Bybit Crypto Insights Report: Markets are mixed following the much-anticipated October 2025 rate cut and uncertainty on December’s decision

The Federal Reserve’s October rate cut marked a pivotal moment in the 2025 policy cycle, signaling a shift toward growth support amid persistent inflation and labor market fragility. While the move was widely anticipated, its ripple effects across both traditional and digital asset markets were anything but uniform.

Policy pivot despite lacking labor data

Source: Reuters

Policy pivot in a data fog

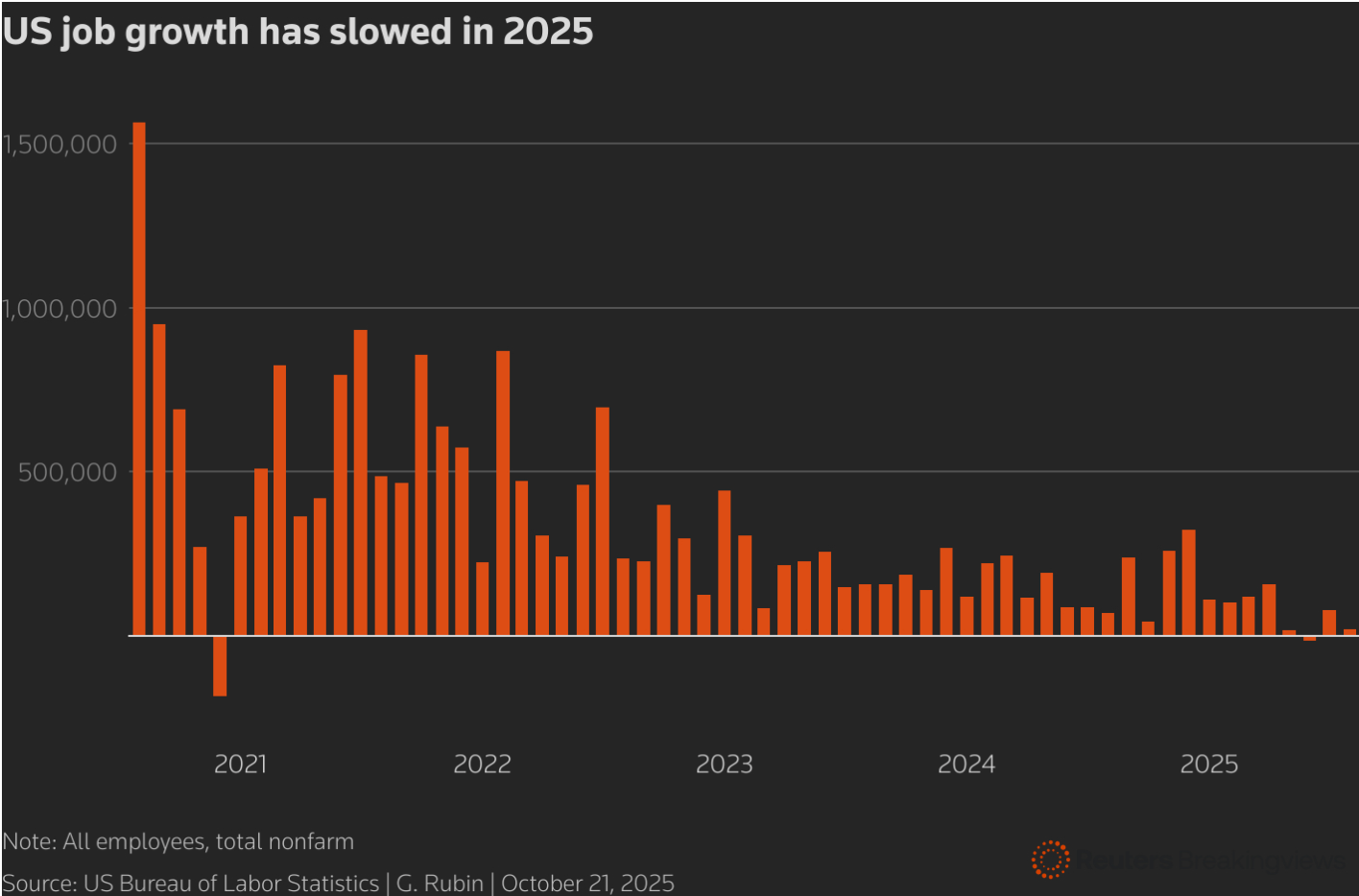

On Oct 29, 2025, the Federal Reserve delivered its second consecutive 25-basis-point rate cut, lowering the federal funds target range to 3.75%–4%. The decision, which passed by a 10–2 vote, was framed as a response to mounting evidence of labor market softening — despite inflation still hovering above the Fed’s 2% target. Chair Jerome Powell emphasized the lack of reliable economic data due to the ongoing government shutdown, likening the current policy environment to “driving in the fog.”

While the Fed maintained that inflation risks remain to the upside, the committee’s tone leaned dovish, with Powell acknowledging that the rate is now “modestly restrictive.” However, he stopped short of committing to further easing in December, citing internal divisions and the need for more clarity on economic conditions.

December’s rate path rattled the market

The risk assets initially welcomed the cut, with equities rallying to fresh highs in anticipation of looser financial conditions. However, Powell’s cautious tone during the press conference tempered enthusiasm. Treasury yields, which had dipped ahead of the announcement, reversed higher as investors reassessed the likelihood of further easing. Meanwhile, the dollar weakened modestly, reflecting expectations of a prolonged pause or further cuts, while gold pared gains after Powell’s remarks.

Credit markets remained stable, but the Fed’s decision to halt balance sheet runoff starting December 1 signaled growing concern over liquidity conditions in money markets. Overall, the October cut reinforced the Fed’s pivot toward labor market support, but the lack of forward guidance left risk assets oscillating between optimism and uncertainty.

Relief rally meets structural caution

Source: Bybit

In crypto markets, the rate cut provided a short-term tailwind. Bitcoin and Ether extended their recent gains, buoyed by the prospect of lower real yields and a softer dollar. The uncertainty in December’s rate cut enlivened the crypto market.

However, the reaction was more muted than in previous easing cycles. Volatility remained compressed, with BTC and ETH options markets continuing to price in low realized volatility and persistent put skews, particularly in longer tenors. This suggests that while macro easing supports crypto valuations, institutional players remain cautious amid regulatory overhangs and uncertain ETF flows. Notably, privacy tokens like Zcash saw outsized gains, driven more by idiosyncratic catalysts than macro policy.

The broader takeaway is that crypto is increasingly behaving like a high-beta macro asset — sensitive to liquidity shifts, but also shaped by internal structural dynamics. The October 2025 Fed decision may have extended the current risk-on window, but without a clear path forward, crypto markets are likely to remain range-bound, awaiting stronger catalysts.