Bybit Crypto Insights Report: Solana’s Spot ETF breakthrough: A new era for institutional access and price dynamics

Solana has officially entered the ETF era. With the October 2025 launch of the Bitwise Solana Staking ETF (BSOL) and Grayscale’s conversion of its Solana Trust (GSOL) into a publicly traded product, SOL joins Bitcoin and Ethereum as one of the few digital assets with regulated, brokerage-accessible exposure in the United States. This milestone not only validates Solana’s position as a leading Layer 1 blockchain, but also opens the door to a new wave of institutional capital — potentially reshaping its price trajectory and market structure for years to come.

ETF mechanics and initial market reaction

The Bitwise ETF, which includes native staking yield, debuted with $116 million in net inflows within its first two trading sessions, signaling strong demand from wealth managers and institutional allocators. Grayscale’s Solana Trust, while smaller in scale, adds further legitimacy to Solana’s investment profile. Together, these products offer US investors direct exposure to SOL without the complexities of custody, staking or on-chain interaction.

Yet, the immediate price reaction was underwhelming. SOL fell nearly 8% during the week of the ETF launch, underperforming both BTC and ETH. This muted response echoes the “sell-the-news” dynamic observed in prior ETF approvals. Bitcoin and Ethereum both experienced short-term corrections following their respective spot ETF launches earlier in 2025 before rebounding on sustained inflows. Solana may be following a similar pattern, with early profit-taking and whale rotation — such as Jump Crypto’s large on-chain transfer — temporarily suppressing upside momentum.

Structural impact: Liquidity, legitimacy and institutional onboarding

Beyond short-term price action the ETF listings represent a structural shift in how SOL is accessed, traded and perceived. ETFs provide regulated, tax-efficient vehicles for exposure, allowing financial advisors, pension funds and family offices to allocate capital without navigating crypto-native platforms. This dramatically expands Solana’s addressable investor base.

Bitwise estimates that every $1 billion in ETF inflows could translate into a 30–50% increase in SOL’s market cap, assuming similar elasticity to Bitcoin’s ETF response. If inflows reach $2–3 billion over the next 12 months — a plausible scenario, given Solana’s growing role in tokenized finance and stablecoin issuance — SOL could revisit its all-time highs near $260, or even push toward $300–$350 in a bullish macro environment.

Moreover, the staking component of BSOL introduces a yield-bearing dynamic that enhances Solana’s appeal relative to non-yielding assets such as BTC. As ETF issuers accumulate SOL and delegate it to validators, staking demand could rise, reducing circulating supply and amplifying price effects. This feedback loop — ETF inflows driving staking, which tightens supply and boosts price — could become a defining feature of the Solana ETF era.

Global expansion: Hong Kong, Brazil and the multi-jurisdictional ETF landscape

Solana’s ETF footprint isn’t limited to the US. In parallel with the American launches, Hong Kong approved a Solana Spot ETF issued by China Asset Management, offering dual RMB and USD settlement. This product targets both retail and institutional investors in Asia, where Solana’s speed and cost efficiency have made it a preferred platform for tokenized assets and stablecoin rails.

Brazil and Canada also host Solana ETFs, creating a multi-jurisdictional framework that enhances global liquidity and price discovery. As these products mature, cross-border arbitrage and synchronized inflows could stabilize SOL’s volatility and deepen its integration into traditional finance.

Narrative shift: From altcoin speculation to institutional infrastructure

Perhaps the most profound impact of Solana’s ETF listings is the narrative shift they catalyze. SOL is no longer just a high-beta altcoin favored by retail traders — it’s now a regulated, yield-bearing asset with institutional access and global distribution. This rebranding aligns with Solana’s technical evolution, as its role in powering tokenized treasuries, real-world assets and permissioned stablecoin issuance makes it a foundational layer for the next generation of financial infrastructure.

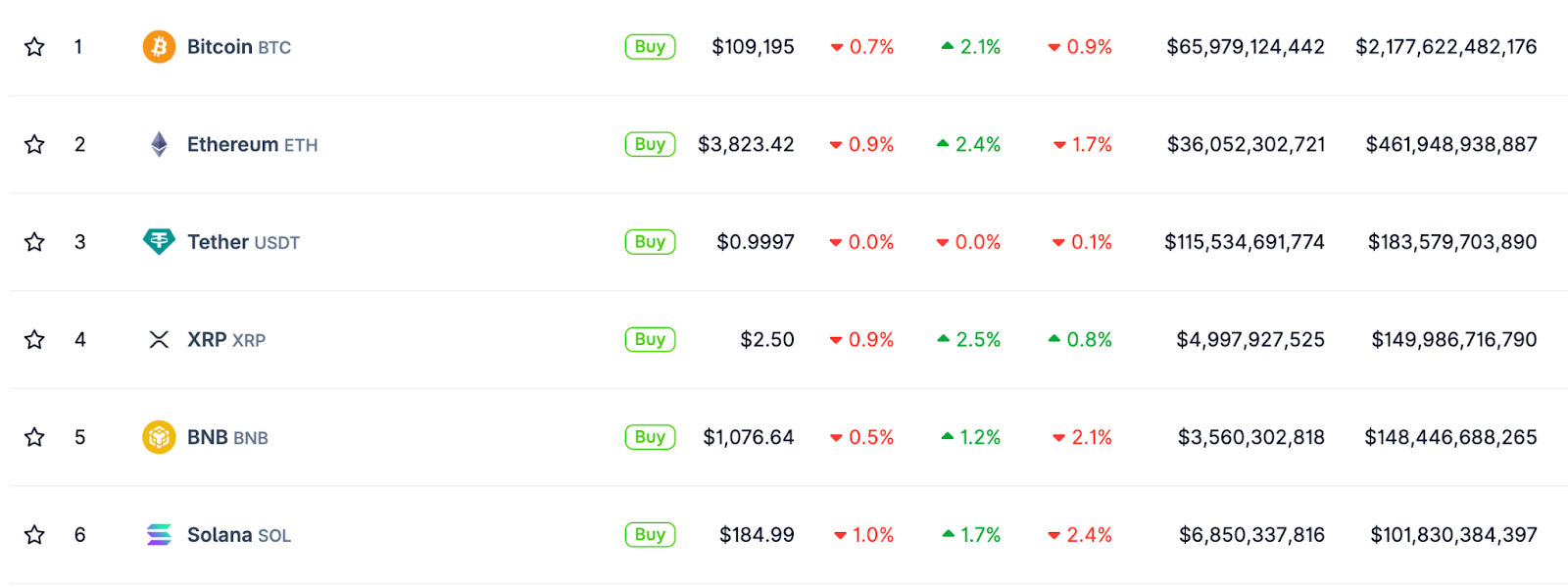

As macro conditions stabilize and ETF inflows build, Solana could transition from a speculative asset to providing a strategic allocation in diversified portfolios. Wealth managers may begin treating SOL as a core holding alongside BTC and ETH, particularly as staking yields and tokenized finance use cases differentiate its value proposition.

The ETF era as a catalyst for maturity and price repricing

While the initial price reaction to Solana’s ETF debut was subdued, the long-term implications are anything but. The ETF structure enhances legitimacy, unlocks institutional capital and introduces staking-driven supply dynamics that could materially reprice SOL over time. Combined with global ETF expansion and Solana’s growing role in tokenized finance, the ETF era marks a turning point in SOL’s market maturity.

If historical patterns hold — and if ETF inflows mirror those of Bitcoin and Ethereum — Solana could be on the cusp of a multi-quarter rally that redefines its position in the crypto hierarchy. The next few months will reveal whether ETF momentum can overcome short-term selling pressure and usher in a new phase of institutional adoption. Regardless, one thing is clear: Solana is no longer just a fast blockchain — it’s now a regulated investment vehicle with global reach and strategic relevance.