Weekly Institutional Insights: Macro Worsens; Trump Hosts Summit

Mar 3, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — Consumer Spending Falls

In January 2025, U.S. consumer spending unexpectedly decreased by 0.5%, the largest drop in nearly four years, primarily due to severe winter weather and a notable decline in motor vehicle purchases. This decline followed a robust holiday season, raising concerns about economic resilience. Spending on services also slowed, leading economists to question whether this reflects a more cautious consumer trend for 2025.

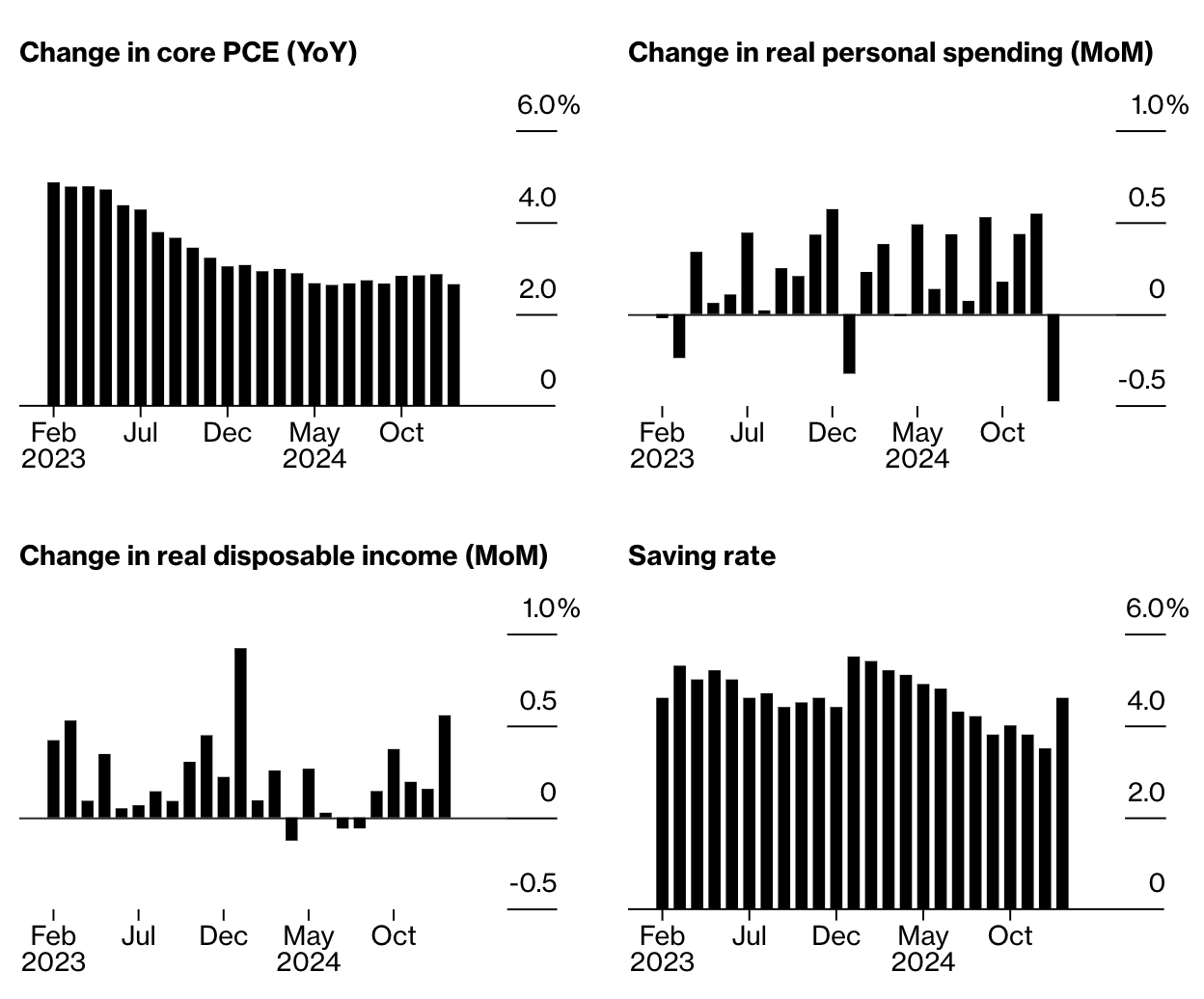

Despite the spending downturn, the U.S. Bureau of Economic Analysis (BEA) reported a slight easing in inflation. The core personal consumption expenditure (PCE) price index rose 0.3% from December, and 2.6% year-over-year, marking the smallest annual increase since early 2021. Core services prices increased by 0.2%, while goods prices, excluding food and energy, rose 0.4%.

Nominal incomes climbed by 0.9% in January 2025, supported by Social Security cost-of-living adjustments, driving a 0.6% increase in inflation-adjusted disposable income and raising the savings rate to its highest level since June 2024. However, ongoing price pressures and new tariffs may challenge consumer spending moving forward. Consumer sentiment has dipped, due to fears of rising prices linked to tariffs, with long-term inflation expectations reaching their highest level in nearly 30 years.

Overall, while inflation trends seem promising, weak service spending and rising costs could pose significant challenges for the economy ahead.

Weekly Crypto Highlight — Trump to Host Crypto Summit

U.S. president Donald Trump will host the White House's first cryptocurrency summit next Friday, highlighting his support for the industry. He will address a gathering of notable crypto founders, CEOs, investors and members of the president's Working Group on Digital Assets.

The summit will be led by venture capitalist David Sacks, the White House's AI and Crypto czar, with Bo Hines, executive director of the Presidential Council of Advisers for Digital Assets, overseeing the event. Following his inauguration, Trump established a working group to advise on digital asset policy, involving key agencies like the Treasury, Justice Department, SEC and CFTC.

During his 2024 campaign, Trump, who previously criticized crypto as a “scam,” pledged to streamline regulations, appoint supportive figures and establish a Bitcoin stockpile. Although some promises remain unfulfilled, his administration's approach and the summit represent a significant shift from the Biden administration's stricter regulations following the FTX collapse.

Trump has also entered the crypto space himself, launching a meme coin and backing a project with his sons, World Liberty Financial. The White House stated its commitment to creating a clear regulatory framework to foster innovation and protect economic liberty.

Other Top-Performing Tokens

Token | Catalyst |

Nervos Network (CKB) | CKB surged 18.6% following the launch of Nervos Docs v2.15.0, with CCC Molecule SDK and SUDT fixes. Read more here. |

Kaito (KAITO) | KAITO surged nearly 41.7% after Kaito AI launched staked KAITO voting for Pre-TGE projects on the Yapper Launchpad. Read more here. |

Alchemy Pay (ACH) | ACH surged nearly 7.9% after Alchemy Pay joined Visa’s Ramp Provider Program to expand global crypto payments. Read more here. |