Weekly Institutional Insights: Has the Turning Point for ETH/BTC Arrived?

Feb 17, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

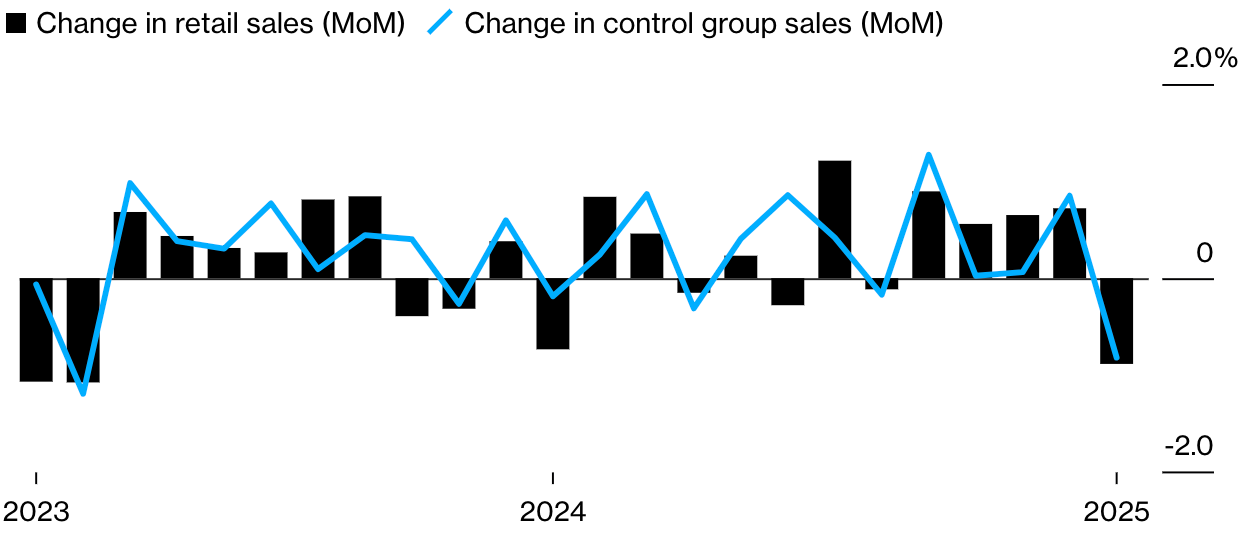

Weekly Highlight — Softer-Than-Expected U.S. Retail

In January 2025, U.S. retail sales saw a notable decline, the largest in nearly two years, indicating a sharp pullback in consumer spending after a robust holiday season in late 2024. According to Commerce Department data, retail purchases, not adjusted for inflation, dropped by 0.9%, following a revised 0.7% increase in December 2024. This downturn was evident across nine of the 13 reported categories, particularly in motor vehicles, sporting goods and furniture.

This decrease coincided with severe winter weather, and the devastating wildfires in Los Angeles, California, which likely hindered in-store shopping. However, the decline may also reflect broader economic concerns. Consumers increasingly face persistent inflation and high borrowing costs, leading many to rely on credit cards and loans — an approach becoming riskier as delinquency rates rise amid ongoing elevated interest rates. Federal Reserve Chair Jerome Powell has indicated that the central bank isn’t rushing to cut rates, especially with consumer prices climbing.

Furthermore, impending tariffs proposed on various goods by President Trump might have led consumers to stockpile items, but the January drops in sales suggest this trend may be fading. The report's control group, which excludes specific sectors, also declined by 0.8%, signaling a broader slowdown in spending. As economists analyze these trends, the forthcoming personal consumption expenditures report will provide further insights into inflation-adjusted spending, helping to clarify the current economic landscape and consumer behavior.

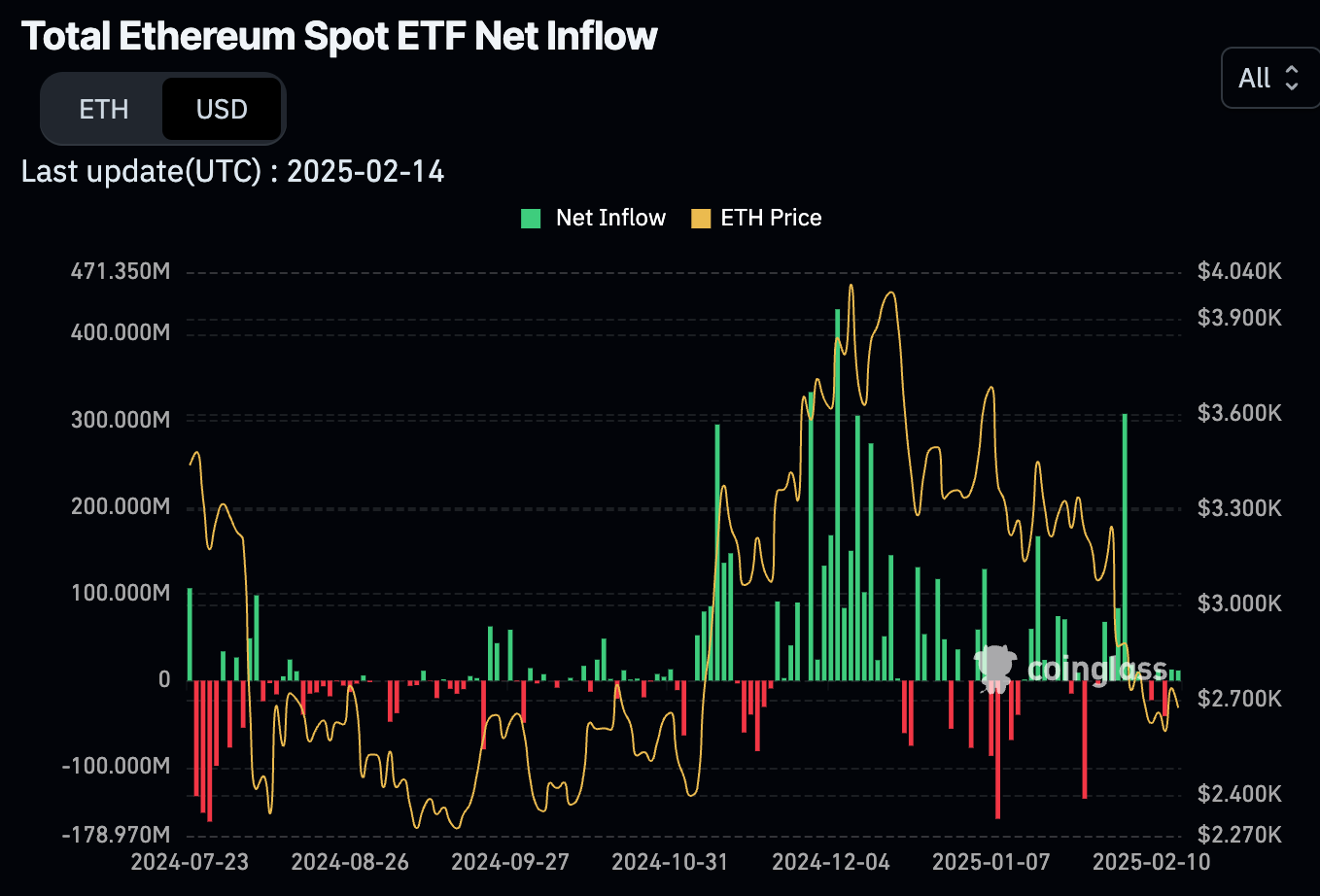

Weekly Crypto Highlight — ETH Spot ETF Flows Outpace BTC Counterparts

Last week, investors seized a notable buying opportunity for Ethereum, directing more capital into Ethereum-based funds than into those focused on Bitcoin. This shift marks this year's first instance in which weekly deposits into Ethereum products exceeded those for Bitcoin, with a substantial $793 million being funneled into Ethereum-related investment products globally.

Ethereum stole the show as investors responded to a price dip that brought Ether’s price down to nearly $2,100, a price drop that likely prompted many to view it as an attractive entry point. Additionally, a tweet from Eric Trump, son of the president, may have influenced sentiment. He suggested last Monday that it was a “great time to add ETH,” garnering approximately 13.6 million views. Notably, his original tweet included a playful remark, "You can thank me later," before being edited.

Ethereum is currently trading at around $2,670, representing a significant decline from its all-time high of $4,878 in November 2021. Despite the launch of new American Ethereum Spot ETFs last July, the asset has struggled to regain its previous highs.

In contrast, Bitcoin has also seen significant new capital inflows, thanks to the approval of BTC Spot ETFs in January of last year, pushing its price to new records, particularly following the election of Donald Trump, who promised to support the digital asset industry. However, last week, Bitcoin-related funds attracted only $407 million in net inflows, as concerns over President Trump's potential tariffs unsettled investors across various asset classes.

Despite recent excitement around Ethereum, the question remains: will this newfound interest in Ethereum lead to a sustained upward trend, or is it merely a temporary blip in a market dominated by Bitcoin? Only time will tell.

Other Top-Performing Tokens

Token | Catalyst |

AI Rig Complex (ARC) | ARC surged nearly 16.6% following the unveiling of its streamlined token launch mechanism. Read more here. |

Aleo (ALEO) | ALEO surged 9.7% after Aleo joined ETHDenver 2025 as a Meta Sponsor to drive blockchain innovation. Read more here. |

BakerySwap (BAKE) | BAKE surged nearly 90.8% following BNB Chain’s 2025 road map update, enhancing BakerySwap with speed, AI and gasless transactions. Read more here. |