How to Make Profits With Bybit Futures Grid Bot

Grid trading is a trading strategy that is being increasingly adopted in the futures market. Thanks to the higher levels of trading automation available to the modern trader, futures grid trading, which lends itself extremely well to automation, has become a convenient way to earn profits with minimum time and effort required.

The Bybit Trading Bot now also includes a futures grid bot, an industry-leading product that helps you derive maximum benefit from automated futures grid trading. In this article, we will take a closer look at this product and detail the ways to maximize your profits when using it.

What Is Bybit Futures Grid Bot?

Grid trading is not a newcomer in the field of trading methodologies. However, the recent advances in trading automation and AI-based trading have made this trading strategy more relevant for a variety of traders, from beginners to experienced futures market players. In grid trading, you select a reference price for your target asset and place several order triggers above and below the price point.

The points above the reference price trigger short orders when the asset’s price touches them. Conversely, the price points below the reference price trigger long orders. The key rationale is pretty simple – buy low and sell high. In Bybit Futures Grid Bot, the entire process of triggering short and long orders is automated.

The bot also has three pre-defined grid trading strategies – Long, Short, and Neutral – that you may choose to adjust your overall grid trading execution process. The Neutral mode is the classic way of how grid trading works. Under this mode, the bot will execute short orders when the price is above the reference point and long orders when the price is below the reference point.

The Long and Short modes are modifications to the standard grid trading approach. In the Long mode, the bot will only execute long positions. Conversely, the Short mode will make the bot execute only short positions. As we cover different market scenarios below, you will see how the Long and Short modes become useful in uptrending and downtrending markets, respectively.

When To Use Bybit Futures Grid Bot to Trade

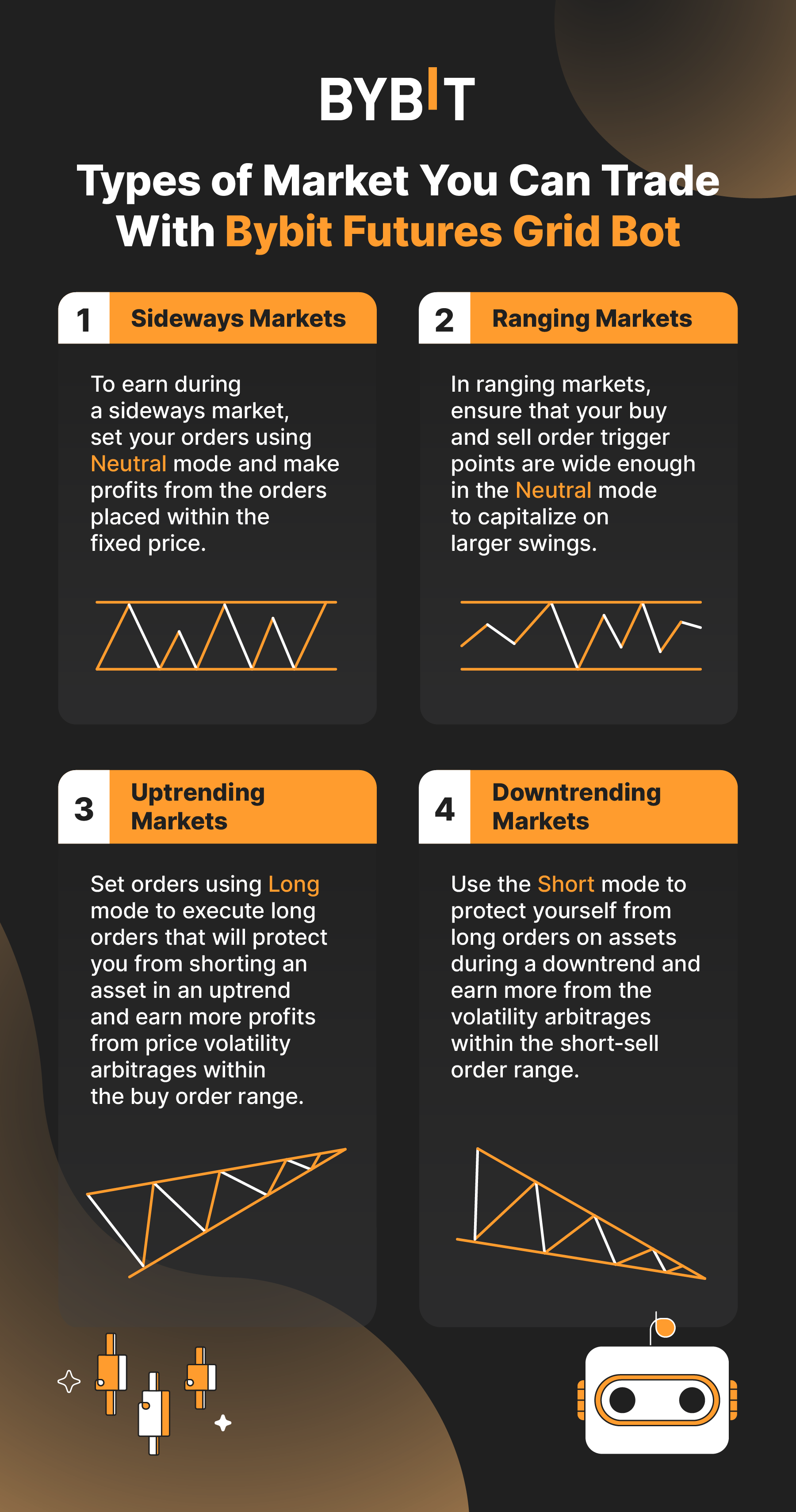

You can easily use Bybit Futures Grid Bot to make profits in a variety of market situations – sideways markets, wildly oscillating markets, as well as markets that trend up or down.

Sideways Markets

Sideways markets are the ideal scenario for using the Bybit Futures Grid Bot. The entire principle of grid trading is based on taking advantage of price fluctuations in such markets. When the market is moving sideways, many other popular trading strategies, e.g., trend trading or swing trading, become less applicable. This is when grid trading takes the center stage and helps you earn profits in an otherwise uneventful market.

To earn during a sideways market, all you need to do is set your orders using Neutral mode and make profits from the orders placed within the fixed price.

Ranging Markets

Contrary to popular belief, grid trading’s usefulness is not limited to stable sideways markets. Oscillating markets are also a great environment to take advantage of the bot’s automated grid trading. These markets are characterized by large ups and downs, creating opportunities for even larger profit opportunities as you get to earn from multiple positions in a larger grid.

In these markets, simply ensure that you set your buy and sell order trigger points wide enough to capitalize on the larger swings.

Uptrending Markets

The Bybit Futures Grid Bot is not just an ordinary grid automation platform. By offering adjusted grid strategies – the Long and Short modes – the bot provides you with something that has long been absent from the arsenal of grid traders – the opportunity to use this trading strategy in trending markets.

The standard grid trading becomes less useful when the market is trending upward. However, the Long mode of the Bybit Futures Grid Bot allows you to earn profits in an uptrend too. As this mode only executes long orders, the bot will protect you from shorting an asset that has entered an uptrend. Further, since you set a range at which you think the price will rise to instead of a specific price point, you get to earn more profits from the volatility arbitrages when the prices oscillate within the buy order range.

Downtrending Markets

Downtrending markets have also long been considered a poor scenario to use grid trading. Not anymore with Bybit Futures Grid Bot! If you use the bot’s Short mode, you will protect yourself from long orders on assets that have joined the market in a downtrend. At the same time, you can earn more from the volatility arbitrages as well within the short-sell order range.

Key To Maximizing Your Profits

Bybit Futures Grid Bot may be used under various risk-reward scenarios - from conservative, low-risk trading to high-risk trading that tries to capitalize on significant volatility. Naturally, trading’s overarching principle—the higher the risk you are willing to take, the higher the potential profits you might earn, and vice versa—still applies.

For low-risk traders, it is advisable to select a high-cap established coin, e.g., Bitcoin (BTC) or Ether (ETH), and take advantage of the relatively smaller price fluctuations of these “giant coins.” If, however, you prefer trading under a high-risk, high-reward scenario, you could choose a small-cap coin and capitalize on its wider price fluctuations.

Below are some tips to help you maximize your profits while minimizing your risks when trading with the Bybit Futures Grid Bot.

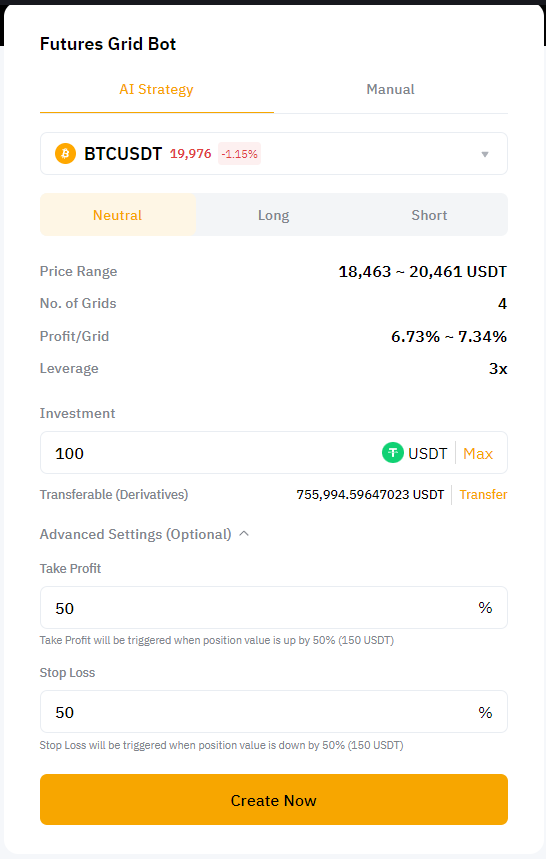

Set Take Profits and Stop-Losses Carefully

In addition to fine-tuning your trading risk levels, ensure that you set appropriate take-profit and stop-loss levels to automatically buy a position when a limit price is reached and sell a position when a certain amount of loss is met. This is of particular importance in grid trading. While grid trading allows you to earn great profits when the asset price bounces within a certain catchment range, you risk the possibility of the price breaking out of the range and trending beyond the expected levels. This risk is particularly relevant when you use the standard Neutral mode in the bot. When you set take-profits and stop-losses, you trade within your limits, thereby controlling your losses.

Make Proper Position Sizing

Futures trading using grids is often accompanied by the use of leverage. For instance, Bybit Futures Grid Bot lets you access generous leverages of up to 20x (the default leverage level in the bot is 10x, adjustable up to 20x). While leverage is a great tool to capitalize on even the smallest of price fluctuations, it carries risks of its own. Thus, while using leverage to amplify your profits in grid trading, always ensure that you set your position sizes cautiously to avoid margin calls.

Keep Abreast of Crypto Industry News

Many novice traders concentrate excessively on studying price charts and pay considerably less attention to fundamental analysis elements, such as following industry news and announcements. However, any experienced and successful trader knows the benefit of keeping abreast of industry news. These news might have a significant impact on the market and asset prices. If these news concern the leading coins, important regulatory changes, or other significant developments, the market might well change its direction or turn from a sideways hibernation to a strong trend. Such changes might require you to tweak the modes in your Bybit Futures Grid Bot.

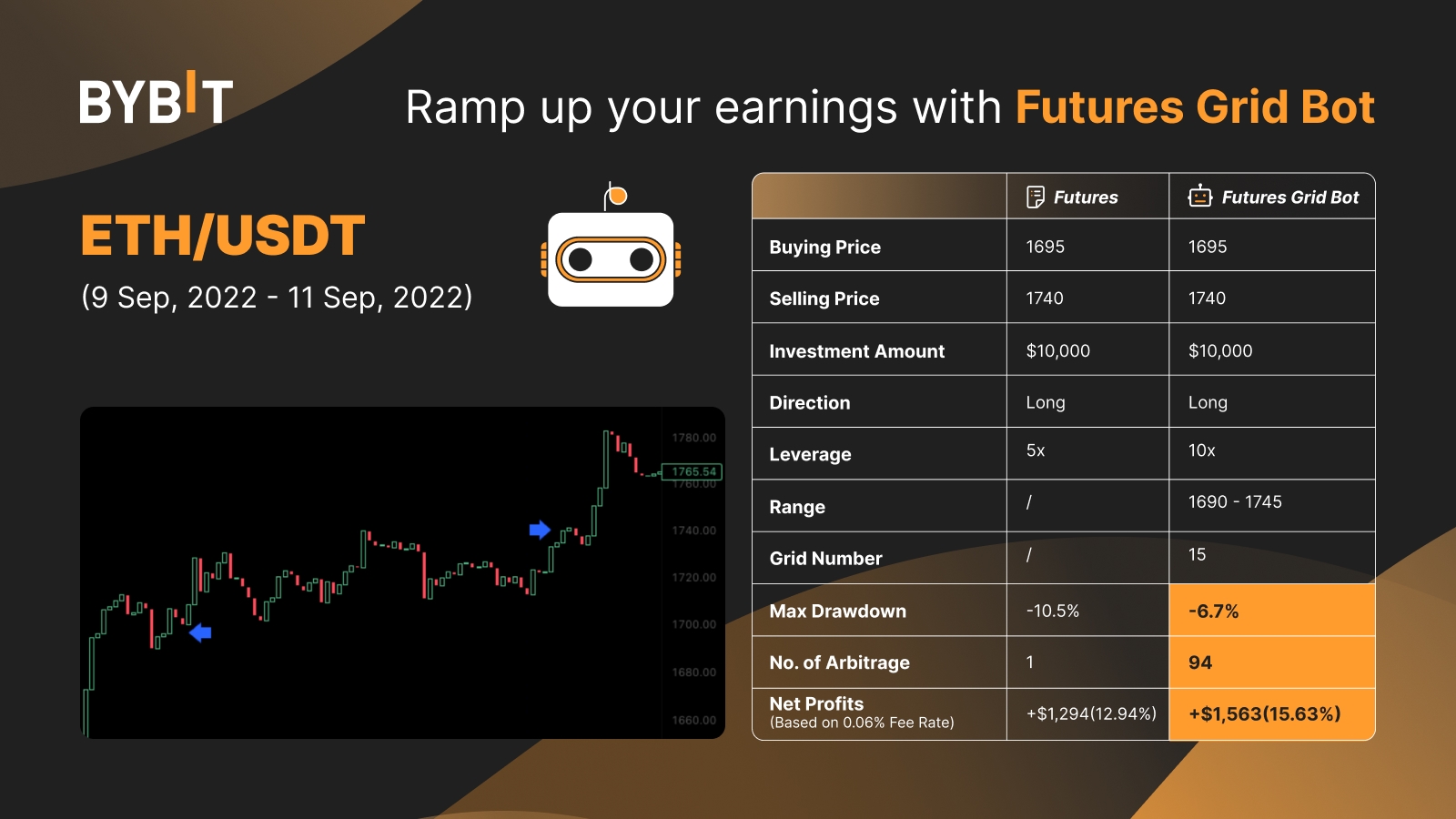

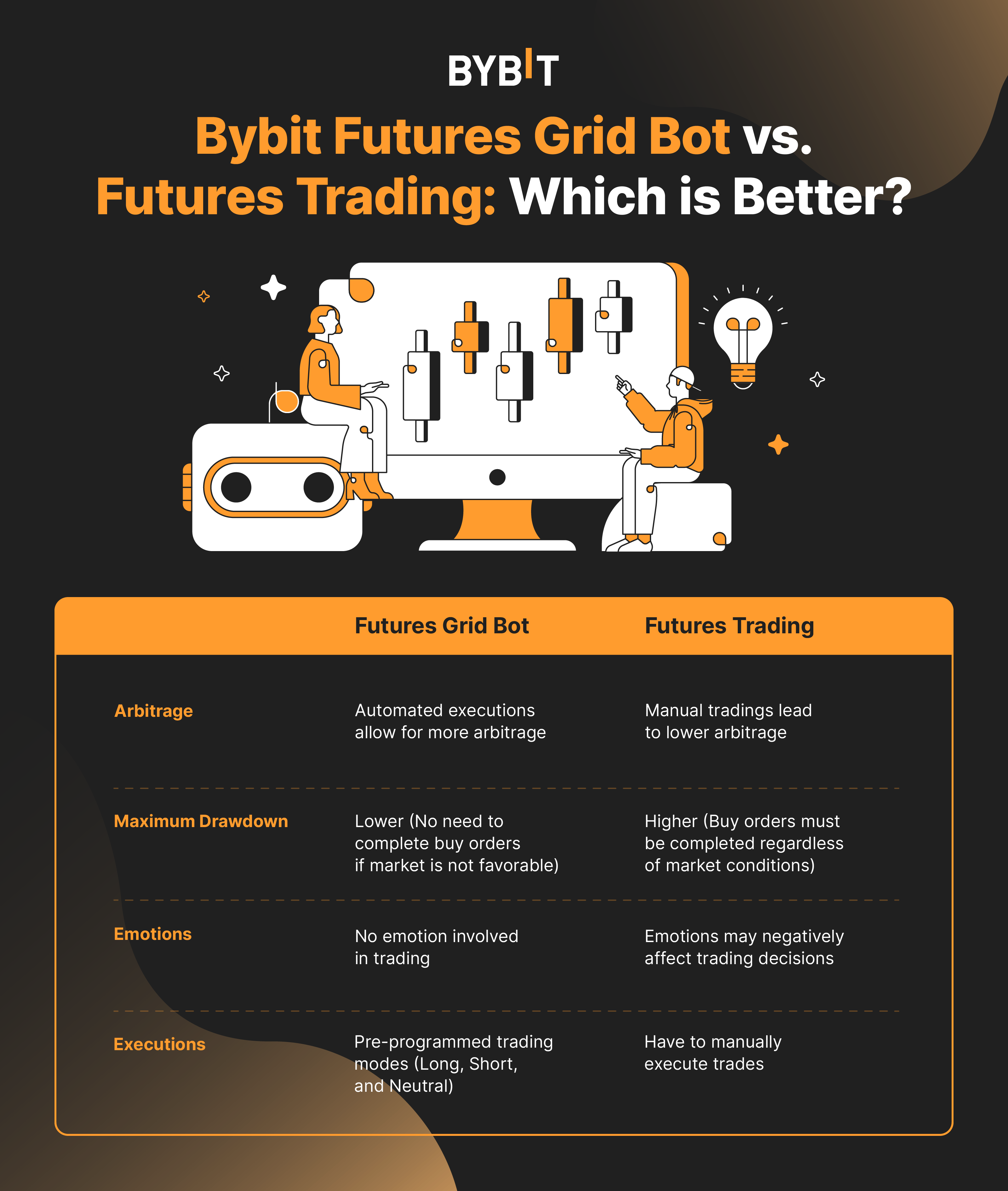

Bybit Futures Grid Bot vs. Futures Trading: Which is Better?

You might be wondering why use Bybit Futures Grid Bot and not simply trade futures manually. While manual trading in futures is an option open to any qualified trader, the bot provides considerable advantages to users of all levels, from novice traders to experienced gurus. The key benefits of the bot over manual futures trading are:

- Better arbitrage. Bybit Futures Grid Bot is an automated fellow that works tirelessly in a high-frequency mode, placing orders. By applying the automated high-frequency approach, the grid bot can give you more arbitrage opportunities. Such a level of automated execution is virtually impossible for a real trader.

- Lower maximum drawdown. When you trade futures, you have to complete your buy orders regardless of the market conditions. In contrast, with the Bybit Futures Grid Bot, you don’t have to do so when the price movement is not favorable. If the market turns unfavorable for you, the bot will offer a level of protection that manual futures trading simply cannot match.

- No emotion involved in trading. Any form of manual trading, including futures trading, carries an element of emotion. Traders, even the most capable ones, are often susceptible to emotions and biases when placing their trades. The Bybit Futures Grid Bot allows you to set your strategy and then take your eyes off the market charts, freeing your overall trading from being affected by emotions.

- Pre-programmed trading modes (Long, Short, and Neutral). This is perhaps the biggest benefit of the Bybit Futures Grid Bot. Regardless of how the market is shaping up – sideways, uptrending, or downtrending – the bot offers you an appropriate pre-set trading mode. Novice traders will find this automated mode especially helpful.

Final Thoughts

Turning a profit with Bybit Futures Grid Bot is very easy, particularly for beginners, who can leverage the bot’s pre-set defaults. More experienced futures traders will also benefit from the time savings delivered by the automated trading process. Thus, regardless of your futures trading experience, the bot can help you turn profits, and it can do so under any market direction scenario! So sign up for a Bybit account and start using the Bybit Futures Grid Bot today!