Weekly Institutional Insights: Cooling CPI Relieves Market; Bitcoin Regains $100K Ahead of Trump’s Inauguration

Jan 20, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — Cooling CPI Relieves Market

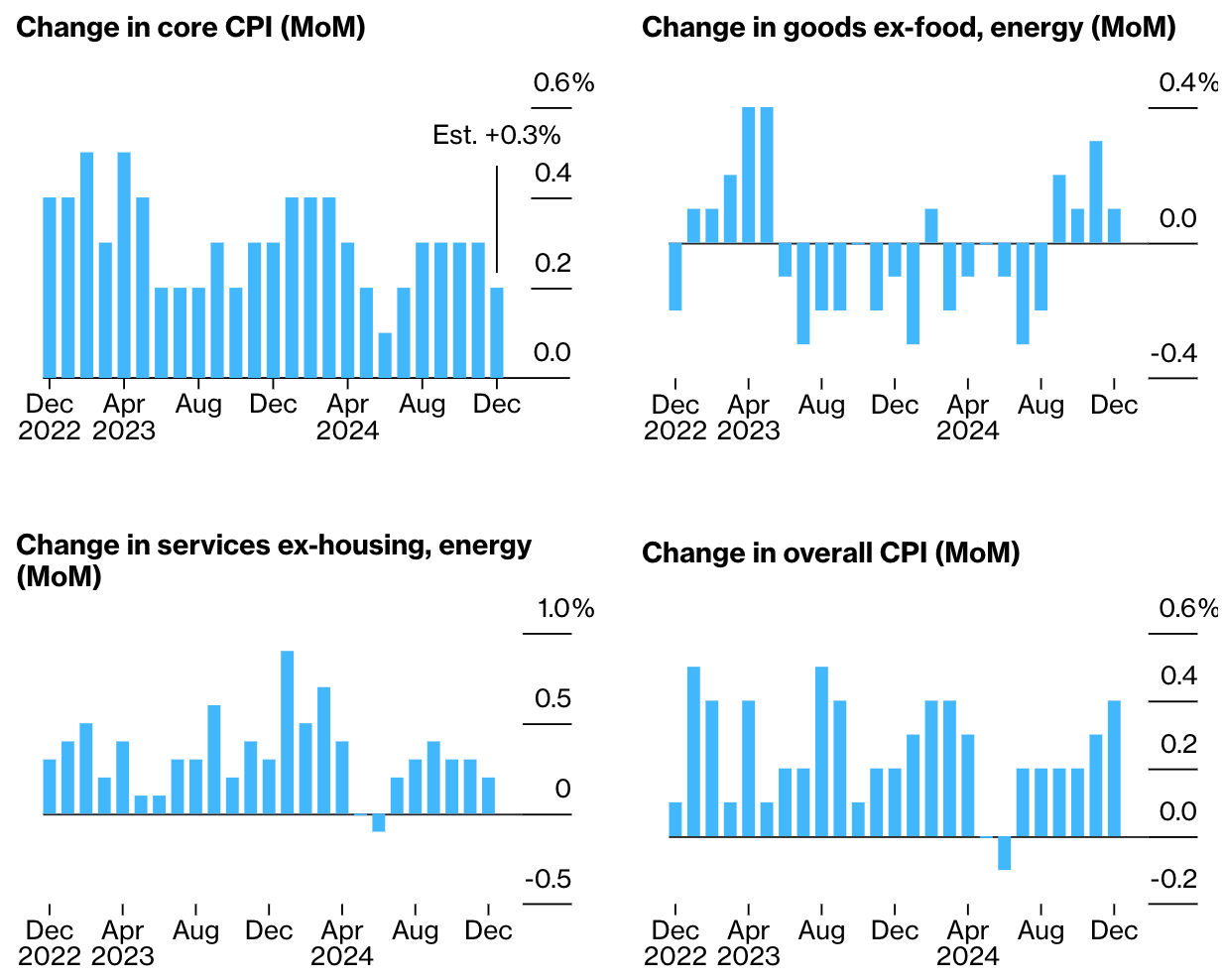

Recent data indicated a stagnation or potential reversal in inflation progress, with a key measure of underlying price hikes — the core Consumer Price Index (CPI) — remaining unchanged for months. However, this trend shifted on Wednesday, as the Bureau of Labor Statistics reported a slowdown in the core CPI for the first time in months.

The CPI, which tracks price changes for commonly purchased goods and services, showed an overall increase of 0.4% from November 2024, lifting the annual rate to 2.9%. This rise was primarily driven by surging gas and food prices, with energy costs alone contributing to 40% of the monthly increase. Food prices also remained high, impacted by weather conditions and disease affecting key staples like meat and eggs.

Excluding volatility for food and energy prices, the core CPI only rose 0.2% from November, easing to 3.2% after being stuck at 3.3% since September 2024. Market reactions were positive, as traders hoped the Federal Reserve would continue its rate-cutting campaign.

While inflation has slowed since peaking at 9.1% in June 2022, the journey back to normalcy has been bumpy. Everyday item prices are now 21% higher than in 2021, straining household budgets, particularly for lower-income Americans. Though wages have risen faster than inflation over the past 20 months, they still lag behind pre-pandemic levels.

This latest CPI report, the last before President Biden transitions power to president-elect Trump, underscores the ongoing challenges in managing inflation, particularly for essential goods and services.

Weekly Crypto Highlight — Crypto Cases Drop Before Trump’s Inauguration

Digital Currency Group and its subsidiary, Genesis Global Capital, reached a settlement with the Securities and Exchange Commission (SEC) on Friday, indicative of a broader trend among cryptocurrency firms resolving regulatory issues as the Biden administration approaches its conclusion. Over the past week, multiple U.S. regulatory agencies — including the Commodity Futures Trading Commission (CFTC), the Justice Department and the SEC — have announced various settlements and charges across at least six cases involving digital assets, signaling a renewed focus on enforcement as the administration winds down.

During Biden's term, more than 100 enforcement actions were filed against crypto companies, reflecting heightened scrutiny of the industry. However, with president-elect Donald Trump set to take office, there’s an expectation of a paradigm shift in regulatory approaches. Trump, once a critic of cryptocurrencies, has appointed crypto-friendly officials to key positions and intends to prioritize legislation that supports the industry.

For many crypto firms, settling with regulators is seen as a strategic move. Legal experts note that such settlements allow these companies to close contentious chapters and redirect their efforts in a potentially more favorable regulatory environment. Jonathan Groth, a partner at DGIM Law, commented on the implications of the incoming administration, suggesting that support for extensive enforcement actions may diminish.

Recent high-profile cases include a $5 million fine against Gemini for regulatory violations and a $100 million penalty for BitMEX due to failures in anti-money laundering measures. Additional actions have targeted fraudulent schemes, and individuals involved in illegal cryptocurrency activities. As the regulatory landscape shifts, firms settling with agencies may be positioning themselves for a fresh start under a more accommodating regime.

Other Top-Performing Tokens

Token | Catalyst |

Ripple (XRP) | XRP surged nearly 8.5% following growing speculation about a Spot ETF and increased accumulation by large holders. Read more here. |

Aave (AAVE) | AAVE surged 4.3% after announcing Aave and GHO's expansion across networks for broader integration. Read more here. |

Hyperliquid (HYPE) | HYPE surged 9.4% following Hyperliquid's partnership with ANIME to launch a decentralized anime ecosystem. Read more here. |