Mirror Trading in Crypto, Explained

Due to the volatile nature of the cryptocurrency market, crypto trading poses significant risks for novice traders. Some of the ways to reduce these risks involve using trading strategies that emulate the market moves of experienced successful traders — mirror trading and copy trading. In this article, we’ll take a detailed look at mirror trading and its applicability to crypto.

What Is Mirror Trading?

Mirror trading is a strategy whereby you precisely copy all the market moves of an established and well-performing trader in a real-time format to replicate their success. This trading strategy relies on automation to immediately mirror all the trades placed by a Master Trader, whose behavior is being “mirrored.” It’s considered to be an algorithmic trading strategy.

Mirror trading originated in the first years of the 2000s, thanks to advances in the development of trading software. It was first used in the stock market and forex trading. More recently, mirror trading has become available on some crypto trading platforms as well.

Originally, mirror trading was limited to large institutional traders. As trading became more dependent upon automation, and the cost of trading software declined, retail investors also started using it. By now, mirror trading is a commonly used strategy in the stock market, forex and commodities markets, and, increasingly, in the crypto market.

How Does Mirror Trading Work in Crypto?

Traders wishing to use a crypto mirror trading strategy first need to select a platform that supports mirror trading services, and then choose a Master Trader they’d like to mirror. Master Traders’ performance data and history are listed on each platform to help you make an informed choice when setting up your mirror trading account. Master Traders themselves are incentivized to share their trading strategies by earning a proportion of the profits generated by their followers.

As a follower mirror trader, you can simply relax and leave everything on autopilot as the software on the platform precisely replicates the moves of your chosen Master Trader. All the analysis and work are done by your Master Trader and the software that links your account to theirs.

When using mirror trading, note that the specifics of the cryptocurrency market introduce additional factors for consideration. First, due to the fast-changing nature of the crypto market, some strategies selected by your Master Trader might require rapid adjustments. If your Master Trader doesn’t react quickly enough to sudden price changes so prevalent in crypto trading, both you and the Master Trader may abruptly slide into loss.

Secondly, the choice of mirror trading platforms in crypto is still relatively limited. Only a few crypto exchanges offer a full-scale mirror trading platform, leading to higher fees and fewer discount options.

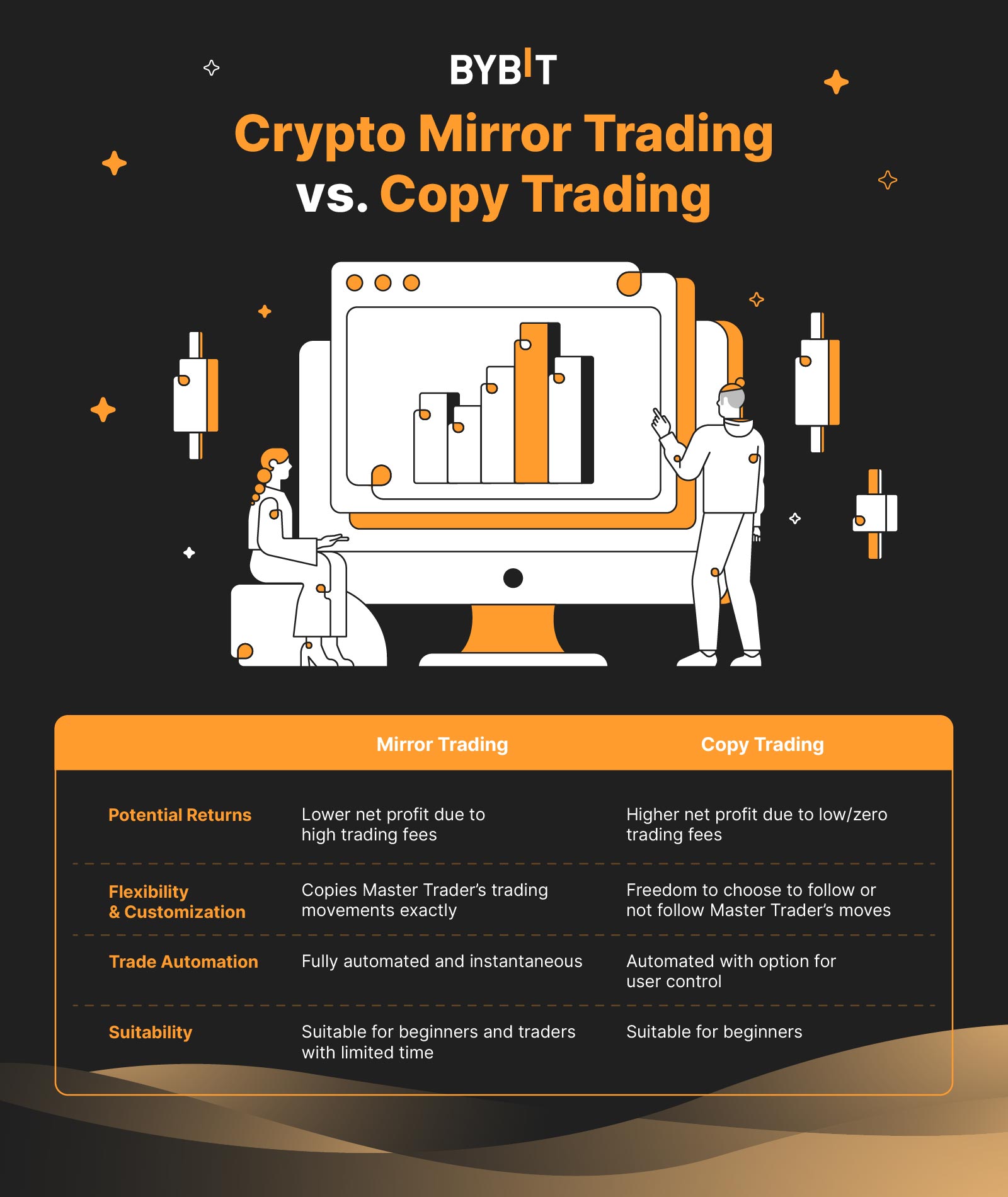

Crypto Mirror Trading vs. Copy Trading: Which Is Better?

Mirror trading is similar to — though not exactly the same as — copy trading. In copy trading, you also follow an established and successful Master Trader, replicating their moves. However, copy trading is customizable and leaves some of the decisions to the follower trader. While mirror trading involves the unquestioned, automated following of all the moves of a Master Trader, copy trading allows you to make some adjustments.

In addition to giving you more flexibility, crypto copy trading is available on more platforms than mirror trading is.

Potential Returns

Regardless of whether you adopt a mirror trading or copy trading strategy, your potential returns will largely depend on your Master Trader’s risk profile and trading style. Both mirror trading and copy trading essentially represent strategy replication methods. As such, they don’t necessarily differ significantly in terms of risk-vs.-return.

However, as fewer platforms offer mirror trading, these fees are consequently higher, which eats into any profits earned. Copy trading, on the other hand, generally offers low trading fees. On Bybit, copy trading is free to use for both Followers and Master Traders, which means substantially higher gains in the long run.

Trading Flexibility & Customization

As noted above, mirror trading is less customizable than copy trading. Therefore, copy trading might be a better choice for someone who wants to retain some control over their trading. Copy traders have the freedom to follow or not follow their Master Traders’ specific moves, a luxury not available for mirror trading.

For instance, in copy trading, if you decide that a particular move by your Master Trader is too risky, or is simply incorrect, you can opt not to mimic them on that trade. In contrast, mirror trading mandates that you follow your Master Trader’s moves precisely — even if you disagree with some of them.

Trade Automation

Both mirror trading and copy trading rely on automation to work. The former might be considered a more automated strategy, as it’s completely reliant on “set and forget.” Meanwhile, when copy trading, you can choose to halt trades and manually close a position before the Master Trader does.

Suitability

While copy trading is also suitable for beginning traders, mirror trading is a particularly good fit for those who may not have the knowledge to devise even the most basic trading strategies. Traders who would like to dedicate a minimum amount of time to managing their trading activities might also find mirror trading helpful.

Pros and Cons of Crypto Mirror Trading

As with any other form of trading, mirror trading comes with its own set of pros and cons.

Advantages

Beginners can be profitable right from the start. Even before you’ve mastered the myriad techniques and approaches used in trading, mirror trading lets you reap profits straightaway. Many novice traders delay starting their trading activities due to lack of knowledge. They might spend significant time learning the basic trading techniques, reading the advice of prominent traders online, researching various markets and testing the waters with tiny amounts of funds.

While all these activities are useful in developing the fundamentals of your trading knowledge, you’re missing out on market opportunities if you stay away from the market while you’re learning. Mirror trading allows you to start mimicking the skillful moves of your Master Trader while you learn.

Zero emotional element in making trading decisions. Since this mode of trading is completely automated and relies on other traders’ decisions, there’s no emotion involved in your trading. This is incredibly helpful for newbie traders who may get overly stressed from having to make various trading decisions.

Mirror trading is time-efficient. Initially, you’ll spend some time selecting a Master Trader you’d like to mirror. After that, the time required to stay on top of your account is minimal. Of course, you do need to check occasionally how your account is doing in order to spot if your Master Trader’s performance changes significantly. Other than that, mirror trading requires very little time commitment.

You get to learn from an established Master Trader. As they execute their moves and your account mirrors these, you get an opportunity to see the actions and behavior of an experienced market trader.

Disadvantages

Mirror trading is not a magic-bullet strategy, and does have its own drawbacks and limitations.

Complete dependency on another trader’s style and decision-making. As you gain trading knowledge, you might notice some decisions made by your Master Trader that you don’t understand or agree with. Perhaps some of their moves are too risky or, on the contrary, too cautious from your perspective. While you might agree with their overall approach and profit by mirroring them, you might question some elements of their strategy.

Unfortunately, you cannot be selective in mirror trading. You are bound to exactly mirror your Master Trader. If you disagree with any part of their strategy, you only have the option to completely drop them. In that respect, copy trading acts as a good alternative to mirror trading by giving you the choice to opt out of certain of your Master Trader’s moves.

You’re tied to the performance of another trader. Although Master Traders are usually successful, past performance isn’t necessarily a guarantee of future success. If your Master Trader executes the wrong trade and takes a loss, the automated, real-time nature of mirror trading can quickly put your account at risk.

Is Mirror Trading Legal?

Mirror trading is a perfectly legal activity, both for Master Traders and for anyone who mirrors them. In many parts of the world, mirror trading is regulated, with Master Traders legally responsible for maintaining legitimate trading practices.

Some traders might be under the mistaken impression that mirror trading is illegal. This is largely due to a highly publicized “mirror” trading scandal involving Deutsche Bank and some financial entities in Russia. The scandal saw Germany’s largest bank embroiled in an illegal scheme to move large sums of cash out of Russia. The “mirror” trades under the scheme had nothing to do with mirror trading.

Another publicized case that is, unfortunately and undeservingly, associated with the term “mirror trading” concerns the failed South African entity called Mirror Trading International, a fraudulent Bitcoin pool operator involved in the theft of its own clients’ funds. Like the Russian scandal involving Deutsche Bank, Mirror Trading International has nothing to do with the strategy of mirror trading.

Conclusion

Mirror trading is a good strategy for beginners and even for experienced traders who would like to spend less time watching the market and placing trades. It allows you to take a completely hands-off approach to trading, a significant benefit for traders of all kinds.

Of course, the biggest limitation of mirror trading is the lack of flexibility when following a Master Trader’s strategy. For traders interested in automated, hands-off strategies, but who also want to retain some level of control and customizability, copy trading might work as a great alternative to mirror trading.