Bybit VIP Fees Explained (Updated 2024)

Anyone who trades crypto actively understands that expensive trading fees can redefine a successful trade. Fortunately, with the newly revised Bybit fee structure, traders can increase their net profits in these trading sessions with lesser burdens from these transaction fees.

In this guide, we'll highlight the key differences between the normal trading fees on Bybit and the VIP trading fees, the calculation, and how you can activate the VIP trading program.

Key Takeaways:

VIP traders can enjoy competitive maker-and-taker trading fees and maximize their net profits on each trade regardless of the trading volume.

VIP traders can also unlock higher withdrawal limits, rebates, and access to exclusive events.

All Spot, Contract, and Options trading fee structures are revised to optimize their expenses spent on trading fees.

Understanding Bybit Trading Fees Structure

Crypto trading fees refer to transaction costs charged when a trader places an order on a crypto exchange. These exchanges generate revenue based on the volumes traded. The higher the trading volume, the more fees will be generated. These fees include deposit and withdrawal fees, funding fees, margin and leverage costs, trading fees, and even bid-ask spread costs. Exchange fees usually vary from 0.1% to 1% or more per transaction. But they varied from one exchange to another.

Here's an overview of the differences between market and taker fees.

Maker Fees vs. Taker Fees

Maker fees refer to a limit order that was made but not executed, and they sit on the order book until the order is matched. Whenever traders add liquidity to the order book, they will be charged a maker fee to encourage users to add liquidity to the exchange.

Typically, the orders are placed like this:

Buy order to be placed at a lower price than the lowest sell order

Sell order to be placed at a higher price than the highest buy order

However, suppose the market has surplus liquidity providers (makers) with no execution trades. In that case, it will be considered a thin market.

Taker fees refer to a market order executed immediately on the order book. Whenever a taker takes the liquidity from the order book, they will be charged a taker fee. These orders are typically fulfilled immediately, and the orders should look like this:

Buy order to be placed at the lowest sell order (best ask price) to be matched instantly

Sell order to be placed at the highest buy order (best bid price) to be matched instantly

Bybit Fees vs. VIP Trading Fees: The Differences

Before diving into the fee differences when considering VIP Trading Program membership, it's essential first to understand the maker-taker fee model. Maker-taker fees are trading fees that users are charged based on their maker or taker role in the transaction. Makers provide liquidity to the exchange, whereas takers remove liquidity from an exchange. That's why taker fees tend to be high on some exchanges.

Bybit's cost-effective fee structure can be broken down into spot trading fees and futures and derivatives trading fees.

Bybit VIP Program Fee Structure

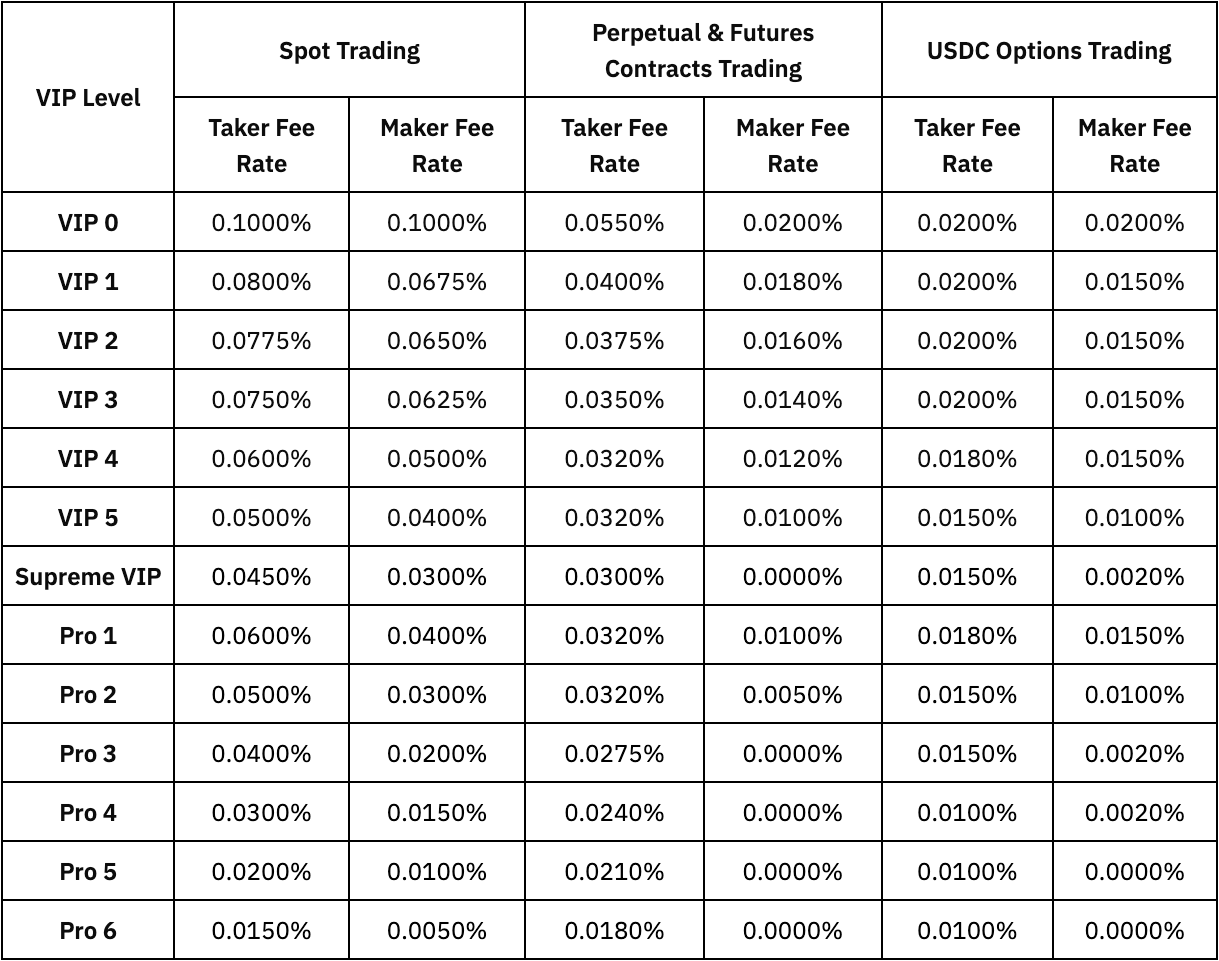

Bybit VIPs get to enjoy a range of benefits that enhances the trading experience on Bybit. One of the main benefits is the discount on trading fees for trading spot, perpetuals, futures, options and fiat-to-crypto pairs.

For more on fees that VIP Trading Program members get to enjoy, refer to the breakdown below:

VIP Crypto Trading Fee Structure

Futures and derivatives trading refers to the buying and selling of agreement contracts for the future price of cryptocurrencies. Examples of such contracts include USDT Perpetual and USDC Perpetual contracts that use USDT and USDC as collateral and have no expiration date, Inverse Perpetual contracts that use the desired crypto as collateral and have no expiration date and Inverse Futures contracts that use the desired crypto as collateral and have pre-determined expiration dates.

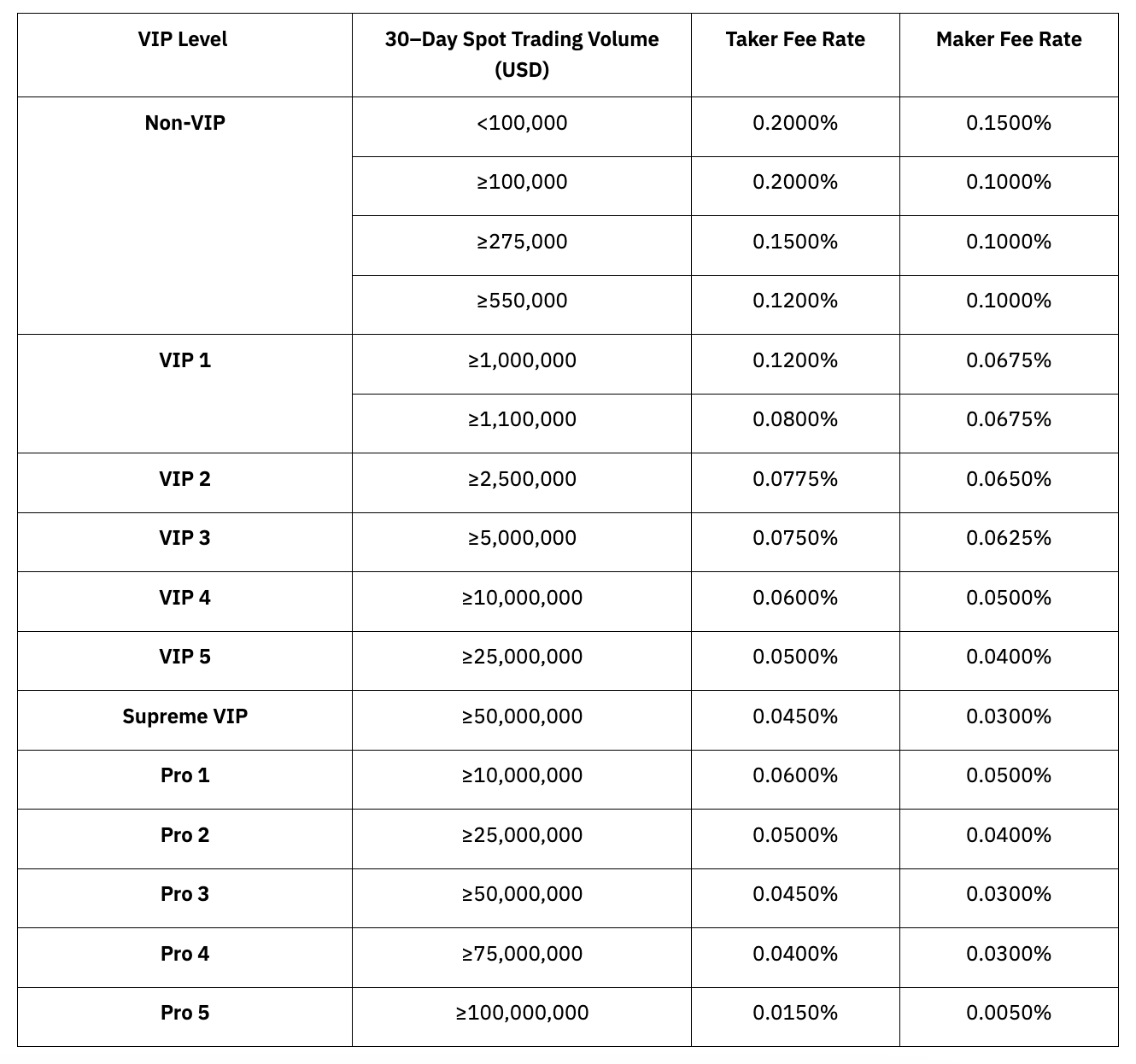

VIP Fiat Trading Fee Structure

Besides discount on trading crypto trading pairs (e.g. BTCUSDT), VIPs also get to enjoy lower fees for Fiat-Crypto Trading Pairs (e.g. USDT/EUR).

The fee discount tier depends on a user's 30-day spot trading volume or VIP and PRO level, whichever is higher.

Bybit VIP Withdrawal Limits

Did you know that being a Bybit VIP Program member also entitles you to high withdrawal limits?

With an individual level 2 KYC verification, you’re able to withdraw up to 2M USDT daily and have no capped withdrawal amount on monthly withdrawal, so it makes moving funds in and out of Bybit without fuss.

When Can I Start Enjoying the VIP Perks?

Once you qualify for the Bybit VIP Program by meeting the minimum asset balance or monthly trading volume criteria, you’ll be able to enjoy the VIP perks once your VIP level is updated. This platform-wide update will be held every day at 7 AM UTC and your new trading fee rates will be reflected within five minutes of this update.

Are Institutional Clients Eligible for the VIP Program?

As an institutional client, you’re entitled to special rates as part of Bybit’s Institutional Services on top of diversified data reports and OTC lending. As such, the benefits of the VIP Program do not apply for institutional clients.

The Bottom Line

Given our attractive VIP Program trading fees, you’re certainly missing out by not being a member. So what else are you waiting for? Sign up for Bybit’s VIP Program membership today and secure those low fees so you can maximize your returns.

#LearnWithBybit