Weekly Institutional Insights — Weak Job Reports Fail to Cheer the Market; MATIC Transitions to POL

Sep 9, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Weakening Job Reports Boost Rate Cut Chance

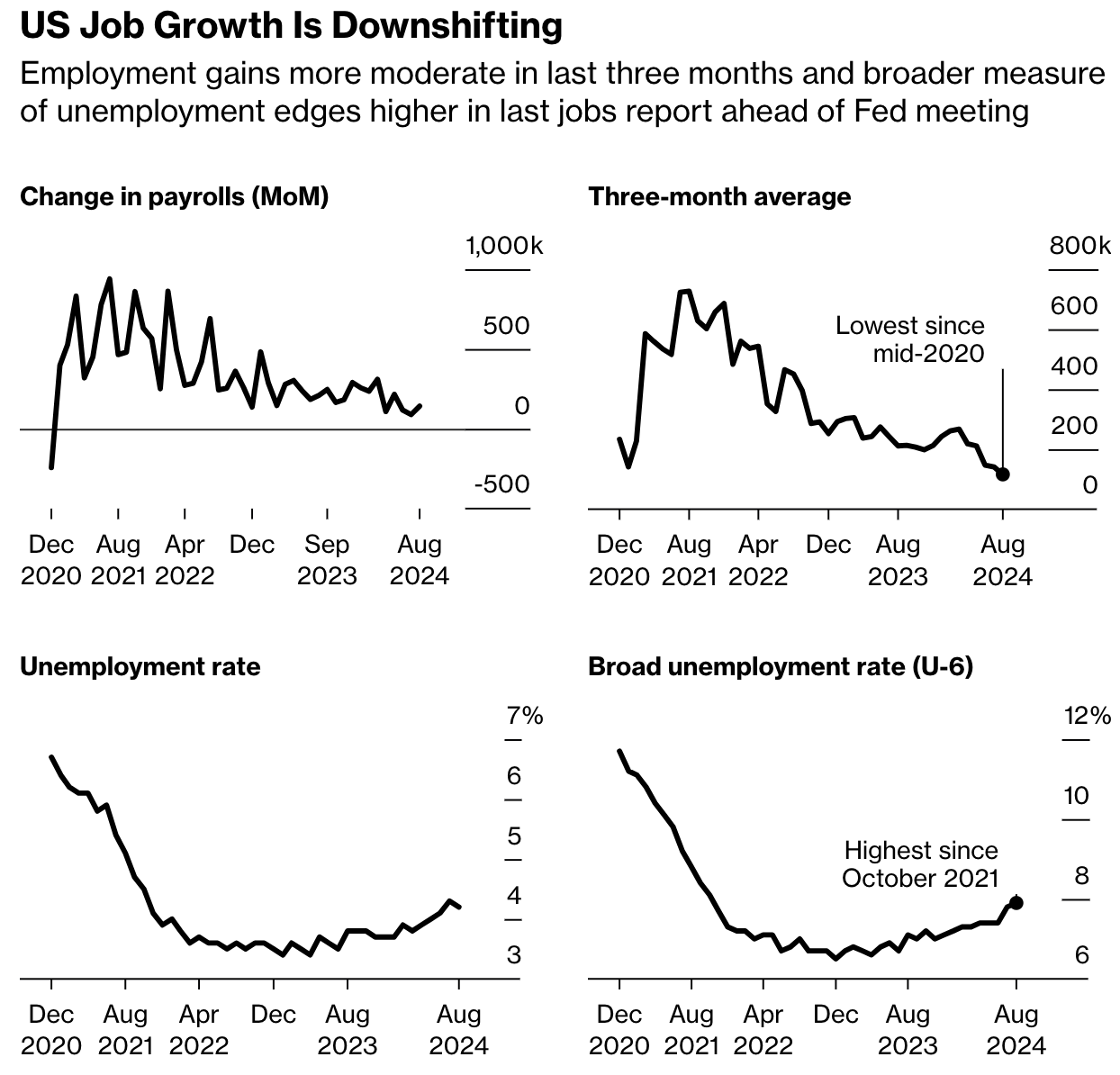

Source: Bloomberg

US hiring fell short of expectations in August, with nonfarm payrolls increasing by just 142,000, the lowest three-month average since mid-2020. The unemployment rate dipped to 4.2%, the first decline in five months, reflecting fewer temporary layoffs. Forecasts had anticipated a rise of 165,000 jobs, highlighting a trend of moderate employment gains.

In response to the weak job growth, Treasury yields fluctuated, and traders speculated that the Federal Reserve might cut interest rates by half a percentage point in their upcoming meeting. Analysts, including Sonu Varghese of Carson Group, suggested that the labor market's softening warrants Fed intervention, potentially leading to a September rate cut.

Job losses were noted in sectors such as manufacturing and retail, while hiring in education and healthcare slowed significantly. The broader underemployment rate rose to 7.9%, its highest since October 2021. Although average hourly earnings increased by 3.8% year-over-year, the Fed remains cautious, weighing the need for rate adjustments against signs of economic cooling. Officials are considering two approaches: steady 25-basis-point cuts or larger reductions to signal a stronger response to labor market conditions.

Weekly Crypto Highlight — MATIC Transitions to POL

Polygon is transitioning from using the MATIC token to the new POL token, sparking discussions on whether this change is merely a rebranding or a significant shift for the platform. Originally launched as Matic Network in 2017, the project rebranded to Polygon in 2021, retaining MATIC as its gas token. Despite its early successes, MATIC has seen an 87.1% decline from its all-time high in 2022.

The recent change sees POL replacing MATIC as the native gas and staking token on the Polygon PoS sidechain at a 1:1 ratio. The potential impact of this upgrade is mixed. On the bearish side, MATIC's circulating supply is nearing its cap of 10 billion, while POL will introduce a 2% annual inflation over the next decade—though this may not be significant in the long run. Additionally, Polygon has lost market share to newer competitors, with its total value locked (TVL) at approximately $887 million compared to Arbitrum's $2.6 billion.

Conversely, the bullish case hinges on Polygon's strong business development team and its ability to leverage partnerships, such as with Reddit. The introduction of POL as a staking token for multiple chains within the Polygon ecosystem could create new demand. The vision for a unified L2 ecosystem, though still under development, aims for scalability and liquidity through Polygon’s AggLayer technology.

For current MATIC holders, migration to POL is straightforward, with staked MATIC automatically upgraded and regular MATIC requiring migration via Polygon Portal. There is no urgency for this migration, allowing users to proceed at their own pace.

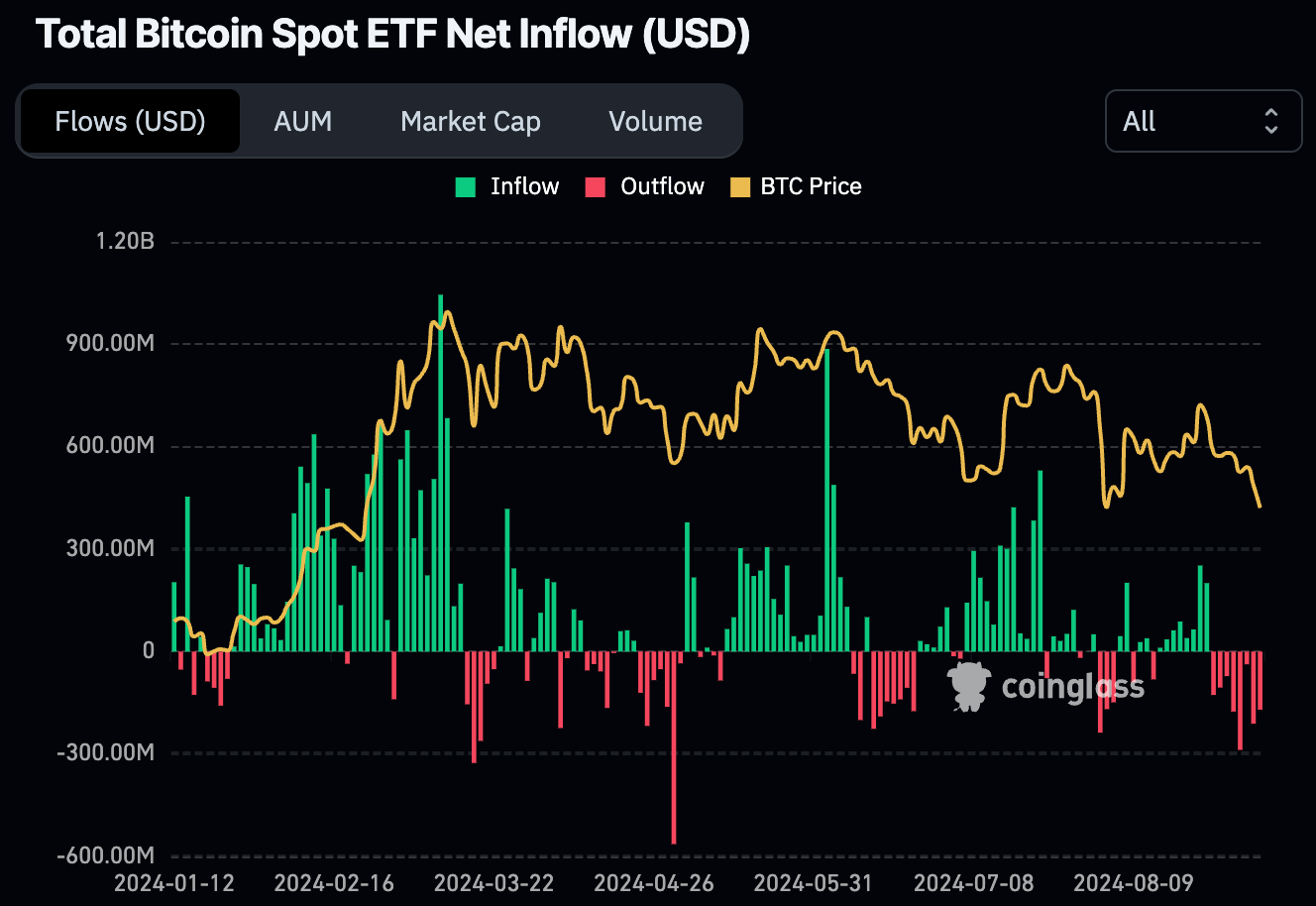

Bitcoin Spot ETF Flows

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Sep 6, 2024

Bitcoin is facing significant challenges in its pursuit of breaking above the $60,000 mark. In the past week, the cryptocurrency has experienced consecutive weekly net outflows from Bitcoin Spot ETFs, marking the longest streak of outflows since these ETFs were introduced in January 2024. This trend suggests a growing sentiment among investors who may be cautious about entering or maintaining positions in Bitcoin at its current price levels.

In light of these developments, some analysts are forecasting a potential dip to the $50,000 range. This level is viewed as a critical support zone for Bitcoin, where many bullish investors are likely to step in and buy, believing it represents a favorable entry point.

Other Top Performing Tokens

Token | Catalyst |

Sui (SUI) | SUI surged following the launch of the AUSD stablecoin on Sui, boosting its DeFi ecosystem and liquidity. Read more here. |

Ordinals (ORDI) | ORDI surged 19.1% following the announcement of the Ordinals Summit and Inscribing Atlantis hosting a major Bitcoin event at the National Gallery Singapore. Read more here. |

NULS (NULS) | NULS surged 10.6% after the announcement of the NULS Oracle as the first project of the Ecosystem Ignition Initiative. Read more here. |

Check out the Q2 2024 CoinDesk Report on top-performing tokens.