What Is Bybit Futures Grid Bot And How To Use It

As crypto markets and choices grow increasingly sophisticated, strategies for trading automation are getting more popular among savvy traders. Trading strategies that lend themselves well to automation are experiencing a surge in popularity, such as copy trading or grid trading. The latter is the focus of Bybit’s innovative Futures Grid Bot trading product, which lets you enjoy the numerous benefits of grid trading in a completely automated way.

What Is a Crypto Futures Trading Bot?

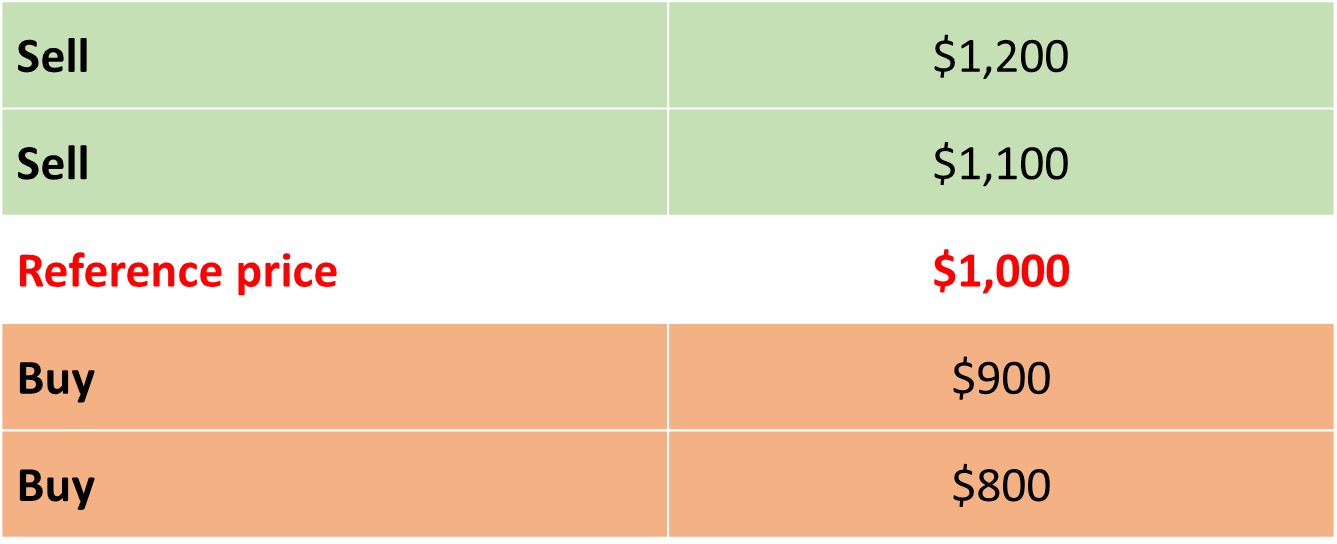

Grid trading is a popular strategy in which a set of orders is placed at several points above and below a reference price for an asset. Grid trading is based on the overarching goal of buying low and selling high. The price points above the current asset price are designed as sell orders, while the price points below the current price are reserved to trigger buy orders. When the asset’s price reaches a preplanned point in the grid, the corresponding order is executed.

Grid trading may be very simple or quite complex, depending on the trader’s experience and choices. Below is an illustration of a simple 4-price grid for an asset currently priced at $1,000.

Simple 4-price point grid

With its simple, rule-based structure, grid trading lends itself extremely well to automation by using trading bots. These bots allow you to take a hands-off approach to trading by specifying order rules and triggers in advance. You can then sit back and let the software trade on your behalf.

Additionally, grid trading bots are useful for futures trading. Instead of trying to predict the future price of an asset and placing contracts manually, you devise several buy and sell price points around your reference price and rely on the bot to execute your strategy.

The role of futures grid trading bots is just that: To apply the benefits of automation to grid trading, based on futures.

Advantages of Futures Trading Bots

Futures trading bots offer many benefits. Naturally, the automation of trading is the most obvious one: You avoid wasting time following the market and your target asset’s price developments. The bot also removes the element of emotion from your trading. When the order rules have been pre-specified and put on autopilot, you’re no longer at the risk of making emotional decisions as a response to price fluctuations or other unanticipated market developments.

Furthermore, futures trading grid bots require very little complex forecasting. You can specify a wide enough price range, without having to meticulously predict price movements. This also gives you more room for error in case prices don’t go entirely according to your expectations.

A third advantage is the ability to access the general benefits associated with futures trading, such as leverage and higher potential profits, as compared to spot trading.

Finally, futures grid bots are a great tool for making consistent profits in sideways markets. These are characterized by significant periods of time without much upward or downward movement. Many other popular strategies — for example, trend trading — become less useful when markets trade sideways, and this is where automated grid trading can really shine.

Why Use Bybit Futures Grid Bot?

Bybit offers you a versatile futures grid bot product with significant benefits and advantages:

- Low minimum investment requirement. You can invest as little as $1, unlike a majority of trading bot offers on the market, which typically requires minimum investments of between $10 and $100.

- Community support and VIP benefits. Some of the key VIP benefits include discounts on maker and taker fees during derivatives trading and VIP-only events. VIP benefits are also shared across the four key trading sections of Bybit — Derivatives, Spot, USDC Perpetual and USDC Options. Thus, you can enjoy fee discounts even when you jump over to other trading modes, e.g., spot trading.

- 24/7 automated futures trading with just a few preset parameters.

- Access to leverage to amplify your position sizes and earn more from small price fluctuations.

- Preset parameters for beginners to help them start trading effectively. We realize that grid trading, and particularly futures trading, might feel complex to beginners. That’s why we’ve designed Long (suitable for volatile uptrend markets), Short (suitable for volatile downtrend markets) and Neutral. If you choose Long mode, the bot will only open and close long positions. Conversely, in Short mode, the bot will only execute orders on short positions. In Neutral mode, the bot will open and close short positions above the market price, and open and close long positions below the market price.

- A beginner-friendly gateway to futures trading. Futures trading is a relatively complex area of crypto trading. There are significant benefits associated with it, but also nontrivial risks involved compared to plain vanilla spot trading. The futures grid bot, with its preset parameters and user-friendly options, is a great way for relatively less experienced traders to get their feet wet with the futures market.

We also have the popular Spot Grid Bot that offers similar benefits, but for the spot market. Compared to its spot market equivalent, the Futures Grid Bot lets you access the key benefits of futures trading — higher leverages and the potential to earn higher profits.

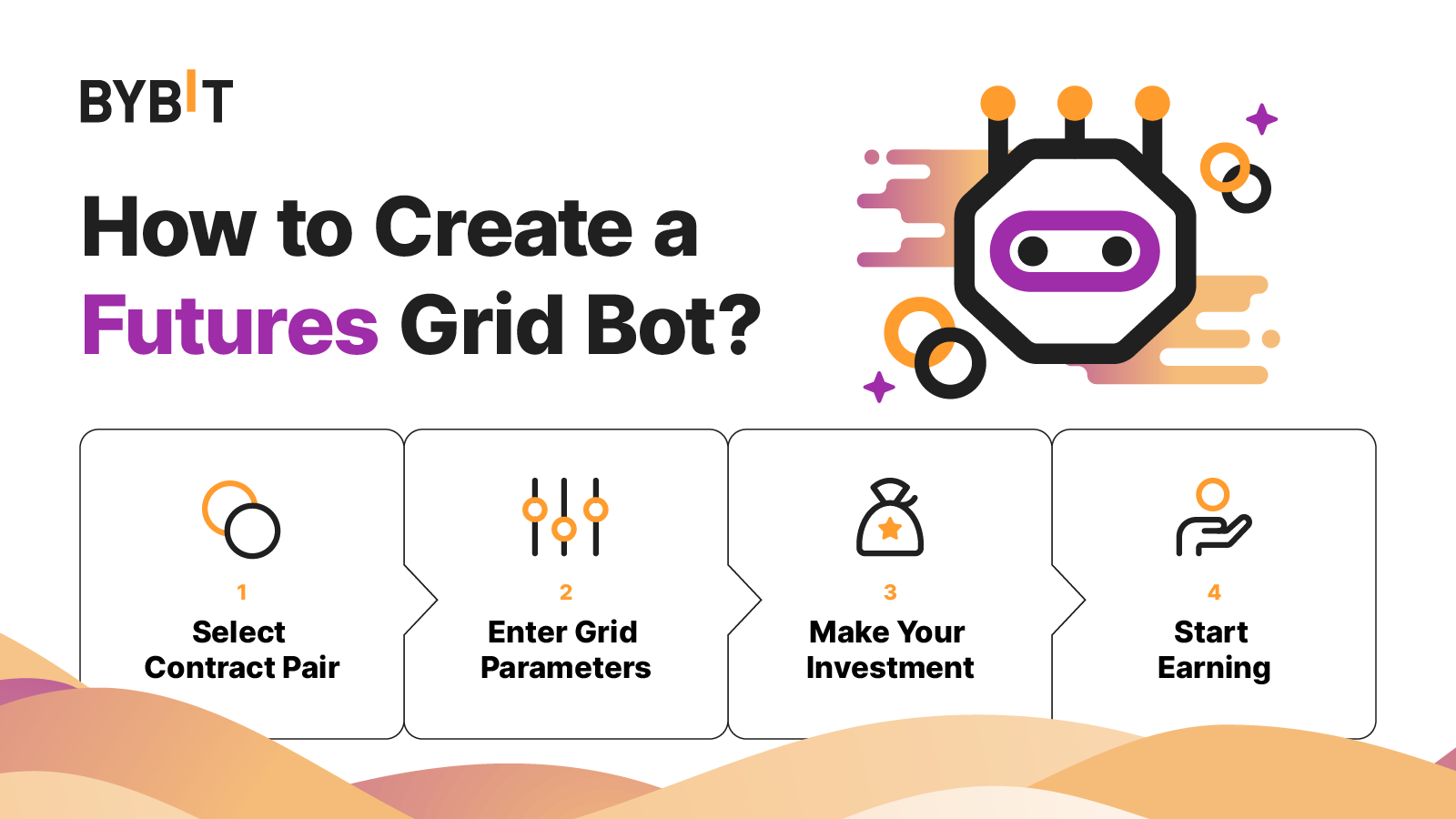

How to Use Bybit Futures Grid Bot

While creating a futures trading bot on Bybit is as simple as the four steps above, you can actually choose from two interfaces on Bybit to create your futures grid bot — the main trading bot page and the Derivatives trading page. Below, we’ll cover both methods.

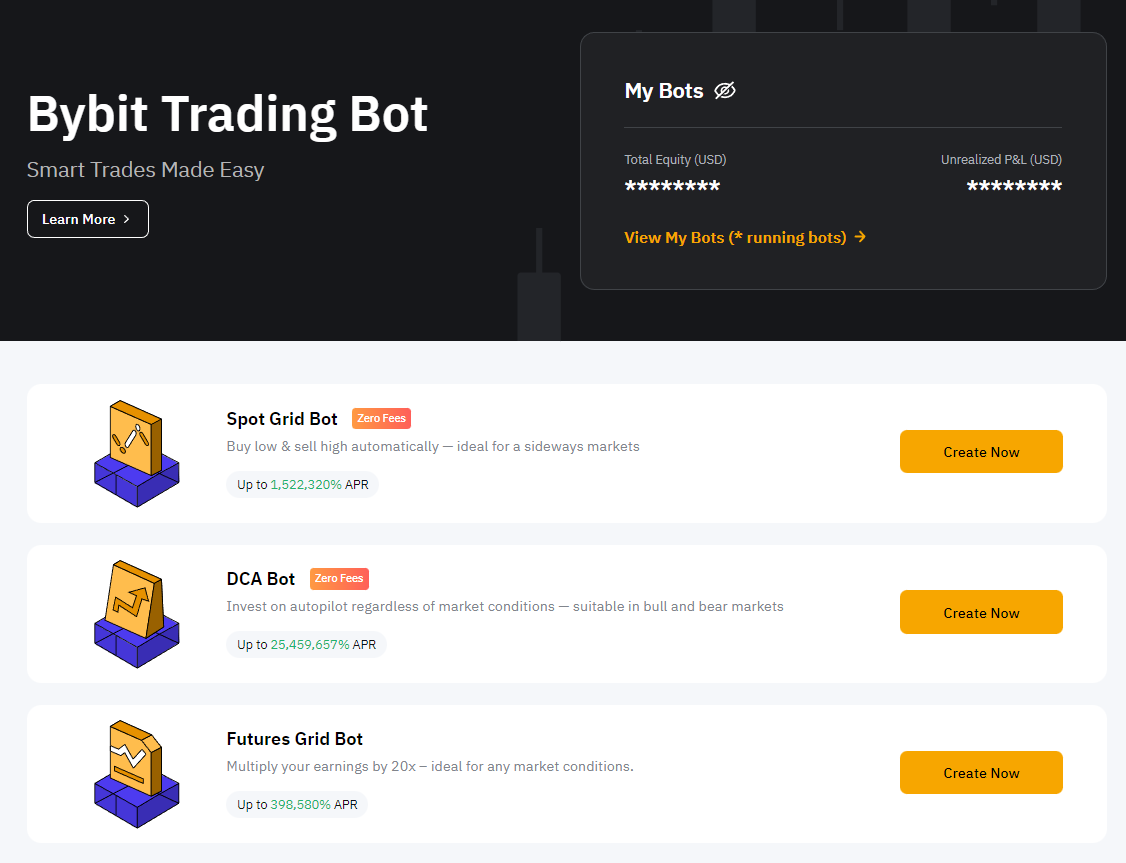

1. Create a Futures Trading Bot via Trading Bot Page

On Bybit’s homepage, choose the Trade option from the top menu, and then Trading Bot to go to the Bybit Trading Bot main page.

Select the Create Now button next to Futures Grid Bot to create your bot. You may create up to 50 bots in total, giving you an unmatched variety of choices if you’d like to follow many grid strategies at the same time.

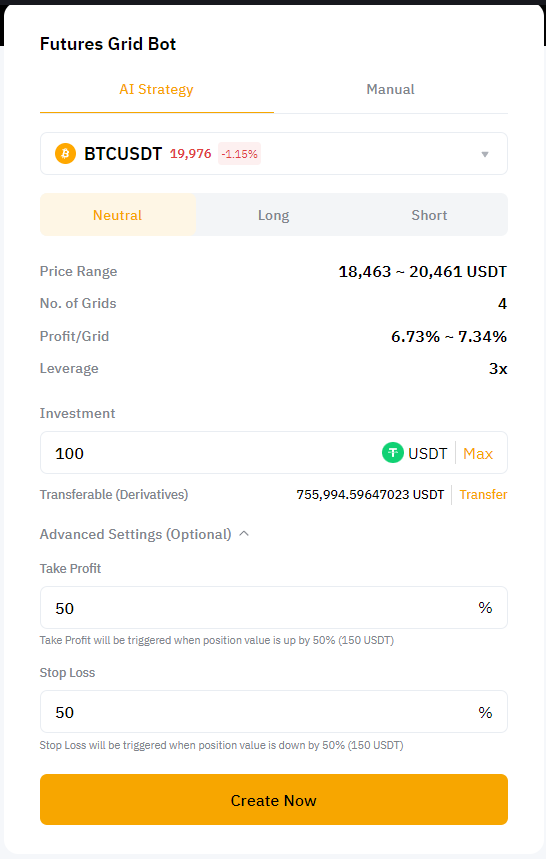

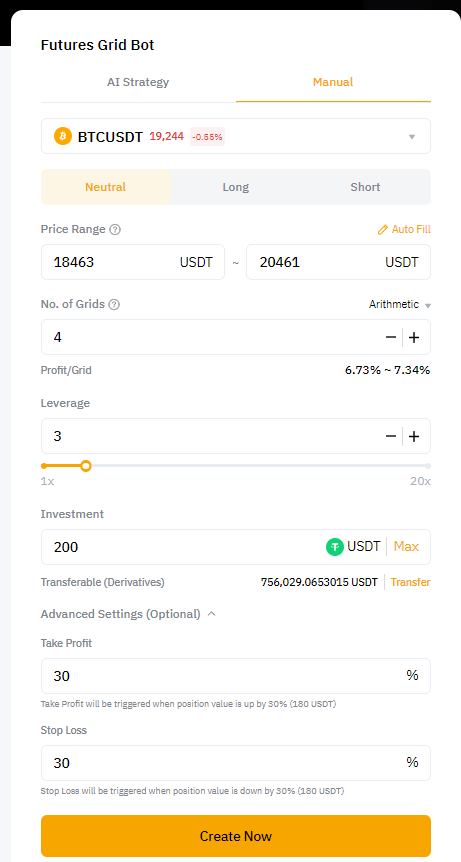

There are two ways to create the Futures Grid Bot: AI Strategy, and Manual. Choose the option that suits your preferences and experience with futures and grid trading.

Futures Grid AI Strategy

The AI Strategy option is a great choice for beginners and even experienced traders who would like to take full advantage of the bot’s automation capabilities. If you select AI Strategy, you’ll need to specify the following options:

- Pair: Select a trading pair.

- Order Direction: Long, Short or Neutral, as described above. Neutral is the default setting.

- Total Investment: Specify the total amount you’d like to invest.

- Advanced Settings (Optional): Unlike the main three options above, these are completely optional. Under Advanced Settings, you can choose two parameters:

- Take Profit — This value shouldn’t exceed 500%.

- Stop Loss — This value shouldn’t exceed 100%.

Based on your choices above, the AI Strategy mode will automatically work out the other key trading parameters — Price Range, Number of Grids, Profit/Grid, and Leverage — based on the historical data performance of the selected trading pair.

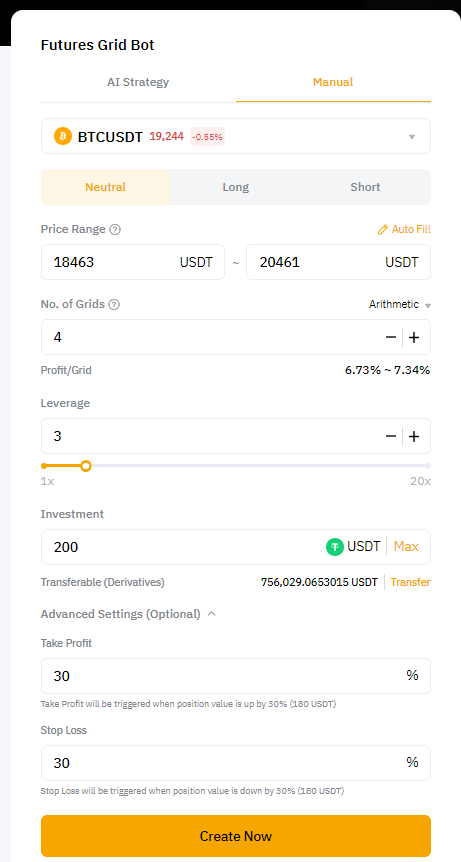

Manually Set Parameters

Alternatively, you may choose to specify all the key parameters manually. If you select the Manual option, note that there are two types of grids: Arithmetic and Geometric. For Arithmetic, each grid has an equal price difference. For Geometric, each grid has an equal price ratio difference. The higher the number of grids, the smaller the price intervals. This means that in a volatile market your orders may be filled more frequently, but your profits would be lower, due to multiple trading fees.

You’ll need to choose the trading parameters as follows:

- Pair: Select a trading pair.

- Order Direction: Neutral (Default), Long or Short

- Price Range: Set lower and upper price bounds.

- Number of Grids: Enter the number of grids.

- Leverage: Enter your preferred leverage (the default option is 10x, but you may specify a leverage of up to 100x for neutral order direction and up to 50x for long or short order directions).

- Total Investment: Specify the total amount you’d like to invest.

- Advanced Settings (Optional):

- Take Profit — This value shouldn’t exceed 500%.

- Stop Loss — This value shouldn’t exceed 100%.

After you’ve specified all the required options, click the Create Now button. You’ll then be asked to confirm your overall choices. Review your selected parameters, and click on Confirm when ready. Your Futures Grid Bot will then be created.

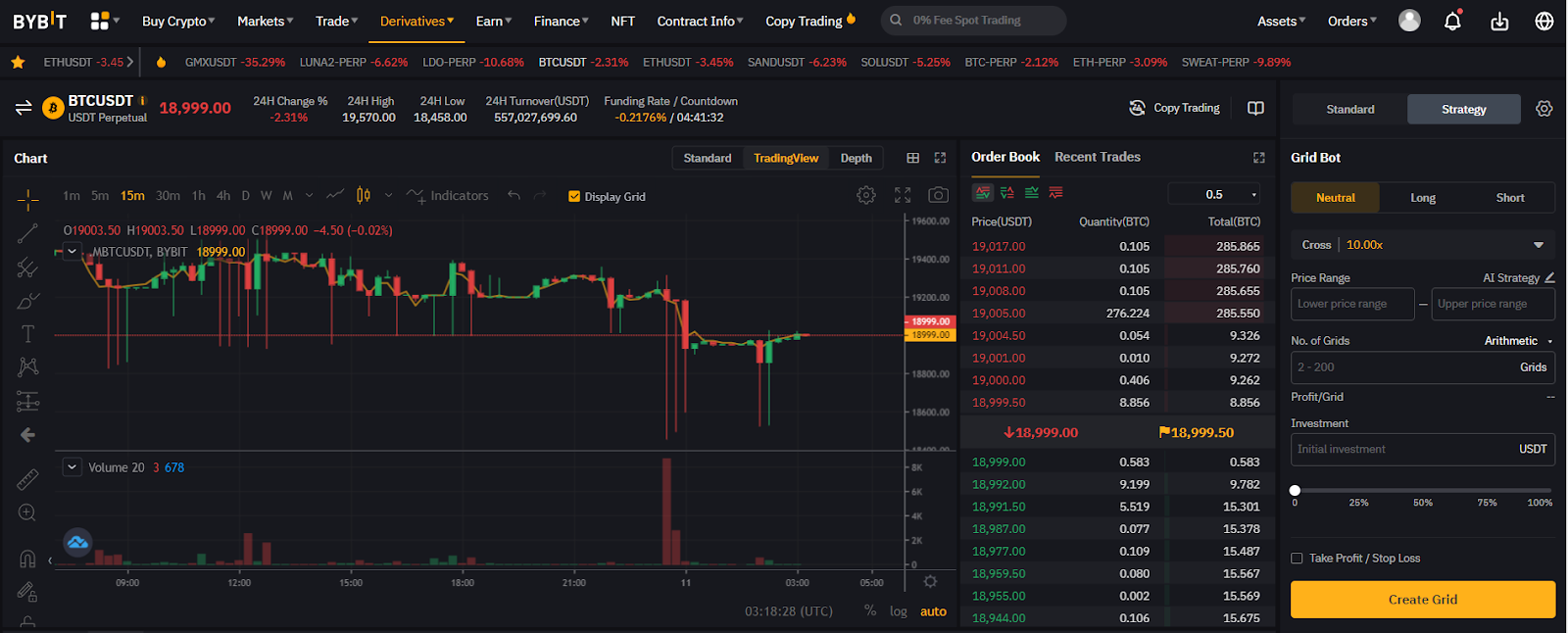

2. Create Futures Trading Bot via Derivatives Trading Page

You may also create your Futures Trading Bot via the main Derivatives page. Choose USDT Perpetual from the top menu, and then select Strategy in the order zone on the right side of the USDT Perpetual Trading page.

You can then choose one of the two trading modes – AI Strategy or Manual.

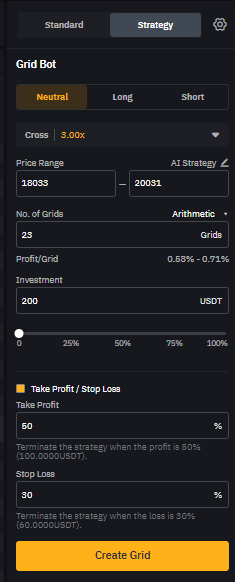

Futures Grid AI Strategy

If you select the AI Strategy mode, specify the following parameters:

- Order Direction: Neutral (Default), Long or Short

- Click on AI Strategy: The parameters for Price Range, Number of Grids, Profit/Grid and Leverage will be automatically calculated, based on historical data.

- Total Investment: Specify the total amount you’d like to invest.

- Advanced Settings (Optional):

- Take Profit — This value shouldn’t exceed 500%.

- Stop Loss — This value shouldn’t exceed 100%.

Manually Set Parameters

For Manual mode, specify your options as follows:

- Order Direction: Neutral (Default), Long or Short

- Leverage: Set your preferred leverage.

- Price Range: Set lower and upper price bounds.

- Number of Grids: Enter the number of grids.

- Total Investment: Specify the total amount you’d like to invest

- Advanced Settings (Optional):

- Take Profit — This value shouldn’t exceed 500%.

- Stop Loss — This value shouldn’t exceed 100%.

After selecting the parameters above, click on Create Grid. A summary of your chosen parameters will be shown to you. Review your options, and then click on Confirm when ready.

The Bottom Line

The Bybit Futures Grid Bot is an invaluable product for futures traders who want to reap the benefits of automation and 24/7 accessibility. With an extremely modest $1 investment requirement, access to VIP benefits, generous leverage offers and beginner-friendly presets, the Bybit Futures Grid Bot is virtually unmatched in this product niche in the crypto market. If you’re serious about crypto futures and grid trading, our bot is the key tool for you to start with.