Weekly Institutional Insights: Trump’s Executive Orders Might Further Boost Crypto

Jan 27, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

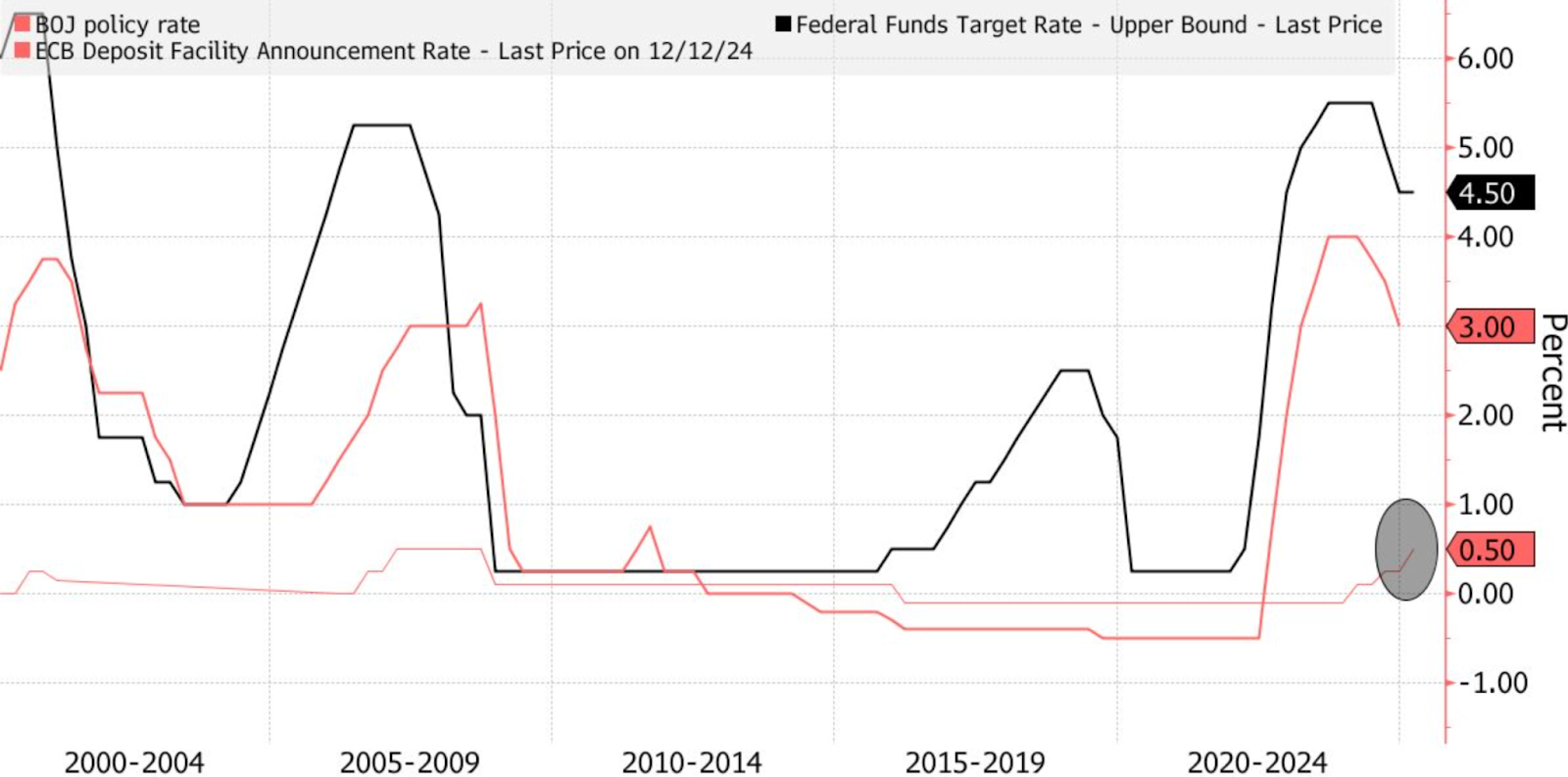

Weekly Highlight — BOJ Raises Rates

The Bank of Japan (BOJ) raised its key policy rate to 0.5% on Friday, marking the highest level since 2008 and reflecting a more optimistic outlook on inflation. This decision, anticipated by the market, follows a two-day meeting led by BOJ Governor Kazuo Ueda, who noted the need to assess wage trends and the impact of Donald Trump's return to the U.S. White House.

The BOJ's statement highlighted stable global financial markets, suggesting it has carefully monitored reactions to the new U.S. administration. Ueda emphasized that future rate adjustments would depend upon economic conditions, indicating no predetermined hike pace. Following the announcement, the yen strengthened against the dollar, and yields on 10-year Japanese government bonds rose.

Market analysts expect further rate increases, possibly by May 2025, contingent on wage pressures. This latest hike is Ueda's third in less than a year, contrasting sharply with the surprise increase in July 2024 that spurred a global market downturn.

Economists had largely predicted this move, with inflation projections now above 2% for the first time. Ueda’s comments on the neutral rate suggest that the BOJ might not align with economists’ expectations of a 1% endpoint, as he believes significant distance remains to reach neutral status.

This rate increase positions Japan uniquely among major central banks, as others, such as the Federal Reserve and ECB, are lowering rates. It allows Japan to respond more traditionally to future economic events. The decision came amid a favorable political climate, with Prime Minister Shigeru Ishiba's cabinet supporting the hike, unlike past cycles that faced strong opposition. Ueda’s confidence, however, remains cautious, due to uncertainties around U.S. economic policy.

Weekly Crypto Highlight — Trump’s Executive Orders to Support Crypto

U.S. president Donald Trump has taken a significant step in supporting the digital asset sector by signing an executive order that establishes a working group to advise the White House on cryptocurrency policy. This group includes key agencies, such as the Treasury, Justice Department, SEC and CFTC, and aims to submit recommendations for a regulatory framework within six months.

The order emphasizes the importance of the crypto industry for U.S. innovation and economic development, while encouraging regulated dollar-backed stablecoins. However, it expresses concerns about central bank digital currencies (CBDCs), citing potential risks to the financial system and privacy.

Industry leaders view this executive action as a historic win, with Matt Hougan of Bitwise Asset Management stating it establishes crypto as a national priority. During the signing, Trump highlighted the potential economic benefits of these actions and expressed a desire for America to lead in the crypto space.

This order aligns with Trump’s campaign promises, which included streamlining regulations and appointing crypto-friendly officials. He has made some strides in this area, including the pardon of Ross Ulbricht, the creator of Silk Road, and the appointment of agency heads supportive of the crypto industry.

In a related move, the SEC repealed a guideline that had restricted banks from offering custody services for digital assets, which the industry has criticized as being limiting. Following these developments, Bitcoin rose 1.5%, reflecting positive market sentiment.

Trump's evolving stance on digital assets, from skepticism to advocacy, coincides with increased political engagement from the crypto sector. His administration's actions suggest a commitment to fostering a favorable regulatory environment for digital currencies, potentially setting the stage for significant growth in the industry.

Other Top-Performing Tokens

Token | Catalyst |

Mantle Network (MNT) | MNT surged nearly 10.1% after Mantle Network partnered with Synergy to drive cross-chain innovation between the TON and EVM ecosystems. Read more here. |

Worldcoin (WLD) | WLD surged nearly 5.5% following the boost from Trump's AI investment plan. Read more here. |

ai16z (AI16Z) | AI16Z surged nearly 31.4% following the Bebop integration, enhancing AI trading efficiency with ElizaOS and new features. Read more here. |