Maximizing Benefits With Bybit Liquidity Mining

The concept of liquidity mining has transformed the landscape of cryptocurrency investments, introducing a method for participants to generate returns by providing liquidity to trading pools. Among these innovations, Bybit Liquidity Mining has emerged as a leading paradigm, offering a distinct approach that leverages the benefits of liquidity pools based on the automated market maker (AMM) model. This article aims to explore the unique advantages of Bybit Liquidity Mining, providing insights into how it stands apart from conventional crypto investment strategies and highlighting its suitability for both volatile markets and diverse investment portfolios.

Key Takeaways:

Bybit Liquidity Mining is an innovative investment avenue within the centralized finance ecosystem. It enables participants to contribute liquidity to pools governed by the AMM model, and offers the unique benefit of up to 10x leverage, resulting in potential yield earnings in USDT.

The key advantages of Bybit Liquidity Mining include suitability for volatile markets, profit comparison with pure holding, and earnings and flexibility.

Explore Bybit Liquidity Mining and start leveraging its benefits on Bybit today.

What Is Bybit Liquidity Mining?

Bybit Liquidity Mining is an innovative investment avenue within the centralized finance (CeFi) ecosystem. It enables participants to contribute liquidity to pools governed by the AMM model, and offers the unique benefit of up to 10x leverage, resulting in potential yield earnings in USDT.

This model diverges from traditional decentralized finance (DeFi) liquidity mining by integrating leverage, which amplifies the potential returns (and risks) of providing liquidity. Participants (liquidity providers) contribute to the depth and stability of the market, facilitating smoother trades and earning from trading fees generated in the process. The leverage feature enhances appeal by potentially increasing your returns as compared to non-leveraged liquidity provision.

Key Advantages of Bybit Liquidity Mining

Bybit Liquidity Mining is designed with several key benefits that cater to the needs of modern crypto investors.

Suited for Volatile Markets

Crypto markets are notoriously volatile, presenting both challenges and opportunities. Bybit Liquidity Mining is designed with this volatility in mind, offering a strategic advantage for those looking to profit from market movements. By participating in liquidity mining, investors have the opportunity to earn consistent yields, which can be particularly advantageous in a market that doesn’t have a clear direction but is prone to rapid price changes.

Profit Comparison With Pure Holding

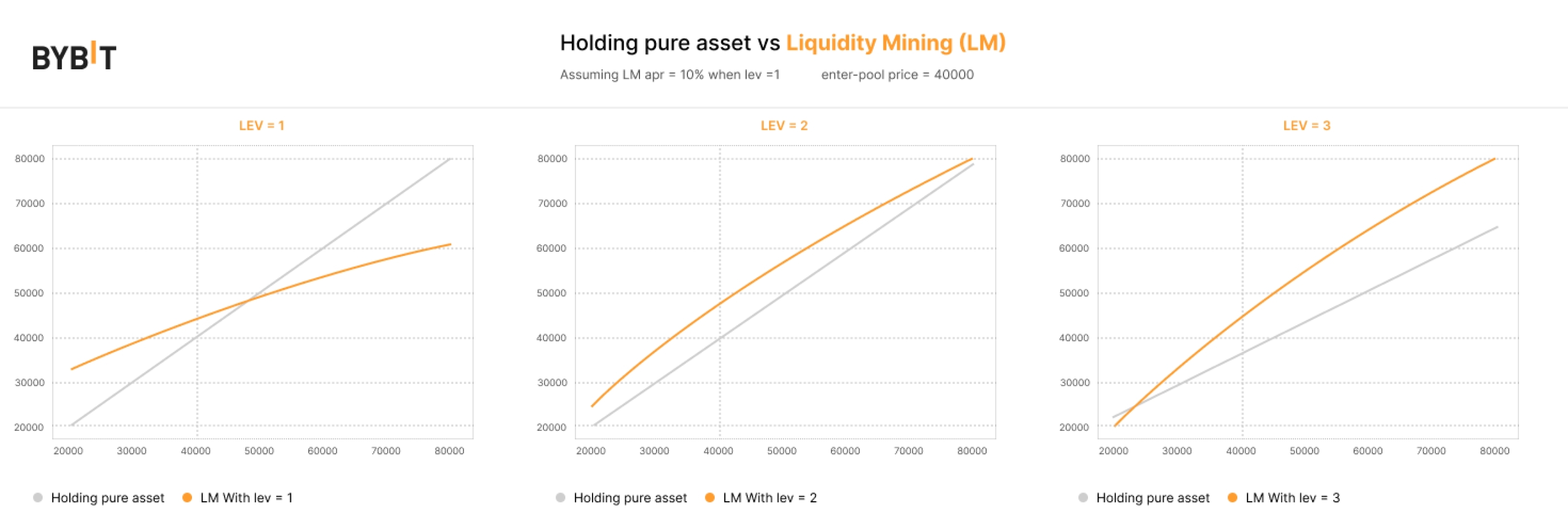

While the traditional strategy of holding cryptocurrencies can yield substantial long-term gains, Bybit Liquidity Mining proposes an alternative that can potentially lead to higher returns in the same market conditions.

For instance, leveraging a position not only diversifies your investment but also increases your exposure to potential price increases. Instead of holding 1 BTC valued at 40,000 USDT, you could use Bybit Liquidity Mining to diversify into a combination of 20,000 USDT and 0.5 BTC. This strategy not only reduces risk during market downturns by diversifying investments, but also leverages gains during market upswings, potentially leading to higher returns than pure holding.

Earnings and Flexibility

A notable feature of Bybit Liquidity Mining is the hourly earnings in USDT, which provides a consistent income stream. This aspect is particularly attractive for those seeking regular returns on their investments, offering a contrast with the more traditional, long-term hold strategy in which returns are realized upon selling the asset. The flexibility to reinvest or withdraw these earnings at any time enhances the liquidity of the investment, making it an appealing option for those seeking both income and flexibility in their investment strategies.

Understanding the Risks

While Bybit Liquidity Mining presents numerous advantages, it's crucial to acknowledge the inherent risks involved in any investment strategy.

Protection Against Downturns

Although liquidity mining can be profitable, it's important to recognize the risks, particularly in a downturn. Bybit Liquidity Mining offers a measure of protection against market downturns through its structure of hourly USDT yields. This consistent earning mechanism can provide a buffer that mitigates the impact of negative price movements, offering a more stable investment option as compared to trading strategies that are more volatile.

Risk of Liquidation

The introduction of leverage in Liquidity Mining amplifies not only potential returns but also risks, notably the risk of liquidation as your leverage increases. Hence, it is paramount to practise proper risk management in leveraged liquidity mining, as you could potentially lose your entire principal investment if your positions are liquidated.

Should You Use Bybit Liquidity Mining?

Considering the blend of benefits and risks, Bybit Liquidity Mining emerges as a versatile tool for both novices and veterans in the crypto trading space. It offers a unique combination of income generation, market participation and investment growth opportunities, balanced with a structured approach to risk management. For those intrigued by the dynamics of crypto markets who are looking to diversify their investment strategies beyond traditional holding, Bybit Liquidity Mining could provide a rewarding pathway.

The Bottom Line

Bybit Liquidity Mining represents a frontier in crypto investment strategies, offering a structured yet dynamic approach to earning in the cryptocurrency space. It balances the potential for high returns through leverage with mechanisms designed to mitigate the inherent risks of market volatility and liquidity provision. The crypto market continues to evolve, and Bybit Liquidity Mining offers a sophisticated option for investors aiming to navigate its complexities with a strategy that’s both innovative and grounded in risk management principles.

In the landscape of crypto investment, Bybit Liquidity Mining stands out as a testament to ongoing innovation, providing a compelling option for those looking to maximize their returns while engaging directly in the market's liquidity and dynamism.

#Bybit #TheCryptoArk