Optimizing Futures With AI: 4 Trading Strategies via Bybit Futures Combo

Futures trading can be challenging, due to the complexity of futures contracts and the need for constant market monitoring. However, automation and artificial intelligence (AI) can help mitigate some of these challenges by offering tools for analysis, risk management and trade execution. Bybit Futures Combo is a sophisticated tool kit that uses AI to optimize trading strategies, making futures trading more accessible and efficient.

This article introduces Bybit Futures Combo and explains how you can implement effective futures trading strategies by leveraging this innovative tool.

Key Takeaways:

Bybit Futures Combo allows users to create diversified portfolios with multiple futures contracts, automatically rebalancing to maintain preset ratios and align with strategic goals amid market fluctuations.

The platform supports various trading strategies, enabling traders to optimize their approaches according to market dynamics and personal preferences.

Bybit Futures Combo uses AI technology to recommend strategies and provide insights, helping users improve decision-making and build portfolios tailored to their preferences.

What Is Bybit Futures Combo?

Bybit Futures Combo is an automated tool that allows users to construct multiple contract portfolios. It automatically rebalances positions to maintain preset ratios, despite market fluctuations, ensuring the portfolio stays aligned with the user’s strategy.

Best Bybit Futures Combo Trading Strategies

Strategy | Scenario/Example | Illustration |

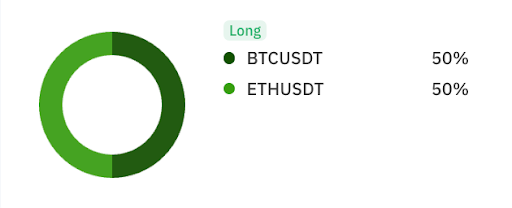

Allocate your investment evenly to long each asset and keep rebalancing. Buy low and sell high among different assets. | Different coins typically fluctuate at different times. When BTC’s value rises more than that of ETH, the trading bot will sell BTC to buy ETH, and vice versa, achieving a cross-asset “buy low and sell high” effect. | |

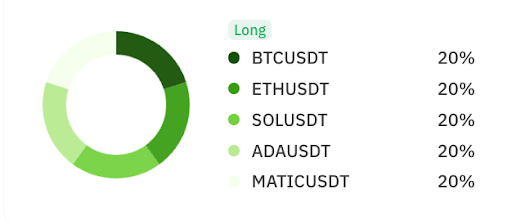

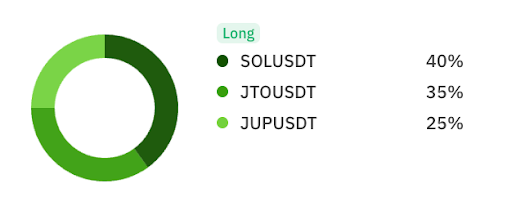

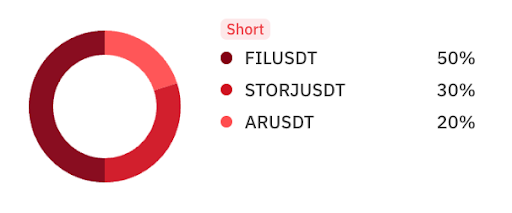

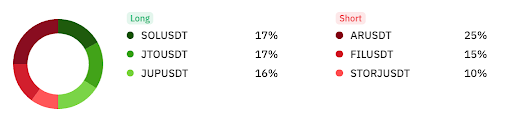

Long/short specific market sectors you expect to perform well or poorly. | Let’s suppose you believe Solana will perform well in the near future. You can create a portfolio to long key cryptos in the SOL ecosystem. Alternatively, let’s suppose you believe that on-chain storage will underperform in the near future. You can create a portfolio to short cryptocurrencies associated with this sector. | |

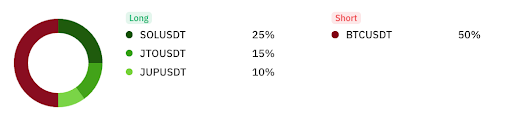

You can long one asset or one market sector and short another, with a 50%/50% proportion, and still profit as long as the long portfolio outperforms the short one. | Suppose you believe BTC will outperform ETH, and allocate 50% to long BTC and 50% to short ETH. As long as BTC rises more or falls less than ETH, you can still gain profit. | |

Long one asset or one market sector, and short the benchmark asset. Returns are independent of market performance. | Suppose you’re highly optimistic about the Solana ecosystem, and believe its gain will exceed the overall market. You can long SOL and relative cryptos, and short BTC 50%-50%. |

Strategy 1: Equal Allocation and Rebalancing

Standard portfolio management involves allocating assets to targeted percentages. If you’re looking to spread your risk evenly across several futures, you can initiate your trade with Bybit Futures Combo to distribute your total investment evenly among selected assets. Since the crypto futures market is known for its volatility, having an automated way to rebalance your portfolio saves you time and effort.

As the trading bot monitors the price movements, you can set thresholds or time intervals to rebalance your portfolio. This involves buying low and selling high — i.e., selling futures that have relatively increased in value and buying futures that have relatively decreased in value.

Strategy 2: Ecosystem-Based Index Trading

This strategy capitalizes on forecasting the performance of cryptocurrency sectors. Traders can choose to analyze various sectors to identify those that might experience growth or those that are likely to underperform in the foreseeable future.

Suppose you assess that Solana (SOL) is poised for growth due to its increasing adoption and upcoming technological upgrades. You can then strategically build a portfolio that longs the key cryptocurrencies within the SOL ecosystem, capitalizing on their potential upside.

Alternatively, suppose you assess that the on-chain storage sector will underperform in the near future due to regulatory concerns or technological setbacks. You can then build a portfolio that shorts cryptocurrencies associated with the on-chain storage sector.

Strategy 3: Relative Value Trading

Buying undervalued assets and selling overvalued ones is a classic trading strategy that’s made easier with Bybit Futures Combo. Thorough analysis may indicate specific areas of the market that may under or outperform. If you anticipate that coins within a particular ecosystem will benefit from a specific catalyst, you may choose to automatically buy those futures while selling futures on cryptos that have been overhyped. In taking a relative bet on undervalued versus overvalued assets, you may stay somewhat market-neutral so that you can attempt to make money in a bear market as well as a bull market.

Strategy 4: Buy Futures vs. Benchmark

Another type of relative performance trade is to choose futures you expect to perform well versus the general crypto market. Choose a portfolio of futures you’re positive on, and buy them versus selling BTC (which is a proxy for the overall market). In this way, you’re effectively creating a market hedge against the portfolio of futures you believe will gain value.

Should You Use Bybit Futures Combo?

Whether you're an experienced trader seeking efficiency and flexibility or a newcomer looking to explore advanced trading strategies, Bybit Futures Combo’s suite of tools and features provides compelling reasons to consider it for your futures trading needs:

Diversified portfolios: Create diversified portfolios by combining anywhere from two to 10 futures contracts, each customized with allocation ratios that fit your strategy. This capability ensures that you can spread your risk across different assets while maintaining control over how much weight each contract carries in your portfolio.

Easy rebalancing: Bybit Futures Combo simplifies portfolio management with effortless rebalancing. This feature automatically adjusts your portfolio composition according to preset thresholds or specific time intervals, ensuring it stays aligned with your strategic goals even as market conditions evolve.

Flexible trading strategies: Bybit Futures Combo’s platform also offers the flexibility to adapt to various trading strategies. It accommodates your preferences, be it long or short positions, different levels of leverage or specific rebalancing settings. This adaptability allows you to optimize your approach in line with current market dynamics, maximizing your potential returns while managing risk effectively.

AI optimization: For those looking to further enhance their trading decisions, Bybit Futures Combo offers optional AI-powered optimization strategies. Leveraging artificial intelligence, these tools provide sophisticated insights and recommendations to improve portfolio performance based on market trends and data analysis.

The Bottom Line

Bybit Futures Combo integrates a robust tool set and advanced AI technology to streamline futures trading strategies. It offers a diversified portfolio management system that dynamically adjusts to market fluctuations, and employs automated rebalancing to ensure your investments align with your risk tolerance and financial goals. Seasoned traders and newbies alike can rely on its flexibility and AI-driven insights to enhance trading performance and efficiency in evolving market conditions.

#LearnWithBybit