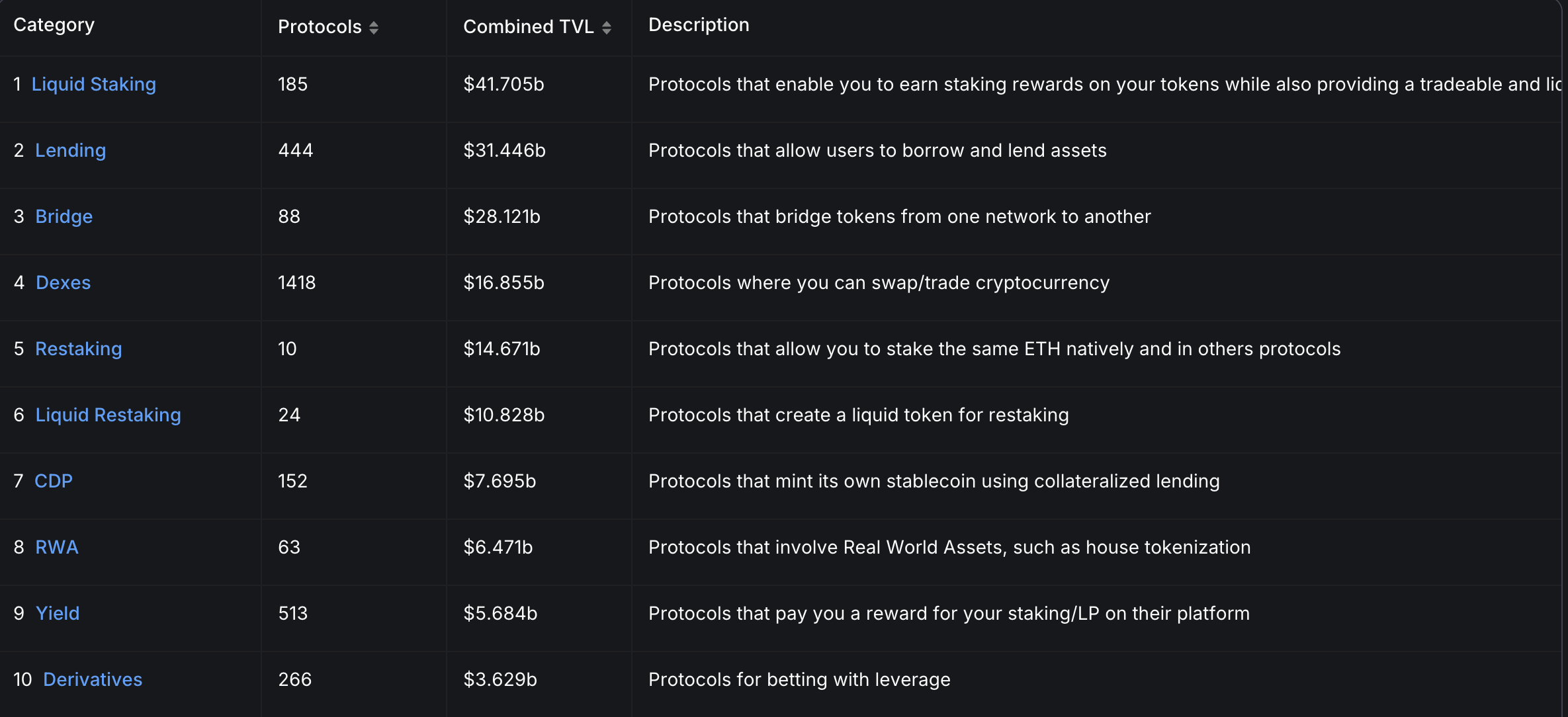

Top DeFi Categories. Source: DeFiLlama

The top five DeFi categories are liquid staking, lending, bridges, DEXs, and liquid staking, among which liquid staking, lending and staking might not meet Vitalik's requirements.

While some may view his critique as overly harsh, it reflects a broader truth about the current state of DeFi. Buterin seems to advocate for a more mature version of DeFi, one that connects better with real-world economies. However, he may not be fully attuned to ongoing developments in DeFi, as his focus is likely on enhancing Ethereum’s core functionalities. Ultimately, his comments could steer builders toward more meaningful use cases, benefiting the ecosystem in the long run.

Bitcoin Spot ETF Flows

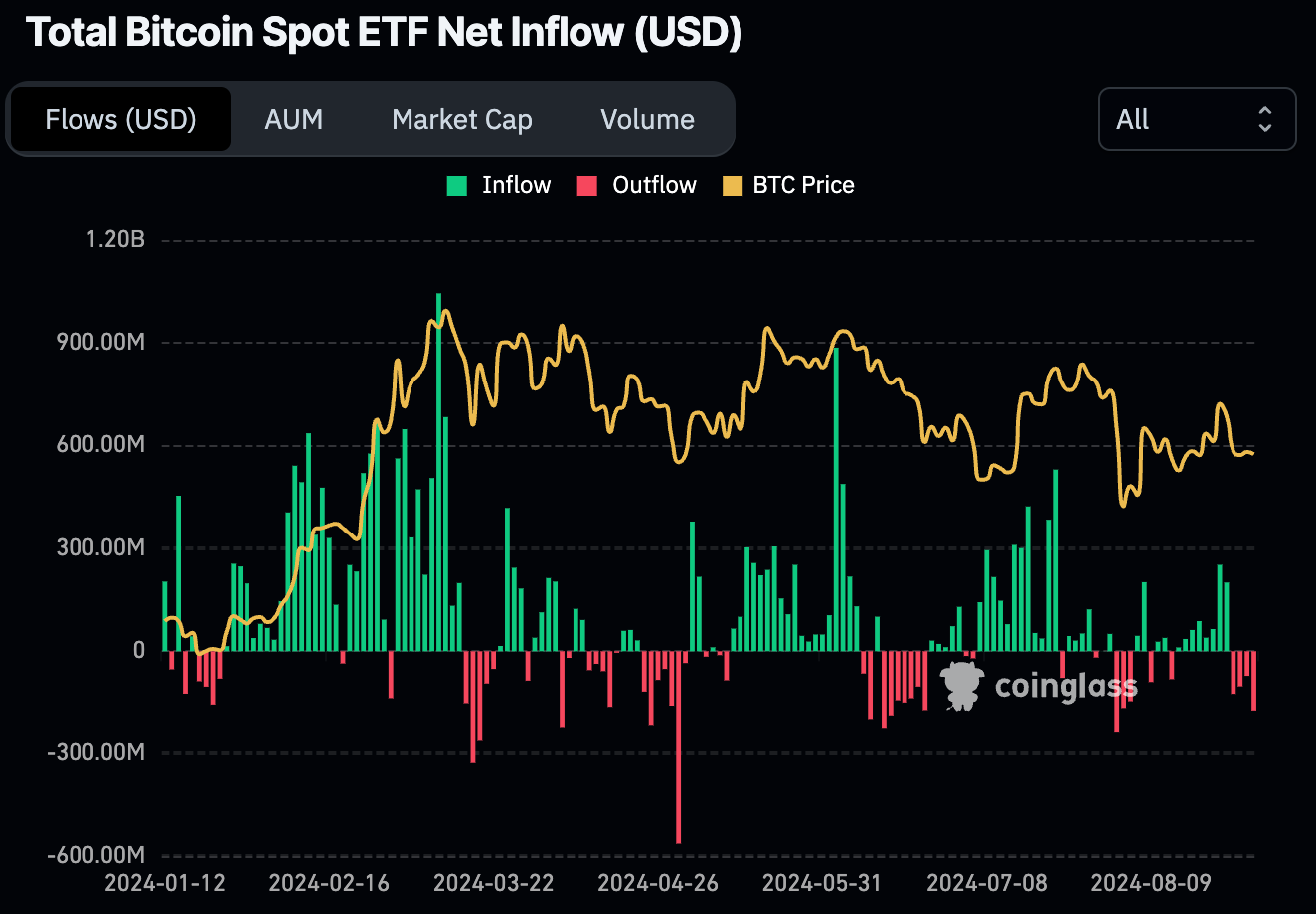

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Aug 30, 2024

Bitcoin Spot ETFs have recently experienced consecutive outflows for five straight days, coinciding with Bitcoin's decline below the $60,000 mark. Its repeated failure to hold above this critical threshold suggests that traders are being cautious, perhaps awaiting more robust indicators before committing further capital.

Compounding this uncertainty, the economic landscape this week lacks any blockbuster data that may spur market movement. Investors are now seeking more precise signals regarding Bitcoin's subsequent direction, including both the upcoming August 2024 job report next Friday, and moves from central banks worldwide.

Other Top-Performing Tokens

Token | Catalyst |

Sanctum (CLOUD) | CLOUD surged 28% following the announcement that Bybit was launching bbSOL, which is powered by Sanctum. Read more here. |

Dogs (DOGS) | DOGS surged 19.5% following Bybit's announcement of a boosted prize pool to 20,000 USDT for its DOGS Trading Competition. Read more here. |

IDEX (IDEX) | IDEX surged 37.8% following the announcement of its upcoming Mainnet launch as the first Omnichain Perpetuals DEX. Read more here. |