Weekly Institutional Insights: Bitcoin Clings to $90K; Ethereum Unveils Beam Chain

Nov 18, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Rate Cut Hopes Dampened in the Wake of Strong Economy

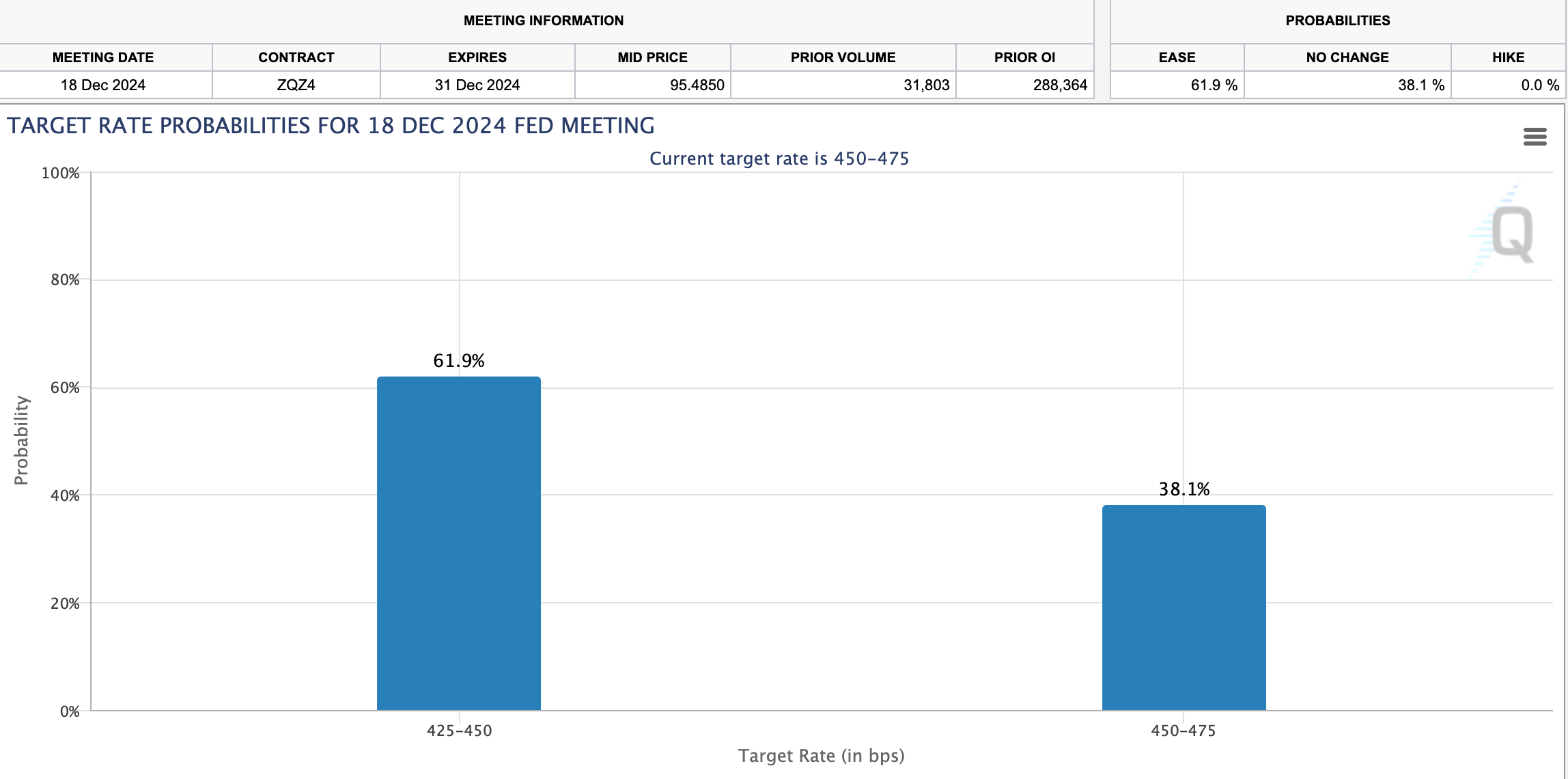

Target rate probabilities for Federal Reserve meeting on Dec 18, 2024. Source: FedWatch

Recent strong economic and inflation data is reshaping the discussions among Federal Reserve policymakers regarding interest rate cuts. On Friday, investors further lowered their expectations for a rate reduction at the Fed's upcoming December 2024 meeting.

Central bankers have expressed confidence that inflation is stabilizing, suggesting that the benchmark rate, currently between 4.5% and 4.75%, could eventually be lowered to a more neutral level that encourages spending and investment. However, the pace of these potential cuts and the definition of "neutral" remain topics of debate. Fed Chair Jerome Powell indicated that the robust economy allows for a measured approach.

This shift in sentiment follows a political change after Donald Trump's election, with Wall Street adjusting to the prospect of inflationary pressures from potential tax cuts, increased tariffs and immigration restrictions under the new administration. Although Fed officials have not explicitly factored these political developments into their considerations, market expectations for rate cuts have diminished over the past week.

Susan Collins, president and CEO of the Federal Reserve Bank of Boston, noted that while there isn't a pressing need to cut rates, December 2024 still remains a possibility. Other officials, including Richmond Fed President Thomas Barkin, have emphasized that any pause in cuts would indicate a slower approach, rather than a complete halt.

Recent data, including strong retail sales and rising import prices, has led traders to reduce to around 60% the likelihood of a December rate cut. Chicago Fed President Austan Goolsbee has acknowledged that inflation indicators remain high, though he maintains a general expectation for inflation to trend toward the Fed's 2% target. He suggested the Fed might cut rates by a quarter point next month, and by a full percentage point throughout the next year, in line with projections from September. Investors now anticipate rates could remain higher than previously expected, with fresh projections set to be released in December.

Weekly Crypto Highlight — Beam Chain: Justin Drake’s Ambitious New Plan for Ethereum

At Devcon (2024), Ethereum’s annual conference for developers, excitement surged as Justin Drake, a leading Ethereum researcher, unveiled his "most ambitious initiative" yet: Beam Chain, a new consensus layer that utilizes zero-knowledge (ZK) technology to enhance Ethereum’s infrastructure.

What Is Beam Chain?

Ethereum operates on two layers: the execution layer, which handles transactions, and the consensus layer, which handles network security. Beam Chain aims to improve the Consensus Layer with several key benefits, as follows.

Faster Confirmations: Reduces transaction confirmation times from 12 seconds to just 4 seconds.

Enhanced Decentralization: Maintains or improves Ethereum’s decentralization.

Reduced Bot Extraction: Eliminates certain bots that exploit users, particularly those using reorg-based miner extractable value (MEV).

Lower Staking Requirements: Decreases the minimum ETH needed to stake from 32 ETH to just 1 ETH, making staking more accessible.

Quantum Resistance: Future-proofs Ethereum against potential quantum computing threats.

Criticism and Responses

Despite the palpable excitement, the presentation faced criticism on the below fronts.

Timing: Many consider the five-year timeline too slow for the fast-paced crypto market.

Response: Justin Drake explained that the estimate is conservative, with potential for an earlier rollout if progress is smooth.

Priority: Concerns arose that Ethereum isn’t effectively addressing competition from faster networks such as Solana.

Context: This criticism extends beyond Drake’s talk to the Ethereum Foundation’s broader approach. While his focus is on the consensus layer, there are ongoing efforts to improve Ethereum as a whole.

Researchers acknowledge the need to enhance Ethereum’s Layer 1, with plans to address fragmentation set for adoption by 2025. Upcoming features like pre-confirmations and based rollups aim to further benefit Ethereum L1 validators.

Conclusion

Justin Drake’s presentation didn’t drastically shift opinions, but it did solidify bullish sentiment among Ethereum supporters, particularly regarding Layer 2 developments. Meanwhile, skeptics remain concerned about ETH's recent price performance, which has lagged behind that of Bitcoin and Solana. In the complex landscape of cryptocurrency, the Ethereum community recognizes the importance of careful, deliberate progress as they navigate substantial investments in this evolving space.

Bitcoin Spot ETF Flows

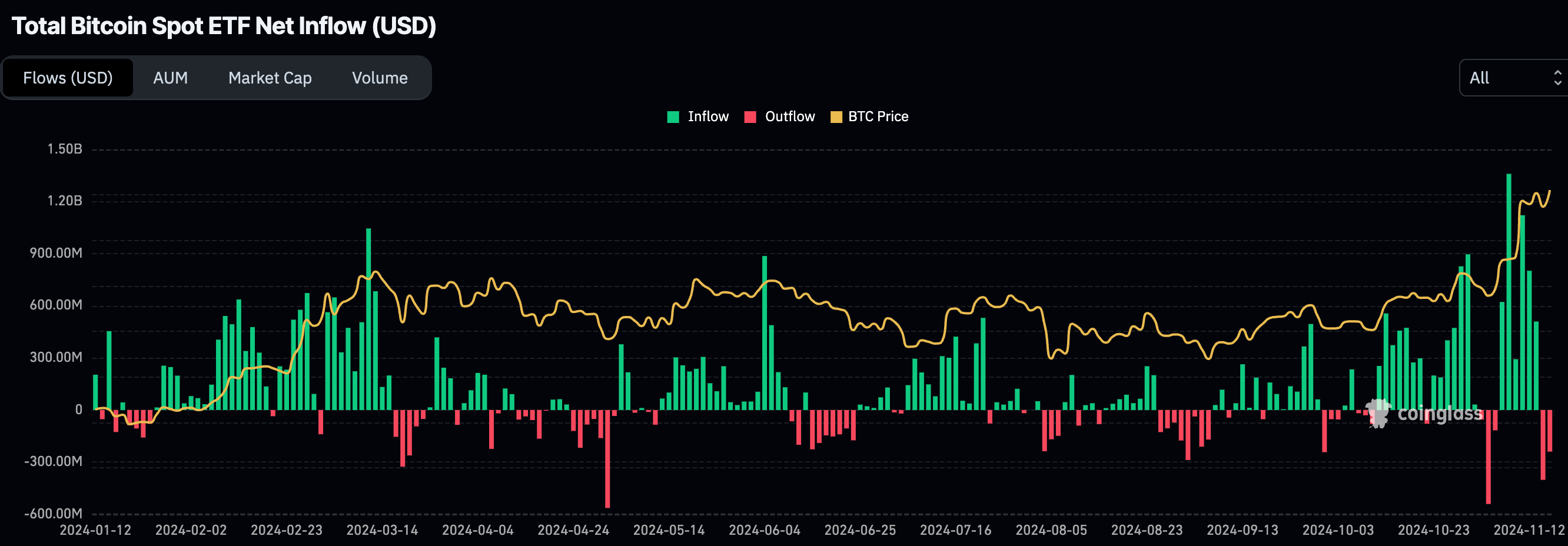

Total Bitcoin Spot ETF Net Inflows. Source: CoinGlass

Inflows into Bitcoin Spot exchange-traded funds (ETFs) experienced a significant slowdown in the latter half of last week. This deceleration can be attributed to two main factors: profit-taking by investors, and the broader market's response to anticipated changes in monetary policy.

As Bitcoin's price surged in recent weeks, many investors have seized the opportunity to lock in gains, leading to reduced inflows into these ETFs.

Additionally, the overall landscape for risk assets, including cryptocurrencies, has been complicated by the Federal Reserve's signals regarding interest rate cuts. Investors are now grappling with the possibility that the central bank may adopt a more cautious approach in its upcoming meetings, potentially leading to fewer rate reductions than previously expected. This uncertainty creates headwinds for riskier assets, as a less accommodative monetary policy can dampen investor sentiment and reduce appetite for volatility.

Other Top Performing Tokens

Token | Catalyst |

Near Protocol (NEAR) | NEAR surged 7.9% after Deutsche Telekom joined NEAR Protocol to boost decentralization and user-owned AI. Read more here. |

Pepe (PEPE) | PEPE surged 76.7% following Robinhood Crypto's expansion of U.S. offerings to include Solana (SOL), Cardano (ADA), XRP and PEPE. Read more here. |

Ethena (ENA) | ENA surged 8.2% following Pendle's partnership with Ethena Labs for Boros v3, revolutionizing yield trading with margin and funding rate efficiency. Read more here. |