How to Choose a Master Trader to Magnify Profits (Complete Guide)

Copy trading is one of the best ways for traders to emulate the success of established traders and earn profits on par with these market gurus. A well-established strategy in traditional finance, copy trading has also proved itself to be a popular tool in the crypto market. In copy trading, there is perhaps no element more important than choosing the right Master Trader. This choice will make or break your crypto copy trading. Read on to learn all about copy trading and Master Traders to get the most out of your trading.

Key Takeaways:

Master Traders (MTs) on Bybit cater to various trading styles, from aggressive short-term strategies to conservative, long-term ones.

Bybit provides comprehensive metrics like ROI, win rates, and drawdown stability so that you can make an informed decision when choosing a Master Trader.

What Is Copy Trading?

Copy trading is a popular trading strategy whereby a novice trader or follower replicates orders placed by an established trader with a track record of positive returns, known as a Master Trader. You can choose to manually copy a Master Trader’s strategy, or simply use automated software to copy their orders. For example, Bybit offers you a convenient platform for easy and flexible automated crypto copy trading where you can freely communicate with top-tier Master Traders.

Copy trading is often compared to — or even confused with — mirror trading, which is largely a similar strategy in which you precisely follow the market moves of an established trader in an automated fashion. The key difference between copy trading and mirror trading is that the former leaves you room for applying your own customization and judgment when replicating the market moves of your chosen trader.

Meanwhile, mirror trading mandates following the trader’s moves exactly, even when you disagree with a particular order or strategy.

With copy trading, beginners can become profitable even without deep knowledge of the market and trading methodologies. It’s also a great time saver, as nearly all of it is automated, and relies on the established trader’s moves. Copy trading, similar to other automated trading strategies, also removes the element of emotion from your decisions and performance.

An experienced trader who would like to share their knowledge and trading strategy with others can become a Master Trader. In doing so, they also earn additional profits from their dedicated followers, since no one acts as a copy trading master without being reimbursed for it.

Currently, Bybit supports crypto copy trading only for the Derivatives markets. Traders whose strategies are followed earn 10% fees on profits generated by their followers.

Who Is a Master Trader in Copy Trading?

A Master Trader is a trader whose strategies and moves are being copied by others, known as followers. Master Traders have a track record of great performance and positive returns. You wouldn’t want to copy their trades otherwise, would you? They don’t necessarily need to be the biggest names in the market, or have millions of traders following them on social media. Massive fame and celebrity-like status are, thankfully, not a requirement. Great Master Traders often maintain low profiles but deliver results in terms of profitability and win rates.

How Do Master Traders Earn Profits?

The primary profit source for Master Traders in copy trading comes from the fees charged on their followers’ returns. Because copy trading is automated, attributing the profits earned by a follower to a specific Master Trader is easy. As noted above, Master Traders on Bybit earn a 10% fee on followers’ returns.

In addition to this main profit source, Master Traders also benefit from their activity indirectly by creating a follower base, a great reputational benefit for any trader.

How to Choose a Master Trader on Bybit

Choosing a good Master Trader (MT) is undoubtedly going to be the key element in your copy trading strategy, particularly if you’re a novice trader. You can copy up to ten Master Traders at the same time. However, the settings for each MT are different and independent. It's worth noting that the performance of both USDT Perpetual Trades and Trading Bots created via Copy Trading will be considered when ranking MTs.

To begin, familiarize yourself with the six categories on the Master Trader page, tailored to different risk appetites:

Top Traders by ROI — Ideal for followers with high-risk tolerance, these Master Traders aim to maximize returns in the short term with bold, high-reward strategies.

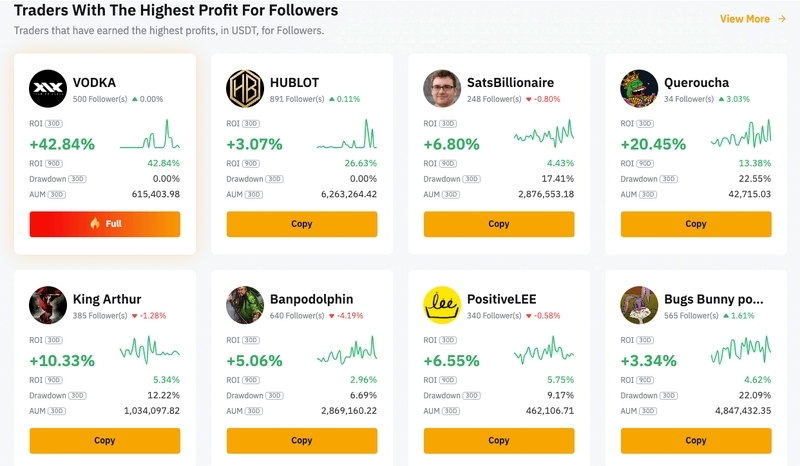

Traders With the Highest Profit for Followers — Perfect for those prioritizing steady, long-term gains, due to their consistently high profitability and strong capital preservation.

Top Intraday Traders — Best suited for followers who thrive on quick market movements and can closely monitor trades, these MTs focus on fast-paced strategies, often executing multiple trades daily.

Lowest Drawdown — Tailed for more conservative traders who seek gradual growth with minimized risk, these traders emphasize capital management and long-term stability.

Top Balanced Traders — An excellent fit for those who seek active but moderate-risk strategies, these MTs balance risk and reward by actively trading every day for 30 consecutive days while achieving a positive ROI.

Top New Talents — Ideal for traders willing to take a calculated risk on promising new Master Traders who have achieved a positive 7-day ROI in less than 30 days.

Grasping these distinctions can help you align your risk appetite with the trading approaches of the top MTs, resulting in a smoother copy trading journey and higher chances of success.

High Risk, High Reward in the Short Term

The Top Traders by ROI category appeals to those seeking significant short-term returns. Master Traders in this group have achieved the highest ROI in the past seven and 90 days, indicating that they may possess excellent trading skills or have made some high-risk, high-reward trades. However, it's essential to recognize that high short-term ROI doesn't necessarily guarantee long-term sustained profitability.

Long-Term Consistent Profitability

If you're looking at long-term consistent profitability, the section entitled Traders With the Highest Profit for Followers showcases Master Traders who have earned the highest profits (in USDT) for their followers and maintained a positive ROI over the past 90 days. Consistent profitability indicates that these MTs could produce reliable profits.

Nevertheless, past performance doesn't guarantee future results, and you should still exercise caution by assessing each Master Trader's abilities and the risks involved.

Fast-Paced Day Trading

The Top Intraday Traders section caters to those interested in day trading. MTs in this group are intraday traders who have achieved an ROI of over 20% and a win rate of more than 50% over the past seven days. Their high returns within a short period — coupled with a higher success rate — suggest that they possess good market insights and quick decision-making abilities suited for intraday trading. Note that the fast-paced nature of day trading comes with inherent volatility, which results in substantial losses if trades don’t move in the anticipated direction.

Enhanced Risk and Capital Management

For more risk-averse traders, the Lowest Drawdown category is ideal. It consists of Master Traders who have achieved an ROI of over 10% and a maximum drawdown of 20% in the past 30 days. These MTs typically demonstrate better risk management strategies and capital management abilities, making them more attractive to conservative traders who prioritize preserving their capital. Nevertheless, it’s still crucial to be aware that, while risks may be mitigated, they aren't fully eliminated, so you may still incur losses.

Balanced Risk and Reward

The Top Balanced Traders category caters to people seeking consistency and balance in risk and return. MTs in this category have actively traded for more than 30 days and achieved a positive 30-day ROI. To verify their consistency, the MT should not have an inactive badge (which is placed on a trader who hasn't opened a position in the Past seven days or traded in the past 14 days). Note that following MTs who demonstrate consistent risk and reward isn’t a foolproof plan as they still face potential losses.

Fresh New Opportunities

Traders in the Top New Talents category are new Master Traders (who might be experienced, but are new on the Copy Trading page). These traders have traded for less than 30 days and achieved a positive 7-day ROI. Calculated risk-takers who are constantly on the hunt for new opportunities will find this category exciting. Naturally, new MTs lack a proven track record, so you’ll need to evaluate each one carefully before choosing an MT from this category.

Tips on Choosing the Best Master Trader for You

While Bybit already helps you filter top traders according to your risk appetite, it’s also important to understand the metrics used to rank the performance of Master Traders in order to make an informed decision when choosing a Master Trader.

It’s not recommended that you simply follow popular MTs with a higher follower count (and even higher cumulative profits) without considering other metrics. This is because an MT's popularity doesn't indicate reliability or guarantee future success. Instead, it’s advisable to balance the popularity indicator with actual performance metrics, as outlined below.

Return on Investment (ROI) — ROI is calculated based on the MT's type of account. The ROI for an MT with a Standard Account is derived from dividing the total profit by the previous account equity plus new deposits. Total Profit is obtained using the following formula:

Total Profit = Current Account Equity − Previous Account Equity − Total Deposits + Total Withdrawals

For an MT with a Unified Trading Account (UTA), ROI is calculated in a similar way, but the Total Profit is determined using a more complex formula:

Total Profit = Realized PnL + Funding Fee Income − Trading Fee + Current Unrealized PnL − Previous Unrealized PnL

ROI Stability — An indicator of how stable the MT's earnings are. A high value means lower stability.

Master's PnL — The real-time Total Profit, including the realized and unrealized profit and loss.

Win Rate — Ratio of trades realizing profit to the total number of closed trades.

Follower's PnL — Reflects the total profit generated by past and current followers, including realized and unrealized profit and loss.

Max. Drawdown (MDD) — The maximum unrealized loss of an MT in the previous month. If this is low, it means that the unrealized loss from the MT's trading strategy have been relatively small.

Profit-to-Loss Ratio — The ratio of average profit per winning order to average loss per losing order over a specified number of days.

Sharpe & Sortino Ratios — The Sharpe ratio measures an MT's profitability while accounting for total earnings volatility risk (both gains and losses). In contrast, the Sortino ratio measures an MT's profitability, focusing on the risk of an earnings downturn (only negative volatility). A higher value in either metric indicates better risk-adjusted returns for the trader.

While these metrics may offer comprehensive details of an MT's performance, the following criteria are more universally understood and effective for evaluating performance at a glance.

ROI

Typically presented as a percentage, ROI indicates an MT's return on an investment. Various factors are considered when calculating the ROI, including the total profit and account equity (wallet balance + unrealized PnL). Unrealized PnL includes positions held in USDT Perpetual trades and Trading Bots. To gauge if a trader has consistent profitability, review their ROI for the past 7, 30 and 90 days.

Win Rates

Win rates reveal an MT's ability to close trades profitably. However, it’s critical to balance win rates with ROI to ensure that an MT’s emphasis on small, frequent wins doesn’t impact their overall profits.

Drawdown Stability

This term refers to the consistency and predictability of a Master Trader's drawdowns over time. In the context of copy trading, it indicates the trader's ability to manage risks in order to prevent erratic or excessively large equity declines. As a follower, especially if you’re risk averse, a lower and stable maximum drawdown (the largest percentage drop from a peak) reflects careful risk management.

Trading Consistency and Trading Activity

A Master Trader's trading consistency and activity are also crucial factors when making a decision on whose trades to copy. Thus, it’s important to focus on an MT's performance over the past 7, 30 and 90 days. Since the crypto market is highly volatile, it’s essential to establish if the MT has consistently sustained profits across changing market conditions.

Key factors to consider include the following.

Trade Frequency: Metrics like average weekly trades or holding times can determine the aggressiveness or conservativeness of a trader's approach.

Volatility Exposure: Consider ROI volatility metrics to assess how stable or risky the MT’s returns are.

How to Become a Master Trader on Bybit

Becoming a Master Trader on Bybit is a form of investing. You not only get to promote your investing strategy, but you can share in the profits earned by your followers for copying your trading strategy.

To become a Master Trader on Bybit, you'll need a Subaccount (either the standard Subaccount, or the Unified Trading Subaccount). Note that the Unified Trading Subaccount only allows Master Traders to conduct USDT Perpetual trading, while you can trade a variety of other products with a standard Subaccount (which your followers won’t copy).

Once you’ve successfully applied, you'll need to complete new Master Trader missions in the mission center. Completing these missions allows you to be featured on the Bybit Copy Trading Recommendation page.

Once you've completed the compulsory missions, you'll enter into Bybit's Master Trader Level System, which is categorized into four tiers: Cadet, Bronze, Silver and Gold. As you gain more followers, you'll be upgraded to the next tier. The higher your level, the greater the perks you unlock.

There's also a Master Trader Level evaluation, which is done once you complete the required tasks and pass a review by Bybit. You'll be rated based on your account balance, 30-day cumulative profit and maximum drawdown in the past seven days.

Conclusion

Copy trading is a great way for novice crypto traders to become profitable from Day One of their trading activities by following an established Master Trader. More experienced followers can also improve their returns and save time by adopting copy trading. For Master Traders, copy trading represents a great avenue for additional profits. Thus, no matter your trading experience or success rate, you can reap significant benefits from copy trading.

#LearnWithBybit