Navigating the 2024 U.S. Election: What It Means for Crypto Investors

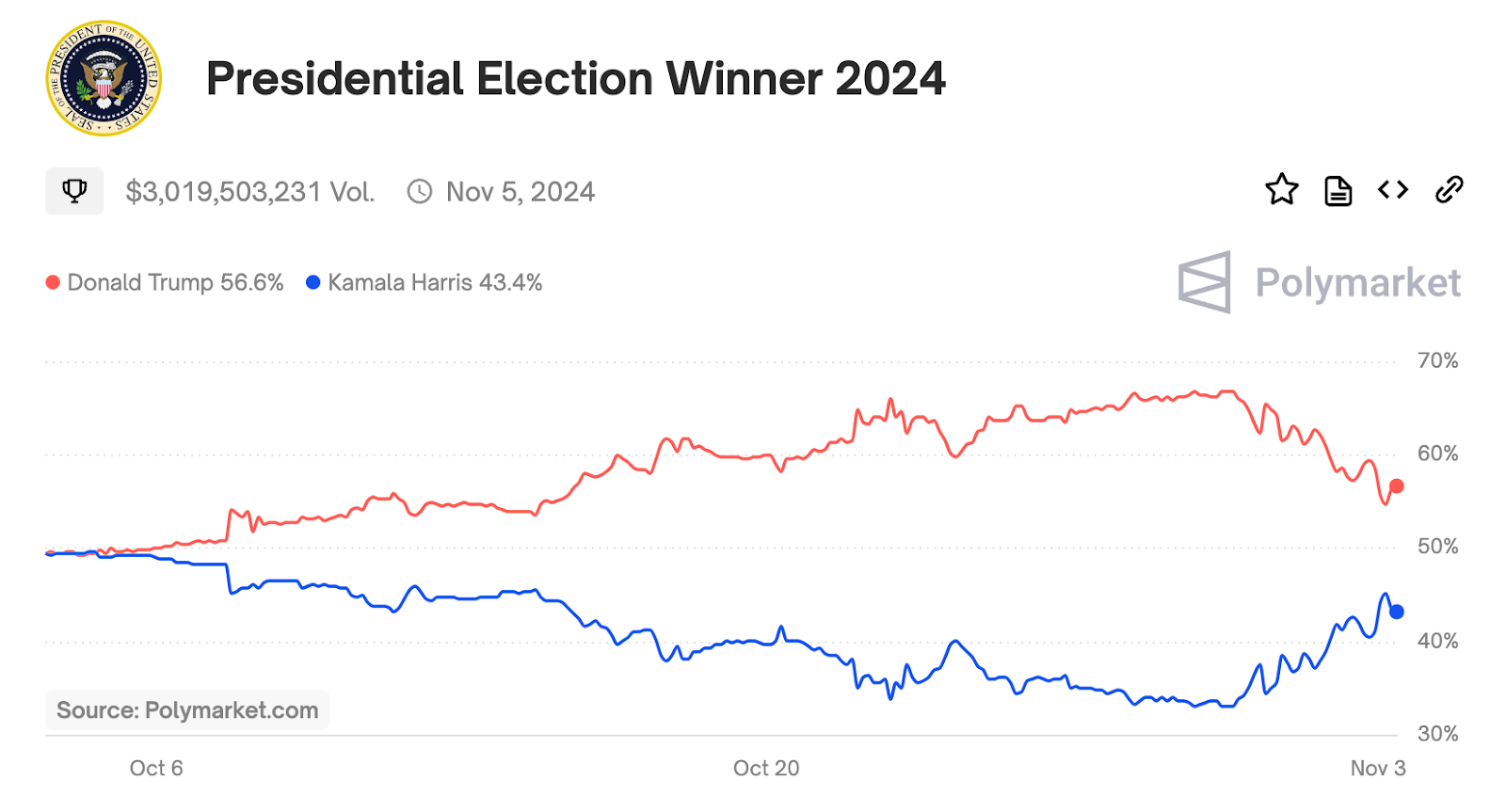

With the U.S. presidential election on November 5, crypto investors worldwide are closely watching to see how the results may impact the cryptocurrency and web3 sectors. According to Polymarket, polls currently show Donald Trump leading with 56.5% to Kamala Harris’s 43.5%, and both candidates are appealing to crypto supporters with promising policies. Here’s a breakdown of each candidate's stance and the key factors to consider as a crypto investor.

Candidate Stances: A Crypto-Friendly Election

Both Donald Trump and Kamala Harris present themselves as proponents of cryptocurrency, albeit with differing perspectives and approaches to its regulation and adoption.

- Donald Trump: Trump, who previously criticized crypto, has now committed to establishing the U.S. as a global leader in digital assets. He has pledged to create a national Bitcoin reserve and ease regulatory restrictions to drive growth in the sector. Trump has actively courted the crypto community, headlining major Bitcoin conferences and promising to make the U.S. the “crypto capital of the planet.” This approach has resonated well with crypto advocates, many of who view him as the most pro-crypto candidate in history, with promises that signal a serious commitment to digital innovation (Wired). However, some remain cautious, questioning whether he will fully deliver on these ambitious pledges (Cryptonews).

- Kamala Harris: Harris, while supportive of innovation, takes a more balanced approach, emphasizing consumer and investor protection alongside the promotion of new technologies. She recently stated her intent to "encourage innovative technologies like AI and digital assets while protecting consumers and investors,” which appeals to those seeking a moderated approach to growth in the sector (CoinDesk).

While Trump's bold proposals and vocal support for the crypto sector and Harris’s eagerness to drive innovation forward have sparked enthusiasm, it's essential for crypto enthusiasts to approach these promises with cautious optimism. Given the evolving regulatory landscape and complexities surrounding cryptocurrency policies, it’s our due diligence to monitor both candidates' positions closely.

The crypto community should remain aware that campaign pledges may not translate directly into actionable policies, and any proposed reforms will need to navigate through a complex legislative process. Staying informed on both candidates' evolving stances and potential implications is crucial for making well-rounded decisions.

Bullish Factors Supporting the Market

Although election outcomes may influence market dynamics, a variety of positive factors are contributing to a sense of optimism within the cryptocurrency sector:

Lower U.S. Recession Risks

Goldman Sachs recently revised its recession forecast, lowering the probability of a U.S. recession to 15%. This improved economic outlook reflects a combination of resilient consumer spending, moderated inflation and stabilized interest rates, which collectively signal that the economy may avoid a significant downturn. Such stability has a positive effect on investor sentiment, as a reduced likelihood of recession tends to decrease risk aversion and encourage capital flow into higher-risk assets, including cryptocurrencies.

For the crypto market, which is highly sensitive to shifts in macroeconomic trends, greater confidence in economic resilience could translate to increased investment and liquidity. While traditional markets may initially see the biggest boost, the spillover effect of investor optimism often extends to digital assets, suggesting a potential uptick in market activity and valuations across the crypto space.

Record-Breaking Bitcoin ETF Inflows

Bitcoin Spot ETFs led by BlackRock and other institutions have attracted record investments, with net inflows hitting $5 billion in October 2024. BlackRock now holds over 400,000 BTC (worth close to $27 billion), reflecting growing interest from traditional financial players. This kind of institutional involvement boosts Bitcoin’s reputation and highlights its appeal as a valuable investment.

Global Interest Rate Cuts

Central banks worldwide are continuing a trend of interest rate cuts aimed at supporting economic growth. Recently, the U.S. Federal Reserve also lowered its benchmark interest rate, followed closely by similar moves from the European Central Bank and other central banks globally. By reducing interest rates, central banks make borrowing more affordable, thereby encouraging spending and investment in various sectors. This increase in liquidity is intended to stimulate economic activity and alleviate financial pressures faced by businesses and consumers alike.

For investors, lower interest rates generally lead to a “risk-on” sentiment, making them more inclined to invest in higher-yielding, higher-risk assets, such as equities and cryptocurrencies. With traditional savings and bond yields weakened, the appeal of alternative investments grows, drawing more attention and capital into the crypto markets.

However, while this environment can create favorable conditions for market growth, it also brings increased volatility and potential inflation concerns, underscoring the importance of cautious yet informed investment strategies. As central banks worldwide navigate these rate adjustments, investors should monitor the broader economic impacts, as further rate cuts or policy shifts could continue to shape market dynamics.

Bearish Factors: Risks to Watch

While numerous factors fuel optimism in the cryptocurrency sector, it’s equally important to remain vigilant about potential risks. Investors and participants should consider these uncertainties alongside the positive outlook, ensuring a balanced approach that mitigates risks while embracing opportunities.

Evolving Regulatory Landscapes

The implementation of frameworks such as Markets in Crypto-Assets (MiCA) represents a significant step toward establishing a standardized regulatory approach for crypto assets across Europe. MiCA introduces comprehensive requirements for issuers, exchanges and other service providers, focusing on increasing consumer protection, enhancing transparency and reinforcing market integrity. These measures aim to safeguard investors and ensure a stable operational environment for cryptocurrency markets.

However, while such regulations provide a more secure and structured ecosystem, they may also introduce limitations for European investors by potentially reducing flexibility in asset offerings and trading options. Therefore, as MiCA and similar frameworks take effect, investors should stay informed about both the protections and constraints these regulations bring.

Geopolitical and Regulatory Uncertainty

Ongoing global tensions and shifting regulations are currently creating a layer of unpredictability. Governments may respond with more strict policies, which could pose challenges for the crypto industry (Markets Insider).

Long Bull Market Cycle

The cryptocurrency market is experiencing one of the longest sustained bullish cycles in recent memory, marked by steady price increases and growing investor confidence. While this extended period of gains has fueled optimism, it also raises the possibility of a market correction, as markets rarely move in a single direction indefinitely. Prolonged bull runs often attract heightened attention from both retail and institutional investors, which can create a sense of euphoria and potentially inflate asset valuations beyond their intrinsic worth.

Investors should remain mindful that such strong uptrends can shift abruptly, especially in the crypto market, which is known for its heightened volatility and sensitivity to market sentiment. A sudden reversal or profit-taking sell-off could trigger rapid declines, especially if sentiment shifts due to regulatory news, macroeconomic developments or broader market trends. These factors underscore the importance of a balanced investment strategy that includes risk management practices, such as stop-loss orders and diversified portfolios. While long bull cycles can offer attractive returns, being vigilant against emotional reactions in the market can help protect gains and mitigate the impact of potential downturns.

Stay Informed and Take Advantage of Market Opportunities

As the U.S. election unfolds, both leading candidates have expressed varying levels of support for cryptocurrency, indicating a potentially favorable regulatory environment in the future. However, while this emerging political interest is promising, the crypto landscape remains complex and dynamic, with unique risks and opportunities that demand informed decision-making. Positioning yourself in this evolving landscape not only involves capturing potential gains, but also understanding how to mitigate potential risks. We encourage you to make the most of these resources to build a balanced approach — one that leverages market opportunities while managing the uncertainties that can arise in the crypto space.

Bybit offers a wealth of resources on Bybit Learn and Bybit Help Centre that are designed to help you make well-rounded investment choices, including educational materials on crypto fundamentals, insights into advanced trading strategies and updates on the latest market trends. Take your first step with Bybit to discover the tools and information that empower your journey.

#Bybit #TheCryptoArk