Weekly Institutional Insights: Robust US economic data sends stocks higher; Strategy sees no pause in Bitcoin purchase

May 5, 2025: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

Weekly highlight — Robust economic data might support June rate cut

Things are becoming increasingly complicated for the Federal Reserve as it prepares for its upcoming meeting. With inflation in focus, officials are likely to maintain interest rates. Yet, concerns about an economic slowdown are growing, exacerbated by calls from President Trump for a rate cut.

Fed Chair Jerome Powell may find some reassurance in recent labor data, which reported a robust increase of 177,000 jobs in April 2025. This solid job market provides a rationale for the Fed to hold rates steady. Additionally, the Fed's preferred inflation measure indicates a slight easing of price pressures. However, rising tariffs on imports threaten to undermine this progress.

Uncertainty looms globally over major central banks, as the White House seeks trade deals that could significantly alter economic forecasts. Economists suggest Powell will emphasize the importance of price stability, especially as inflation expectations appear to be shifting.

Meanwhile, the European Central Bank continues to lower rates in anticipation of disinflation and weaker growth due to US tariffs, and the Bank of Canada has diverged from its usual practice of issuing a standard forecast, opting instead for two contrasting scenarios based on the tariff situation with the US.

Looking ahead, the US economic calendar is sparse, with upcoming data on service sector activity and jobless claims expected to provide insights into labor market trends. Globally, monetary policy decisions are anticipated in several countries, highlighting the widespread impact of trade tensions.

As central banks navigate these turbulent waters, the interplay of tariffs and inflation will be critical in shaping future economic policies.

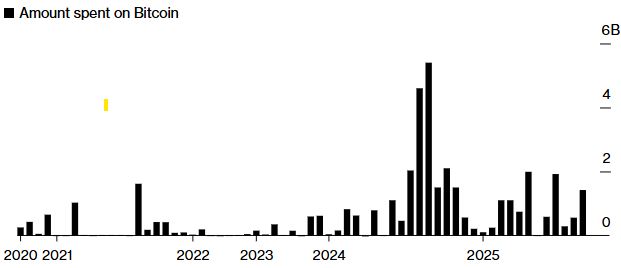

Weekly crypto highlight — Strategy sees no pause in Bitcoin purchase

Michael Saylor's company, Strategy, has doubled its capital raising plan to $84 billion following a record $4.2 billion first-quarter loss. This loss was attributed to a new accounting rule mandating that the firm value its substantial Bitcoin holdings at market prices. On Thursday, Strategy registered to sell an additional $21 billion in common shares, having exhausted a previously authorized equity program.

Additionally, the company has increased its planned debt purchase program from $21 billion to $42 billion, with $14.6 billion remaining. This shift reflects a growing awareness among corporate Bitcoin buyers of the unrealized earnings fluctuations that can occur, such as in Strategy's dramatic quarterly loss. The company holds approximately $53 billion in Bitcoin.

Prior to this accounting change, Strategy classified its Bitcoin as intangible assets, which limited its ability to recognize gains unless the assets were sold. This resulted in permanent markdowns whenever Bitcoin prices fell.

Over the past five years, Saylor has transformed Strategy, formerly known as MicroStrategy Inc., into the largest leveraged Bitcoin proxy globally. However, revenue from its software division fell 3.6% to $111.1 million in the first quarter of 2025.

Saylor's advocacy has significantly contributed to Bitcoin’s mainstream acceptance, inspiring numerous companies to follow suit by purchasing Bitcoin for their balance sheets. Analysts suggest that as more firms adopt this strategy, demand for Bitcoin will rise, potentially benefiting Strategy further.

Despite the stock's remarkable 3,000% increase since Saylor began buying Bitcoin in 2020, concerns remain about the sustainability of this approach. New competitors are emerging, including well-funded entities like Twenty One Capital Inc., increasing the pressure on Strategy. Nonetheless, Saylor shows no signs of slowing down, and is continuing to expand Bitcoin acquisitions aggressively.

Other top-performing tokens

Token | Catalyst |

Arweave (AR) | AR gained 16.8% following CloneX's successful migration to Arweave, sponsored by ArDrive. Read more here. |

Curve Finance (CRV) | CRV surged 11.4% after Spark's integration of new Curve pools, enhancing stablecoin liquidity and improving DeFi infrastructure. Read more here. |

Drift Protocol (DRIFT) | DRIFT surged 28.7% following the introduction of Amplify, Drift's tool for simplified leverage that boosts yields with increased risk. Read more here. |