Weekly Institutional Insights: Mixed U.S. Job Reports; Crypto IPOs Coming

Feb 10, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — Mixed Job Reports Rattle Market

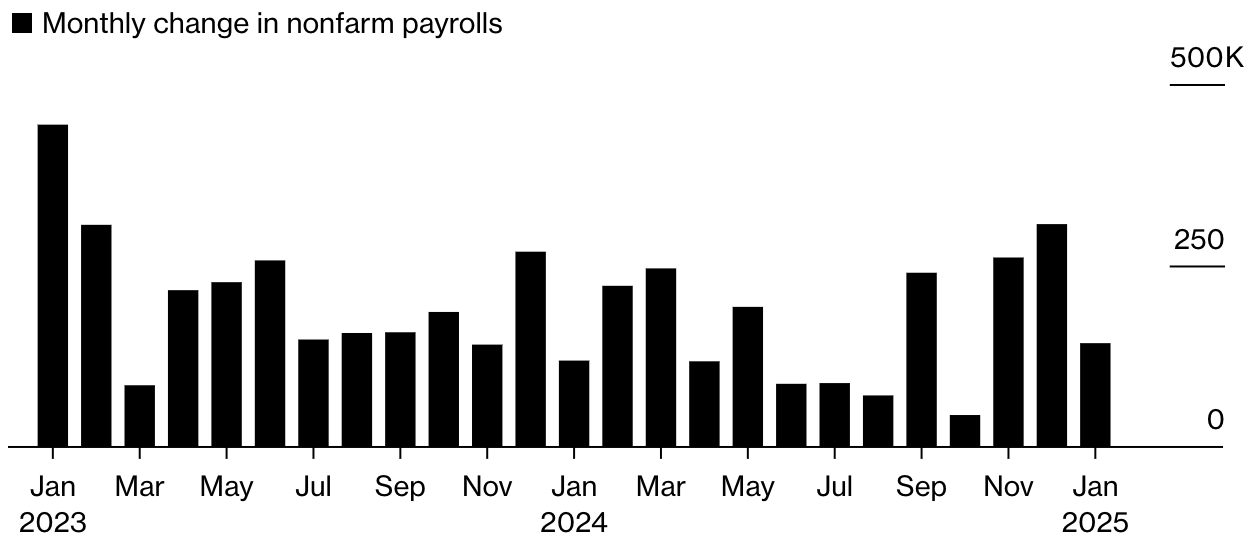

The recent Bureau of Labor Statistics report indicates that U.S. job growth is slowing, yet remains healthy. Nonfarm payrolls grew by 143,000 last month, with upward revisions for November and December 2024, as they added 100,000 jobs. The unemployment rate has dipped to 4.0%, demonstrating a robust labor market, although the annual revisions suggest job gains were softer than initially reported, averaging 166,000 per month in 2024.

Simultaneously, inflation expectations are rising, driven partly by tariffs proposed by U.S. president Trump. Data from the University of Michigan reveals consumers anticipate price increases, which may complicate the Federal Reserve's decision-making. Fed officials have indicated they aren’t in a rush to lower interest rates further after a series of cuts last year, suggesting they prefer to observe how the economy reacts to potential policy changes.

The job growth in January 2025 was primarily concentrated in health care, retail and government sectors, while mining and manufacturing faced declines. Severe weather conditions contributed to nearly 600,000 people missing work, the highest impact in four years.

Despite these fluctuations, hourly wages increased by 0.5% month-over-month and 4.1% year-over-year, reflecting pressure on wages amid labor market tightness. The participation rate in the labor force stands at 62.6%, with notable contributions from foreign-born workers, highlighting immigration as a critical factor in employment growth.

As the Fed assesses the stability of the labor market, upcoming directives from the Trump administration, including potential immigration restrictions, could impact future job growth and economic conditions. While the landscape shows signs of moderation, it remains resilient, with cautious optimism surrounding economic stability.

Weekly Crypto Highlight — Crypto IPOs Coming

As reported, Gemini, the cryptocurrency firm founded by the Winklevoss twins, is potentially exploring an initial public offering (IPO) this year. The company is currently discussing the listing with potential advisers, although no final decisions have yet been made.

Bullish Global, a crypto exchange operator whose backers include billionaire Peter Thiel, is considering an IPO as soon as this year.

The interest in going public comes amid a surge of crypto firms accelerating their IPO plans since President Trump's election, as he has shown support for the industry. The Winklevoss twins, known for their legal battles with Facebook's Mark Zuckerberg, previously donated Bitcoin exceeding the campaign contribution limit to Trump, later receiving a refund for the excess.

Gemini employs over 500 people across several global locations, including New York, Seattle and London. Recently, the firm agreed to pay $5 million to settle a Commodity Futures Trading Commission (CFTC) lawsuit alleging it misled regulators while trying to launch the first U.S.-regulated Bitcoin futures contract. Additionally, Gemini has committed to returning at least $1.1 billion to customers affected by the Genesis Global Capital bankruptcy as part of a settlement with New York regulators relating to its Gemini Earn program.

Other Top-Performing Tokens

Token | Catalyst |

Ampleforth (AMPL) | AMPL surged nearly 49.1% following the announcement of Ampleforth’s Evergreen Cycle, a decentralized solution for resilient DeFi treasuries. Read more here. |

Ethena (ENA) | ENA surged nearly 23.2% following Ethena & ConcreteXYZ's Launch of $100M Vaults with 20% APY in MOVE Rewards. Read more here. |

Hyperliquid (HYPE) | HYPE surged 2.73% after the integration of Hyperliquid DEX with CMM for seamless trade tracking and analytics. Read more here. |