Bybit Crypto Insights Report: Is Ether regaining favor? How far will it go?

Ether has recently regained its status as the crypto golden boy, leading a rally since May 7, 2025 that’s outpaced both Bitcoin and most altcoins. This unusual performance has prompted market observers to speculate on the reasons behind it, and whether this impressive trend will continue.

The ETH/BTC ratio has been declining since January 2024, when the SEC approved Bitcoin Spot ETFs. Despite the subsequent approval of Ether Spot ETFs, this downward trend has continued.

In Q1 2025, disappointment in Ether's performance reached its peak, driven by market drawdowns and concerns about Ethereum Foundation leadership, leading to a significant exit of investors from the world’s second-largest cryptocurrency. However, on May 7, 2025, the market narrative changed abruptly as Ether surged over 20% in just one day.

Why has ETH surged?

Reports following Ether's landmark surge on May 7, 2025 largely attribute this rally to the completion of the Pectra upgrade. While the timing of the upgrade coincides perfectly with Ether's rebound, however, this view doesn't capture the full story.

Historically, the ETH/BTC ratio began to rebound two months before the official completion of The Merge. Similarly, the Pectra upgrade had been anticipated for some time. Despite its smooth execution, the market had low expectations regarding challenges in Q1 2025.

Moreover, Ether's resurgence coincided with BTC surpassing $100,000, as broader risk assets rallied due to positive developments in US tariff negotiations with the UK and China.

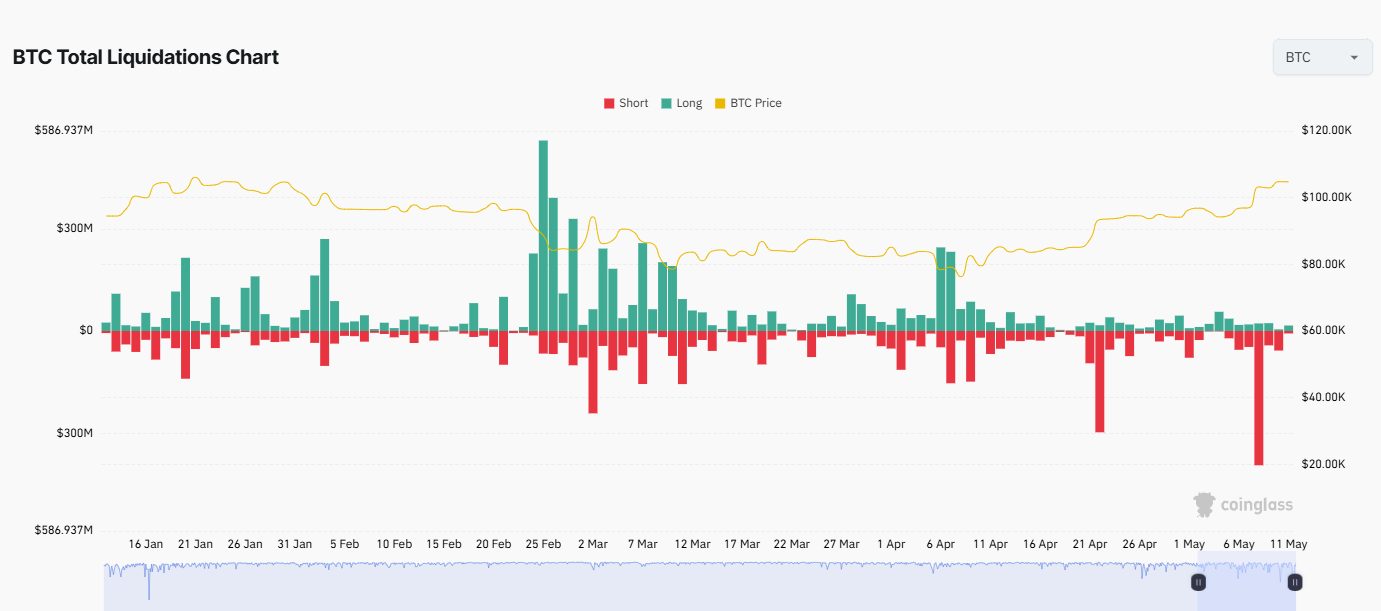

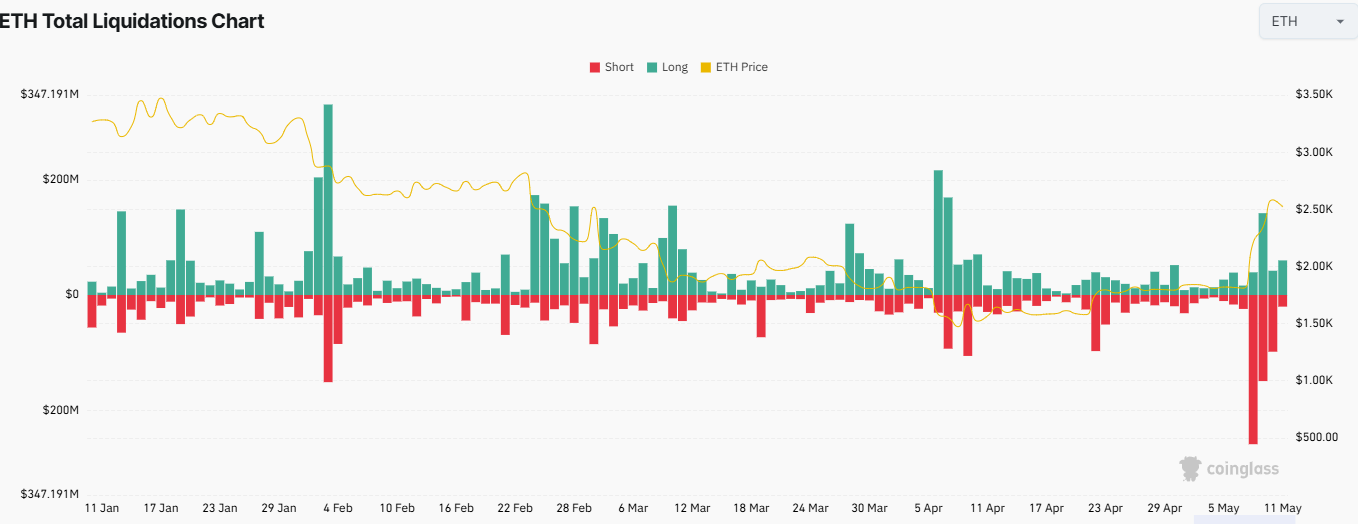

In summary, the overall asset rally triggered Ether's rise, while the Pectra upgrade enhanced its performance against Bitcoin. Additionally, Ether's strong outperformance over other altcoins likely resulted from significant short liquidations.

In the days following Ether's record rally, ETH experienced over $500 million in short liquidations. This phenomenon significantly contributed to the unusual surge of more than 20% in a single day for a leading token such as Ether.

Will Ether continue to outperform?

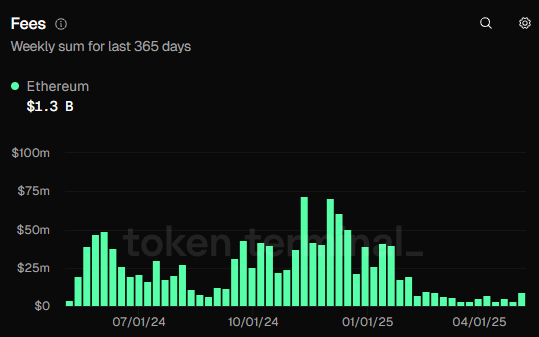

The most common criticism of Ethereum is that it loses revenue to Layer 2 solutions.

The trading volume on decentralized exchanges (DEXs) for Ether has consistently declined, partly due to competition from other Layer 1 blockchains such as Solana, as well as Ethereum's own L2 networks. Since most L2 solutions have their own utility tokens, the activities conducted on these platforms don’t directly generate fees for L1, since they bundle transactions and post them to the Ethereum Mainnet.

This dilemma doesn’t appear to have a quick fix. In the medium term, Ethereum’s key value proposition may need to shift from that of a profit-generating blockchain with a deflationary asset to one that functions as a financial instrument that’s akin to a bond.

Ethereum’s staking feature has yet to face direct competition, and the amount staked within the ecosystem continues to grow. As of Q1 2025, approximately 34 million ETH are staked, yielding an annual return of 2.9%.

Ongoing developments in Hong Kong and Canada may allow ETH Spot ETFs to incorporate staking features. Notably, the Pectra upgrade increases the staking limit for each node from 32 ETH to 2048 ETH, which could incentivize ETF issuers to operate their own nodes in the future. Adding staking rewards to ETH Spot ETFs could enhance their attractiveness, especially as the Fed eventually returns interest rates to more typical levels.

With a 2.9% return on Ether staking, Ether is increasingly positioned as a bond-like investment.

Ethereum’s leadership change and future outlook

Vitalik Buterin’s recent proposals for Ethereum

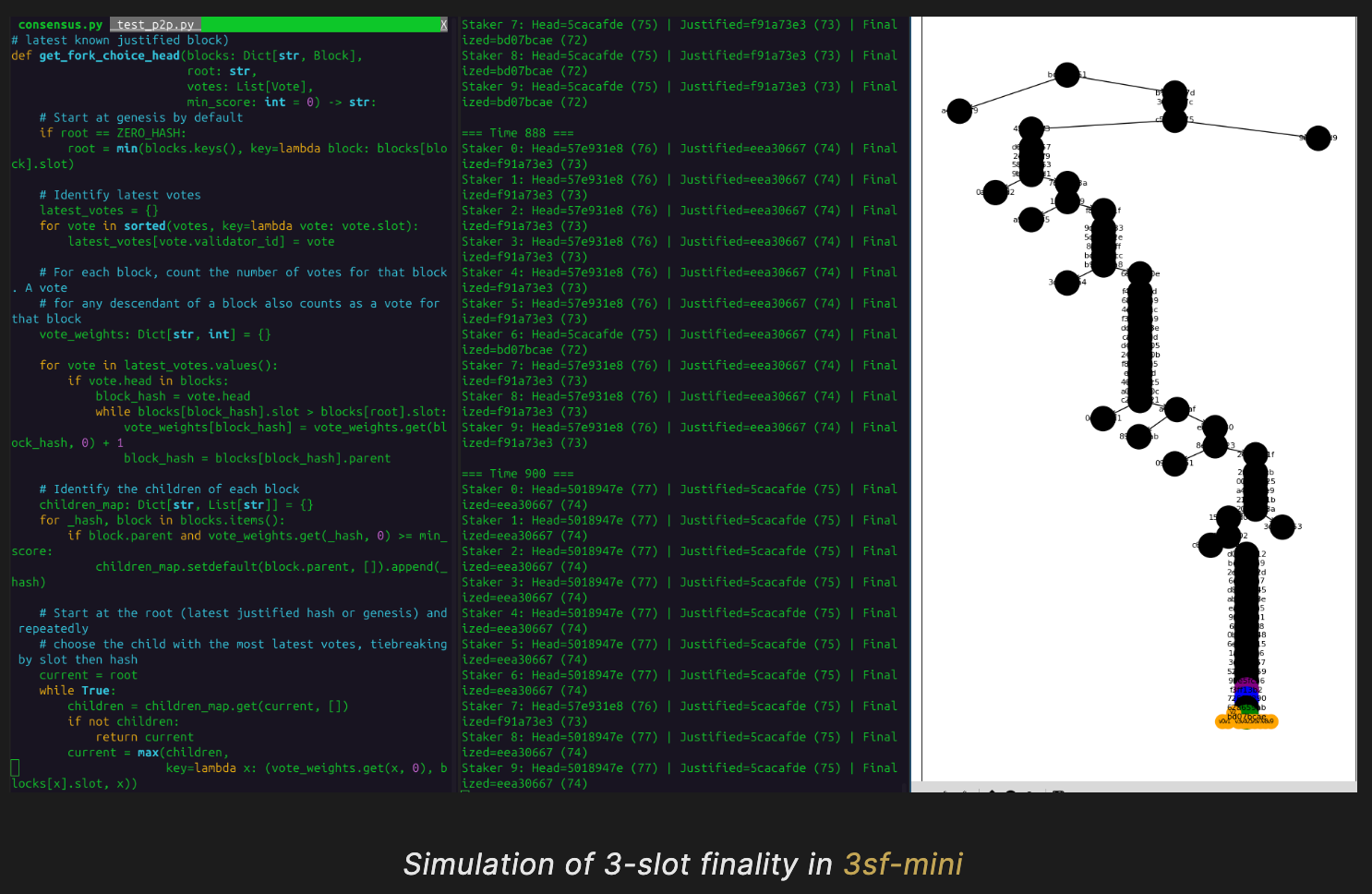

Ethereum co-founder Vitalik Buterin recently outlined his vision for simplifying Ethereum's Layer 1 in a post titled Simplifying the L1, emphasizing that scalability alone is insufficient: Ethereum must also be understandable, maintainable and secure in order to reliably serve as a platform for civilization’s assets. Buterin proposes a significant reduction in complexity, aiming for an Ethereum that will be as simple (within five years) as Bitcoin is now. He believes that a simpler protocol will enhance security, attract more developers and facilitate easier upgrades.

To achieve this, Buterin introduces a beam chain proposal that aims to streamline consensus by reducing technical complexity, eliminating epochs and sync committees, simplifying fork choice rules and enhancing the validator lifecycle for easier onboarding and recovery. He advocates replacing the current Ethereum virtual machine (EVM) with RISC-V, a more efficient, general-purpose virtual machine. This transition promises a clearer specification that will reduce bugs and maintenance challenges; more flexibility for developers to use various programming languages; and the potential to increase throughput by 100 times.

To address existing applications, Buterin suggests a phased transition that introduces RISC-V precompiles and allows dual deployment options during the shift, gradually moving legacy features out of the core protocol to keep it lean. He also calls for standardizing tools within the network to reduce redundancy and complexity, proposing a unified encoding system, shared data splitting methods and a simpler state structure. Ultimately, Buterin believes that regaining simplicity is essential in order for Ethereum to maintain its flexibility and durability as it scales.

With a new road map for Ethereum and proposed leadership change to the Ethereum Foundation to make the Ethereum guardian more accessible, we believe Ethereum has more upside coming.