Peer-to-Peer Blockchain Networks: The Rise of P2P Crypto Exchanges

Cryptocurrency is an exploding asset around the globe, with an estimated 300 million users worldwide. The most popular crypto, Bitcoin, was created to exchange value anonymously and directly among users with a peer-to-peer (P2P) transaction model that eliminates the need for a central intermediary such as a bank or broker. This P2P model laid the foundation for the peer-to-peer blockchain technology which powers Bitcoin — and all cryptocurrencies.

In this article, we’ll explain the mechanism of peer-to-peer networks, their incorporation into crypto exchanges, and the peer-to-peer blockchain technology that’s revolutionizing the crypto domain.

What Is a P2P Network?

The term P2P refers to decentralized networks of interconnected computer systems containing peers, or nodes. All nodes are equal, and the exchange of data occurs without a central server — that is, each computer or node can act as both a file server and a client. For example, when acting as a client, a node downloads data from other participants; and when it’s acting as a server, it can be a downloading source.

Put simply, the peers or participating computer systems can simultaneously consume and provide resources on the same network. These resources can be files, storage, access to a scanner or printer, or processing power. There is no centralized authority, and no single point of failure. All interconnected nodes can engage in storing, distributing and uploading files. Transactions are peer-to-peer — P2P — meaning that they take place directly between the two parties involved, sans intermediary.

How Does P2P Work?

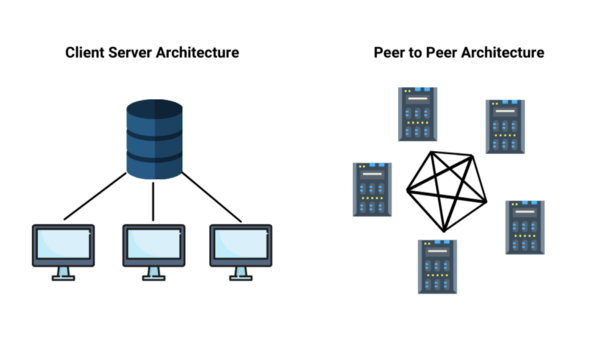

Each node in a network shares files with every other node without going through a central authority or administrator. As mentioned, nodes play the dual roles of client and server to other nodes on the network. P2P networks differ from traditional client/server networks, where clients request specific resources from central servers.

Client-Server vs. Peer-to-Peer Network

In 1979, Duke University graduate students Jim Ellis and Tom Truscott built the Usenet, the earliest implementation of a P2P network. The Usenet is a communication system that allows users to share messages and news amongst themselves without a central server or administrator. It was developed as an alternative to the U.S. military-owned ARPANET, the earliest version of the internet as we know it today. Its usage was limited to the academic community and early computer hobbyists.

It wasn’t until 1999, when Shawn Fanning developed Napster, that P2P networks went mainstream. Napster was a peer-to-peer sharing network that allowed users to share and download music files. It took the entertainment industry by storm, exploding in popularity. By 2000, it had amassed over 20 million users.

However, the music industry didn’t take kindly to Napster’s disruptive, royalty-free model, and started a series of lawsuits and campaigns that led to regulators shutting it down in 2001. Nevertheless, Napster opened the door to similar file-sharing P2P networks such as LimeWire, Kazaa, Morpheus Gnutella and BitTorrent, which flourished in the 2000s.

From file-sharing networks, the P2P model progressed to a revolutionary application in transferring value using peer-to-peer blockchain technology. The pseudonymous Satoshi Nakamoto launched Bitcoin in 2009, heralding a new era of cryptocurrencies. Bitcoin became the face of a new class of P2P use cases.

As opposed to other P2P systems in which immutability isn’t a priority, Satoshi wanted to introduce a system of nodes that would store a linked and ever-growing transaction record that cannot be altered or revised. P2P networks are the fundamental framework of the peer-to-peer blockchain technology that makes cryptocurrencies possible. Their decentralized architecture is secure and eliminates the need for third-party intermediaries.

Types of P2P Networks

There are three types of P2P networks, categorized by their architecture: Unstructured, structured, and hybrid P2P.

Structured Networks

Structured P2P networks are organized in such a way that each node can search and locate resources, even the scarcest files. They mostly use a distributed hash table, which ties each file to a specific peer. This makes it easy for participating nodes to retrieve values assigned to a key.

However, this efficiency comes at a cost. Structured networks demand that nodes memorize a list of neighbors that fulfill specific criteria. This lack of flexibility makes them less effective in networks with high churn rates.

Unstructured Networks

Unstructured networks are the easiest type of P2P to set up and are more common. The nodes in an unstructured network are connected randomly, with no structures imposed on them. This makes local optimization possible. Since all the nodes perform the same function, unstructured networks are robust and can withstand high churn rates — high frequency of peers leaving and joining the P2P network.

On the downside, the unstructured nature makes finding and retrieving less common files challenging. The requesting peer has to flood the network with the search query to find as many peers as possible that have the desired file. The flooding uses up a lot of memory, and since each peer is not assigned a specific content, there’s no guarantee that the flooding will find the desired file.

Hybrid Network

Hybrid P2P models combine the traditional client/server and peer-to-peer models. Typically, a hybrid model consists of a central server which provides centralized structured server/client functionality, such as helping nodes find each other and the decentralized aggregation provided by the node equality of a pure, unstructured peer-to-peer network.

Hybrid P2P models usually perform better, since they combine the best of both structured and unstructured peer-to-peer networks.

Example of P2P in Blockchain

As the fundamental element of blockchain technology, P2P architecture manages cryptocurrency transactions. Cryptocurrencies leverage the power of peer-to-peer blockchain technology, as they can be exchanged or transferred without the help of any central body.

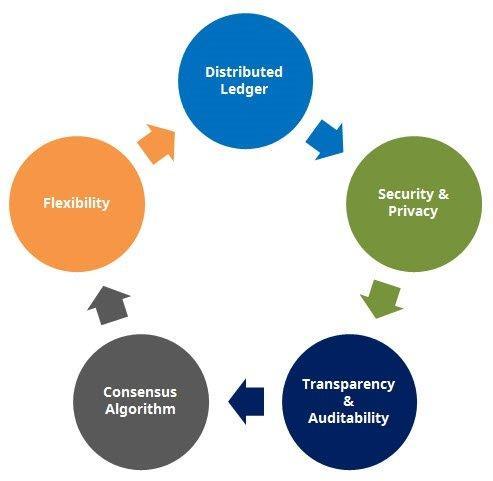

A blockchain is a distributed ledger technology which publicly and permanently stores transactions. New “blocks” containing transaction data are continuously linked to the previously filled blocks, forming a chain of data blocks — hence, a blockchain. The blockchain records transactions immutably in digital blocks that contain time-stamped particulars of senders and receivers. With no central authority managing the network, only participating nodes can validate transactions among each other.

When the individual (or group) known as Satoshi Nakamoto developed Bitcoin in 2008, they envisioned creating a “peer-to-peer electronic cash system” (see title of original white paper) that operates in a trustless manner without an intermediary. P2P networks are a key component of blockchain technology, because they support a decentralized ledger of transactions. The system is “trustless,” in that the network’s architecture in itself guarantees the integrity of the transactions.

Here’s where the peer-to-peer blockchain’s basic decentralized conception comes into play. These chains aren’t kept at a centralized location or regulatory server, but are instead dispersed to all the nodes present in the network (even around the globe). As a result, each node holds a copy of the blockchain (and transaction information), thus securing and validating data stored on the network.

Blockchain Features

Perhaps you’re wondering how a node can be set up for participating in the process. Basically, anyone can participate in the validation procedure by establishing a node. However, a few computational requirements must be met. In the case of Bitcoin, you can set up a node by installing Bitcoin Core software and downloading all of the BTC blockchain data.

This makes the blockchain transparent, egalitarian and democratic. It also ensures that no single person or entity can control the blockchain. This is in contrast to traditional centralized databases, in which a single entity controls all of the data— think Google, Visa or a governmental body. Thus, blockchain technology has the potential to revolutionize how we do business and interact with each other.

One important note is that miners — the nodes who validate the Bitcoin transactions — get rewards for helping to maintain the crypto ecosystem. These nodes are vital, as they authenticate the legitimacy of the distributed ledger and ensure the network’s security.

Peer-to-peer blockchain technology has spawned several applications, most notably cryptocurrencies, with Bitcoin being the most popular. Blockchain also supports finance, gaming, non-fungible tokens, and data applications. Although blockchain technology is still evolving, businesses are exploring ways in which a decentralized and publicly shared ledger system can enhance their operations.

Benefits and Limitations of P2P Networks

P2P networks have transformed file and data sharing services, offering enhanced censorship resistance and efficient transactions. In contrast to client/server networks, where clients request information from centralized servers, P2P networks allow nodes to communicate directly with one another. This decentralized design results in several benefits, including improved network efficiency, resilience to failure, and privacy. However, P2P networks also have several limitations that must be considered when designing or using them.

Benefits of P2P Networks:

- Improved network efficiency: In P2P networks, each node participates in the routing and forwarding of data. This can improve network efficiency, as there’s no need for dedicated routers or servers.

- Resilience to failure: P2P networks are more resilient to failure than centralized networks, as the loss of a single node doesn’t cripple the entire network.

- Privacy: P2P networks are often viewed as more privacy-friendly than centralized networks, as there’s no need for a central authority to store or access user data.

- Scalability: P2P networks are designed to be scalable. Each node or peer can be a server, preventing bottlenecks encountered in centralized systems when the number of clients increases. With a P2P network, an increase in the number of clients means an equal increase in the number of servers.

- Cost: P2P networks are considerably cost-effective, as costs don’t aggregate around a centralized authority but are instead distributed. In addition, these networks are highly scalable and efficient, due to the multiple roles of every node.

- : This fundamental consensus aspect of peer-to-peer blockchains lessens the risk of data amendment or alteration.

Limitations of P2P Networks:

- Slower speeds: P2P networks are often slower than centralized networks, due to the increased number of hops (movements of a packet of data from one network segment to the next) required to reach all nodes.

- More difficult to manage: Managing P2P networks can be more challenging than centralized networks because there’s no central authority responsible for network operations. For example, P2P networks could become vulnerable to malware attacks if viruses permeate the system from numerous nodes. Moreover, the decentralized framework makes the monitoring or controlling of prohibited activities and illegal transactions more difficult.

- Computational power: In the context of proof of work (PoW) blockchains, the massive computational power required for updating information on some networks is a cause for environmental concern.

When examining the benefits and limitations of P2P networks, it’s essential to consider the specific use case for which a network will be used. P2P networks can be useful tools for improved network efficiency, resilience to failure, and scalability — but centralized networks offer greater benefits in some instances.

What Are P2P Crypto Exchanges?

P2P crypto exchanges are decentralized platforms which allow crypto sellers and buyers to trade without involving a third party. In contrast to the “order book” methodology of regular crypto exchanges, P2P exchanges use well-established software to facilitate direct transactions between buyers and sellers.

P2P crypto exchanges list the various buy and sell offers posted by the relevant parties. If you’re a buyer, you can opt for a seller with conditions that match your requirements. Usually, sellers offer different minimum/maximum transaction amounts, payment methods and currency rates. In such decentralized exchanges, users are in charge of their transactions, and can deal with buying/selling parties without the involvement of any central authority. Security features are therefore extremely important.

The majority of P2P crypto exchanges implement an escrow payment system to guarantee the safety of funds. In addition, know your customer (KYC) user verification prevents scams or fraudulent activities on crypto exchanges. The incorporation of additional features, such as two-factor authentication and SSL protocols, also indicates a platform’s viability.

Why Trade Crypto P2P?

P2P crypto exchanges have a few main advantages. For example, they’re an upgraded version of traditional marketplaces and operate without any intervention from a middle party. In turn, participants can exercise more authority over their buy/sell transactions and select the party to transact with, based on perceived suitability.

Using a P2P crypto exchange is typically cheaper than centralized platforms. The prime reason is the decentralized framework of P2P networks, which don’t require any payments made to custodians or third parties.

In addition, P2P platforms don’t hold any user funds for conducting transactions, thus providing a more secure trading environment. The use of escrow arrangements to hold funds until conditions are met further prevents fraudulent activities.

Another important factor is that P2P crypto exchanges are open platforms, free from government interventions and regulatory actions. If you reside in a country with cryptocurrency restrictions, P2P crypto exchanges can be a way to trade your assets.

However, P2P traders can face some challenges, including uncertainty of trades and liquidity issues. A concerned buyer or seller might change their mind in the middle of dealing, posing unnecessary problems. Low liquidity on some exchanges can significantly delay transactions. That being said, some exchanges are even providing P2P marketplaces that have zero transaction fees.

Bybit’s newly launched P2P service is such a venture. It requires no exchange fees and has no hidden charges. The service provides more than 80 payment methods, which is convenient for most individuals. Bybit’s P2P service also implements an escrow system for trading parties to ensure the safe completion of their transactions.

P2P Marketplaces vs. OTC Exchanges

OTC crypto trading refers to the buying and selling of cryptocurrencies outside of standard exchange platforms. It involves a centralized broker-dealer who negotiates trades between the buying and selling parties.

Generally, OTC trading is utilized for significantly larger trades to avoid slippage, which is essentially when your execution price differs from expectation. Slippage occurs frequently with volatile cryptocurrencies. Another reason to use OTC trading is the privacy and anonymity it provides. The broker eliminates the need for direct interaction between the trading parties, which can help guard their identities. However, it can lead to other problems, such as reduced transparency and risky regulation.

In contrast, P2P marketplaces provide a fast, decentralized platform for direct exchange between buyers and sellers. Peer-to-peer blockchain dealings involve no broker, and have no lengthy negotiation procedures, as with OTC trading.

Moreover, peer-to-peer blockchain networks allow the trading parties direct control over their transactions, giving them the ability to choose sellers or buyers according to their preference. Additionally, the trades are completed quickly with lower transaction fees than OTC trades.

Among the various uses of peer-to-peer blockchain networks, cryptocurrencies have gained immense popularity due to their transaction capabilities in the financial world. The “distribution and decentralization” idea of P2P networking was the driving force behind the development of both cryptocurrencies and decentralized exchanges (DEXs).

The primary aim was to remove any reliance on central authorities and create a transparent network with open-source ledgers. Moreover, crypto networks enjoy greater security and resilience towards malicious attacks. Finally, P2P marketplaces cut out the middlemen that OTC exchanges still use.

The Bottom Line

Thanks to its reliable, decentralized and secure framework, P2P has become the underlying technology of many services and applications. Nowadays, P2P networks are utilized in file-sharing applications, online marketplaces and open-source software.

Cryptocurrencies and their distributed ledger technology are landmark illustrations of the P2P model, providing incredible security and enhanced transparency in the financial sphere. These developments have reached the next step with the advent of P2P crypto exchanges that have truly transformed the crypto space into a decentralized network by utilizing peer-to-peer blockchain technology.