Weekly Institutional Insights: Mixed Economic Data Rattles Market; SEC May Dismiss Lawsuit

Feb 24, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — Mixed Economic Data Leads to Risk-Off Strategies

For the past two months, the strong U.S. economy has given investors confidence to invest in markets, even amidst looming tariffs and a stricter Federal Reserve Board. However, recent data indicates that this support may be weakening.

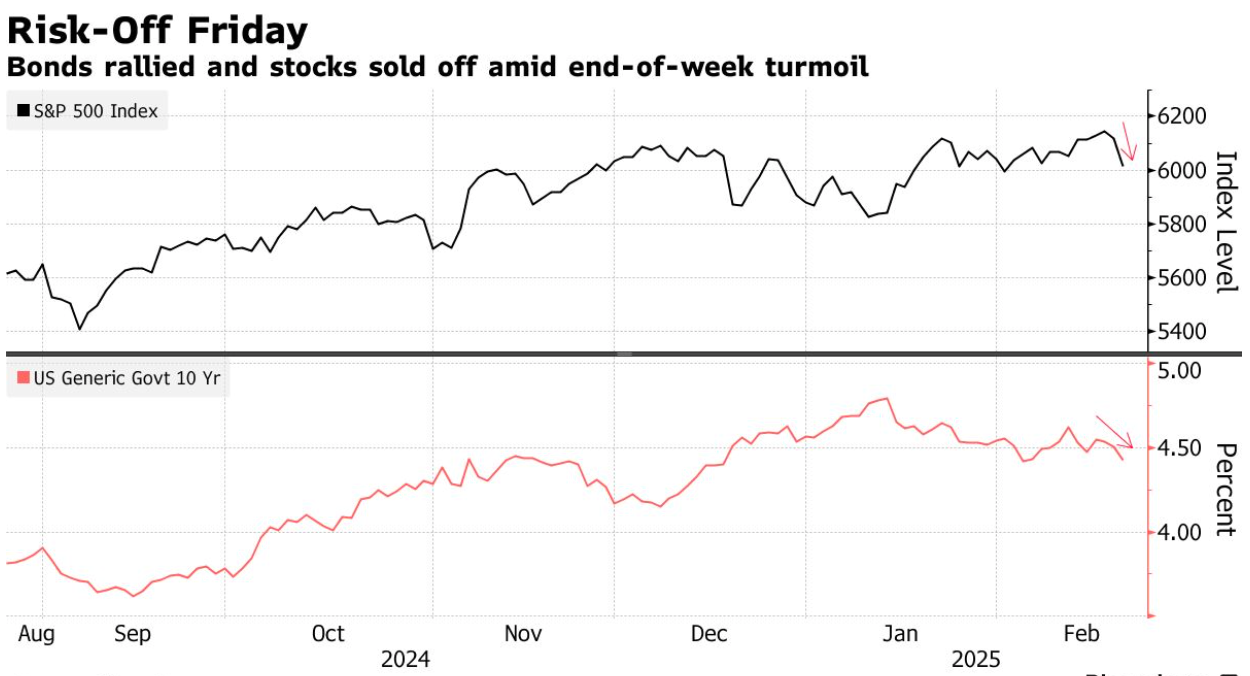

Last Friday, several reports on consumer sentiment, housing and services contributed to the S&P 500's largest loss of the year as it fell 1.7%, wiping out its weekly gains. In contrast, bonds experienced a rally, driving the yield on 10-year Treasuries down to 4.43%. The VIX {the Chicago Board Options Exchange's (CBOE) Volatility Index, known as the "fear gauge"] spiked, but remained below 20, signaling increased market anxiety.

Previously, optimism among investors was fueled by speculation regarding U.S. president Trump’s policies promoting disinflationary growth. However, mixed economic signals are now causing concern, particularly a report showing a decline in consumer sentiment alongside rising long-term inflation expectations — the largest drop since 1995. Additionally, existing U.S. home sales fell for the first time since September 2024, further complicating the outlook.

While January's job growth appeared solid, with 143,000 jobs added and the unemployment rate stable, institutional investors began the year with a pro-risk stance, optimistic about the U.S. economy’s trajectory. Yet, the recent volatility in economic data has prompted a reevaluation of strategies.

Weekly Crypto Highlight — SEC May Drop Lawsuit Against Coinbase

Coinbase announced that the U. S. Securities and Exchange Commission (SEC) has agreed to drop its lawsuit accusing Coinbase of operating an illegal exchange, pending Commissioners’ approval. Following this news, Coinbase shares initially surged in premarket trading, but fell by 4% to $246.30 as of midday in New York. Bitcoin also declined by about 1%, trading at around $97,000.

This decision signals a shift from the aggressive regulatory stance of former SEC Chair Gary Gensler, who faced criticism from the crypto industry for enforcing regulations through lawsuits. Last week, the SEC likewise requested a pause on a similar case against Binance, highlighting ongoing developments regarding a regulatory framework for digital assets.

The SEC's complaint will be unfairly dismissed, meaning it cannot be refiled. Coinbase CEO Brian Armstrong stated that this dismissal will entail no fines or changes in the company’s operations.

Coinbase has actively engaged in Washington, D.C., donating millions to support pro-crypto candidates and recently adding Chris LaCivita, a former Trump campaign manager, to its advisory council. Armstrong has also communicated with Trump directly.

The SEC initially sued Coinbase in June 2023 amidst a broader crackdown on the digital asset industry following the FTX collapse. Gensler had claimed that many tokens fell under SEC jurisdiction.

The dismissal alleviates a significant burden on Coinbase, allowing it to list more tokens and refocus on product development, rather than legal defenses. This outcome removes a key litigation risk, enhancing Coinbase's capacity to innovate. The company recently reported strong fourth-quarter earnings, and now aims to collaborate with Congress and regulators in order to establish clearer rules for the crypto landscape.

Other Top-Performing Tokens

Token | Catalyst |

Berachain (BERA) | BERA surged nearly 15.8% after The Graph integrated Berachain Mainnet, enabling seamless on-chain data access. Read more here. |

Story (IP) | IP surged nearly 29.3% after the Story protocol joined C2PA to enhance digital media verification and on-chain IP protection. Read more here. |

Litecoin (LTC) | LTC surged nearly 5.6% following an announcement by Singh of Kakr Labs as a speaker at Litecoin Summit 2025. Read more here. |