Cup and Handle Chart Pattern: How To Use It in Crypto Trading

The cup and handle indicator is a technical pattern found on crypto price charts. It indicates the correction of a previous uptrend and eventually signals its resumption. The pattern exhibits clearly defined entry and risk levels but can be difficult to interpret in crypto markets due to fragmented volume metrics.

This trading guide explains the importance of the patterns and how you can formulate a strategic trading style to make the best out of it. We’ll be discussing the ins and outs of the indicator and to help you understand some of the limitations.

What Is a Cup and Handle Pattern?

A cup and handle pattern is a consolidation chart pattern signaling bullish in which prices correct a portion of a previous uptrend, then rebound back toward the previous high, forming the “cup.” Prices then trade sideways, creating the “handle” which, when completed, signals a breakout to new highs.

The pattern was popularized by William O’Neil in his 1988 book, How to Make Money in Stocks. I learned to trade stocks 20 years ago using his methods, including the cup and handle pattern. This pattern is found a lot in the stock market and is beginning to appear frequently within the crypto market.

The cup and handle pattern can be found within a variety of time frames, from hourly, weekly to monthly charts. However, it is more powerful on daily chart time frames. There are a couple of variations of the pattern, but they all have a similar look.

Characteristics of the Cup and Handle Pattern

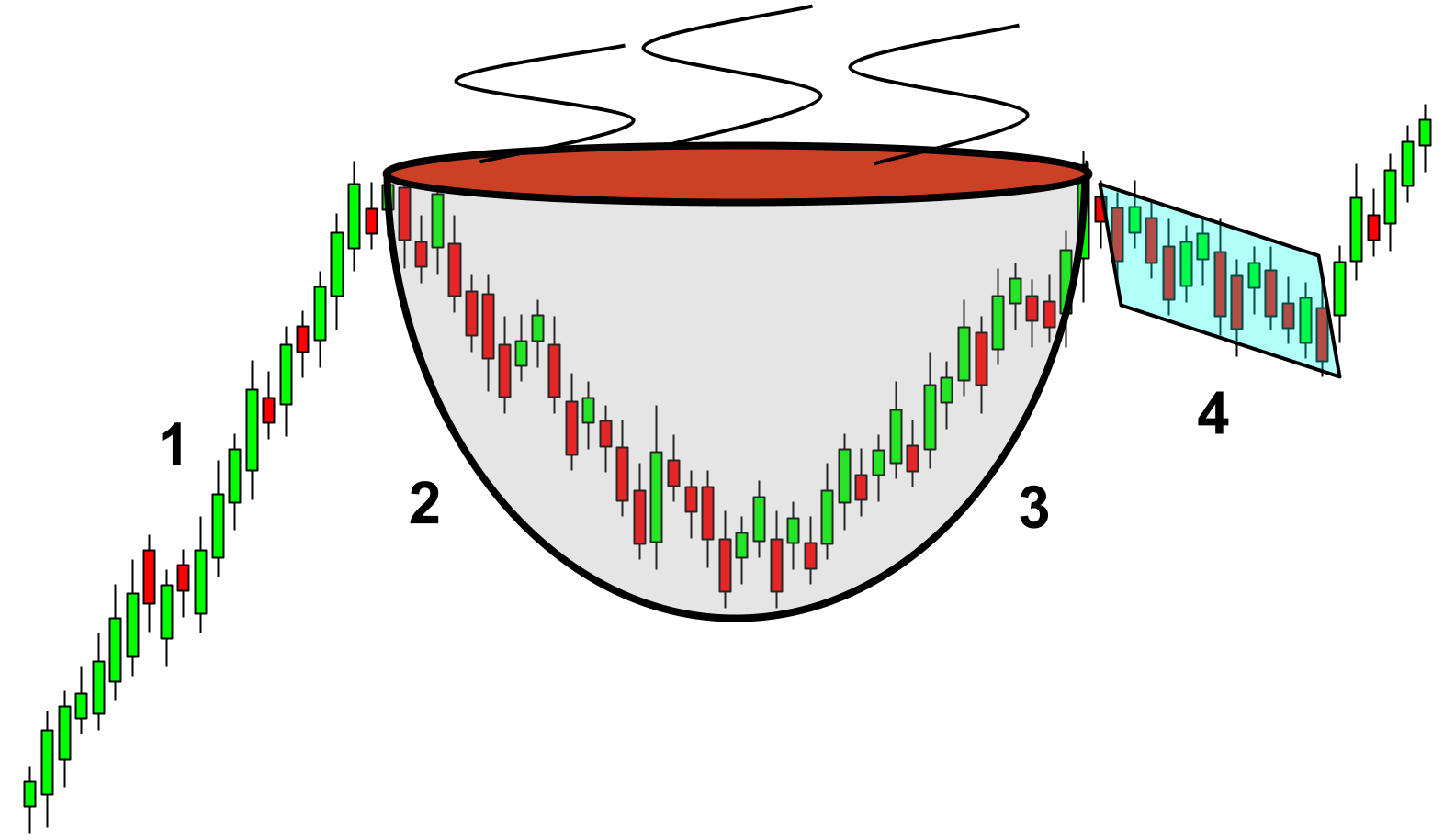

The cup and handle pattern appears after a big rally where the market needs to pause and catch its breath. The pattern consists of five key components, which then lead to a breakout higher.

The first four components help shape the structure for the pattern’s name because they form the outline of a cup with a handle.

- Strong uptrend to set up the potential pattern

- Retracement of the previous rally

- Rebound rally back up near the previous high

- Drift sideways in pricing with a slant to the downside

- 5. Volume needs to increase on the rally of #3, but drift lower in #4 (more on this later)

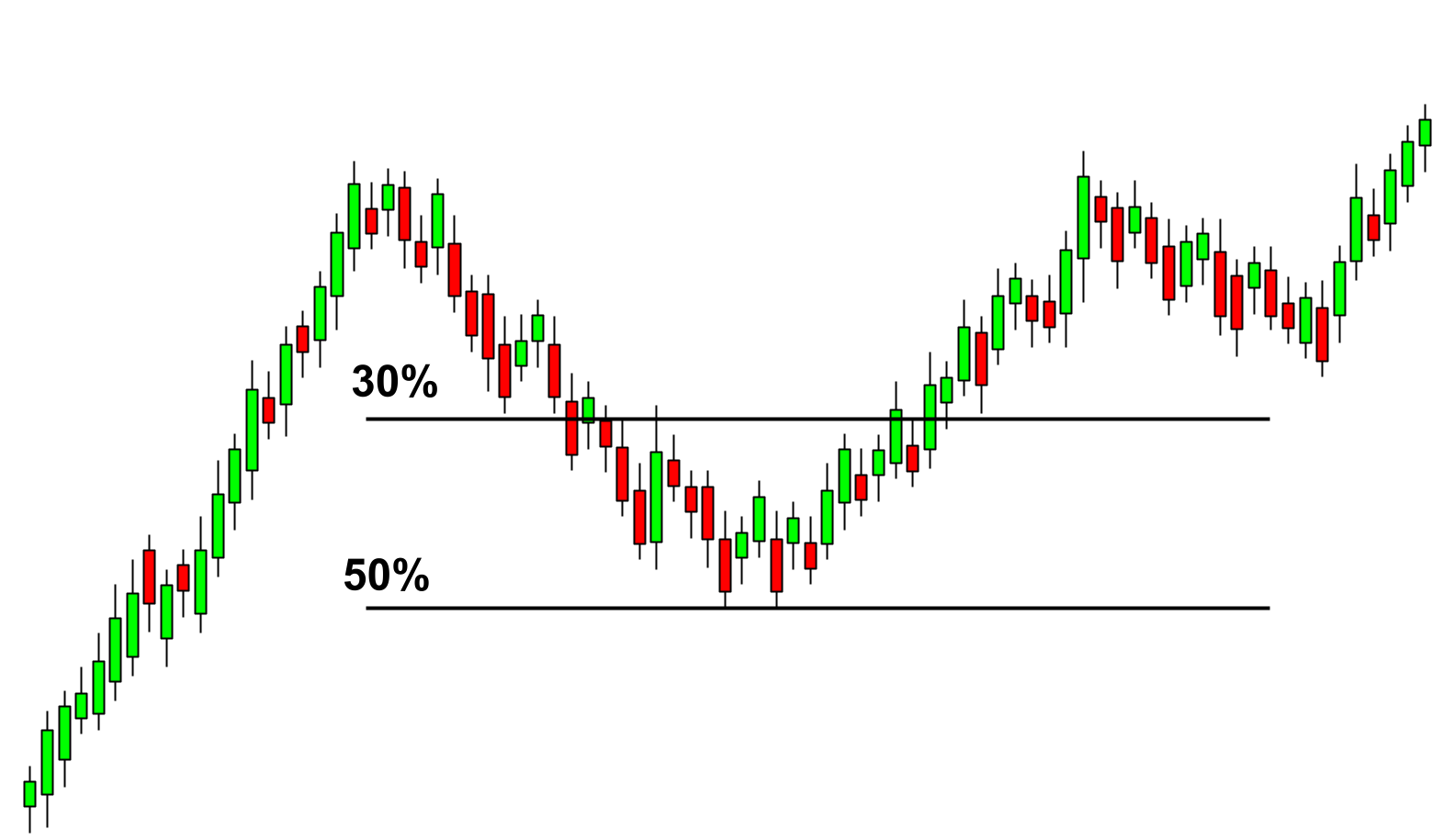

After a big uptrend in price (#1), the market begins to correct lower (#2), shaping the first half of the cup. The dip in #2 generally retraces about 30–50% of the length of the previous uptrend. However, there are instances where a deeper correction may take hold. Once a bottom is formed, prices will begin to rally (#3). This rally pauses within 10% of the previous high. At this point, the cup portion of the pattern has been created.

Now that prices are near their old high, bullish traders stop buying and wait to see if a breakout takes place. Traders who bought near the old high are thankful and nervous at the same time. They are thankful that prices have rebounded back to the old high, but nervous about another selloff. They are considered weak hands. Hence, selling the asset gradually, creating the handle (#4).

However, the total volume begins to decrease as the market is running out of sellers. The price trend is from sideways to slightly lower, and it carves the handle of the pattern.

In the end, the pattern takes the shape of a coffee cup with a handle on the right side.

The pattern is confirmed when prices break above the high of the handle as the previous uptrend continues.

The cup and handle pattern cannot exist without a prior uptrend. As a result, the pattern is found frequently within the crypto market.

Types of Patterns

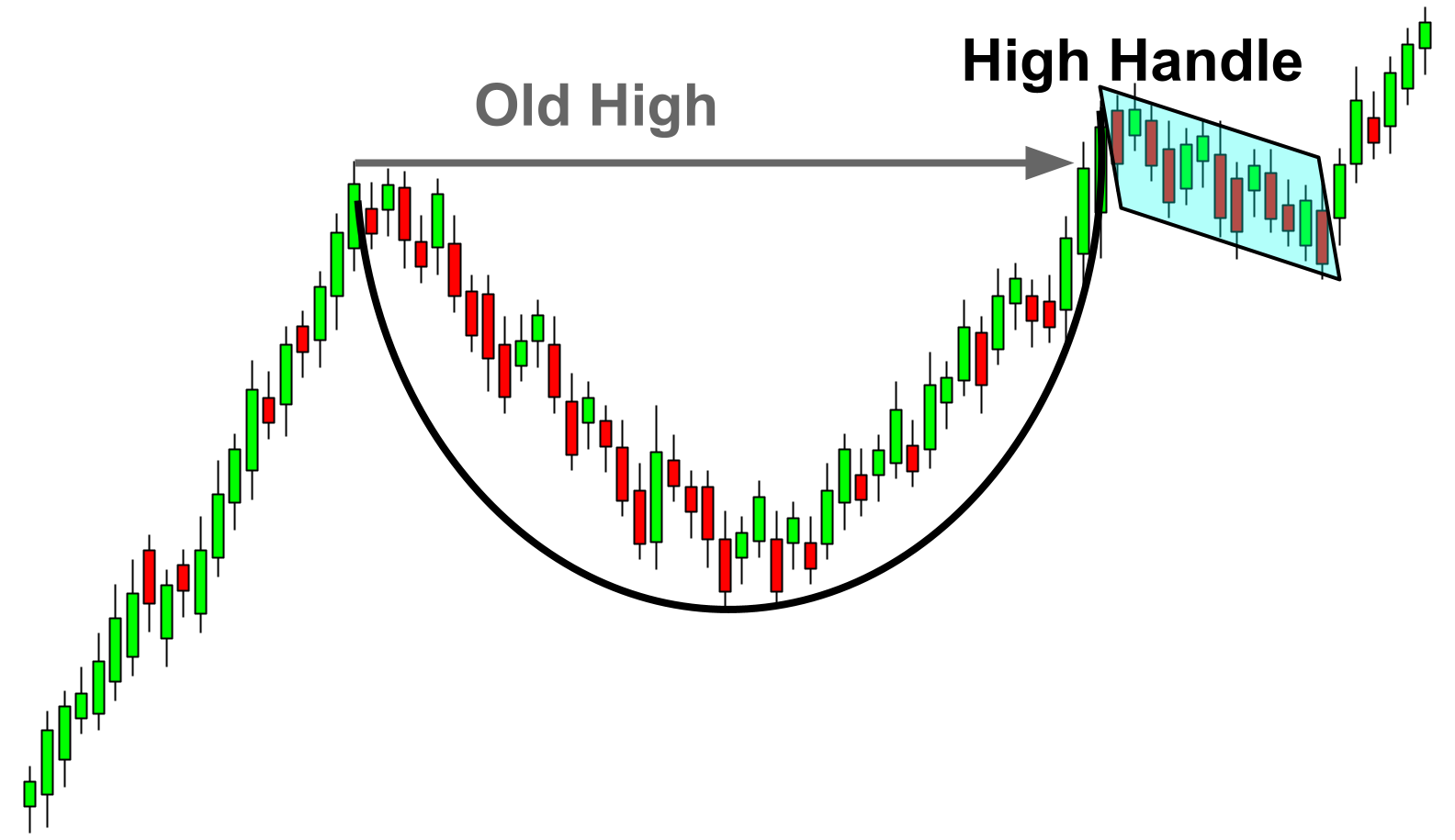

There are a couple of variations to this pattern that crypto traders need to be aware of. First, there are times when the handle portion of the pattern develops above the old high. This is considered the “high handle.” Secondly, since the market is fractal, these patterns will form on a variety of charting time frames, including intraday charts.

Cup and High Handle

One of the characteristics of the cup and handle pattern is that the handle must form within 10% of the old high. There are times when the market is extremely bullish and the handle pushes slightly above the old high but remains within 10% of it. These situations are considered to have a high handle.

In the above example, we see a cup with a high handle. The handle forms above the old high, rather than below. The result of the pattern remains the same where it is a minor breakout higher, but then prices trade sideways on declining volume to form the handle. The pattern is confirmed when the market breaks above the highest price of the handle.

Intraday Cup and Handle

When William O’Neil first identified the cup and handle pattern, the focus was on daily chart time frames. Now that charting software has made access to intraday charts easier, variations of this pattern have emerged such that it can be found within intraday chart time frames.

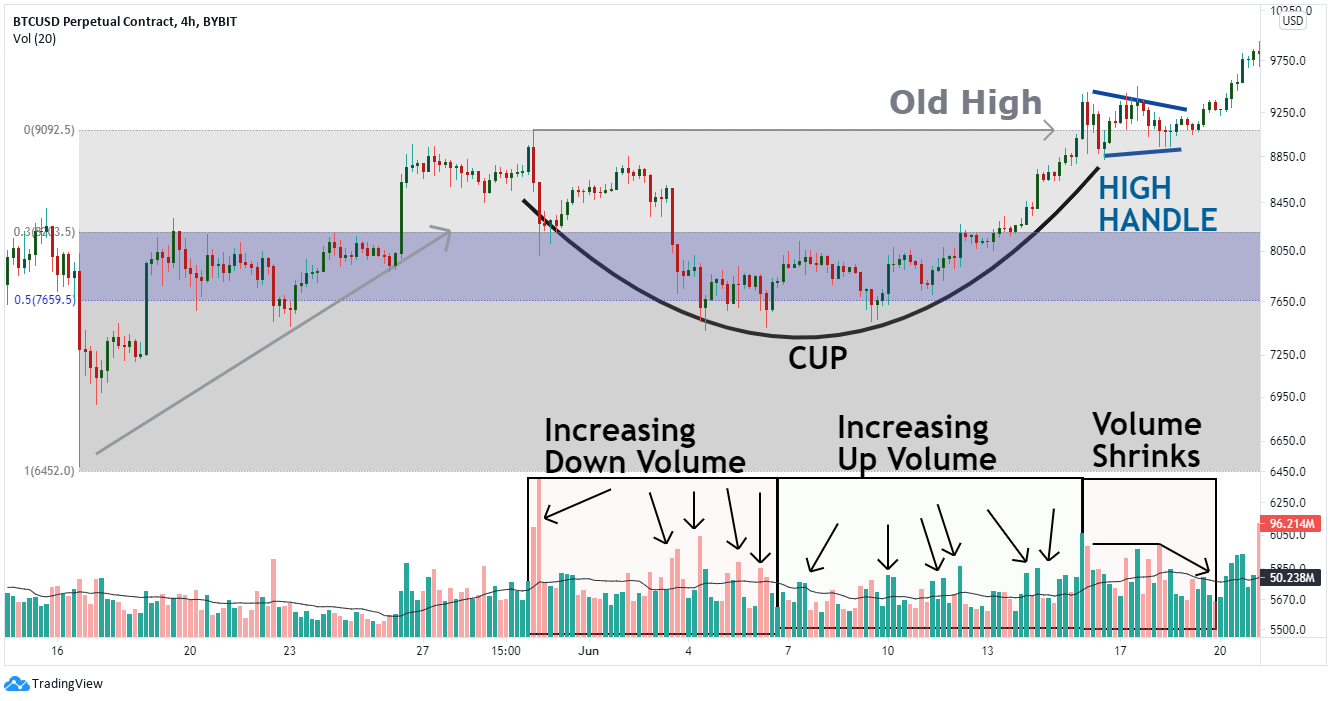

The intraday pattern operates similarly but concludes more quickly. In the Bitcoin example above, we are using a 4-hour chart. All of the necessary ingredients are present, including the volume spikes. During the retracement portion, you want to see increasing down in volume. On the rally portion of the cup, you want to see increasing volume. Then, during the formation of the handle, trading volume will ideally shrink as both buyers and sellers are shaken out.

The Bitcoin chart above also illustrates a high handle, which we discussed in the previous section. After the successful cup and handle portion of the chart, Bitcoin breaks out and accelerates higher.

Inverted Cup and Handle Pattern

The inverted cup is the reversal pattern indicating a momentum sell short signal signaling a bearish continuation pattern. The chart patterns happen within a span of three to six months and volume plays a role in the completion of the pattern and the confirmation of the breakout from an uptrend. At the same time, the inverted cup top is formed when there are more sellers bidding for the price to go down. When it happens, it indicates the end of the bull markets.

The inverted handle pattern forms when the asset emerges out and begins to fall from the right side of an inverted cup. However, a true inverted handle happens when it fails to break down and finally meets the support level and attempts to break to a newer low.

To spot a true inverted cup and handle pattern, the shape needs to be obvious and the trend line needs to curve up and then down like an upside-down cup. When this reversal pattern happens, it tells you that it is not a good probability to trade if pullback or correction is not on the way.

How To Identify the Cup and Handle Pattern

The cup and handle pattern starts with an uptrend, followed by a 30–50% correction. Use the Fibonacci retracement tool to measure out the previous uptrend, then look for the correction to retrace near the 30–50% zone.

After the market has retracted into the 30–50% zone, look for a rally to begin pressing prices back toward the old high.

As prices approach the old high, a failed breakout traps both recent buyers and buyers at the bottom of the base. Recent buyers see their small floating gain evaporate, and buyers at the bottom of the base fear a double top reversal.

Both sets of buyers exit the market; as a result of this entrapment, these buyers are nervous and slowly sell out, creating the handle of the pattern.

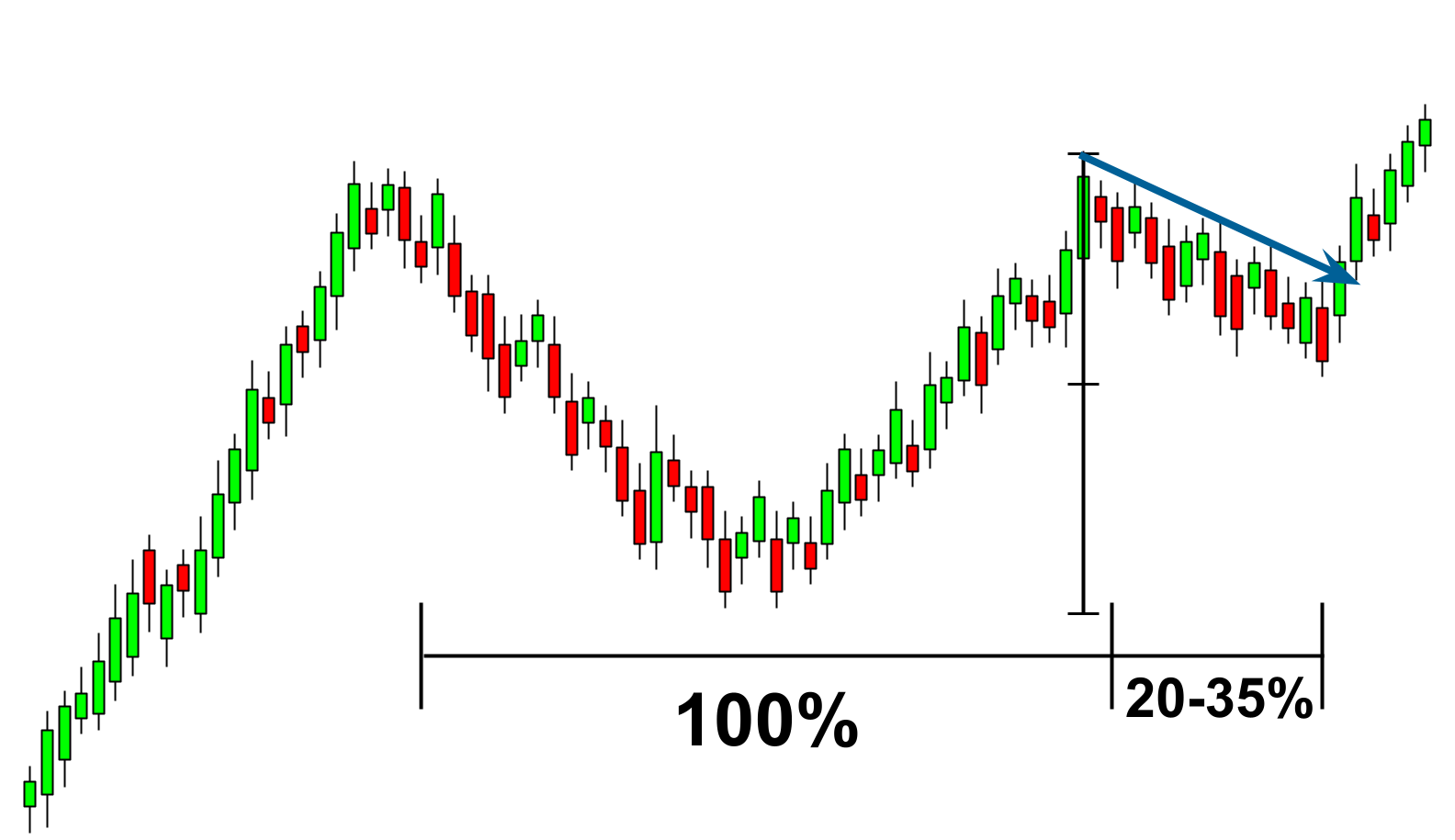

The handle must form in less time than it takes to form the cup. On most occasions, the handle will form in about 1/5 to 1/3 of the time required to form the cup.

Additionally, the handle needs to stay in the upper half of the cup and not drop into the lower half of the cup’s price range. For example, if the cup forms between a price range of $1.0 to $2.0, then the handle needs to form within $1.50 to $2.0. If the handle pushes too low, then it will be ineffective at trapping short sellers.

An effective handle will drift lower, rather than trend lower. This sows doubt among short-sellers, who become nervous about the failed trend to the downside. As a result, they close out their positions, which adds a little buying pressure to the market, popping the price a little.

Then, new buyers enter the market as they see the technical setup complete, pushing the market above prior highs. This adds even more strength to the bullish trend.

How To Use the Cup and Handle Pattern

The cup and handle pattern is an effective combination to flush out weak holders.

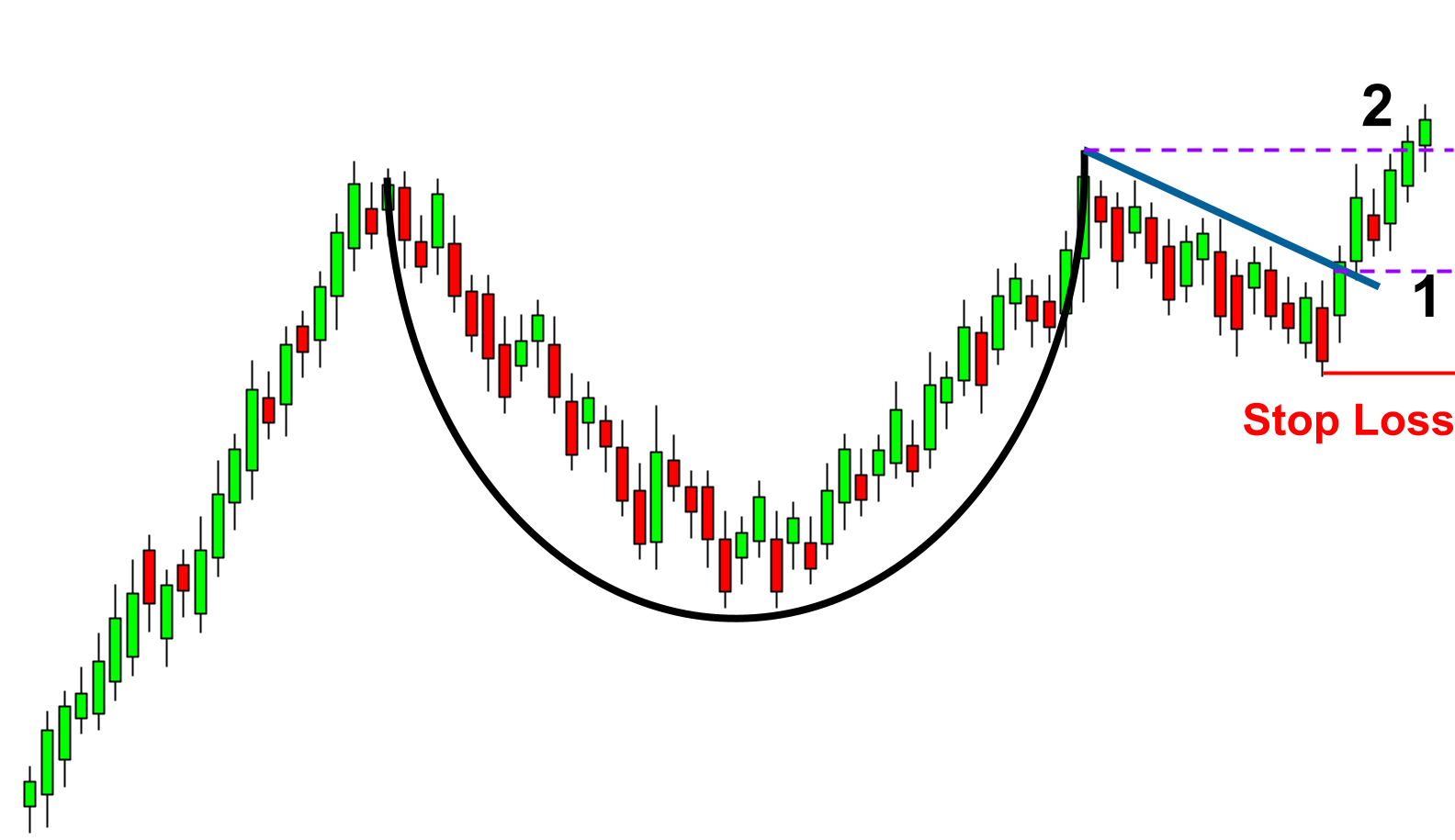

To trade the cup and handle pattern, wait for technical levels of resistance to break. There are two areas where traders can buy the resistance break.

First, draw a resistance trend line encompassing the high prices of the handle. A break at the resistance trend line is your signal to buy. The second opportunity to buy is a break above the high of the handle. Waiting for a break above the handle’s high is a more conservative approach, as you are seeking confirmation from the market that the price is hitting new highs.

The risk and stop loss on the trade will be set at the low of the handle. This way, if the breakout fails and falls back below the handle’s low, then you can close out the trade at a small loss and move on to the next opportunity.

If the breakout is successful, then you can consider moving your stop loss to the breakeven level, locking in the trade without experiencing a loss.

The target for the cup and handle pattern is fairly simple. Measure the distance from the cup high to the cup low and project that same distance beginning at the handle’s low point. So long as the handle remains in the upper half of the cup, this level of price projection leads to an attractive risk-to-reward ratio on the trade.

Case Examples

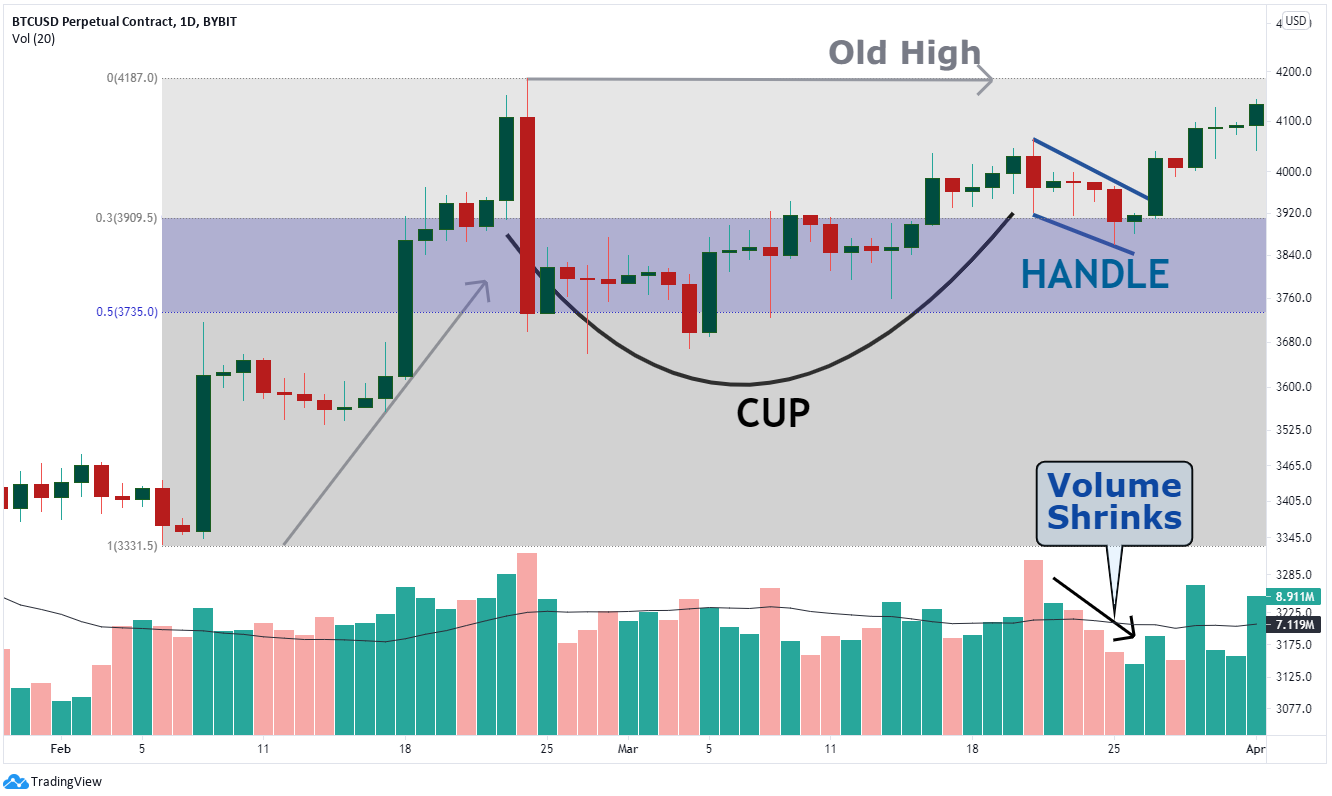

Here is an example of the cup and handle pattern in a Bitcoin chart from 2019.

After rallying 25%, the market corrected lower approximately 50% on increasing bearish volume. Then, the market rallied to come within 3% of the previous high.

At that point, the cup of the pattern was completed and the handle was about to begin. The handle drifted lower on decreasing trading volume. The pricing of the handle remained within the upper portion of the cup, so all of the necessary ingredients were present for a bullish breakout.

Once the handle was finished, Bitcoin rallied higher on increasing volume, which led to new highs.

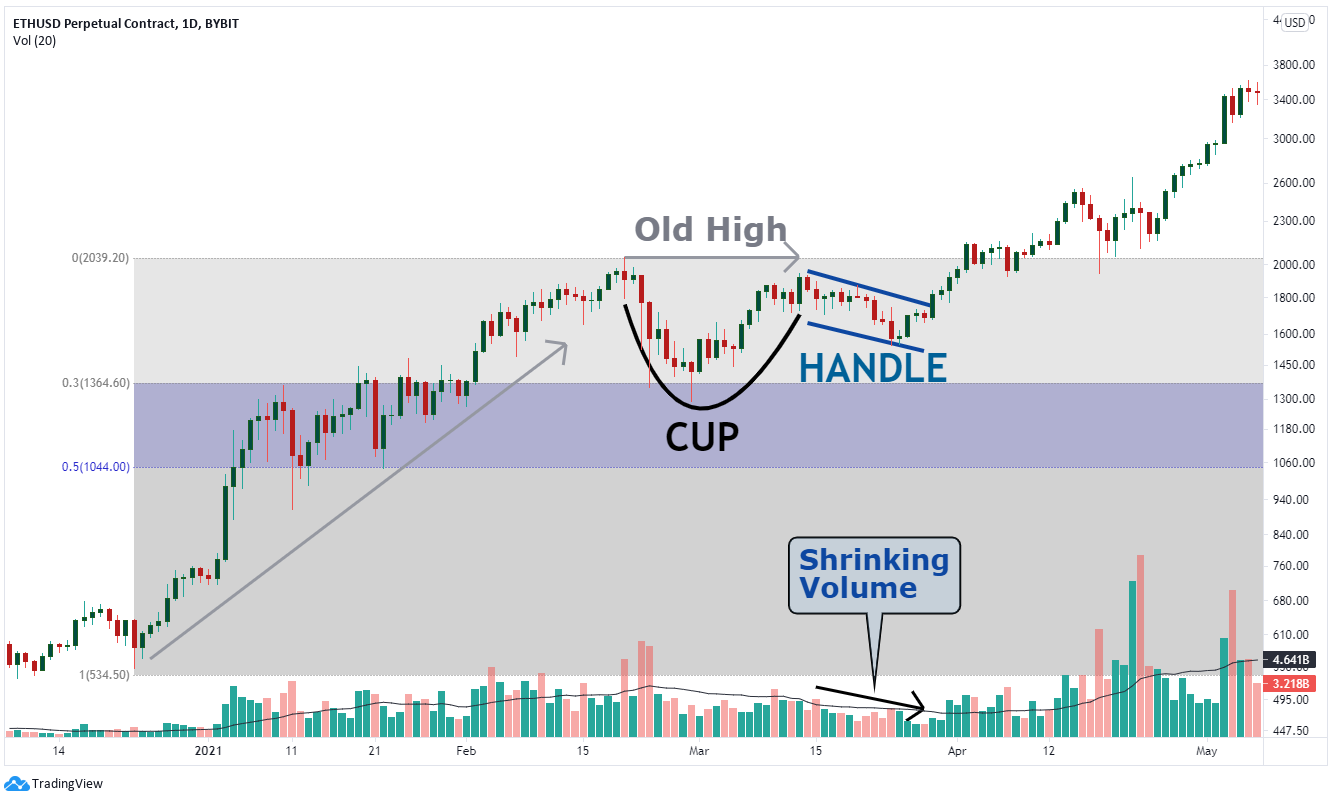

Below is another chart, a cup and handle example for Ethereum.

After rallying 300% to begin 2021, Ethereum began consolidating the uptrend to form the cup. The cup was relatively shallow, at nearly 30% of the previous uptrend. After correcting, the price rallied back to near the old high to finalize the cup.

As the handle began to develop, its slight downward slope, coupled with decreasing trading volume, was a big clue that this may be a minor consolidation. This was a relatively long handle, but once it had finished, Ethereum rallied on increasing volume.

Indicators To Identify the Cup and Handle Pattern

Aside from having a clearly defined pattern with specific entry and exit parameters, this chart pattern is a favorite among traders because it is simple to identify. There aren’t a lot of fancy indicators or technical tools needed to spot the pattern.

There are only four technical indicators needed to help you identify the pattern:

- Support and resistance

- Trading volume

- Moving average on the trading volume

- Trend lines

As you know by now, the pattern consists of two parts, the cup plus the handle. The pattern cannot be anticipated until nearly all of the cup is completed and the price is near the old high.

As a result, the trader will need to highlight the old high with a horizontal resistance line. Additionally, as the right side of the cup is created, we need to observe several bullish candles on rising trade volume. An easy way to figure this out is to place a 50-period moving average on top of the volume.

This moving average indicates the average volume for the last 50 periods. You want to see several bullish candles with volume above the 50-period moving average, while most of the bearish candles remain below the moving average. If a large bullish and bearish volume candle are next to each other, you want to see the bullish candle display a higher volume than the bearish candle.

Once the cup is completed, the handle will begin to develop. The handle will be marked by sloping trend lines. These trend lines should have a slight downward slant to them. The important trend line is the resistance trend line, which is the top line. If prices break above resistance on rising volume, then the market will likely continue its trend higher.

Limitations of the Cup and Handle Pattern

Like any form of pattern and technical analysis, there are times when this predictor works well and other times when the forecast does not work out. There are situations when the reliability of the cup and handle pattern is diminished.

Check the Broad Market Trend

The cup and handle pattern is the result of a bullish breakout. When the broad market is in a bullish trend, that makes the breakout a higher probability move. However, if the broad market is in a bearish trend, then a bullish breakout is less likely to occur.

Bitcoin and Ethereum are the two largest cryptocurrencies, commanding approximately 60% of crypto’s total market capitalization. If both Bitcoin and Ethereum are in an uptrend, then the chance of a bullish breakout is higher. If both Bitcoin and Ethereum are in a downtrend, then a bullish breakout has a smaller chance of occurring.

Apply the Cup and Handle Pattern to Large and Growing Cryptocurrencies

A major limitation to the cup and handle pattern is evidenced when applying it to small cryptocurrencies that do not have a large following. The cup and handle pattern works best with cryptocurrencies that are growing their following. The more buying and selling interest that exists, the better the gauge of the pull between buyers and sellers.

Overall Volume Makes a Difference but It May Be Difficult to Obtain

The trading volume of a crypto asset makes a difference in determining a cup and handle pattern. However, crypto trading takes place on many different exchanges — and even off the exchange. Therefore, arriving at an accurate volume figure is extremely difficult.

The Bottom Line

The cup and handle pattern has been around for over 30 years and is widely followed by many technical traders. Though limitations of the pattern are not to be ignored, the strong trends in crypto help make the cup and handle pattern effective in trading crypto markets.

Candlestick Patterns Professional Traders Use

Best candlestick patterns – A curated list of candlestick patterns most frequently used by traders

How To Read Candlesticks Crypto – Learn the basics of candlestick patterns

Crypto Chart Patterns (Chart basics: trend, neckline, wedges)

Doji Candlestick – Basic candlestick unit

Bullish candlestick patterns

- Inverted Hammer Candlestick

- Bullish Engulfing Candlestick

- Morning Star Pattern

- Three White Soldiers Pattern

- Hammer Candlestick

- Triple Top Pattern and Triple Bottom Pattern

- Falling Wedge Pattern

- Dragonfly Doji Candlestick

Bearish candlestick patterns

- Bear Flag Patterns

- Gravestone Doji Candlestick

- Head and Shoulders Pattern

- Dark Cloud Cover Pattern

- Shooting Star Candlestick

- Rising Wedge Pattern

- Hanging Man Candlestick

- Bear Pennant Pattern

- Evening Star Pattern

- Triple Top Pattern and Triple Bottom Pattern

Other candlestick patterns

- Harami Candlestick – Has both bullish and bearish candlestick

- Hammer Candlestick – Has both bullish and bearish candlestick

- Double Top and Double Bottom – Has both bullish and bearish candlestick

- Spinning Top Candle – Has both bullish and bearish candlestick

- Marubozu Candlestick Pattern – Has both bullish and bearish candlestick

- Tweezer Bottom Pattern – Has both bullish and bearish candlestick

- Continuation Patterns – Determining a continuing trend

.png)