What Is a Spot Grid Bot, and How Does It Work?

The volatility in cryptocurrency trading makes it intimidating for those unfamiliar with crypto, but with the right tactics, you can secure high returns without being a trading expert. One of the easiest trading strategies for making profits is grid trading. This form of trading harnesses the power of grid bots to automate buy and sell orders by taking advantage of the volatile crypto price fluctuations.

Two types of grid trading include futures grid trading bots and spot grid trading bots. In this article, we’ll get acquainted with the Bybit Spot Grid Bot, which is crafted to help conservative traders sit back and chill while growing passive income.

Key Takeaways:

The spot grid trading bot is an effective tool in volatile markets, enabling traders to make steady profits on small price changes while mitigating risks with minimum and maximum price limits.

Bybit Spot Grid Bot helps you maximize your profits and trade across more markets with its advanced settings and wide range of spot pairs, including ETH/BTC and BTC/DAI.

The latest upgrade, Bybit Spot Grid Bot 3.0, includes enhanced features, such as a broader grid range, instant profit withdrawals and more BTC-quoted pairs.

What Is Spot Grid Trading?

Spot grid trading is a nifty tool that allows you to place orders above and below a specific price, creating a neat grid of orders at gradually increasing or decreasing prices. The spot grid bot is especially effective in volatile markets, where prices tend to fluctuate quite a bit. This tool is designed to help traders make profits on small price changes, which is perfect for those who want to take a more conservative approach to trading.

Once this type of grid trading bot has been programmed, it will immediately begin to place buy and sell orders at various points within the range. As long as the asset's price fluctuates within your set range, you can generate profits without actively managing the bot.

How Do Spot Grid Trading Bots Work?

Nearly all crypto grid trading solutions are similar. First, you select a spot grid pair. Next, set the lower and upper price limits. When doing so, keep in mind that there are maximum and minimum price limits for the upper and lower prices. The following step involves creating a certain number of grids.

With Bybit Spot Grid Bot 3.0, the minimum number of grids you can set is two, and the maximum is 330. The system will automatically adjust the maximum number of grids based on your selected price range. For instance, if you set a narrow price range, the maximum grid count will reduce correspondingly so that you’ll make sufficient profits to balance the trading fees.

After setting your price and grid limits, the spot grid mode will immediately split your capital between your selected trading pair assets (e.g., BTC/UDST). A grid of varying price points is then made between the lower and upper bounds you set, after which your starting funds are divided equally between the grids.

When using this grid trading strategy, the bot will automatically sell some of your assets whenever the crypto's price reaches the uppermost grid line. The traded asset is automatically purchased once the price hits the lower line. You'll profit from the total difference between the buy and sell orders.

Sample Trade

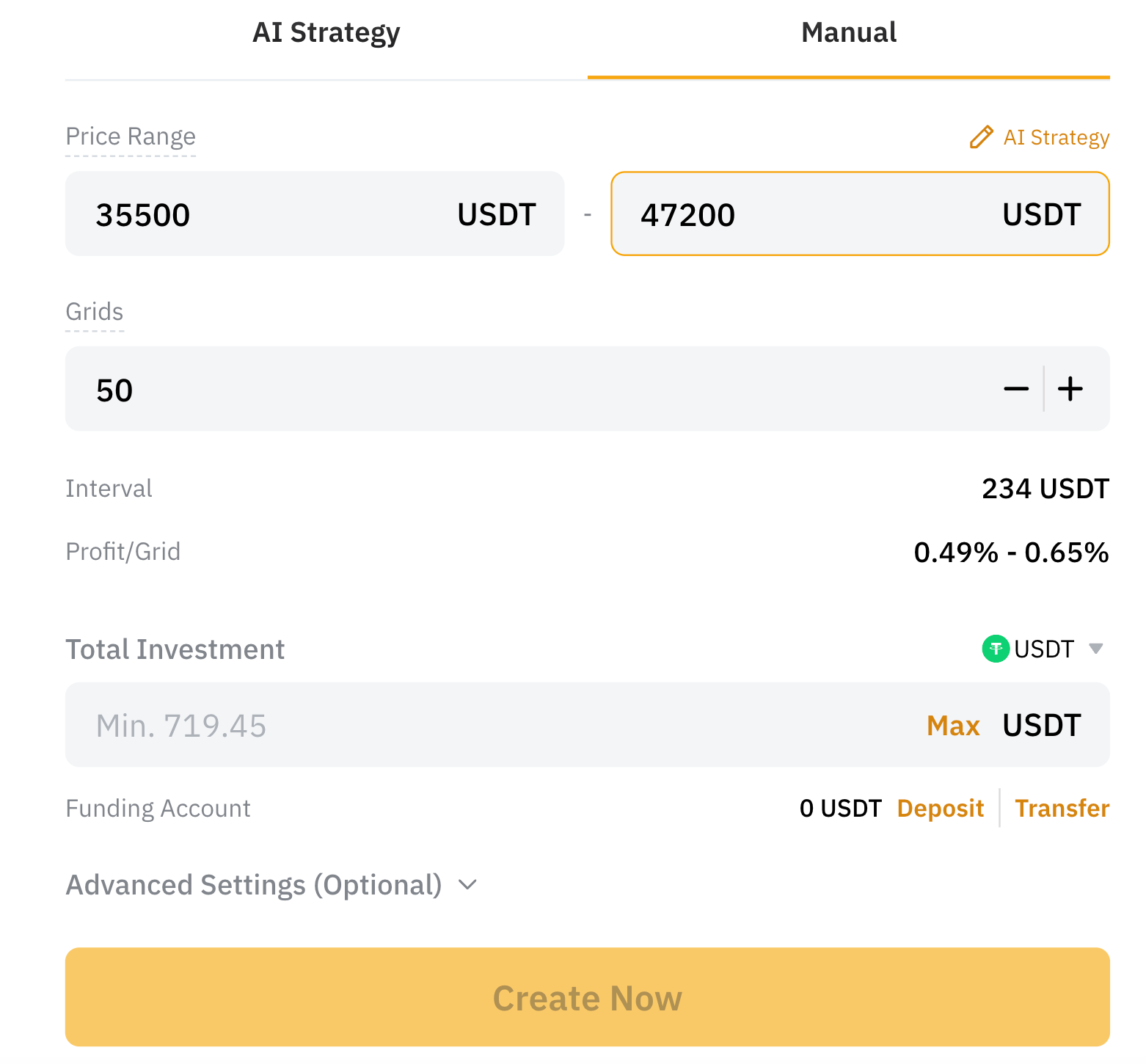

To illustrate, suppose John has 20,000 USDT and wants to capitalize on BTC's price volatility at $43,773.22. If he selects the manual grid trading bot mode and sets a range of 35,550 – 47,200 USDT, divided into 50 grids, buy and sell orders will be placed at every 234 USDT interval.

John's starting position of 20,000 USDT is then divided equally between the number of grid lines by the grid trading bot. In this scenario, each line is provided 400 USDT when dividing 20,000 USDT by 50.

When John initiates his trade, he will begin at the midpoint of the predetermined price range, which is set at $43,773.22. At this stage, half of his 20,000 USDT investment will be converted to BTC automatically. The grid trading bot will then create a series of 400 sell orders for BTC at intervals of 234 USDT, starting from 47,200 USDT and 400 buy orders at decreasing intervals down to 35,550 USDT. As the market price of BTC hits each sell or buy order, the bot will adjust the entire grid by setting a new starting point based on the latest price.

Bybit Spot Grid Bot Key Features

The Bybit Spot Grid Bot has a simple and intuitive interface that enables you to choose an artificial intelligence (AI) strategy to create your bot strategy in a single click — or easily set up a price range in a few steps, if you prefer more control over your strategy.

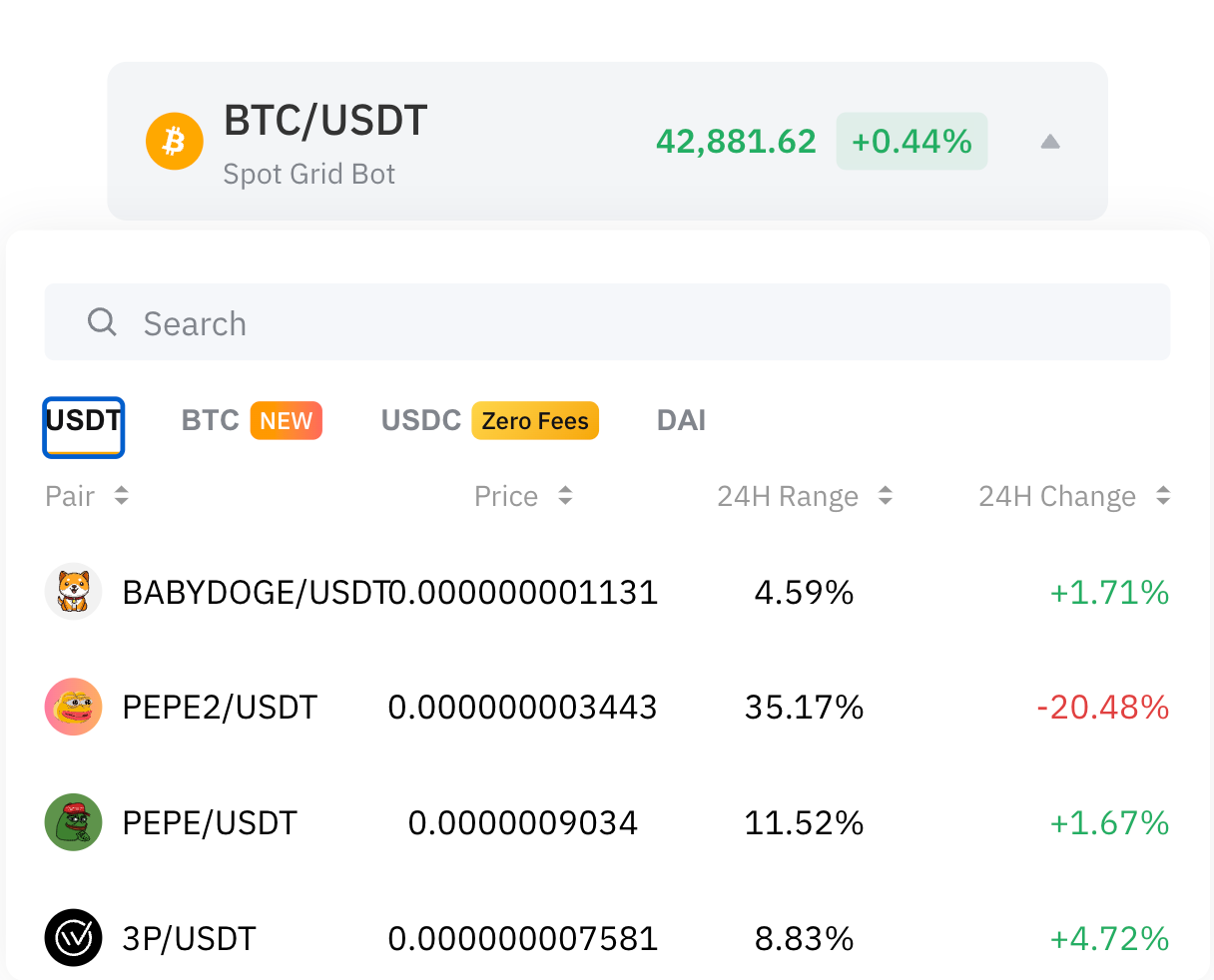

Bybit Spot Grid Bot supports multiple spot quote markets — USDT, USDC, BTC and DAI pairs — empowering traders to diversify their trading strategies across more markets. The USDC-quoted pairs can even be traded at zero fees.

Bybit Spot Grid Bot 3.0 Enhanced Features

The latest version of Bybit Spot Grid Bot comes with five enhanced features, as described below.

1) Broader grid range — With the original Bybit Spot Grid Bot, the maximum number of grids you can set is 200. Bybit Spot Grid Bot 3.0 expands that number to 330 so that you can devise more elaborate and sophisticated trading strategies. This enhancement supports more nuanced approaches, enabling traders to capitalize on even the subtlest price fluctuations and potentially enhance profitability in the dynamic financial markets.

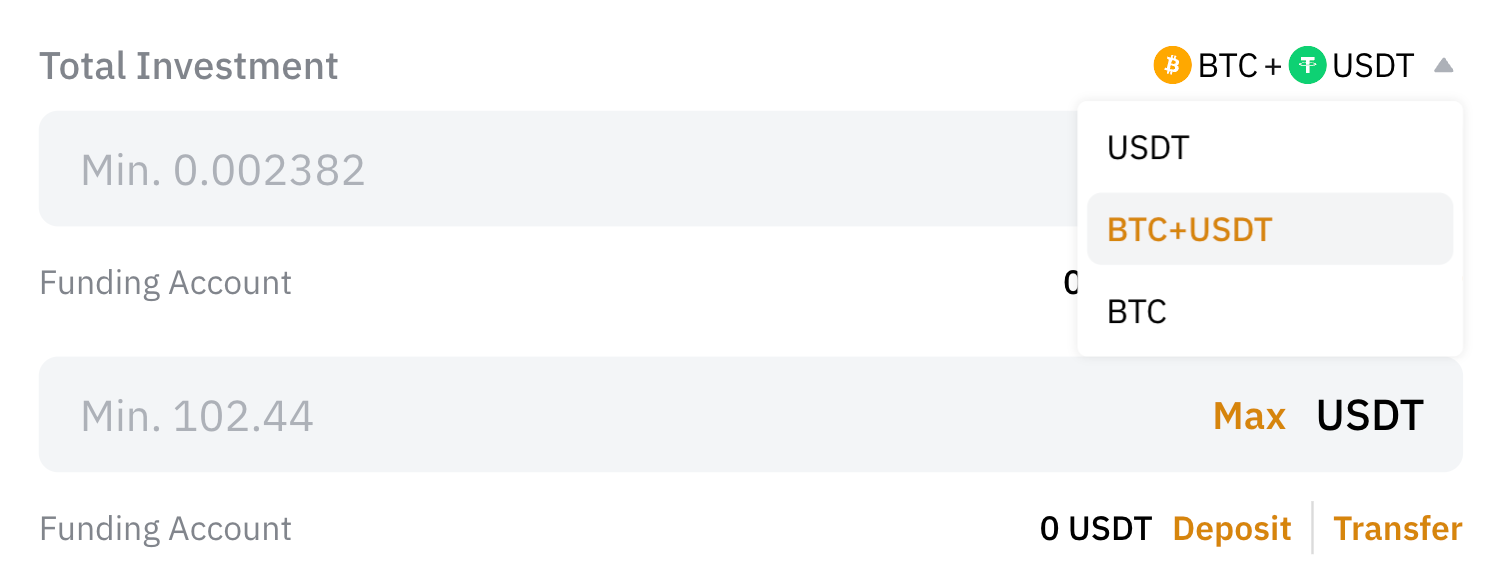

2) Customized investment modes —Previously, you could only initiate a bot with the quote coin for your selected pairing, but Spot Grid Bot 3.0 introduces greater flexibility by allowing you to open a bot with the base coin as well. With three distinct investment modes— Base Mode, Quote Mode and Base+Quote Mode — you can tailor your currency preferences. For instance, opting for the BTC/USDT pair in Quote Mode enables you to invest with USDT, while Base Mode allows you to invest using BTC. When you select Base+Quote Mode, you get to invest with both USDT and BTC without having to first convert your USDT to BTC, so you save on trading fees.

3) Real-time parameter adjustments —You can promptly modify your parameters, such as price range and grid numbers, without stopping the bot. This enables you to seamlessly align your strategy with evolving market trends and swiftly adapt to changing conditions, thereby enhancing the efficiency of your trades.

4) Instant grid profit withdrawal — You can directly withdraw your grid profits, ensuring immediate liquidity for your funds without having to deactivate your bot. This streamlines your profit-making process, giving you swift access to your earnings while your trading bot seamlessly continues its operations.

5) More BTC-quoted pairs — Unlike the previous version, Bybit Spot Grid Bot 3.0 introduces a significant increase in the number of BTC-quoted pairs, now offering a total of 12. When coupled with Base+Quote Mode, you can adeptly seize opportunities presented by market fluctuations. This is achieved through the automatic exchange of higher-value assets for lower-value ones during the respective bullish periods of each cryptocurrency. For instance, if you choose to set up a grid bot for the ETH/BTC pair, you can seamlessly navigate between ETH and BTC, automatically adjusting your asset allocations based on market conditions. This flexibility allows you to optimize your trading strategy and potentially maximize your profits.

6) AI integration — Bybit Spot Grid Bot 3.0 has also integrated Aurora AI, a tool that analyzes historical data to recommend optimal trading bot strategies. This handy AI tool reduces entry barriers, making it easier for beginners to engage in crypto trading.

7) Loss Cover Vouchers — Bybit Spot Grid Bot 3.0 also features Loss Cover Vouchers for you to claim and reduce your potential losses.

Bybit Spot Grid vs. Bybit Spot Grid 3.0

| Bybit Spot Grid | Bybit Spot Grid 3.0 |

Grid Range | 2 – 200 | 2 – 330 |

Investment Modes | 1 | 3 |

Parameter Adjustments | Not in real time | Can be made in real time |

Real-Time Grid Profit Withdrawal | Not available | Instant |

BTC-Quoted Pairs | 1 | 12 |

Aurora AI Integration | Not available | Yes |

Loss Cover Vouchers | Not available | Included |

How to Use Bybit Spot Grid Bot

The Bybit Spot Grid Bot allows you to use an artificial intelligence (AI) strategy or manually set a price range at which the bot will perform automated sell and buy orders.

The first thing you need to do before using a Bybit Spot Grid Bot is to create a Spot Grid Bot from the Leaderboard area on the Bybit trading bot page. Once you've reached this section, find your favorite strategy among the rankings before clicking on Copy for Free, which will redirect you to the Bybit Spot Grid Bot page.

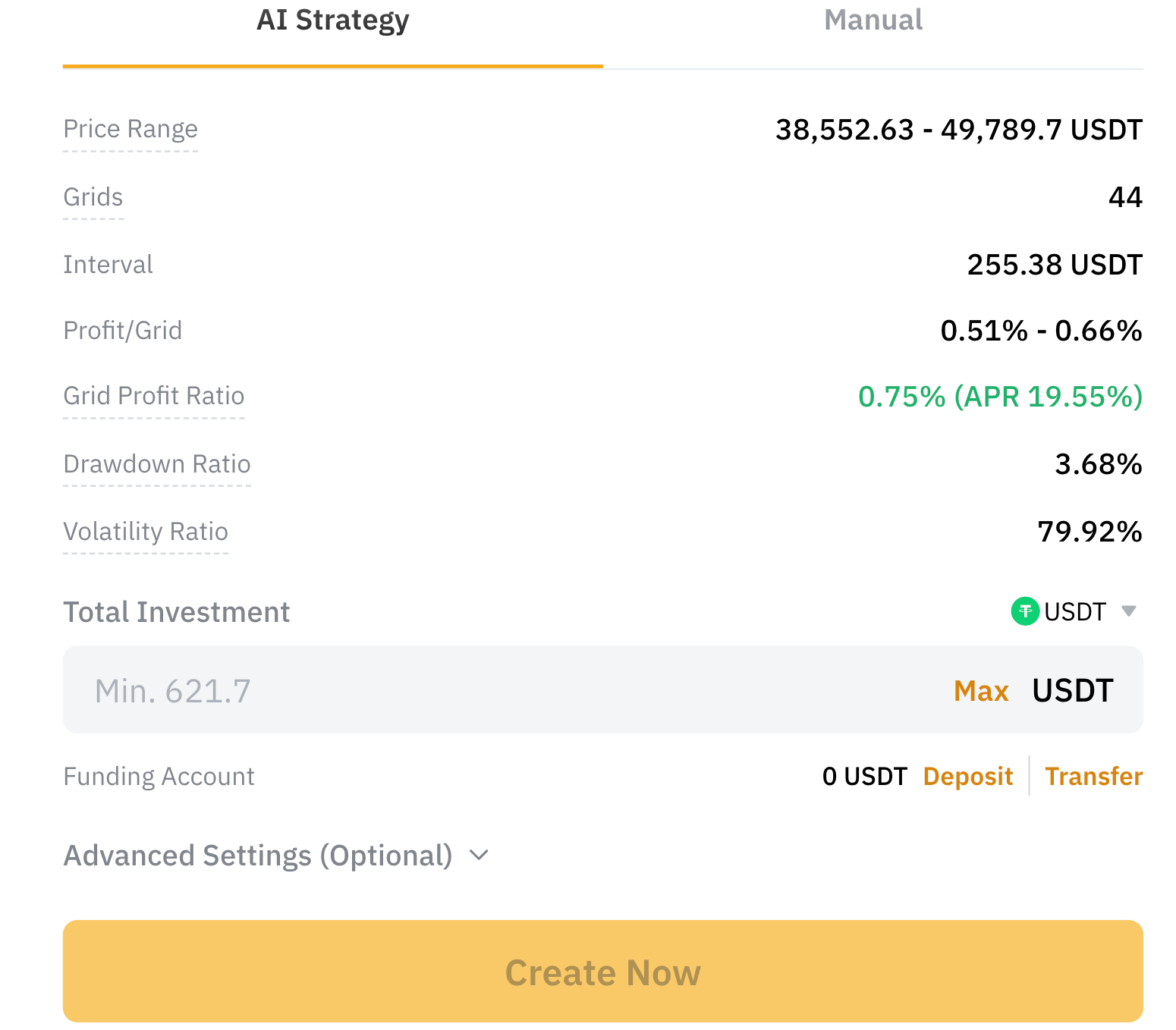

Automating Trades With Spot Grid Bot AI Strategy

If you wish to fully automate trades with a spot grid bot, this strategy uses artificial intelligence to make trades for you. Since you don't need to perform these trades manually, you can sit back and relax while enjoying a passive income stream. To set up automated trades, you first need to select a trading pair, after which you can specify the amount of crypto you'd like to invest.

The next step is optional, and only needs to be done if you want to further alter the settings for this AI strategy. In the Advanced Settings section, there are three parameters you can select: Entry price, take profit and stop loss.

Based on the information you input into the above sections, the AI strategy method will immediately fill in the other essential trading parameters, which include interval, grid profit, number of grids, price range, volatility ratios and drawdown. The volatility ratios are primarily based on historical data for the trading pair you've selected.

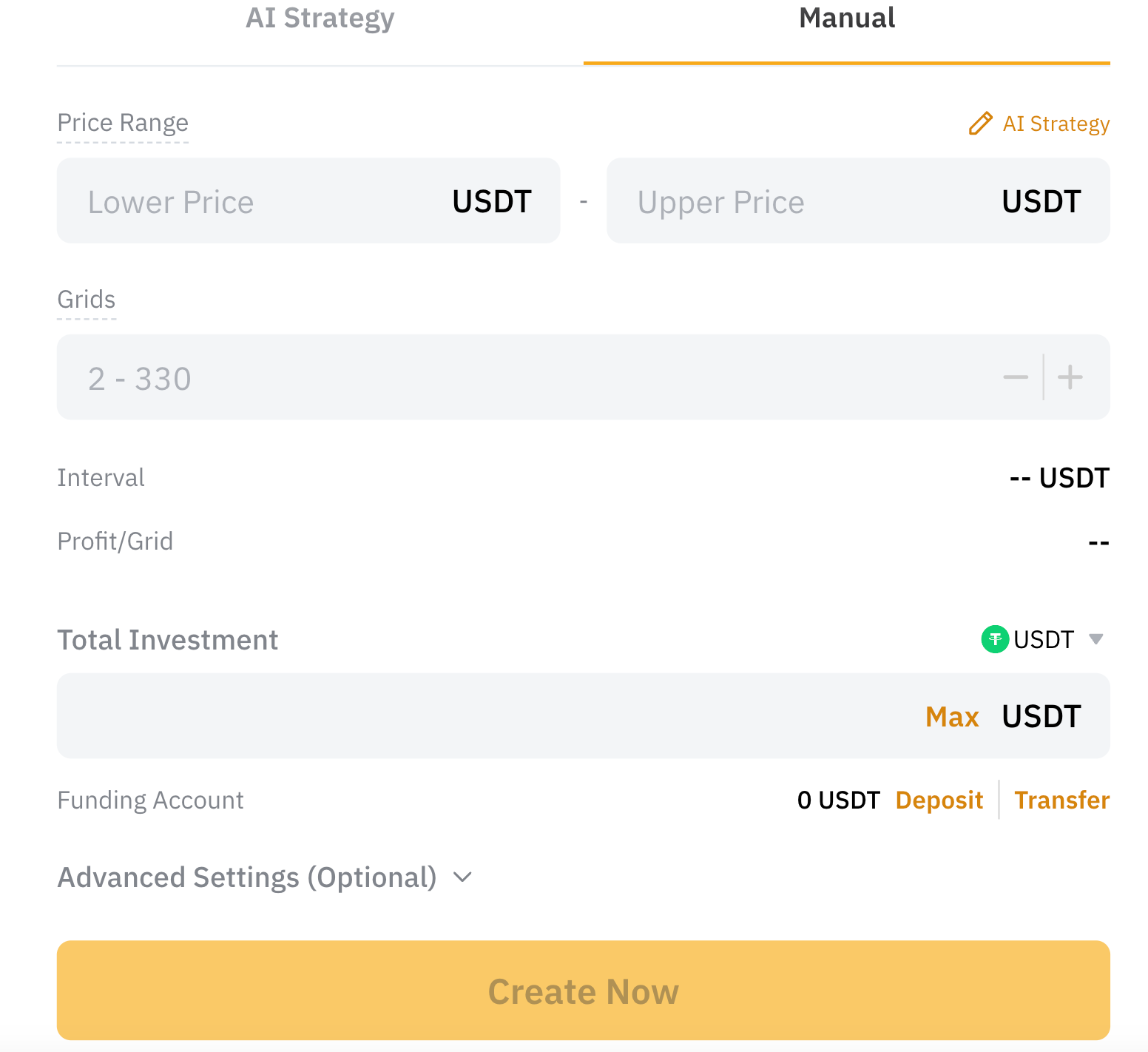

Manually Setting Your Own Parameters

If you'd prefer more control over when and how your trades occur, you can choose to manually set parameters. The first step involves selecting your preferred trading pair. Next, choose the lower and upper price bounds at which you wish to implement the trades. In addition, manually set the following fields:

Number of Grids, which dictates how many price points are created

Total Investment,which determines how much you want to invest

Advanced Settings, including entry price, take profit and stop loss

Once you've inputted all the information, click on the Create Now button. You'll then be asked to confirm the choices you've made. Give one final review to the parameters you've selected before clicking on Confirm.

Benefits of Using the Bybit Spot Grid Trading Bot

There are many benefits associated with using the spot grid trading strategy, from low entry point to better risk management.

Low Entry Point

By setting predetermined price levels you can easily glide in at lower levels, as compared to manually trading, and effortlessly manage orders at multiple low entry points without constantly watching market prices. This is particularly helpful when trading in volatile markets.

Automated Trade Execution

Once you've set your desired limits, the bot automatically executes trades for you, day and night. This means no more constant market monitoring or missed opportunities. Plus, you can create multiple grid trading bots to maximize your profits on various spot pairs. With the Bybit Spot Grid Bot, you can command up to 50 trading bots all at once.

Instant, Rational Decisions

When making trading decisions, emotions can sometimes cloud your judgment, leading to loss. Meanwhile, grid trading bots rely on a clear-cut algorithm with well-defined parameters to make decisions, giving you a more controlled approach for consistent profits. Moreover, these nimble bots can buy and sell much faster than in manual trading, giving you a leg up in the market.

Enhances Risk Management

There are minimum and maximum limits for the low and high price points at which trades are made, which can reduce your risk of losses if you conservatively set the limits. By using multiple trading bots across varied trading pairs, you can diversify your investments and boost your overall profits, even if some coins don't perform well.

Broader Market Coverage

Since the Bybit Spot Grid Bot covers a wide variety of trading pairs, including ETH/BTC and BTC/DAI, you’ll gain access to more assets and have the chance to explore more trading strategies.

Arbitrage Opportunities

Bybit Spot Grid Bot supports multiple spot quote markets, so you can capitalize on numerous potential arbitrage opportunities based on the price fluctuations across various trading pairs. The upgrade to Bybit Spot Grid Bot 3.0 further broadens your arbitrage possibilities, as you can respond to dynamic market conditions by making swift adjustments in allocations via Base+Quote Mode.

Enhanced Profit Potential

The advanced algorithm that the bot uses automatically optimizes grid strategies. This fosters greater possibilities to profit from your trades, as the bot is designed to adapt and respond to real-world market conditions. Spot Grid Bot 3.0 also allows you to reap profits immediately without stopping your bot, so you can continue to trade while receiving profits.

Cost Efficiency and Convenience

BTC holders will appreciate the convenience of Bybit Spot Grid Bot 3.0's Base Mode, which facilitates the initiation of a bot purely with BTC. Base+Quote Mode adds even more flexibility, as you can open a bot without having to convert your quote coin to BTC. You also save on trading fees with Base+Quote Mode, as you don't have to convert your quote coin to BTC.

Creating a Profitable Grid Trading Strategy

Even though a grid trading bot can simplify trading with its AI strategies, you can unlock its full potential to maximize your profits by exploring its advanced features and settings. If you want more control over your grid trading strategies, you can take advantage of these features:

Entry price/trigger price: This is a preset price at which the grid trading bot begins its operations. Buying and selling will only occur once the crypto's market price reaches the entry price. The bot will then be triggered, which opens up the grid for trade.

Take profit: Take-profit orders are limit orders used to close an open position at a predetermined upper price limit to secure a profit. If the price reaches the limit, the take-profit order will be fulfilled.

Stop loss: A stop loss order limits losses by closing the position once the lowest price limit is reached. This option allows you to control the risk you're exposed to, thus minimizing your losses.

It's highly recommended that you find an exchange with low trading fees to get the most out of spot grid bots. Bybit offers low trading fees at only 0.1%, which saves you money.

The Bottom Line

Bybit's user-friendly Spot Grid Bot can boost your trading game by increasing profits and efficiency, while keeping your stress and risk levels to a minimum. If you're eager to boost your earnings with a handy helper, the Bybit Spot Grid Bot is an essential sidekick that will help you reach your investment goals.

#Bybit #TheCryptoArk