9 Best Futures Grid Trading Bots to Use in 2024

The basic economic principle of buying assets at a low price and selling them at a higher price is easy to understand. However, adopting the principle in practice can be more challenging. It requires you to consistently monitor the market and act promptly when the price reaches the desired level.

Futures contracts have been in use to some degree for several hundred years to facilitate trading gains, but they’ve only been used for trading in financial markets for a few decades. Now, futures grid trading bots are taking the use of futures contracts to the next level.

Key Takeaways:

Bybit, Pionex, and Bitsgap are standout futures grid trading bots, each offering unique features for different trader needs.

Platforms like Bybit provide beginner-friendly interfaces with AI-driven strategies and customizable settings.

From free bots like Bybit to premium plans on 3Commas and Coinrule, there’s a bot for every budget and trading style.

What Are Futures Grid Trading Bots?

Futures grid trading bots are automated systems that regulate futures trading activities based on a grid trading strategy, in which a set of orders is placed both above and below a specific reference market price for the asset. Specifically, this strategy automatically executes trades that the investor has preplanned, based on the established parameters.

Many investors have emotional ties to money. Their investment decisions may be swayed by greed, regret and/or other strong emotions. Even an investor who has a solid strategy in mind can be deterred due to these emotions. Futures trading is rooted in leverage, so even a subtle shift in the price of the commodity can dramatically impact the investor’s available capital. By automating transactions, trading bots help investors separate their emotions from their strategies and activities.

How Do Futures Grid Trading Bots Work?

Futures grid trading bots can be used to trade in rising, falling, flat or sideways markets, depending on the mode or strategy used.

Long futures trading can produce a profit when the price remains flat or rises; the trading bot will create a buy position for a portion or all of the invested funds. It will then incrementally close the investor’s position by placing grid orders.

Short futures trading yields profits if the price remains flat or declines. The trading bot will create a sell order for some or all of the invested funds. Grid orders will be executed incrementally. The process of automated trading for both long and short futures can be repeated by the grid bot.

Depending on the settings and features of your selected futures grid trading bot, you may set the trading leverage. This enables you to potentially optimize gains. However, leveraging futures can also yield losses. You can mitigate your exposure to risk and loss by carefully researching and selecting your commodities.

Benefits of Using Futures Grid Trading Bots

It isn’t necessary to use futures grid trading bots to capitalize on futures trading. The process can be completed manually at your discretion. However, once you learn about the important benefits provided by futures grid trading bots, you may understand why many savvy investors choose to use them.

Eliminates Emotionally-Driven Decisions

Emotionally-driven investment decisions can dramatically reduce the profitability of your activities. For example, due to fear, some investors may hesitate to act on a great opportunity that they’ve identified. Others may make poor decisions to buy or sell that are based on greed. Futures grid trading bots are automated according to your predetermined settings. By using them, you’re assured that your thoughtful trading plan will be executed as intended, without susceptibility to emotion.

Prevents the Need for Repetitive Tasks

Many aspects of futures trading are tedious and repetitive. For example, to profit from market volatility, you need to run numbers to determine the limit for each order, and then manually place the order. With a futures grid trading bot, however, the bot will quickly run all calculations, monitor the market and place orders. By doing so, it removes an investor’s fatigue or boredom from the equation to optimize profits. Futures grid trading bots are designed to be easy to use and customizable so that your trading strategy can be effectively implemented.

Saves Time

The cryptocurrency market is open around the clock, every day of the year. Constant monitoring is required to identify and seize opportunities. Unfortunately, it isn’t possible for an investor to monitor the markets non-stop. Futures grid trading bots will work for you 24 hours a day to ensure that you don’t miss potentially lucrative opportunities.

Ability to Amplify Profits

With futures grid trading bots, you can trade with leverage, a feature that other types of bots don’t offer. Leverage allows you to borrow a multiplied amount of your investment, so you can open a much larger position. This gives you the opportunity to amplify your profits with a relatively small amount of capital.

Best Futures Grid Trading Bots

The futures grid trading bot that you use can impact your trading experience in several ways. For example, it can affect your ability to leverage your trades. It may also limit your trading activities to specific assets. Let’s look at some of the most popular futures grid trading bots.

Bybit Futures Grid Bot

Bybit is one of the top derivatives exchanges, known for supporting low slippage and deep liquidity. The Bybit Futures Grid Bot is among the most well-designed and functional futures grid trading bots available, offering a clean, easy-to-use interface that’s just as well-suited for beginners as it is for more advanced futures traders.

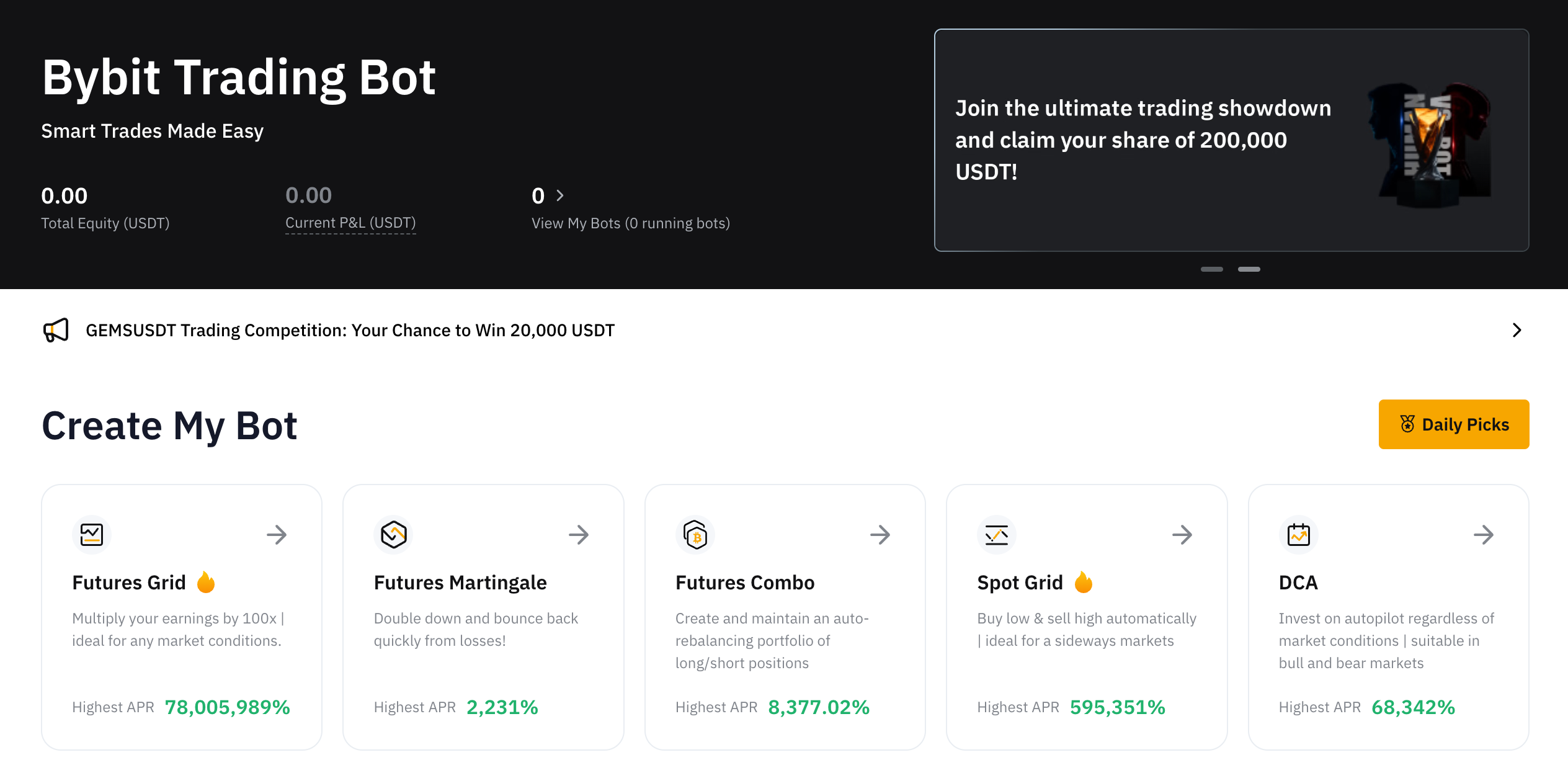

Its many features, available via both app and desktop platform, are accessible for free. Its automated platform has been designed for use on the Bybit exchange and offers five trading modes.

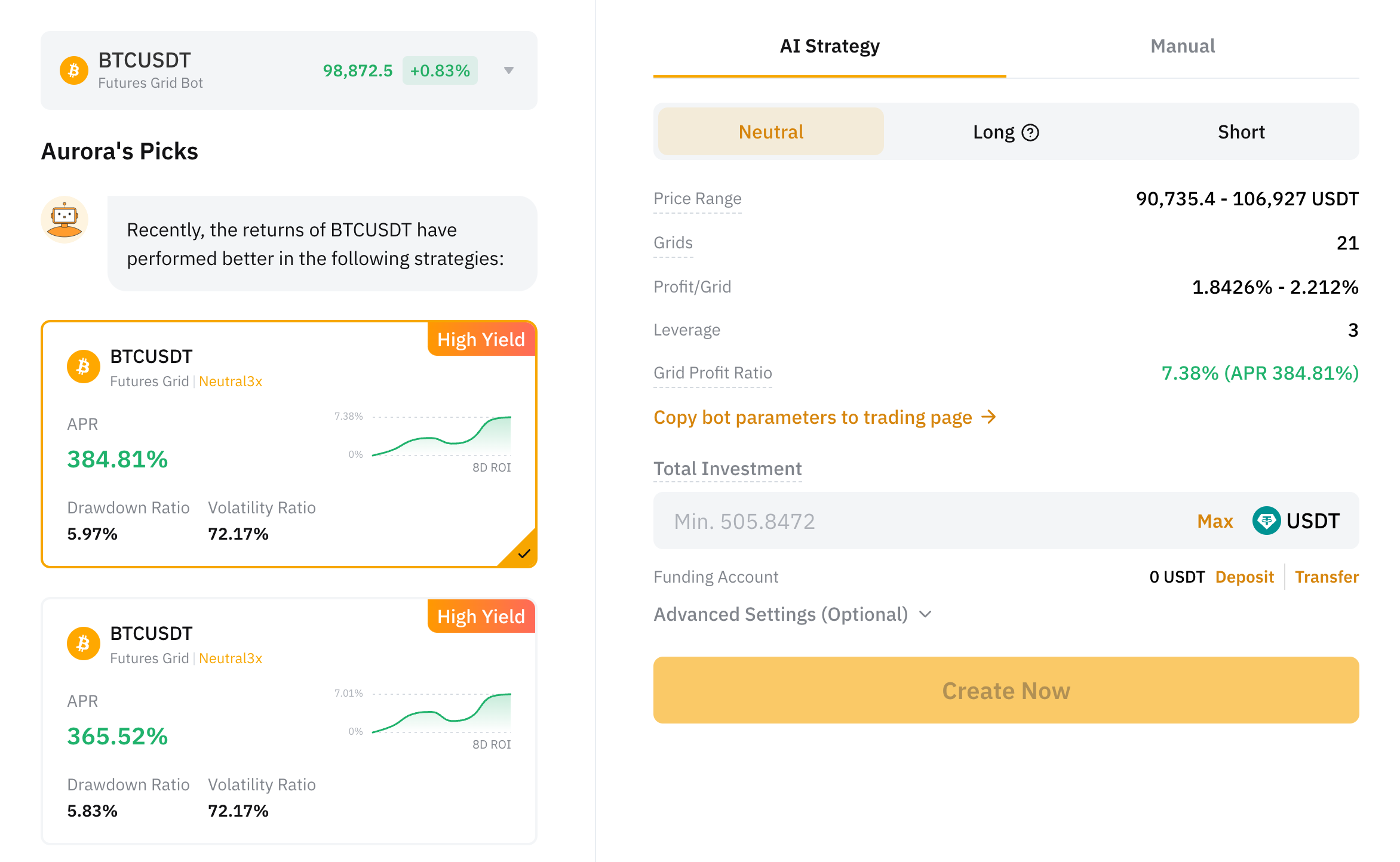

Beginning futures traders can take advantage of the automated AI Strategy parameters, which pre-fill all information such as Price Range, No. of Grids, Profit/Grid and Leverage. Simply input the contract pair, choose which position you’d like — Neutral, Long or Short — and the amount you intend to invest. Additionally, you can choose to manually set Take Profit and Stop Loss parameters, if you prefer. In the near future, you’ll also be able to copy the strategies of expert traders.

Meanwhile, experienced traders can choose the Manual option instead and set their own parameters, such as price range, number and type of grid, as well as leverage. Specifically, you can set Leverage parameters for long, short and neutral positions. If you don’t set any parameters, the leverage will have a default setting of 10x. You can set up to a maximum of 100x leverage for all trading pairs in neutral order direction and 50x for long or short order directions.

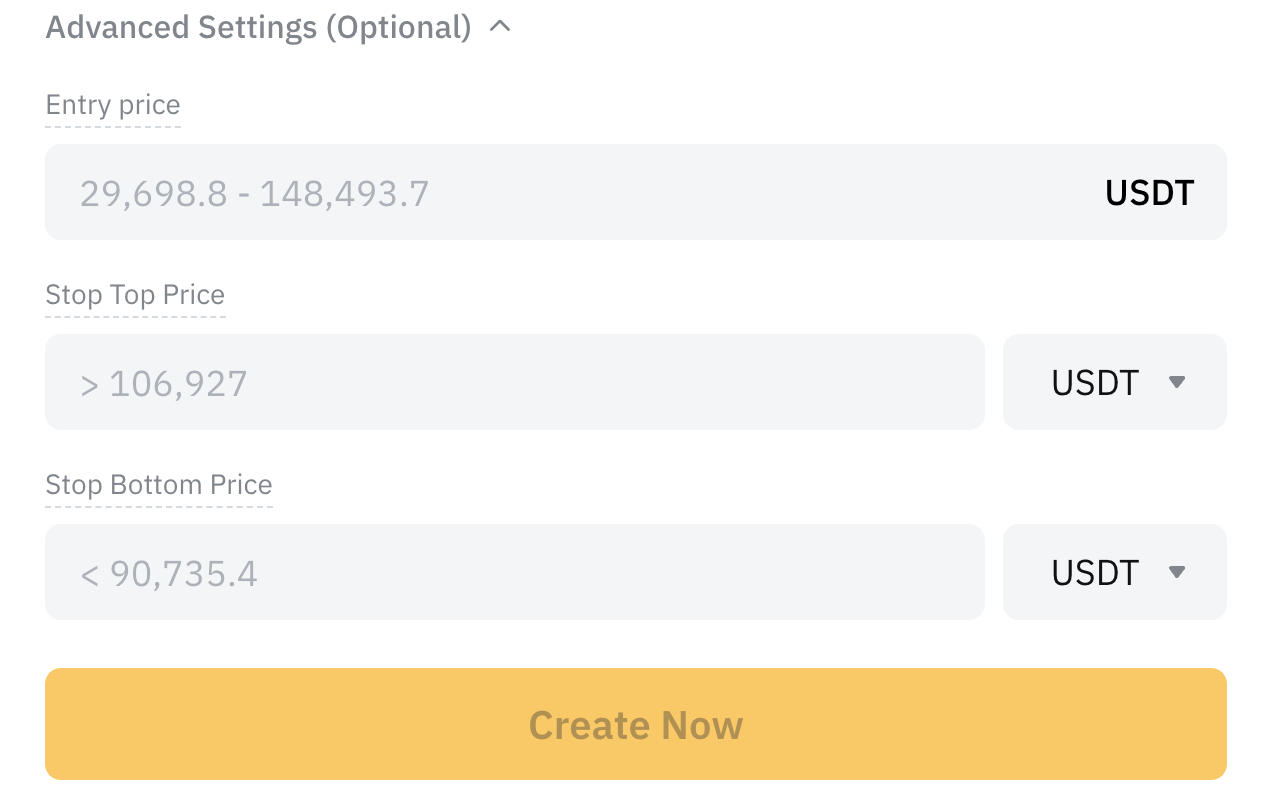

The Bybit Futures Grid Bot also has customization options under Advanced Settings (Optional) that allow you to configure and automate your trades according to your Entry Price, Stop Top Price (Take Profit) and Stop Bottom Price (Stop Loss).

Bybit provides automatic alerts for margins when a bot is running out of your price range, as well as for when your SL/TP triggers. You can create and manage up to 50 Futures Grid Bots simultaneously.

Other than the Bybit Futures Grid Bot, beginning and experienced traders alike can take advantage of other bots offered by Bybit, such as Futures Combo, Futures Martingale and Spot Grid Bot.

Interested in beginning futures trading with Bybit? Get started by signing up for a Bybit account and creating your first Futures Grid Bot.

Pionex

Pionex provides its users with 16 free built-in trading bots that cater to different risk appetites. Notably, Pionex charges a standard maker-taker fee of 0.1% on all Leveraged trades. In addition, it offers a Leveraged Grid Bot. However, the amount of leverage available is variable, based on several factors.

Bitsgap

Bitsgap is a fee-based futures grid trading bot. The three available plans are Basic, Advanced and Pro, with prices ranging from $23 to $119 per month. The plan you select places a limit on the number of active grid bots available to you, with a maximum of 20 for the most advanced and expensive plan. A free trial is available for seven days. The platform is available exclusively via desktop, with no mobile app. Using the desktop platform, you can configure settings, track bot activity and manage your account.

Binance

Binance offers grid trading bots for futures and spot trades. It features an easy account setup process, and its bots are available without cost. This platform works with more than 600 popular cryptocurrencies. While this platform offers high leverage for futures automated trading activities, it’s important to note that there are greater risks with higher leverage. Because of this, only experienced futures traders should use this feature.

KuCoin

KuCoin cryptocurrency exchange offers traders several pairing options and five grid trading bots, including a futures grid trading bot and a spot grid trading bot. While the futures grid trading bots are available without cost, there is a maker fee of 0.02% and a taker fee of 0.06% that can eat into your profits. A limited amount of leverage is available, which varies by trading pair.

BingX

BingX provides its users with both a futures bot and a spot grid bot. It delivers an easy-to-use interface for trades, and a more complicated candlestick chart. Numerous trading pairs are available. However, be aware that new users are subject to a protection period, during which a limit of 10,000 USDT will be enforced on some pairs..

BingX charges a range of fees to its users, including withdrawal fees, conversion fees, standard futures trading fees and perpetual futures trading fees. The maximum leverage available for cryptocurrency trading is 50x, but this varies considerably based on the pairs.

3Commas

3Commas is a trading bot that offers three paid plans, as well as accessibility on both a mobile app and a web-based platform. The Pro plan has a reasonable annual fee of $49.50 and places no limits on grid bots, options bots or DCA bots. There’s also a free plan available that offers only one grid trading bot.

Trading strategies are customizable, based on 20 indicators. The platform supports trades on 18 exchanges. When a trade is completed, a notification is automatically sent to the user. While there is an annual fee, there are no commissions. Leverage is available only up to 3x.

HAL

HAL — previously known as Napbots — supports activities on Kraken, Binance and other popular platforms, and is only accessible via its website. A free trial is offered for the first 15 days. After that, investors are required to pay a monthly $19.50 fee to continue using HAL’s trading bots. It’s important to note that HAL only allows users to trade up to $100,000.

Coinrule

Coinrule provides traders with several paid plans, as well as a free option. The free plan for its crypto grid trading bots offers seven template strategies. The most advanced paid plan, on the other hand, has unlimited template strategies, charting options and tutorials, and is available for roughly $450 per year. This platform currently supports the customization of more than 150 templates, and more will be added soon. Twelve exchanges are supported. In addition, the amount of leverage depends upon the pairings.

Are Futures Grid Trading Bots Worth Trying?

While trading can be highly lucrative, it comes with several risks and challenges. For example, it requires traders to constantly keep an eye on the markets, and crypto markets (unlike traditional financial markets) are open 24 hours a day, every day of the year. Calculations must constantly be made. In addition, emotions can pull traders away from their strategies.

Futures grid trading bots can be customized to automatically execute your trading strategy. They monitor the market and act automatically, based on the predetermined triggers that are in place. In this way, they eliminate emotion from the equation. They also obviate the need to constantly monitor markets and make complicated calculations.

While it’s clear that futures grid trading bots are beneficial, the specific features of bots can vary, and will impact these benefits. Bybit is widely regarded as the best overall platform for both beginning and experienced traders. It has an easy-to-use interface on both its mobile app and desktop platform. With everything from spot grid trading and 20x leverage, to three trading modes, automated alerts and more, Bybit is a platform worth trying. Furthermore, if you ever face any issues, you can always rely on Bybit’s 24/7 live customer support for assistance.

To get started with futures trading today, sign up for your Bybit account and create your first Bybit Futures Grid Bot.

The Bottom Line

Automated trading using futures grid trading bots offers extensive benefits. While all trading activities come with risks, trading bots reduce the risks — and could yield greater profits. If you’ve been looking for a better way to manage cryptocurrency trades, it could be worth your while to try one of the top futures grid trading bots available today.

#LearnWithBybit