CLARITY Act breakdown and what it means for crypto

Read how the CLARITY Act establishes a federal framework for crypto asset classifications while defining the jurisdictional boundaries for the SEC and CFTC.

Long gone are the days when crypto lived in a total regulatory grey area. The CLARITY Act changes the game for the US market, forcing a level of federal oversight that the industry can no longer ignore. This 257-page bill is the best attempt so far to bring the world's largest economy under one set of crypto rules.

In this article, we talk about the bill's main categories, the Senate's current delays, and how it will affect your own investment portfolio in the long run.

Key takeaways:

The CLARITY Act is a US market-structure proposal defining how crypto assets are classified and whether the SEC or the CFTC oversees them.

In essence, the bill defines three main buckets for assets: digital commodities like Bitcoin, investment contract assets sold via ICOs, and payment stablecoins like USDC or PYUSD.

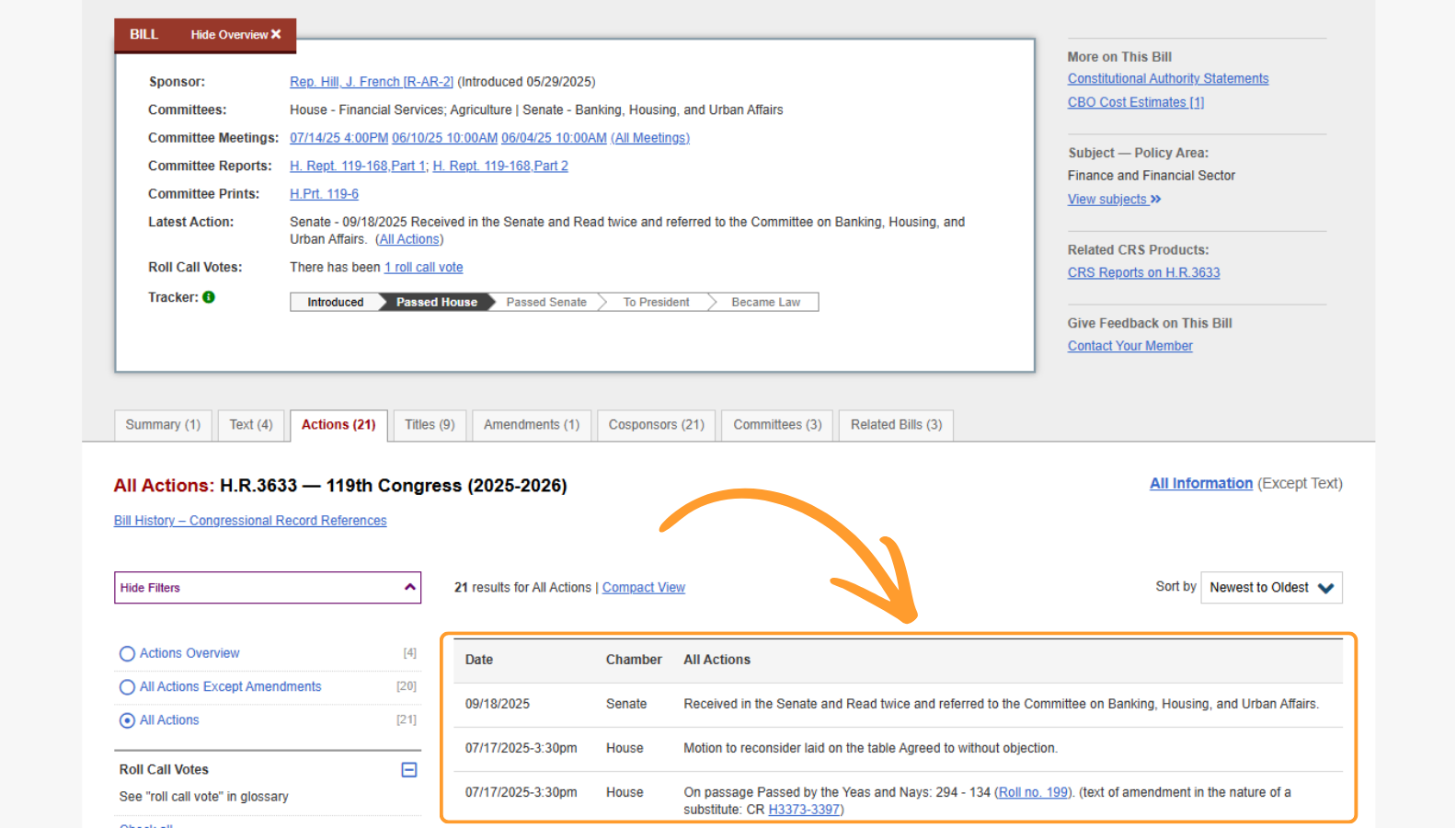

So far, the House passed the bill with a 294-134 vote, but it stalled in the Senate Banking Committee after the Jan 15, 2026 markup postponement.

What is the crypto CLARITY Act?

The CLARITY Act is a regulatory framework for crypto assets, categorizing them as digital commodities or securities to resolve jurisdictional gaps. First suggested on May 29, 2025, it seeks to protect investors while expanding domestic blockchain innovation in the United States.

Formally titled the Digital Asset Market Clarity Act of 2025, the bill was passed by the House of Representatives on Jul 17, 2025. It secured bipartisan approval with a vote count of 294 to 134.

As of late January 2026, the legislation faces delays in the Senate Banking Committee after a scheduled markup was postponed on Jan 15. Support has wavered following disputes over stablecoin interest amendments, leaving the bill’s future momentum in limbo.

What does the crypto CLARITY Act cover?

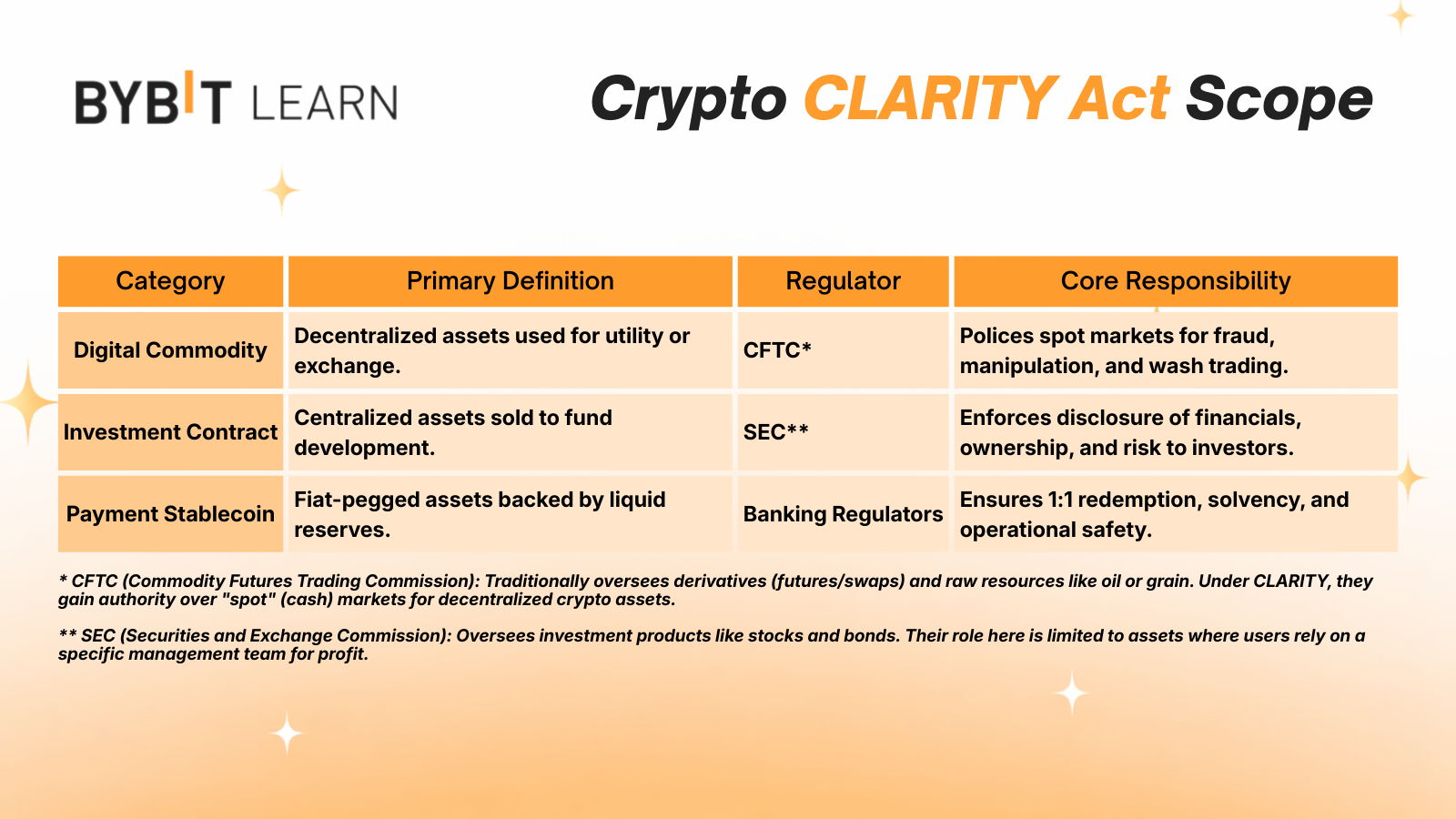

Simply put, the CLARITY Act separates crypto assets into three definitions:

digital commodities

investment contract assets

permitted payment stablecoins

This structure grants the Commodity Futures Trading Commission (CFTC) exclusive jurisdiction over spot markets for digital commodities, limiting the Securities and Exchange Commission (SEC) authority to assets that function strictly as financial securities.

1. Digital commodities

Digital commodities are tokens primarily used to run a blockchain, not to represent a claim on an issuer’s profits. Commonly cited candidates include Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH), plus similar fee or governance tokens on mature networks.

Under the CLARITY Act, spot trading of these tokens would move onto CFTC-supervised platforms, with required registration for digital commodity exchanges, brokers, and dealers. For traders, that can mean clearer market conduct rules, anti-fraud policing, and standardized customer protections.

Additionally, this eliminates the fear of retroactive securities litigation for miners and validators, allowing institutional capital to flow into confirmed non-security assets.

2. Investment Contract Assets

Investment contract assets are tokens first distributed through a fundraising arrangement that looks like a securities offering, even if the token can later circulate peer-to-peer. The SEC has set precedents with examples of issuer-led token sales, including Telegram’s Gram and Kik’s Kin.

Other potential candidates may include:

Tokens sold to fund initial network development via Initial Coin Offering (ICO).

Assets where value relies on a management team (e.g., centralized L2 tokens).

Ledgers controlled by a single foundation or corporate entity.

CLARITY keeps these under SEC authority, requiring strict adherence to traditional financial reporting. Issuers must disclose beneficial ownership and financial health quarterly, preventing teams from offloading tokens to retail buyers while concealing internal development failures.

An important consideration here is that as networks decentralize and meet statutory requirements, the token may transition to digital commodity status.

3. Permitted Payment Stablecoins

Permitted payment stablecoins are fiat-pegged tokens meant for payments and settlement, issued only by approved, regulated issuers under the GENIUS Act (another 2025 bill providing the underlying safety standards for stablecoin issuers). Only fully reserved assets like USDC or PayPal USD (PYUSD) qualify, specifically excluding algorithmic models that lack tangible liquid backing.

The legislation mandates that issuers hold high-quality liquid reserves and publish monthly 3rd-party attestations. This framework forces operational solvency, ensuring users can redeem tokens for fiat currency on demand without fear of a liquidity crisis.

For users, CLARITY largely points stablecoins to the specialized stablecoin rulebook, including reserve backing, redemption expectations, and AML obligations for permitted issuers. The SEC’s role is narrower here, centered on anti-fraud and market integrity around relevant transactions.

Why has the CLARITY Act been delayed?

Even though H.R. 3633 passed the House on July 17, 2025, and was received in the Senate on September 18, 2025, the bill is still stuck at the committee stage.

Timeline (key dates):

May 29, 2025: H.R. 3633 introduced in the House.

Jul 17, 2025: House passed H.R. 3633 (294 to 134).

Sep 18, 2025: Bill received in the Senate and referred to Senate Banking.

Jan 9, 2026: Senate Banking scheduled an executive session/markup to consider H.R. 3633 for Jan 15, 2026.

Jan 14 to 15, 2026: Chairman Tim Scott announced the markup would be postponed and the committee listed the Jan 15 session as Postponed.

What actually caused the stall (in plain English):

The Senate Banking draft ran into a late fight over stablecoin rewards and incentives, plus other market structure provisions. Reuters reported the committee canceled the markup hours after Coinbase CEO Brian Armstrong said Coinbase could not support the bill in its current form, citing stablecoin rewards and other issues.

Scott framed the delay as time for continued bipartisan negotiations, rather than forcing a vote that might fail in committee.

For the full legislative timeline and key definitions, see Datawallet’s Clarity Act guide.

What will change if the crypto CLARITY Act gets signed?

If carried out, this CLARITY Act legislation effectively legitimizes the crypto industry by providing permanent federal guardrails and removing the current enforcement-heavy regulatory approach.

The market would immediately experience these structural changes:

Institutional Custody: Federally chartered banks would gain authority to custody digital assets, unlocking immense capital inflows from previously hesitant pension funds.

Exchange Registration: Spot market platforms must register with the CFTC, implementing surveillance standards that eliminate predatory wash trading and order spoofing.

Stablecoin Settlement: Qualified stablecoin issuers could access Federal Reserve services, enabling instant 24/7 interbank settlement without relying on commercial intermediaries.

Staking choice protections: Exchanges cannot require customers to stake, but may offer blockchain services if customers opt in writing.

IPO Accessibility: Crypto firms could file for public listings with predictable SEC requirements, ending the current era of regulation by enforcement.

Altcoin Derivatives: The CFTC would approve futures contracts for validated digital commodities, allowing traders to hedge risk beyond just Bitcoin and Ether.

Definitive Compliance: Projects would finally have a clear legal path to transition from security status to commodity status via the decentralization test.

Market reaction to the CLARITY Act

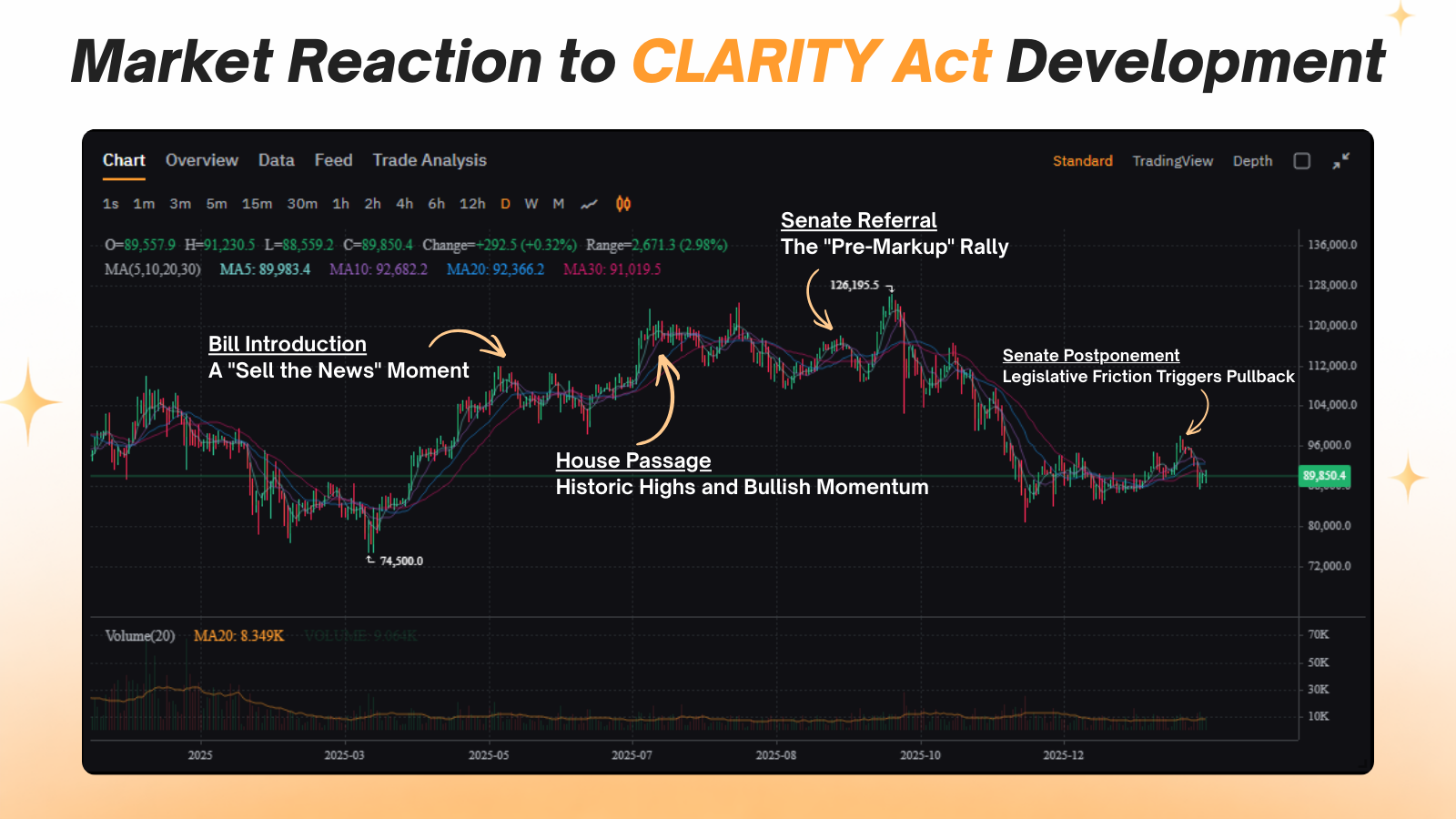

The crypto market has displayed extreme sensitivity to the legislative timeline, oscillating between euphoria during legislative victories and sharp corrections following administrative delays.

Historical price action surrounding key CLARITY Act milestones:

May 29, 2025 (Introduction): Bitcoin slipped 2.3% to $105,935 despite the CLARITY Act announcement, cooling off from its recent record high of $111,695.

Jul 17, 2025 (House Passage): Bitcoin, Ether, and XRP hit all-time highs as investors cheered the bill's approval, with the BTC's year-to-date gains climbing nearly 30%.

Sep 18, 2025 (Sent to the Senate): Trading volumes hit yearly highs as the bill officially headed to the Senate Banking Committee. This milestone fueled a "pre-markup" run-up that eventually pushed Bitcoin toward its October all-time high of $126,000.

Jan 14, 2026 (Senate Delay): Bitcoin slipped below $96,000 after the Senate Banking Committee postponed its hearing following several withdrawals of support for the legislation.

How can you position your portfolio for the CLARITY Act?

For most investors, holding Bitcoin and qualified stablecoins serves as a defensive hedge while the CLARITY Act remains stalled. This strategy mitigates risk during legislative delays, protecting capital against volatility before the March Senate markup.

Conversely, aggressive traders might use this dip to accumulate "Digital Commodity" candidates at a discount. If the bill passes in late March as expected, assets explicitly named in the CFTC transition list could see immediate repricing against the broader market.

What does the CLARITY Act mean for the future of crypto?

SEC Commissioner Hester Peirce argues the CLARITY Act establishes a long-overdue framework to replace the era of "regulation by enforcement." She noted to Bloomberg that "clear rules of the road are essential for digital innovation," ensuring the US remains a global hub for blockchain technology.

Galaxy Digital CEO Mike Novogratz urges the industry to accept the bill despite recent Senate revisions to stablecoin yields. Speaking with CNBC, he stated, "Even if it's not perfect, so what? We can always amend it later" to secure the sector's long-term institutional growth.

Legal experts believe the Act provides the first real path for projects to prove decentralization and escape SEC oversight. This transition would allow hundreds of developers to launch new protocols in the U.S. without the threat of constant litigation.

The bottom line

Whether or not the Senate reaches a consensus by March, the CLARITY Act remains the most viable path toward ending the current regulatory uncertainty in crypto.

Passing this legislation would finally integrate digital assets into the federal financial system, providing the long-term stability needed for massive institutional capital adoption.

Frequently asked questions (FAQ)

1. What is the decentralization test within the CLARITY Act?

The Act introduces a "Certification of Decentralization" allowing issuers to petition the SEC. If a network demonstrates sufficient independence from a central group, the asset is reclassified as a digital commodity, moving from SEC to CFTC jurisdiction.

2. How does the CLARITY Act protect blockchain developers?

The bill includes the Blockchain Regulatory Certainty Act, which provides a safe harbor for non-custodial developers. This ensures software creators, node operators, and miners are not classified as money transmitters simply for publishing code or maintaining protocol infrastructure.

3. Will the CLARITY Act allow banks to custody crypto?

Yes, the Act effectively reverses restrictive accounting policies by prohibiting regulators from forcing banks to treat custodied digital assets as balance sheet liabilities. This shift allows federally chartered institutions to offer secure, large-scale custody services to investors.