What Is Crypto Copy Trading and Why Should You Try It?

Many people assume that the only way to make money in cryptocurrency is by having extensive knowledge of mathematics, finance and technology. However, the reality is that there are a lot of helpful tools available. Crypto copy trading is a type of software that can make it far easier to trade crypto. What is crypto copy trading? Explore our guide to learn what it is and how it works.

Key Takeaways:

Crypto copy trading is an automated trading strategy that lets you (Follower) imitate the actions of a professional trader (Master Trader).

Crypto copy trading is ideal for beginners due to its hands-free nature, which empowers beginning traders to profit from trading — even without fully understanding the market.

Bybit is among the most popular platforms offering crypto copy trading. On it, you can follow up to 10 Master Traders and manually set multiple parameters for a truly customized experience.

What Is Crypto Copy Trading?

Crypto copy trading is a trading strategy that uses automation to buy and sell crypto. It lets you copy a professional trader's methods, so you don't need a lot of time or experience yourself.

The whole concept of crypto copy trading revolves around the idea of identifying successful traders and mimicking their actions. Unlike regular trading, copy trading doesn't focus on identifying market trends or attempting complex trading strategies.

Instead, the automated software simply looks at what another trader is doing and does the same thing. For example, if one trader spends 5% of their money on a certain coin, the copy trader's software would spend 5% of their money on the same coin.

Copy trading is great for beginners because they don't have to fully understand the market themselves. Instead, they can use the expertise of other traders to make smart decisions. Even if you already understand the market yourself, copy trading can be a helpful tool. It's less hands-on, so using copy trading can free up some of your time. Being able to see how other traders make decisions can also help you learn about the market and create strategies that work for your needs.

How Does Crypto Copy Trading Work?

Crypto copy trading only works with the right software. It takes a little time to set up, but once you do, it runs automatically. A typical copy trade system automatically mirrors the Master Trader at all times. The Follower can set it up to invest the same amount as the Master Trader, or a percentage of their funds equal to the Master Trader's percentage.

Though crypto copy trading doesn't require your input, you can add input if you want. You can halt any trade the software makes, and you have the option of manually closing a position before the Master Trader does. Crypto copy trading isn't tied to any specific trader, so you can switch up the person you copy whenever you want.

For crypto copy trading to work correctly, you have to actually have access to another person's trades. How do you get another trader to consent to this? Most copy trading software makes this easy. You look over a selection of Master Traders and find someone with results you like. Then you use the software to automatically begin mimicking that person's trades. You get the profits from the trades, and they collect a small fee, which is usually around 5% to 10% of your profit.

This system might sound very futuristic, but it's actually a time-honored technique. Copy trading has been around in one form or another since 2007. It's very reputable and is recognized by the Financial Conduct Authority, European Securities and Markets Authority, and other regulatory organizations. These organizations place a lot of regulations on copy trading, so as long as you use an authorized copy trading service, you can be confident it's a legitimate trading method.

Pros and Cons of Crypto Copy Trading

To see if crypto copy trading is right for you, it's helpful to learn a little about its pros and cons.

The advantages of copy trading include:

You can use the metrics on copy trading sites to quickly and clearly identify traders with winning strategies.

Copy trading lets you free up your time for other matters while the software does the work for you.

You get to invest your money based on statistics, instead of letting your emotions impact your trades. Copy traders are less likely to make mistakes due to panic or FOMO.

Since you're following expert traders, you can make informed trades without having to do all the research and learn about the cryptos yourself.

Copy trading lets you closely see what other investors are doing, so you get a lot of insight into how the crypto market works.

Using another investor's ideas makes your portfolio more diverse. Instead of sticking to strategies you personally use, copy trading lets you try out other people's tactics.

The fees associated with copy trading can be cheaper than paying an investor to manage your crypto trades for you.

However, there are also a few downsides to copy trading:

Every decision doesn't have to be approved by you, so you lose some control.

Your trades will only be as good as the trader you follow. Picking the wrong trader to follow can cause you to lose money.

Since your trades lag slightly behind the lead traders, a very volatile market can keep you from getting identical results. Some sites will cancel orders if there’s a huge difference between the market price and the price the lead trader used.

Every trader has a different level of comfort with risk. You can encounter issues if you're using all of your savings to copy a trader who has a high risk tolerance and a lot of money to play with.

You may need to share a small percentage of your profits with the lead trader to compensate them for their work.

Crypto Copy Trading vs. Crypto Social Trading

People often confuse the two concepts of crypto copy trading and crypto social trading. Both methods involve collaborating with others on your investments, and making decisions based on input from others. However, there are still some key differences between the two methods.

Social trading is a type of investment where traders form a group and work together. Traders in the group share research and tips with each other, and more than one person may chime in to help a trader optimize their portfolio. In some cases, investors may even pool funds to make a larger investment together. This form of investment has become very popular due to social media. For example, Reddit forums or X followers may start discussing their thoughts and begin sharing market analyses to help their fellow traders.

As you can see, social trading is a lot more informal than crypto copy trading. You don't necessarily have to use any specific software or enter a profit-sharing agreement with an investor. Many people who use social trading browse through a variety of groups and take input from multiple social circles. Some forms of social trading can involve contracts for pooling funds, but you don't have to commit to anything unless you want to.

Crypto Social Trading: Pluses and Minuses

Compared to crypto copy trading, crypto social trading has its own pros and cons. Social trading provides a lot more freedom. You get to make most decisions on your own while getting input from multiple other traders. Social trading also lets you work with others to plan trading strategies that only work with larger amounts of users and funds.

However, social trading requires a lot more work than crypto copy trading. You have to network with others, build trading relationships, and spend a lot of time learning about things on social media.

In addition to being more hands-on, social trading is also less reliable. Unlike crypto copy trading, social trading doesn't let you just set up an account and sit back to watch what happens. You may not have as cohesive a strategy because you're taking input from multiple people instead of a single trader.

Social trading doesn't offer access to the long-term investment strategies you can copy while crypto copy trading. Using social trading for crypto can also cause problems when social media over-hypes news and causes bouts of impulse trading.

Crypto Copy Trading vs. Crypto Mirror Trading

Mirror trading is possibly even more similar to copy trading than social trading is. After all, the only difference lies in the flexibility that copy trading offers as compared to mirror trading. In mirror trading, the copied trades are fully automated, with no room for customization. While this means that you can go completely hands-free and relax as the Master Trader does all the analysis and executions for you, it also means that your fate is directly tied to theirs. If your Master Trader experiences a loss, you’ll be equally affected.

Meanwhile, copy trading empowers you to personalize your trades to a certain extent, giving you more control over your own trades. Hence, if you disagree with some of your Master Trader’s moves, you can choose not to follow them.

Furthermore, as mirror trading is offered on fewer platforms, the trading fees are consequently higher, which could eat into your overall profits. Copy trading is much more commonplace, and usually offers lower fees. With Bybit, copy trading doesn’t incur extra fees for either Followers or Master Traders. The trading and funding fees are the same as when trading on Bybit's Derivatives platform.

How to Start Crypto Copy Trading on Bybit

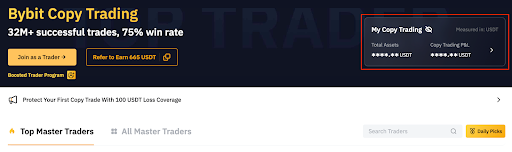

Bybit is one of the most popular crypto copy trading sites. Even when you're still wondering, "What is crypto copy trading?" Bybit makes it easy to understand the process. If you want to give copy trading on Bybit a try, follow these simple steps:

Create a copy trading account:Begin by setting up a crypto copy trading account on your existing Bybit account. Once you've done this, you can go to the Derivatives tab and click on the Copy Trading option to begin trading.

Fund your account:Make sure you have money in your account to begin trading. If desired, you can transfer funds straight from your Funding account or Unified Trading Account to your Copy Trading account. Keep in mind that Bybit currently only supports USDT for funding.

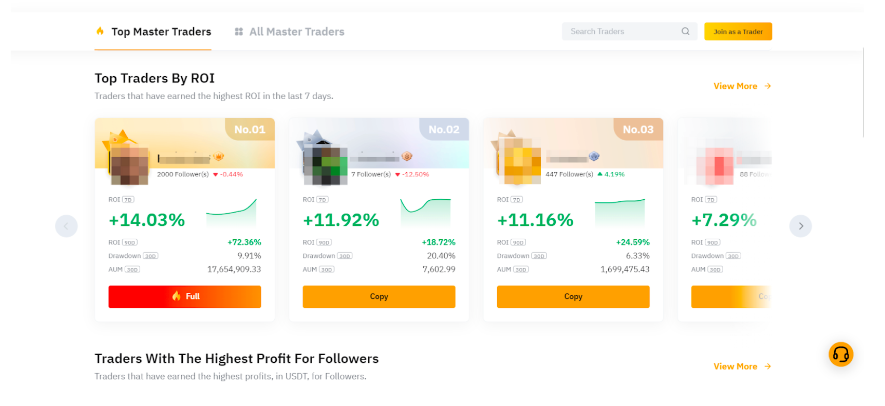

Choose a trader to follow:Browse the Master Trader cards, which are categorized according to seven categories, such as ROI and highest profit, for Followers. Click Copy to select a Master Trader you want to follow. If you wish to learn more about the Master Trader before making your decision, you can click on their card to access their portfolio, which reveals more information, such as their number of winning trades and the profit each of their Followers has received. You can follow up to a maximum of 10 Master Traders.

Select your trading parameters:Once you’re following the Master Trader, Bybit will prompt you to choose two parameters: Investment Amount and Items to Copy. Typically, a minimum of 50 USDT is required for your investment amount, though your Master Trader may set a higher requirement. You can copy two items from your Master Trader: USDT Perpetual Trades or Trading Bots.

Further configure your trading parameters:You can click on More Settings to personalize your trading experience. Some additional options include SyncMaster, a mirror trading–like feature that allows you to copy your Master Trader’s parameters exactly, and Smart Copy Mode, a recommended feature for beginning copy traders because it allows Master Traders to manage your portfolio risk with a fixed position ratio and optimized entry timing.

Confirm your decision:To start crypto copy trading, all you have to do is confirm your decision by checking the Agreement Acknowledgment box and clicking on Copy Now. Once you click on Copy Now, you'll start following the Master Trader’s moves.

Check up on your trades: If desired, you can be completely hands-off. However, Bybit also lets you log in to your account to see your current positions at any time. From the My Copy Trading tab on the top right side of the page, you can monitor your trades and even edit your parameters at any time. And from the User Center (Follower)tab, you can close trades manually or stop following your Master Trader anytime.

Is Crypto Copy Trading Profitable?

What is crypto copy trading's success rate? There are plenty of instances where it works well. On average, industry experts estimate that copy traders make roughly a 30% return on investment when they copy a prop trader. Individual traders usually have an ROI of somewhere between 3% to 57%. Keep in mind that crypto copy trade sites will halt your trades if your account zeroes out, so unlike some other trading strategies, you can't lose more money than you put in.

Keep in mind that your success is heavily dependent on the trader you’re copying. To be successful, you need to have a good risk management strategy in place. Take the time to really research various traders before you start crypto copy trading. Choose those with a decent amount of activity, several other followers, and a reliable return rate.

You'll also need to consider whether a trader does short-term or long-term trades. If you copy a long-term trading strategy, but close your trade out in a week, you might find that you end up losing money. In addition to finding a good trader, you can also increase your chances of success by copying multiple traders at once. This can help you increase your chances of finding a winning strategy.

The Bottom Line

To sum up, crypto copy trading can be an easy and effective way of making crypto trades. Copying other more experienced traders lets you automate your trades and learn a little more about how the market works. As long as you take the time to research traders carefully and follow a reputable trader, you can increase your chances of success.

#LearnWithBybit