Understanding VIP Crypto Loans: A Comprehensive Guide to Bybit

Bybit’s VIP program is an exclusive service designed for high-net-worth traders and institutional clients. The program provides tailored features and benefits to enhance the trading experience on Bybit.

A standout feature is Bybit’s VIP Crypto Loans, which allow clients to borrow significant cryptocurrency amounts without selling existing holdings by using digital assets as collateral. VIP Crypto Loans offer personalized interest rates, flexible repayment options and high borrowing limits.

Key Takeaways:

Bybit’s VIP Crypto Loans feature higher borrowing limits that offer access to larger loans without manual reviews.

Flexible repayment options include early repayment and auto-rollover.

Tailored support enables you to receive personalized loan terms and priority customer assistance.

What Is the Bybit VIP Program?

Bybit’s VIP program caters to high-volume traders and institutional clients, offering tier-based benefits tied to trading volume and asset balances. VIPs enjoy reduced fees, zero maker fees at certain levels and exclusive invites to events.

Key Benefits

Reduced Trading Fees: Competitive taker and maker fees based on VIP level.

Priority Support: Access to dedicated ambassadors and live chat for VIP Level 2 and higher.

Enhanced Limits: Higher API, withdrawal and borrowing thresholds.

What Are Bybit VIP Crypto Loans?

Bybit VIP Crypto Loans offer a seamless borrowing solution tailored to the needs of elite traders and institutions. These loans allow users to leverage existing crypto holdings for high-value loans, enabling them to seize trading opportunities without risk of liquidation.

Example A VIP 3 with 1 BTC as collateral can borrow up to 0.65 BTC (65% LTV). Loan terms include 7, 14 or 30 days, with annual interest rates tailored to the user’s VIP level.

Key Features

Tailored Interest Rates: Competitive rates, such as 10.76% annualized for flexible loans (as shown above).

Higher Borrowing Limits: For example, VIP 5 users can access up to $2 million in loans.

Streamlined Process: No manual reviews for VIPs, thus enabling immediate access to funds.

Flexible Loan Terms: Choose from 7-, 14- or 30-day terms to align with your investment strategy.

Bybit VIP Crypto Loans simplify the borrowing process, enabling VIPs to seize market opportunities swiftly and effectively while managing their portfolios efficiently.

Benefits and Features of Bybit VIP Crypto Loans

Bybit’s VIP Crypto Loans are distinguished by their advanced features, competitive rates and high level of flexibility.

Key Benefits

Competitive Interest Rates: Tailored interest rates based on VIP tier levels provide significant cost savings. For example, a VIP 5 enjoys much lower rates compared to those for a standard user.

Personalized Borrowing Limits: VIPs benefit from enhanced borrowing limits. For instance, VIP 3 users can borrow up to $2 million in crypto, while Supreme VIPs enjoy even higher thresholds to accommodate larger trading needs.

Flexible Loan Terms: Borrowers can choose between flexible 7-, 14- or 30-day terms, with customizable loan durations and interest rates to align with their investment strategies.

Upgraded Features

Higher Borrowing Limits: The VIP program now allows users to access larger loan amounts, empowering them to execute high-value trades and efficiently manage liquidity.

Streamlined Borrowing Process: Unlike standard loans that may require manual reviews, Bybit VIP Crypto Loans are automatically approved within borrowing limits, ensuring rapid access to funds as market opportunities arise.

Additional Perks

Multi-Collateral Support: VIP users can utilize a wide range of crypto assets as collateral, such as BTC, ETH and USDT.

Integration Across Bybit Services: Borrowed funds can seamlessly be used for spot and derivatives trading, or staking in Bybit Earn products.

How to Check Maximum Borrowing Amount and Interest Rates for VIP Loans

Bybit makes it simple for VIP users to explore borrowing limits and interest rates. Follow the steps below for accurate navigation.

Step-by-Step Guide

1. Log In to Your Account

Access the Bybit platform and log in with your credentials. Ensure you’re eligible for VIP services.

2. Navigate to the Crypto Loans Section

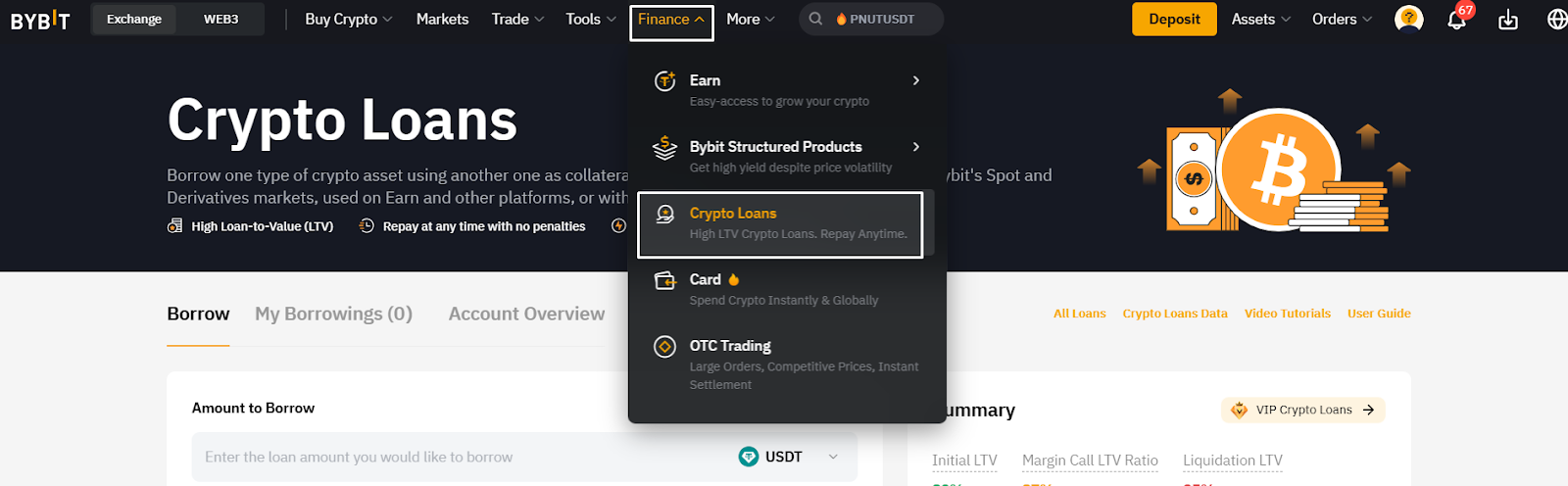

- Hover over the Finance tab at the top of the page.

From the drop-down menu, click on Crypto Loans (highlighted in the screenshot). This will take you to the loan dashboard.

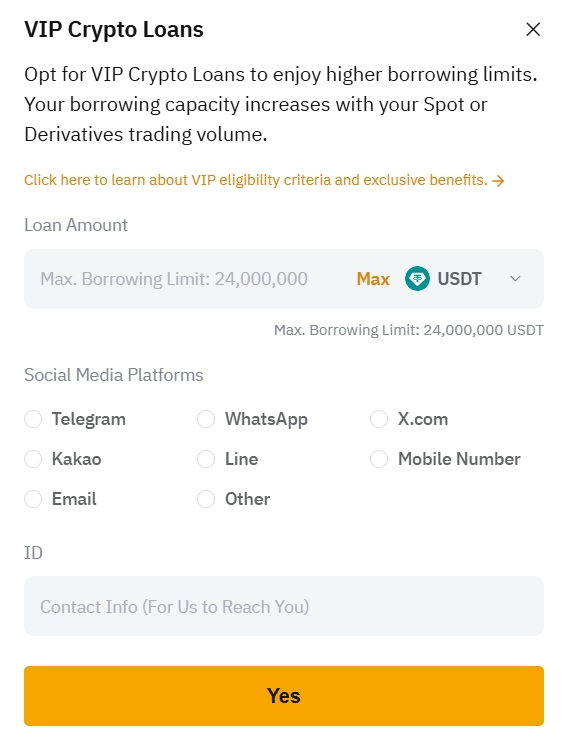

3. Select VIP Crypto Loans

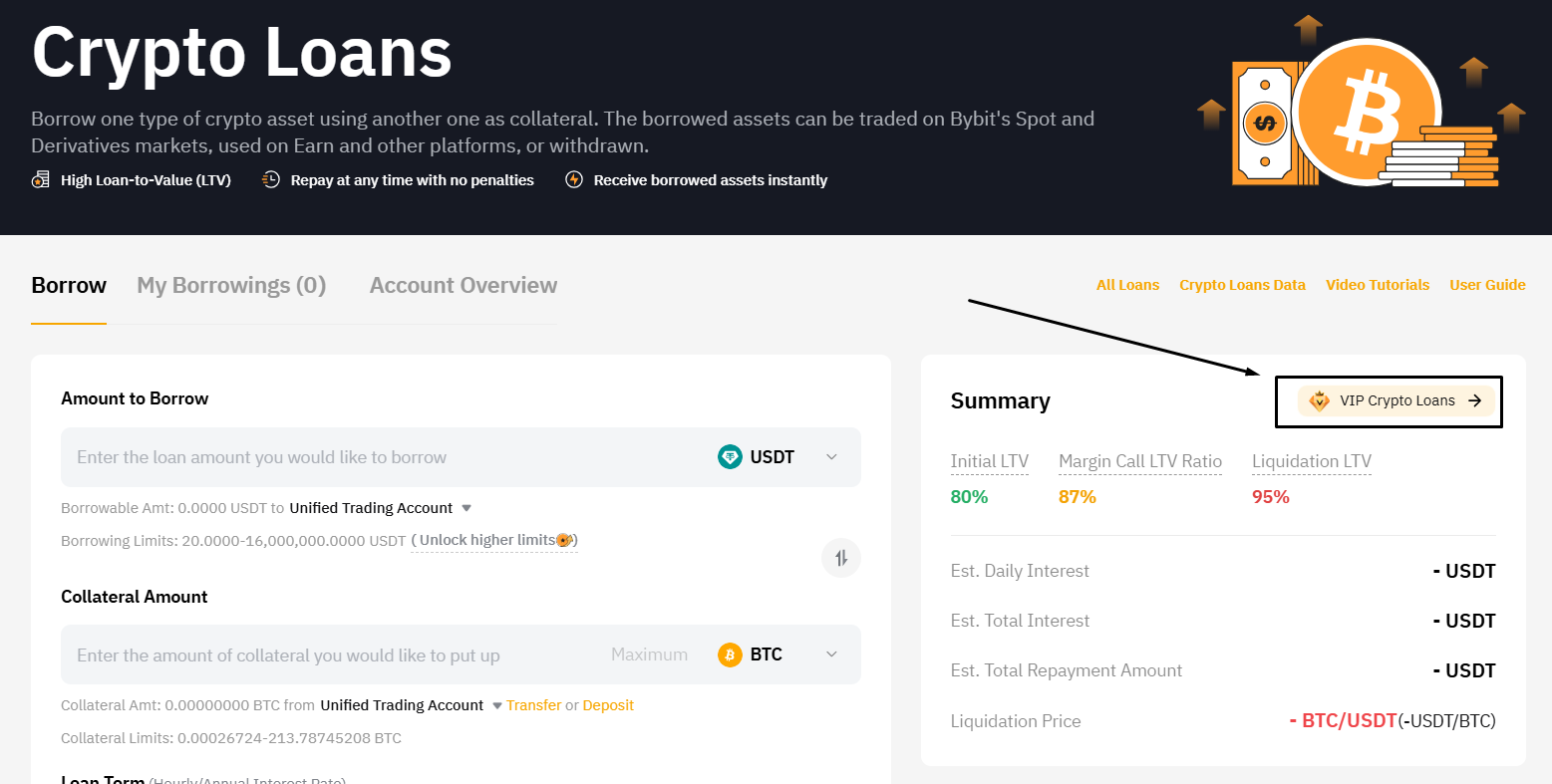

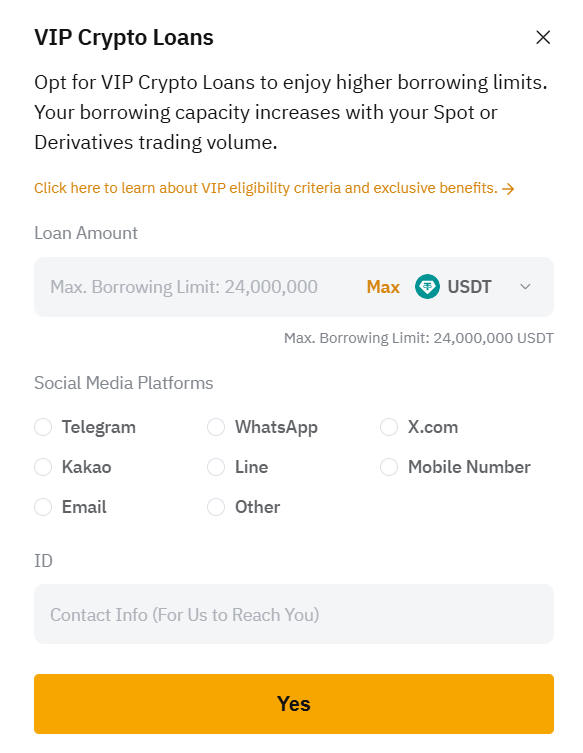

- On the right side of the loan summary panel, click on VIP Crypto Loans to access exclusive VIP lending services.

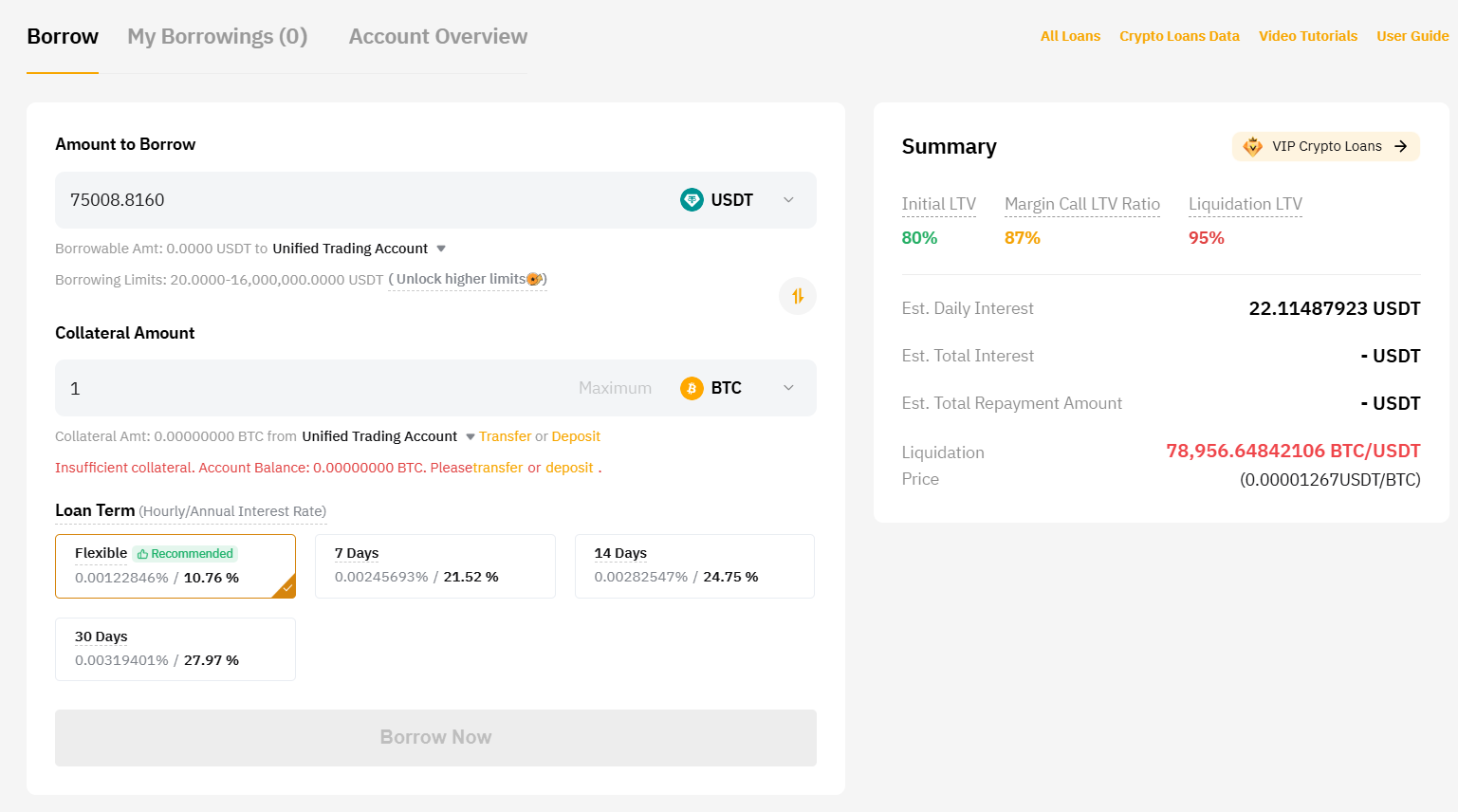

4. View Borrowing Parameters

- Enter your desired collateral amount and choose your loan term (e.g., 7, 14 or 30 days).

- Example: A VIP 1 user can borrow $50,000 with a flexible annual interest rate of 10.76%, while Supreme VIP users may borrow over $1 million at reduced rate.

5. Review Loan Summary

- Check the displayed Initial LTV, Margin Call LTV and Liquidation LTV to understand risk levels and repayment conditions.

This streamlined process ensures VIP users have full visibility into borrowing capabilities before taking action.

Visit the Bybit Loans Overview for more information.

How to Apply for a VIP Crypto Loan

Applying for a VIP Crypto Loan on Bybit is a straightforward process. This premium lending service is tailored for high–net worth individuals and VIP users. Here’s how you can secure a loan, step-by-step:

Start by ensuring you qualify for Bybit's VIP status. Visit the Bybit VIP Program page, review the eligibility criteria (such as trading volume or asset balance) and submit your application. For example, a VIP 3 user needs a minimum asset balance of $500,000 or a 30-day trading volume exceeding $10 million.

Once you’re approved, navigate to Bybit's Crypto Loans under the Finance menu. Select the VIP Crypto Loans option at the top right of the summary box.

From there, input your collateral amount and preferred loan amount. Choose between loan terms, such as 7 Days, 14 Days, 30 Days or a flexible term option that offers repayment flexibility.

Example

Collateral: 10 BTC

Loan Amount: 6.5 BTC (based on 65% LTV)

Term: 14 days at 24.75% annual interest.

Review the interest rates, Initial LTV and repayment details before submitting your application. VIP loans are processed without manual reviews, ensuring quick access to funds for trading or investment opportunities.

Repayment Options and Fees for VIP Crypto Loans

Bybit VIP Crypto Loans offer flexible repayment options to suit different strategies. Borrowers can choose early repayment to reduce overall interest, auto-repayment to settle dues automatically on the loan maturity date or auto-rollover to seamlessly extend the loan term.

However, certain fees may apply:

Interest Rates: Tailored to VIP tiers, calculated hourly

Prepayment Fees: A minor penalty may apply for early repayment

Overdue Fees: Delayed repayment incurs 3x the standard hourly interest during the overdue period

VIP users benefit from transparent terms, ensuring predictable costs for efficient portfolio management.

Conclusion

Bybit's VIP Crypto Loans provide exclusive benefits, such as personalized borrowing limits, competitive interest rates and streamlined processes for high–net worth individuals and institutional traders. The flexibility in loan terms and repayment options makes these loans highly adaptable for diverse trading strategies.

However, potential risks like liquidation or overdue interest must be carefully managed. Bybit’s robust VIP program supports traders in accessing advanced tools for leveraged trading while optimizing their borrowing strategies.

Ready to elevate your trading experience? Join the Bybit VIP Program today and unlock premium crypto lending services.

#LearnWithBybit