Why Gold Can Hedge Your Crypto Portfolio?

If you're a crypto trader, you've probably felt the pain of watching your portfolio swing 10%, 20%, or even 40% in a matter of weeks.

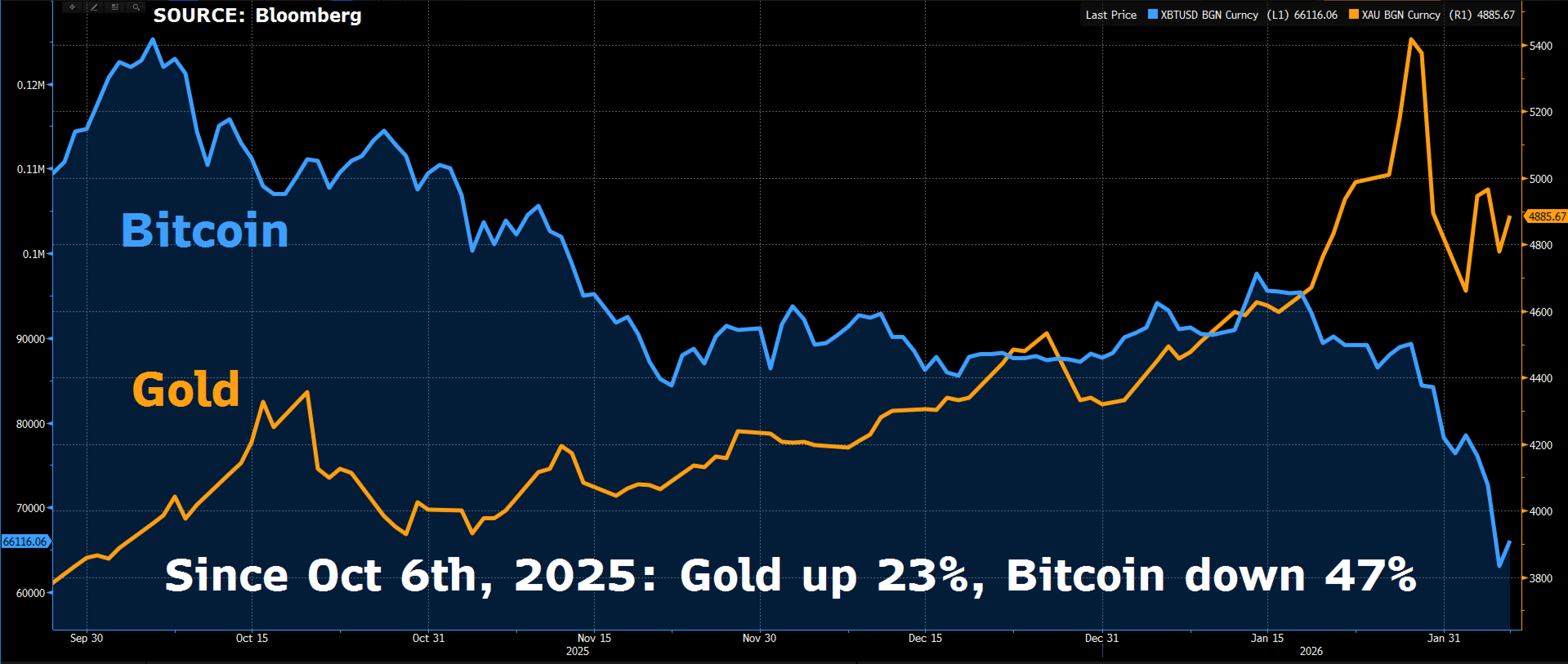

Bitcoin just dropped from over $126,000 in early-October to as low as $60,000 in the first week of February 2026.

That's a brutal haircut of over 50% in four months.

Meanwhile, gold has been on a wild ride of its own, but here's the thing: it doesn't move the same way crypto does, and that's exactly why it matters.

The Problem: Crypto Volatility Can Be Exhausting

Gold has become more volatile than Bitcoin recently, with 30-day volatility climbing above 44%—the highest since the 2008 financial crisis—while Bitcoin sits around 39%.

But here's what most crypto natives miss:

Volatility isn't the same as correlation.

Just because both assets are moving a lot doesn't mean they're moving together.

Economist Mohamed El-Erian pointed out that gold has outperformed Bitcoin over the last five years, and that pattern is playing out again in 2026.

While Bitcoin is down by more than half from its October peak, gold is still up around 13% for the year despite last week's historic selloff on Jan 30th.

The key difference?

Gold has centuries of track record as a safe haven during uncertainty, while Bitcoin is still proving itself.

Why Gold Works as a Crypto Hedge

Gold has virtues that have underpinned its multi-year rally:

- central banks diversifying reserves away from the dollar

- skepticism toward fiat currencies, and

- inflation concerns

When markets panic—like during the recent AI-driven tech selloff—investors rush into gold for safety.

Bitcoin, on the other hand, often gets sold alongside other risk assets when liquidity tightens.

Michael Burry warned that Bitcoin's decline could force institutional investors to unload positions in other assets to cover losses, creating a "collateral death spiral" .

This is exactly why you need assets that don't all crash at the same time.

Gold tends to hold up (or even rally) when crypto is getting crushed, giving your portfolio breathing room.

(data as of February 6th, 2026)

3 Simple Strategies* to Use Gold as a Crypto Hedge

*NOT financial advice. DYOR.

Strategy 1: The 70/30 Split (Beginner-Friendly)

- Step 1: Allocate 70% of your portfolio to crypto (Bitcoin, Ethereum, altcoins)

- Step 2: Put 30% into gold exposure via tokenized gold (like PAXG or XAUT on exchanges) or gold ETFs

- Step 3: Rebalance quarterly—if crypto rips and becomes 85% of your portfolio, sell some and buy more gold. If crypto crashes and becomes 50%, sell gold and buy the crypto dip

Why it works: You stay crypto-heavy for upside but have a cushion when things go south.

Strategy 2: The Volatility Trigger (Intermediate)

- Step 1: Start with your normal 100% crypto allocation

- Step 2: Track Bitcoin's 7-day realized volatility. When it spikes above 60%, immediately move 25-35% of your portfolio into gold. Why 7-day? It catches violent moves in real-time without the big lag—Bitcoin's 7-day vol would have spiked days ago during the recent crash, while 30-day vol is still catching up

- Step 3: Add a confirmation filter (for example, only execute the hedge if Bitcoin's daily RSI drops below 35 at the same time). This ensures you're hedging during actual weakness, not just normal volatility.

- Step 4: Exit the hedge when 7-day volatility drops back below 45% AND daily RSI crosses back above 50—this signals the panic has subsided and momentum is turning positive

- Step 5: Use platforms like Bybit that offer tokenized gold (or stablecoins as a temporary parking spot before buying gold) so you can execute the rotation in under 60 seconds when volatility spikes

Why it works: You're only hedging when markets are actually dangerous, not sitting in gold during bull runs

Strategy 3: The Dual Treasury Approach (Advanced)

- Step 1: Build a "core" position split 50/50 between Bitcoin and gold that you never touch

- Step 2: Use a separate "trading" stack (20-30% of total capital) for altcoins and high-risk plays

- Step 3: When your trading stack doubles, take profits and add to your Bitcoin/gold core

- Step 4: When your trading stack gets cut in half, pull from the gold side of your core to reload (never touch the Bitcoin core)

Why it works: You're building long-term wealth in two uncorrelated assets while still taking shots at 10x gains. Companies like Hamak Gold are literally doing this at the corporate level, and new products like the Bitwise Diaman Bitcoin & Gold ETP make it easy for retail.

The Bottom Line

Gold isn't sexy. It doesn't pump 50% in a week or make you feel like a genius for buying the dip.

But when Bitcoin is down 50% and your portfolio is bleeding, having 20-30% in gold can be the difference between panic-selling at the bottom and having the capital to buy the fear.

The smart money isn't choosing between gold and crypto.

They're using both.

The question is: are you?

.png)

.png)