Weekly Institutional Insights: Bitcoin Retreats Following Equity Sell-Off; Market Expects New ATH for U.S. Equities in 2025

Dec 23, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly Highlight — Market Expects New Record for U.S. Equities in 2025; Will Crypto Follow?

Wall Street’s leading firms have recently shared their forecasts for the S&P 500 in 2025, and the predictions sound strikingly similar to those made in prior years. The average forecast anticipates a 9.1% gain, evoking a sense of déjà vu among investors. A review of 376 firm forecasts over the past 25 years reveals that 53% fell within the modest range of 0% to 10%.

This clustering of forecasts is particularly perplexing when we contrast it with the actual volatility of the market. Over the past eight years, the S&P 500's returns have often exceeded these predictions, suggesting that strategists frequently underestimate the index’s potential for growth. Historical data indicates that significant gains and losses have been more prevalent than single-digit increases, which occurred only 14 times in 97 years.

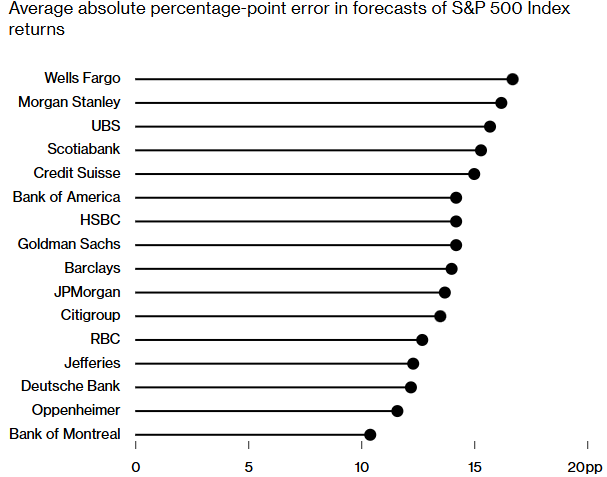

Moreover, strategists' forecasts have shown a consistent tendency to miss the mark — on average, off by more than 15 percentage points — with the most accurate firms still missing by around 10 points. This discrepancy underscores the challenges in market forecasting, as 57% of the analyzed forecasts were below the actual market returns, indicating a widespread inclination toward pessimism.

Given this history, financial planner Elliott Appel advises investors to approach these forecasts with skepticism. He suggests treating them as entertainment, rather than actionable advice. The disparity between forecasted and actual returns highlights the inherent uncertainties in predicting market behavior. Therefore, investors should remain cautious and consider broader market trends and data, rather than relying solely on these forecasts for making investment decisions. In a landscape characterized by volatility, understanding the limitations of these predictions is crucial for informed investing.

Weekly Crypto Highlight — Bitcoin’s Price Whipsawed Following Hawkish Fed Remarks

Bitcoin is on track for its first seven-day decline in eight weeks, driven by hawkish signals from the Federal Reserve that prompted traders to sell, despite the cryptocurrency more than doubling in value this year.

On Friday, Bitcoin fell as much as 5.3% to $92,149, having reached an all-time high just above $108,000 earlier in the week. Its price has dropped around 5% since Sunday (December 22) and was trading at approximately $97,400 in New York. This downturn has had an impact particularly on smaller cryptocurrencies like Ether and Dogecoin, even as U.S. equities have moved higher.

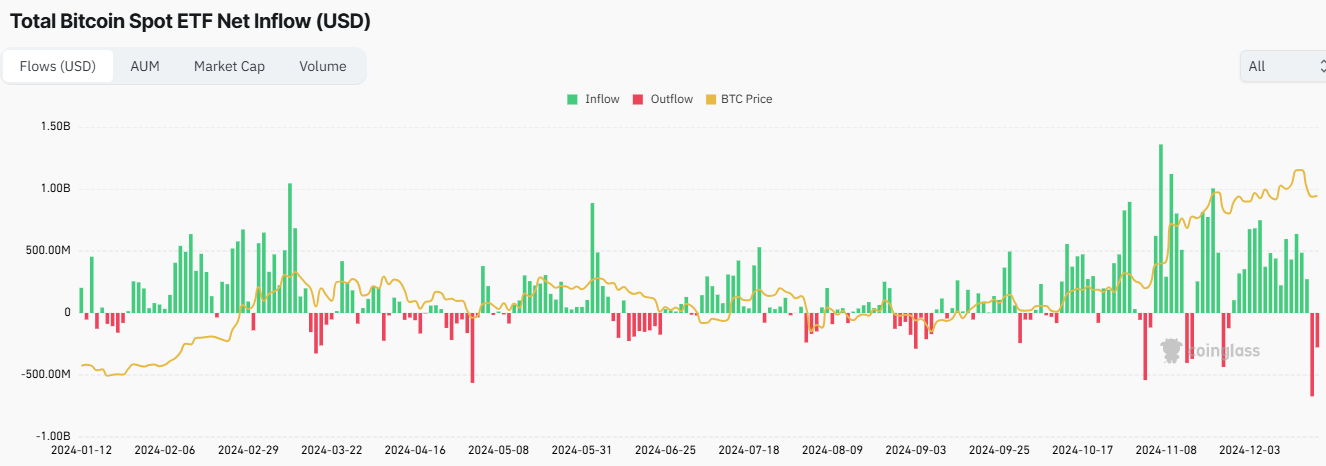

A group of U.S. ETFs directly investing in Bitcoin reported a record outflow of $680 million on Thursday (December 19), breaking a 15-day streak of inflows. This shift in sentiment highlights the growing uncertainty in the market.

The market volatility follows a rally that occurred after Donald Trump’s victory in the U.S. presidential election on Nov 5, 2024. In our view, positioning has become "overly bullish," making digital assets susceptible to shifts in the Fed's tone as it focuses on controlling inflation.

As the holidays approach, uncertainty in the crypto markets is likely to persist, especially with Trump threatening tariffs against both allies and adversaries. With the Fed expected to slow its easing measures, attention is shifting to the speed of institutional adoption of cryptocurrencies.

The interplay of monetary policy, institutional adoption and political developments will keep Bitcoin sensitive to both macroeconomic and crypto-specific factors through 2025.

Open interest for Bitcoin futures at CME Group reached near-record highs on Tuesday, but has since declined. It’s advisable to take caution in the short term, noting that while a price collapse isn't imminent, the momentum has waned, with buyers losing control.

Other Top-Performing Tokens

Token | Catalyst |

Ripple (XRP) | XRP surged 3.3% following the global launch of Ripple USD (RLUSD), setting new standards for stablecoins. Read more here. |

EigenLayer (EIGEN) | EIGEN surged 11.2% after the Eigen Foundation pledged 1% of the EIGEN supply to support the Protocol Guild. Read more here. |

CoW DAO (COW) | CoW surged 52.8% following the launch of CoW Swap and CoW Protocol on Base, offering gasless trades and protection against MEV attacks. Read more here. |