Bitcoin breaches $93k for first time in 2 weeks! Can the rebound last?

So much for all the "drama" surrounding Bitcoin's declines at the start of this week.

Recall just a couple of days ago, on Dec 1, the world's biggest crypto fell rapidly and dipped below $84k, prompting many doomsayers to appear en masse.

Since then, Bitcoin has staged a stunning rebound, not just erasing all of this past Monday's drop, but also punching its way to a 2-week high!

Earlier today, BTC even teased the $94k mark - reaching a price not seen since Nov 17.

RECAP: What drove Bitcoin's drop on Dec 1st?

Coming into this new week/month, the crypto world was hit with a trio of bearish developments:

1) Strategy to force sell Bitcoin hoard?

The CEO of Strategy (formerly known as MicroStrategy), Phong Le, admitted that this Bitcoin treasury company may be forced to sell its BTC stash to keep funding its dividend payments. The company even unveiled a US$ 1.4 billion dollar reserve - but that did little to sooth market fears, initially.

2) China central bank cite crypto risks

Over the weekend, The People's Bank of China (PBoC) cited the re-emergence of risks surrounding speculation and hype tied to virtual currencies. The PBoC also added that virtual currencies do not have the same legal status as fiat currencies, lack legal tender status, and should not be used as currency - key components of what constitutes modern-day "money".

3) Japan central bank chief's "hawkish" surprise

Bank of Japan (BoJ) Governor, Kazuo Ueda made public comments hinting at a December rate hike. His comments led markets to price in an 80% chance of a BoJ hike on Dec 19, while 10-year Japanese bond yields have since soared to their highest since mid-2007.

NOTE: Generally, higher government bond yields make them more attractive, pulling away investor funds from riskier assets such as stocks and cryptos.

Why is Bitcoin rebounding?

Risk appetite is attempting a turnaround - even the SP500 is en route to erasing its Monday declines - on the back of these "risk-on" developments:

1) Greater odds of December Fed rate cut

Fed funds futures now point to a 91% chance that the Federal Reserve - the most important central bank in the world - will lower US interest rates by 25-basis points on December 10th.

NOTE: The thought of US interest rates going down tends to cheer riskier assets, such as stocks and cryptos.

2) SEC's "innovation exemption" measures incoming?

The Securities and Exchange Commission (SEC) Chairman, Paul Atkins, plans to unveil more details about the "innovation exemption" for digital-asset companies (DATs). That seemed to allay some of the fears surrounding Strategy and its fellow DAT peers, as written above.

3) Fears ease slightly on Japan bond yields

Japan's 10-year government bond auction drew solid demand on Tuesday (Dec 2), which temporarily eased Japan's bond yields lower - though that didn't stop 10-yr yields pushing to its highest since 2007 today (Wed, Dec 3).

Can Bitcoin sustain its rebound?

That is, of course, the "$1 trillion" question!

(based off the notion that total crypto market cap now stands at about US$ 3.12 trillion - still some 27% and more than US$ 1 trillion below its all-time high of US$ 4.27 trillion, according to TradingView data.)

To be certain, crypto market sentiment remains fragile:

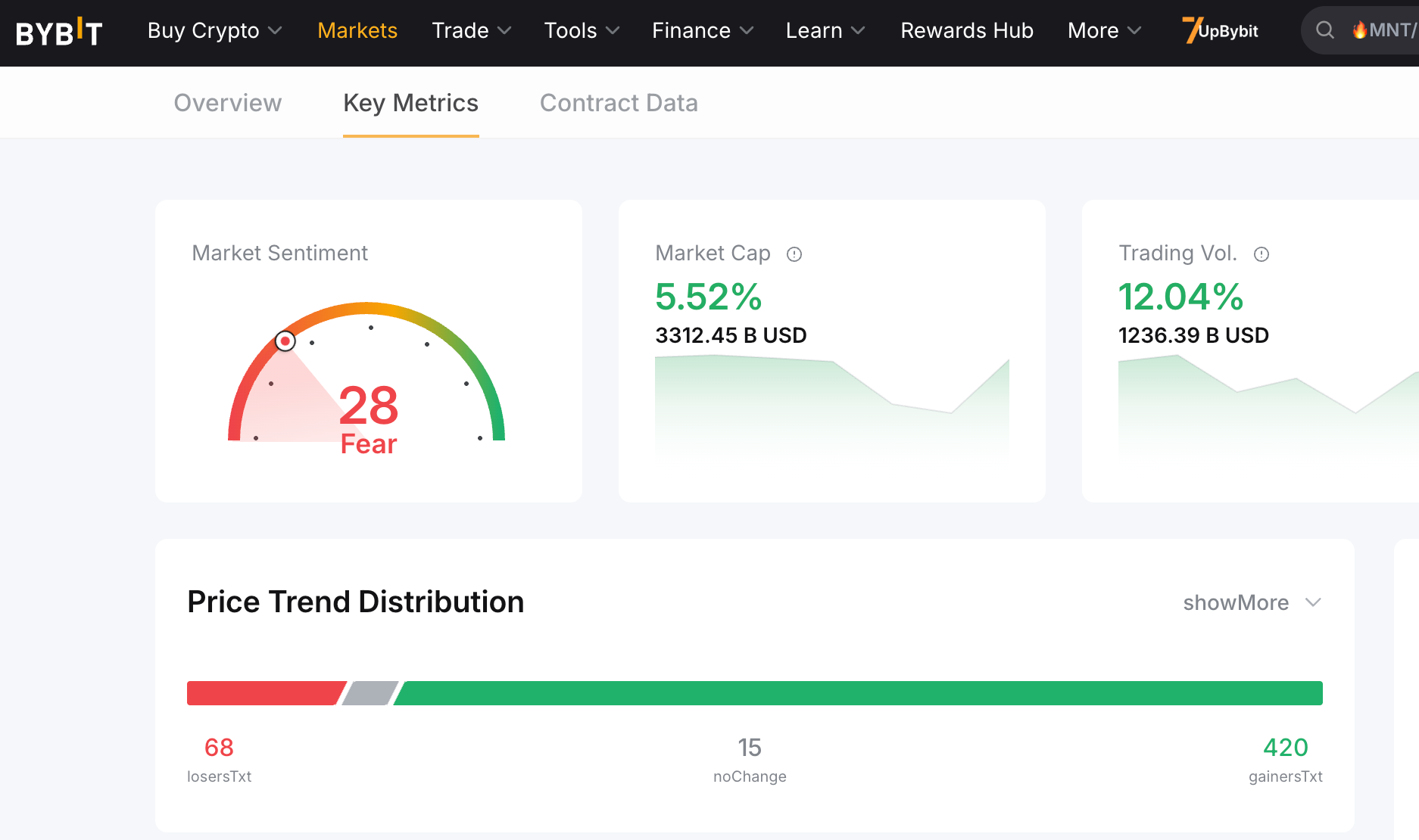

- "Fear" still evident

Despite the ongoing BTC rebound, Bybit's "Market Sentiment" meter still reads within the "fear" camp.

For context, that 28 number marks a notable easing from the 11 number which denoted 'extreme fear' back on Nov 20.

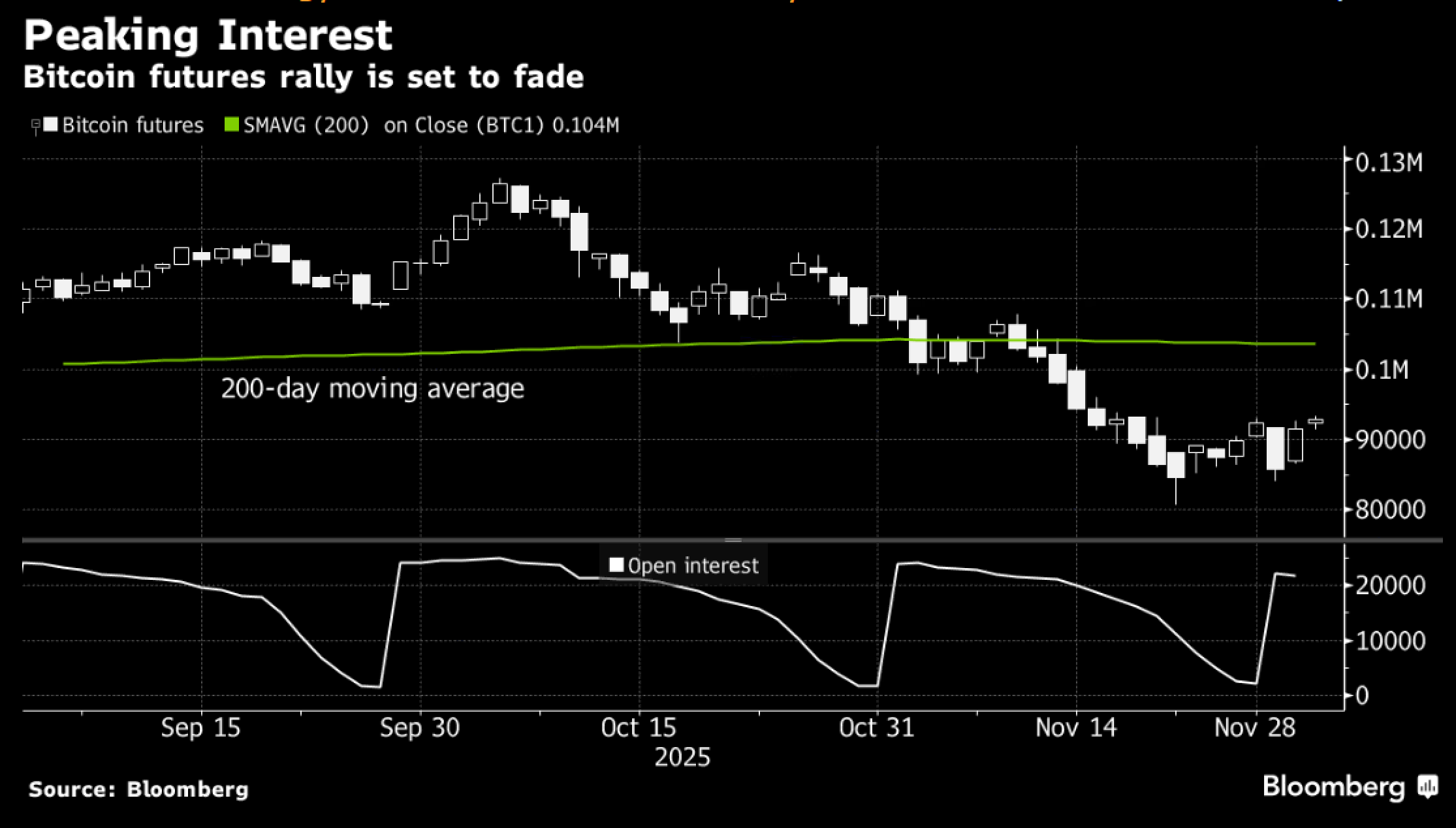

- Futures positioning may soon peak.

According to Bloomberg data, Bitcoin's rebounds tend to fade when open interest on futures breach 20k - which it already has.

BTC's ongoing relief rebound may be nothing more than a short squeeze.

Already, over the past 24 hours US$ 400 million worth of bearish bets across all tokens have been liquidated, according to Coinglass data.

According to Bloomberg, this suggests the rebound may fade by the weekend ... though the pivotal Fed rate decision looms next week.

Key Events: BTC rebound sustained / bear market extended?

Of course, there are major MACRO events in the weeks ahead that could either determine a sustained rebound for crypto, or extend the current bear market:

- Dec 10: Fed rate decision (91% chance of a rate cut)

- Dec 16: US November jobs report

- Dec 18: US CPI (consumer price index a.k.a. inflation) report

- Dec 19: Bank of Japan rate decision (81% chance of a rate hike)

- Jan 15, 2026: MSCI decision on Strategy's inclusion in major stock indices

From a technical perspective ...

For Bitcoin bulls (those hoping prices can still push higher) ...

The 21-day simple moving average (SMA) has to keep supporting Bitcoin prices.

- UPSIDE: As long as the 21-day SMA support holds, then the $95,000 target may still be in reach - a target we had highlighted since Nov 21.

- DOWNSIDE: If the 21-day SMA however fails as the crucial support level, Bitcoin could revisit the $84k psychological level soon.