Bybit Crypto Insights Report: Project Crypto — a paradigm shift in market regulation and blockchain integration

In an era defined by digital transformation and decentralized innovation, financial regulators are faced with an increasingly complex challenge: how to balance innovation with investor protection in the volatile cryptocurrency sector. The US Securities and Exchange Commission (SEC) recently unveiled an ambitious regulatory framework known as Project Crypto. Spearheaded by SEC Chair Paul Atkins, this initiative seeks to migrate traditional financial systems to blockchain infrastructure while establishing clearer rules for digital assets. The proposal marks a pivotal moment for markets globally, with profound implications across asset classes, technology sectors and economic jurisdictions.

Defining Project Crypto

Project Crypto’s goal is to create transparency within, and access to, the financial world by utilizing blockchain technology. Here's what it's proposing:

Define digital assets: Figure out definitively whether crypto, NFTs and stablecoins are securities, commodities or another type of entity. This will help clarify under whose jurisdiction they fall.

Tokenize traditional finance assets: Imagine your stocks, bonds and even real estate as digital tokens on a blockchain, making it easier and more efficient to trade them.

One license for all: Crypto companies, such as exchanges and wallet providers, could obtain a single license, eliminating the need to navigate numerous federal and state regulations.

Smart DeFi rules: Instead of just shutting down decentralized finance (DeFi), the SEC wants to create special rules so it can grow safely and protect DeFi’s users.

Innovation playgrounds: New crypto startups would have a safe space to test their technology without immediately facing regulatory issues.

Better control of your crypto: You'd have more say in how your digital assets are held, which means more security and stronger ownership rights.

Implications for the market

The impact of Project Crypto’s implementation could reverberate through multiple layers of the financial ecosystem. Below are key areas in which the proposal is likely to leave a transformative imprint.

Institutional adoption by more diverse RWAs

For years, institutional hesitancy toward crypto assets has stemmed from regulatory uncertainty. By establishing clear guidelines and consistent oversight, Project Crypto has the potential to attract major banks, asset managers and pension funds to the space.

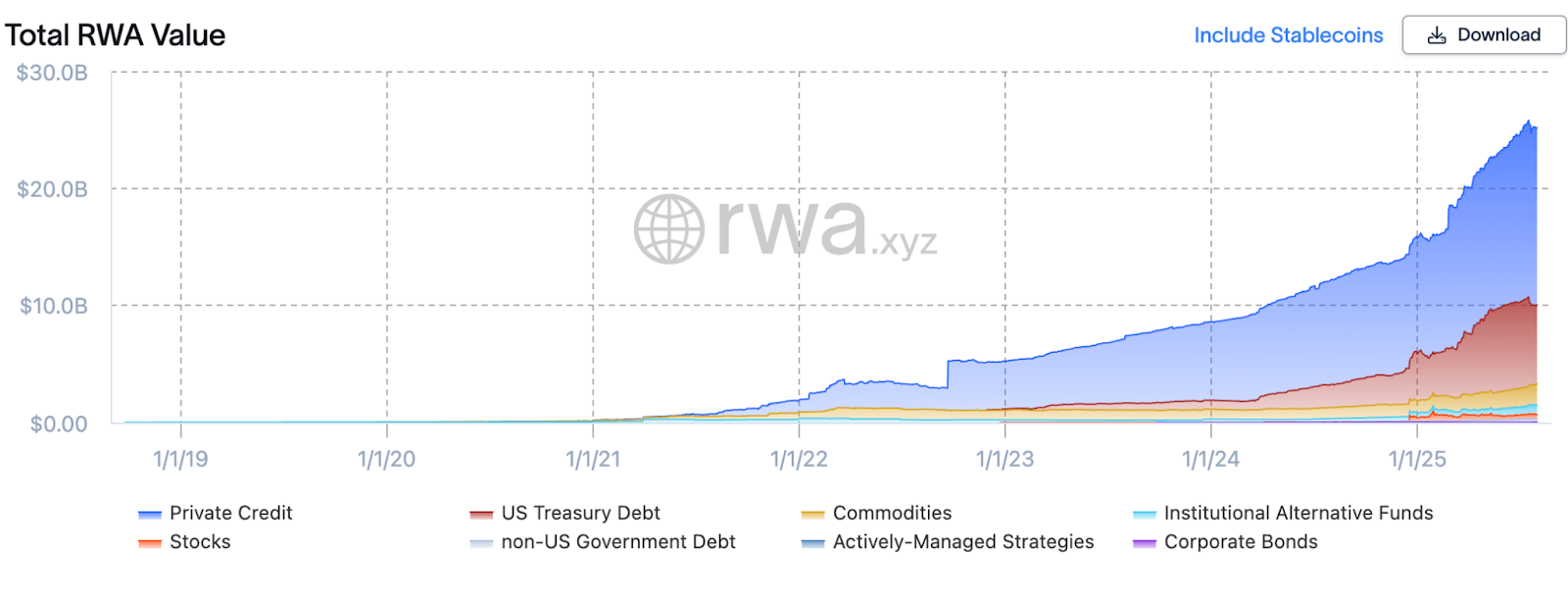

Source: rwa.xyz

Tokenized real-world assets (RWA) and regulated DeFi platforms could unlock billions of dollars in liquidity, driving deeper integration between traditional finance (TradFi) and DeFi. Project Crypto may be able to expand RWA usage beyond tokenized treasury products into all other conventional asset classes. As of this writing (Aug 3, 2025), treasury-related RWAs are a mainstay of this asset class, while stocks, alternative funds and actively-managed strategies are still in their early stages. RWAs are expected to develop a broader tokenization of all classes of conventional assets.

Cross-border influence and regulatory harmonization

Project Crypto could set a precedent for regulatory frameworks worldwide. Its adoption might prompt similar moves in Europe, Asia and Latin America, which would promote cross-border cooperation and standardization of trade. Nations like Singapore and Switzerland, already active in terms of crypto-friendly regulation, may build upon this foundation to create interoperable markets.

In addition, Southeastern nations have been active in their crypto regulation, as highlighted in Bybit’s previous regulation report. Project Crypto is expected to set an example for countries that are latecomers to implementing crypto regulations.

However, geopolitical tensions and divergent monetary policies could also spark competitive regulatory responses — especially from countries wary of US dollar dominance in digital asset settlement.

Crypto VCs bloom

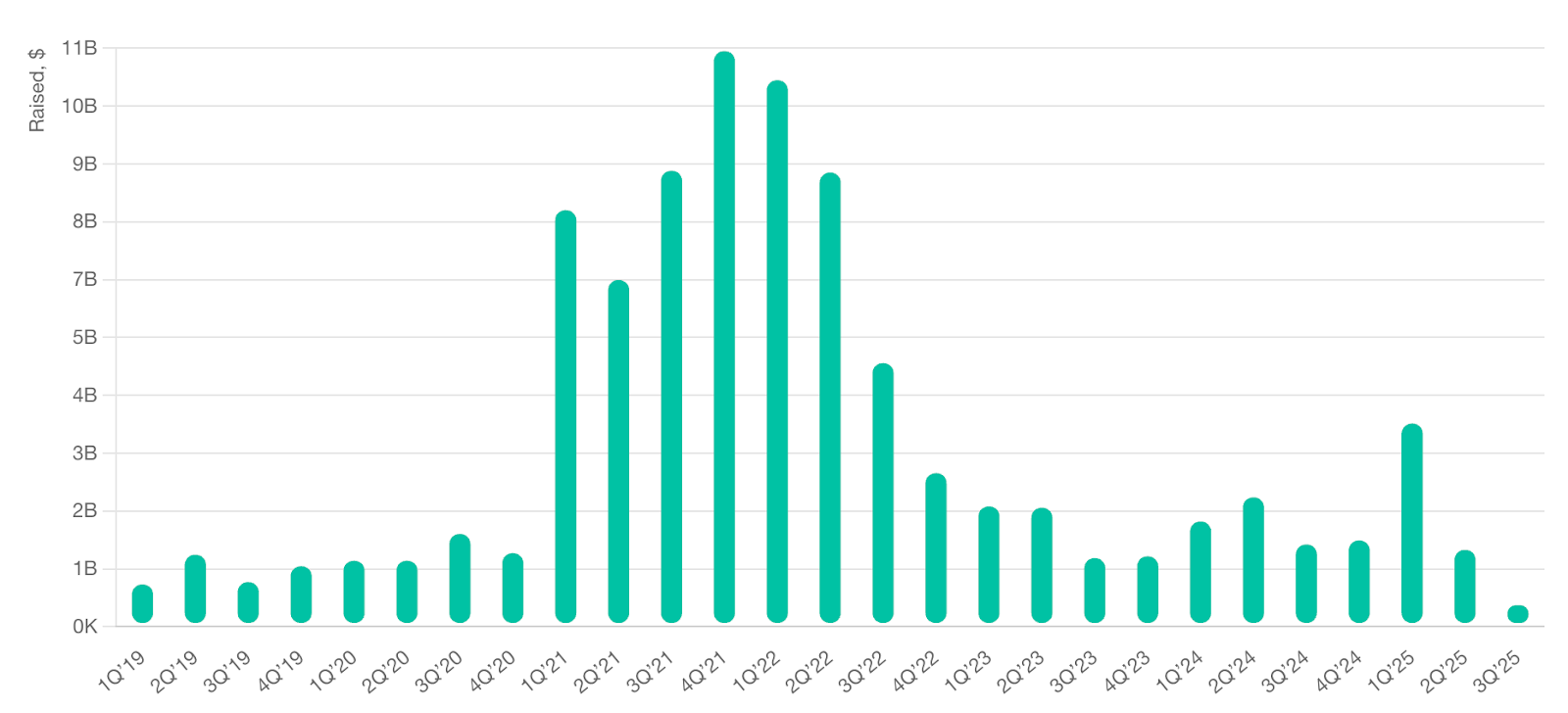

Web3 startup funding. Source: Crunchbase

Venture capital firms may increase allocations to crypto startups, with early-stage capital finding safer havens under the project’s protective canopy. As shown in the chart above, web3 funding hasn’t yet recovered to 2022 bull cycle levels. Project Crypto can boost confidence from venture capital and increase the web3 investment allocation in its portfolio. What’s more, access to sandbox environments will be a boon for entrepreneurs and developers, who often face regulatory risks when launching blockchain solutions.

By reducing barriers to entry and signaling regulatory openness, Project Crypto could catalyze a new wave of innovation across fintech, digital identity, payments and smart contract applications.

Challenges

The most significant risk to Project Crypto is whether 2026’s US midterms elections could weaken the influence of crypto-friendly candidates. Continuity is a key concern for venture capital that expects its return on web3 startups in a 5-to-10-year horizon.

Other than the political risk, Project Crypto faces notable hurdles:

Technological risks: Blockchain infrastructure must achieve scalability, security and interoperability in order to support national financial systems. Early-stage platforms may struggle with congestion or vulnerabilities.

Privacy and surveillance concerns: While permissioned DeFi enhances oversight, critics argue it could erode user privacy and facilitate state surveillance. Finding a way to strike the right balance between transparency and individual rights is a critical point of debate.

Global coordination: Regulatory arbitrage remains a risk if major jurisdictions diverge on digital asset policies. Without global standards, capital may flow to the least restrictive environments, undermining consistency.

Final words — Project Crypto is an initiative for global finance

Project Crypto represents one of the boldest attempts in financial history to reconcile innovation with regulation. By integrating blockchain into traditional market infrastructure and defining clear roles for digital assets, the initiative could reshape the way capital is raised, traded and stored across the globe. While implementation remains uncertain and challenges persist, the potential for improved market access, investor protection and systemic efficiency is undeniable.

Investors, developers and policymakers would be wise to monitor Project Crypto’s trajectory — not simply as a US initiative, but as a blueprint for the future of global finance.