How to trade silver on Bybit TradFi

Silver, a precious metal that has often kept a lower profile in financial markets compared to gold, is currently drawing the utmost attention from investors. After surging to record highs above $80 per troy ounce on Dec 26, 2025, in just three days, silver has entered a sharp correction on Dec 29, 2025, with prices pulling back to around $70 as profit-taking hits momentum-driven trades.

While such dramatic moves can unsettle long-term holders, they often attract traders looking to capitalize on price swings across a wide range of silver-related instruments. Bybit offers you a convenient and flexible way to trade silver via our TradFi platform. You can use your crypto to buy and sell silver, gold and other commodities, stocks as contracts for difference (CFDs) and other traditional financial assets.

Key Takeaways:

After rallying to record highs above $80 per ounce on Dec 26, 2025, silver has pulled back sharply amid profit-taking, reinforcing its role as a highly volatile asset that can offer short-term trading opportunities.

Bybit gives you the flexibility to respond to rapidly changing market conditions via two CFD trading pairs on its TradFi platform: the US dollar–based XAGUSD and the Australian dollar-based XAGAUD.

Why silver is gaining attention in global markets

While a popular metal commodity, silver has traditionally attracted far less investor attention than gold, the king of safe-haven assets in times of market uncertainty or bear markets. However, the investment world is currently paying silver the kind of attention the metal has never seen before. After surging to fresh record highs above $80 per troy ounce, silver has entered a sharp pullback phase, with prices retracing to the low $70s as short-term profit-taking has hit momentum-driven trades.

Rather than signaling a breakdown in the silver story, this sudden reversal highlights exactly what makes silver attractive to traders: heightened volatility within a strong structural uptrend.

Several structural drivers continue to support silver’s longer-term outlook. First, gold's unrelenting growth over the past two years has driven the price of the precious yellow metal to historical highs, which had tilted the crucial gold-silver ratio in its favor. Secondly, the US government added silver to its list of critical minerals in early November 2025, while rising industrial demand is putting a squeeze on the worldwide silver supply.

Additionally, lower interest rates and a weak US dollar are strongly driving the demand for precious metals, including silver. While gold continues to enjoy the status of the ultimate value protector, silver is seen as its more volatile alternative, offering potentially higher return opportunities.

The recent pullback reflects positioning and profit-taking that can create short-term trading opportunities for active traders. Meanwhile, longer-term participants can continue to monitor silver’s evolving role as both a monetary and industrial asset.

Demand remains strong across a wide range of silver-related instruments, including silver futures, silver stocks, silver ETFs and silver CFDs. With elevated volatility expected to persist, silver continues to offer multiple trading opportunities across different strategies and time horizons as markets move toward 2026.

How to trade silver on Bybit TradFi (step-by-step Guide)

Bybit offers you a convenient and accessible way to buy silver on the Bybit TradFi platform using two silver trading pairs: XAGUSD and XAGAUD. The former is silver traded in US dollars, while the latter is Australian dollar–denominated silver. Both pairs offer you a way to gain exposure to the silver price as a CFD. This can help you speculate on the underlying market price of the metal and implement your silver trading strategy, without having to trade silver futures contracts or other silver instruments via commodity exchanges. This makes Bybit TradFi a highly flexible and affordable alternative for silver-trading enthusiasts.

To access XAGUSD and XAGAUD on Bybit TradFi, follow the steps below.

On website

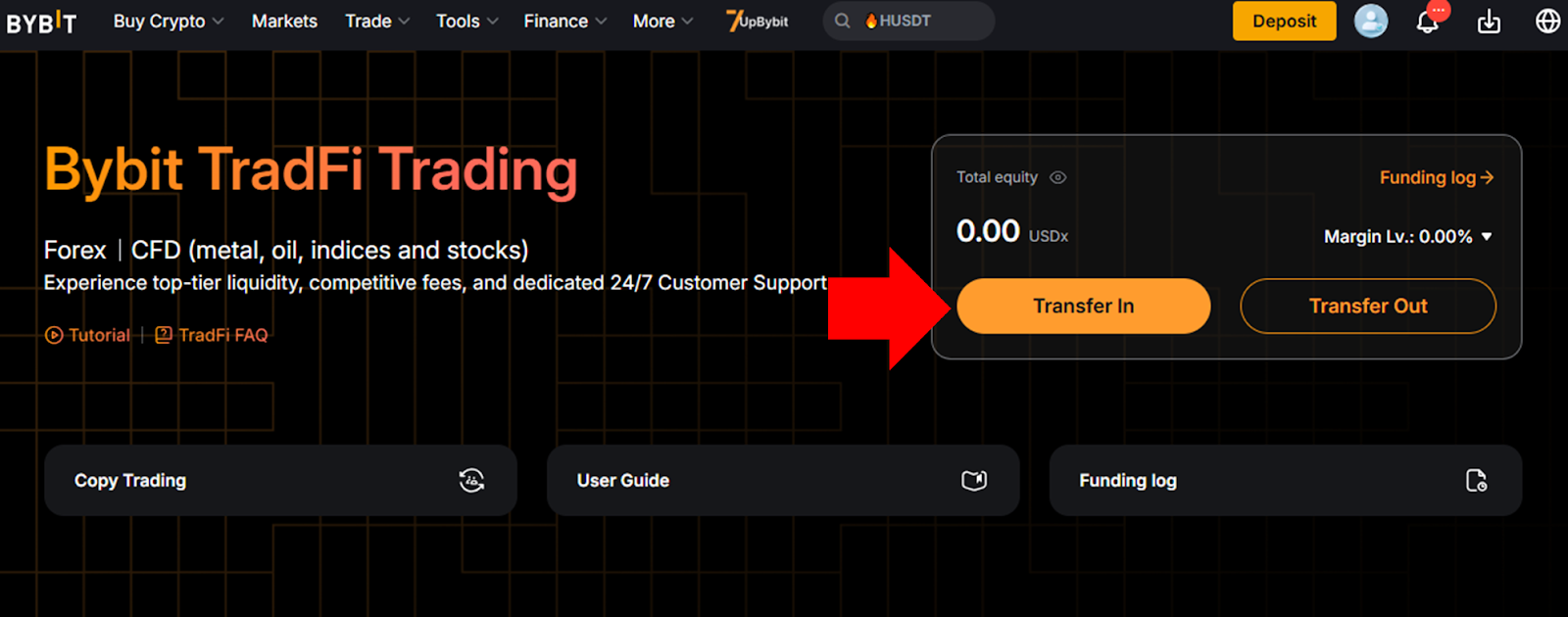

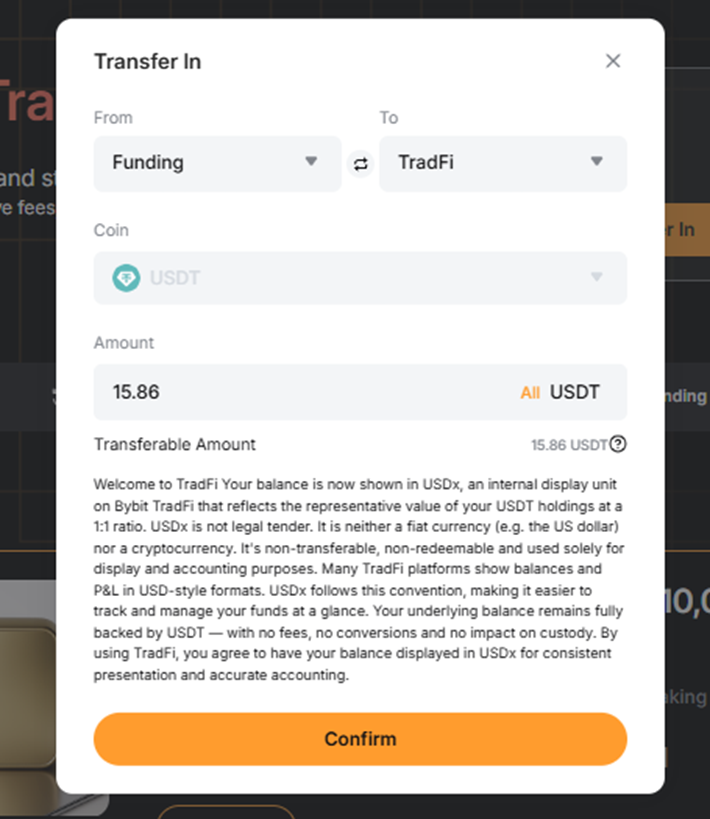

Step 1: Visit the Bybit TradFi page, log in to your account, click on the Transfer In button to transfer funds from your other Bybit accounts to your TradFi account and click on Confirm in the transfer dialog box. The transferred funds will be shown in USDx in your TradFi account, which is an internal display unit based on a 1:1 ratio with Tether (USDT).

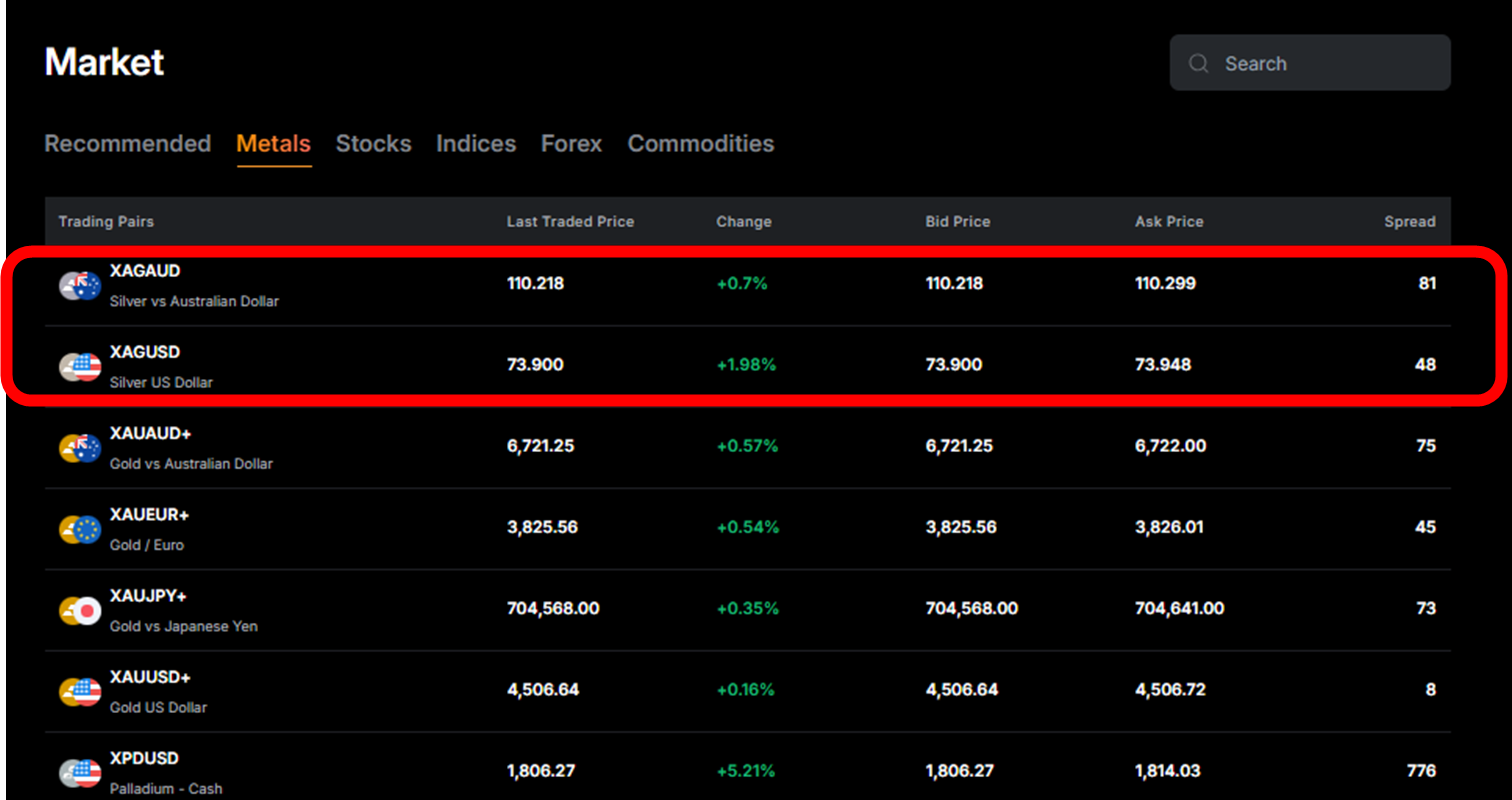

Step 2: Once your TradFi account is funded, on the TradFi page scroll down to the Market section, select the Metals tab and click on your preferred silver trading pair, XAGUSD or XAGAUD.

Step 3: In the trading screen's order pane (on the right), specify your order details (Buy or Sell, Value in USDx or Quantity in lots) and click on the Buy/Sell button to place your order.

On Bybit App

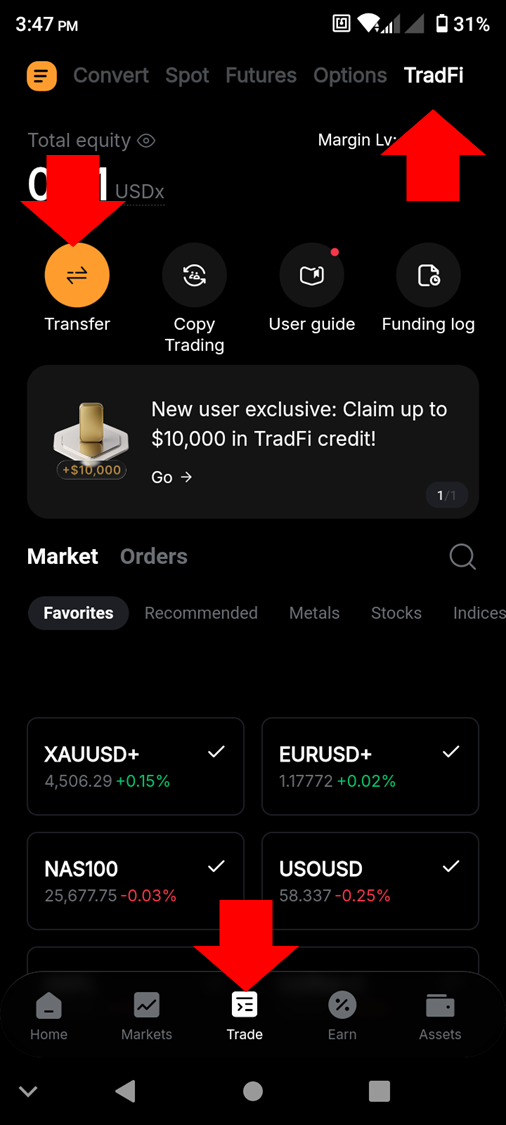

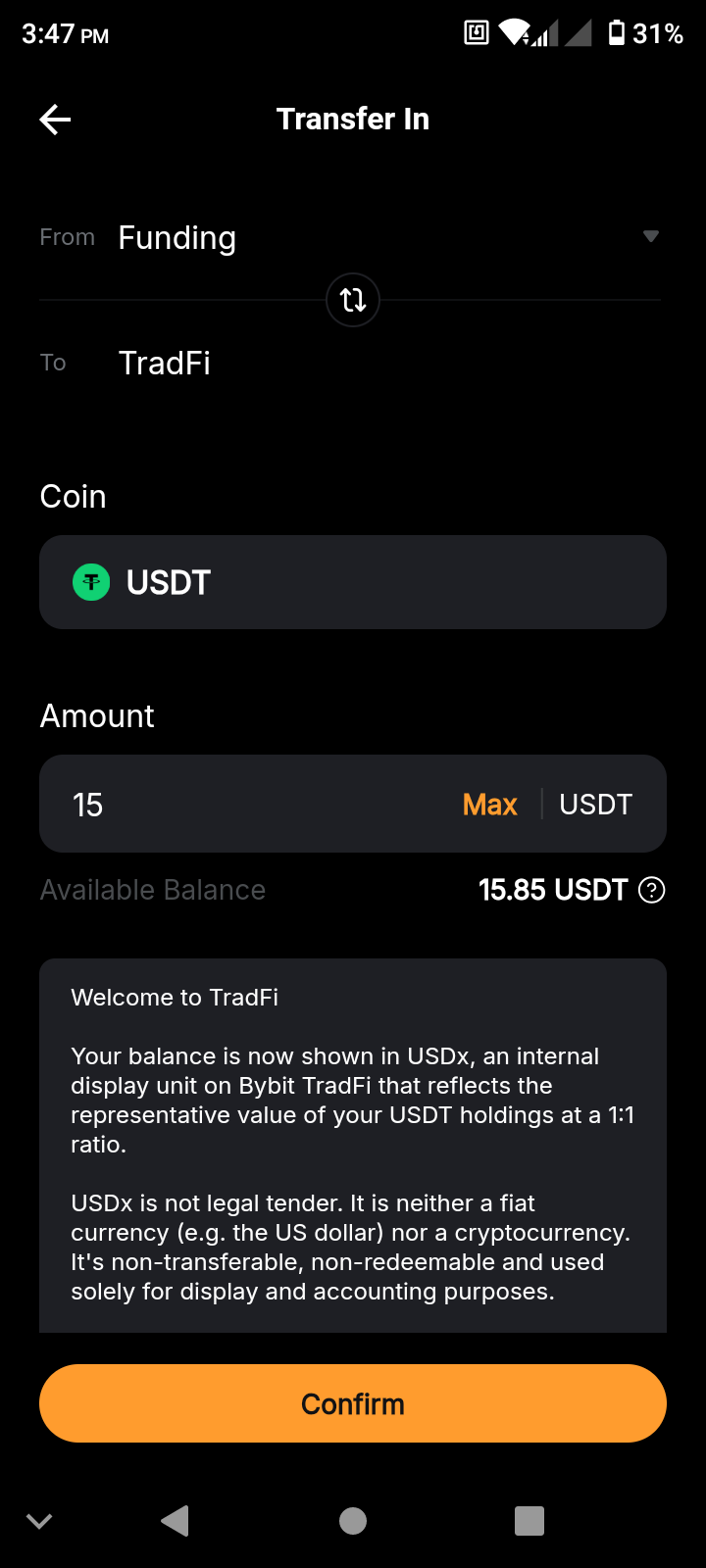

Step 1: Open the Bybit App, tap on Trade in the bottom menu, tap on TradFi in the top menu and then tap on Transfer to transfer funds to your TradFi account.

Step 2: Specify the amount you'd like to move to your TradFi account, and tap on Confirm.

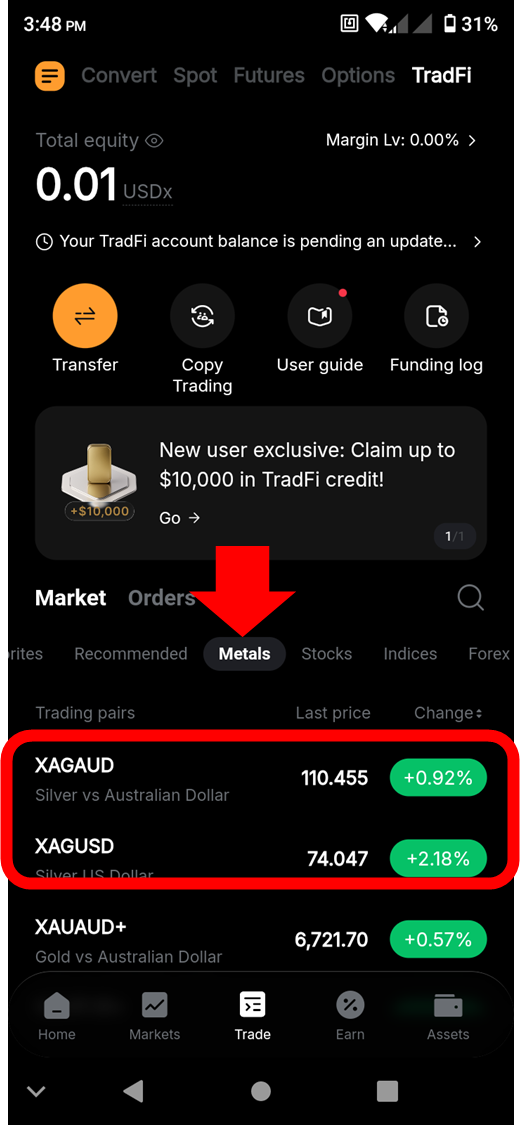

Step 3: In the TradFi screen's Market section at the bottom, tap on the Metals tab and then tap on your preferred silver pair, XAGUSD or XAGAUD.

Step 4: In the selected pair's trading screen, tap on the Buy or Sell button at the bottom.

Step 5: Specify the Order value in USDx or Quantity in lots, and tap on the Buy/Sell button at the bottom of the screen to place your order.

Why to trade silver on Bybit TradFi

What is Bybit TradFi?

Bybit TradFi offers you the opportunity to trade traditional asset classes, such as forex pairs, metals, other commodities, market indices and stocks in the form of CFDs directly on the platform using the USDT stablecoin as collateral. TradFi acts as a major bridge between crypto and the world of traditional finance (TradFi).

TradFi is extremely flexible and versatile. For instance, you don't need to buy physical silver or traditional silver futures to benefit from the asset's rise. Using the XAGUSD and XAGAUD pairs, you can track silver spot prices with CFDs.

Benefits of trading silver on Bybit TradFi

Trading CFDs based on silver via Bybit TradFi offers several distinct advantages:

The platform offers competitive fees and tight spreads, making it easier for you to achieve profitability.

TradFi also boasts deep liquidity and advanced charting tools to help you effectively analyze the market before making your trades.

Your crypto capital can directly be put to active use for silver trading, as moving funds between TradFi and your other Bybit accounts is easy, completely free and takes literally seconds to execute.

Bybit TradFi silver CFDs are also considerably more flexible than silver futures offered through commodity exchanges. Compared to traditional silver futures, TradFi's silver pairs offer benefits such as no expiration dates, easier long and short execution, much lower minimum capital requirements and 24/7 availability.

XAGUSD vs XAGAUD: Which silver pair should you trade?

Trading XAGUSD on Bybit

Trading XAGUSD (as opposed to XAGAUD) lets you take advantage of the deeper liquidity enjoyed by the pair and its USD macro exposure. The global liquidity for XAGUSD is also significantly higher, with the US dollar being the world's primary pricing currency for silver.

Deeper liquidity can be beneficial when trying to capitalize on smaller price movements. It can also be valuable if you need to try various strategies quickly — i.e., trend-trading strategies, range-trading strategies or other techniques — before deciding on a final long-term strategy for your silver trading.

Trading XAGAUD on Bybit

Though not a match for XAGUSD in terms of liquidity depth, XAGAUD can be an excellent choice if Asia-Pacific market cycles are of relevance for you, as the Australian dollar is tightly integrated into the vast region's market dynamics.

The AUD is also a classic "commodity currency," often experiencing sharp fluctuations in line with global commodity cycles. Usually, rising commodity prices help lift the AUD, while falling prices drag the currency down with them. With silver already retreating from recent highs amid heightened volatility, trading XAGAUD can help rebalance exposure. Moreover, if both silver and the AUD weaken during broader commodity corrections, price movements in the pair may help mitigate directional risk rather than magnify losses.

Risks of trading silver CFDs

Naturally, there are certain risks involved in trading silver CFDs. One of these is the historically higher volatility of silver when compared to gold, as evident in the recent sharp pullback. This volatility is one reason why some traders choose silver over gold, hoping for greater returns when the metals market is buoyant. However, the same volatility also means that there are greater downside risks in trading silver.

Additionally, if you trade on leverage, there's always the risk of magnified losses and margin call or margin wipeout.

To mitigate these risks, it's crucial to take proactive steps, such as setting stop-loss orders and carefully managing position sizes. Stop-loss orders allow you to specify a certain price level at which your silver position will automatically be sold. These orders are typically used to limit losses. Position sizing is based on estimating the amount of risk you’re willing to take with each trade and limiting your individual orders accordingly.

Closing thoughts

Silver has just experienced one of its most volatile phases in recent history, surging to record highs before pulling back sharply as traders locked in profits. Rather than ending the story, however, the recent correction has reinforced silver’s reputation as a highly dynamic asset that can offer both risk and opportunity across different market conditions. Bybit TradFi offers you a highly flexible, versatile and affordable way to respond to silver's rising and falling prices through the XAGUSD and XAGAUD CFD-based trading pairs. As always, it's essential to conduct your own research, understand the risks involved and determine how silver can fit into your broader trading strategy.

#LearnWithBybit