Bybit Spread Trading: Smart strategies for market swings

Whether markets are flying high or wobbling unpredictably, one thing remains true: traders are always looking for smarter ways to manage risk and find profit opportunities. That’s where Bybit Spread Trading comes in. This feature is tailor-made for those who want to go beyond basic buy/sell plays and start taking advantage of price discrepancies between related instruments. In this guide, we’ll walk through exactly how Bybit Spread Trading works, why it matters and how you can start using it today, whether you’re hedging exposure or chasing arbitrage gains.

Key Takeaways:

Bybit Spread Trading allows traders to simultaneously buy and sell two related instruments in order to hedge risk or profit from price discrepancies.

Spread Trading on Bybit currently supports various combinations, such as Spot and Perpetual, Spot and Expiration, Perpetual and Expiration or even two Expiration contracts with different dates.

What is Bybit Spread Trading?

Bybit Spread Trading is a newly launched Bybit feature that allows users to simultaneously buy and sell two related instruments — such as Spot, Perpetual or Expiry contracts with different settlement dates — in order to hedge risk or profit from price discrepancies.

This type of trading strategy is popular among institutional and professional traders because it enables more precise, controlled market exposure. However, with Bybit’s interface, the barrier to entry is significantly lowered, opening the door for individual traders to tap with just a few clicks into a powerful set of tools.

How does Bybit Spread Trading work?

At its core, Spread Trading on Bybit is about executing what’s called a combo trade. This means entering two positions at once: one long, one short. These positions are taken on related instruments, such as a BTC Spot trade and a BTC Perpetual contract, with the idea that their prices will either converge or diverge in a way that benefits your position.

There are two sides you can take:

When you place a buy combo, you’re buying the instrument with the longer expiration (the “far leg”) and selling the one that expires sooner (the “near leg”).

A sell combo is the reverse: selling the far leg and buying the near leg. The profit (or loss) comes from how the spread between these two instruments shifts over time.

For example, if you believe the spread between a Perpetual and a Quarterly Futures contract will widen, you can buy the combo. If the spread increases after your entry, that movement becomes your profit. Bybit calculates your entry and exit prices automatically, based on the mark prices and your defined “order price,” so there’s no need to manually crunch the numbers.

Perhaps the most important feature here is atomic execution. This ensures both sides of your combo trade are filled together, in equal quantities, or the trade doesn’t go through at all. It removes “leg risk,” which is the danger of getting filled on one side of the trade, but not the other. In volatile markets, that alone can save you from an unwanted mess.

Spread Trading on Bybit currently supports combinations such as Spot and Perpetual, Spot and Expiry, Perpetual and Expiry, or even two Expiry contracts with different dates. This flexibility lets you build strategies that align with different market outlooks — bullish, bearish or neutral.

Benefits of joining Bybit Spread Trading

There’s a strong reason why Spread Trading is a go-to for many experienced traders: it allows for strategic plays that are more sophisticated than just guessing price direction. On Bybit, it’s not only powerful, but also convenient.

First, you get price certainty. Your spread is locked in at the price you specify. There’s no slippage between legs because the entry prices are automatically calculated and matched. You’re trading the spread, not the individual legs.

Secondly, the trading experience is smoother. Instead of placing two separate orders and manually trying to sync them, Bybit handles everything as a single transaction. You don’t have to worry about whether one leg gets filled and the other doesn’t — that risk is eliminated through atomic execution.

Third, this setup is a great hedge against volatility. By taking opposing positions on two related contracts, you reduce exposure to sharp price movements. Your P&L becomes more about the relative performance between contracts, rather than the market direction itself.

There’s also a strong cost advantage. Trading spreads on Bybit is significantly cheaper than doing it manually. You pay only half the trading fees you’d incur if you placed two individual trades on the order book. For high-volume or high-frequency traders, that translates to meaningful savings over time.

Finally, it unlocks strategy flexibility. Whether you're arbitraging funding rates between Spot and Perpetual, doing calendar spreads with different Futures contracts or taking advantage of price convergence before expiry, this platform gives you the tools to execute those ideas efficiently.

How to get started with Bybit Spread Trading

Now that you have a better understanding of how Bybit Spread Trading works, let’s look into how to get started. Please note that you’ll need to have a Bybit account in order to proceed. If you don’t already have one, please check out our sign-up guide for more information on how to create a Bybit account.

How to place an order

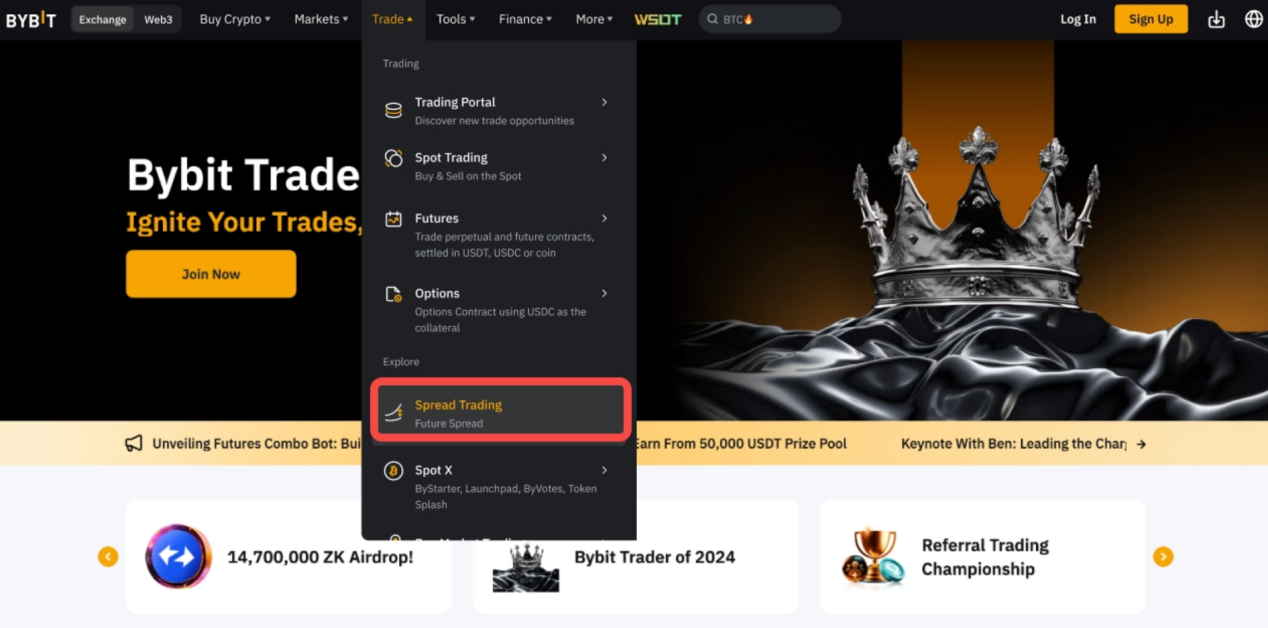

Step 1: Log in to your Bybit account and hover your cursor over the Trade tab. Then, click on Spread Trading.

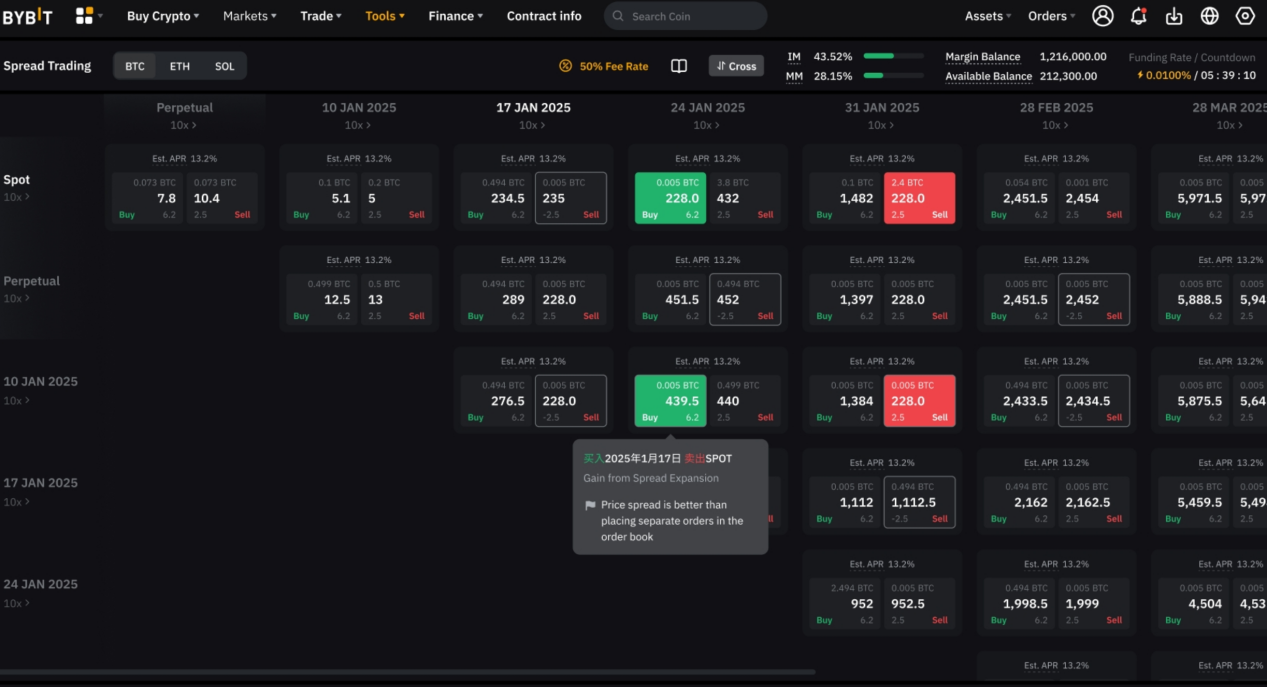

Step 2: The available spreads are organized in a grid, with each tile representing a unique combo. Choose your preferred combo to trade.

Tiles with a border around them signify that Spread Trading offers a better price. Hover over a tile for more details, or use the bar at the bottom of the grid to explore more options.

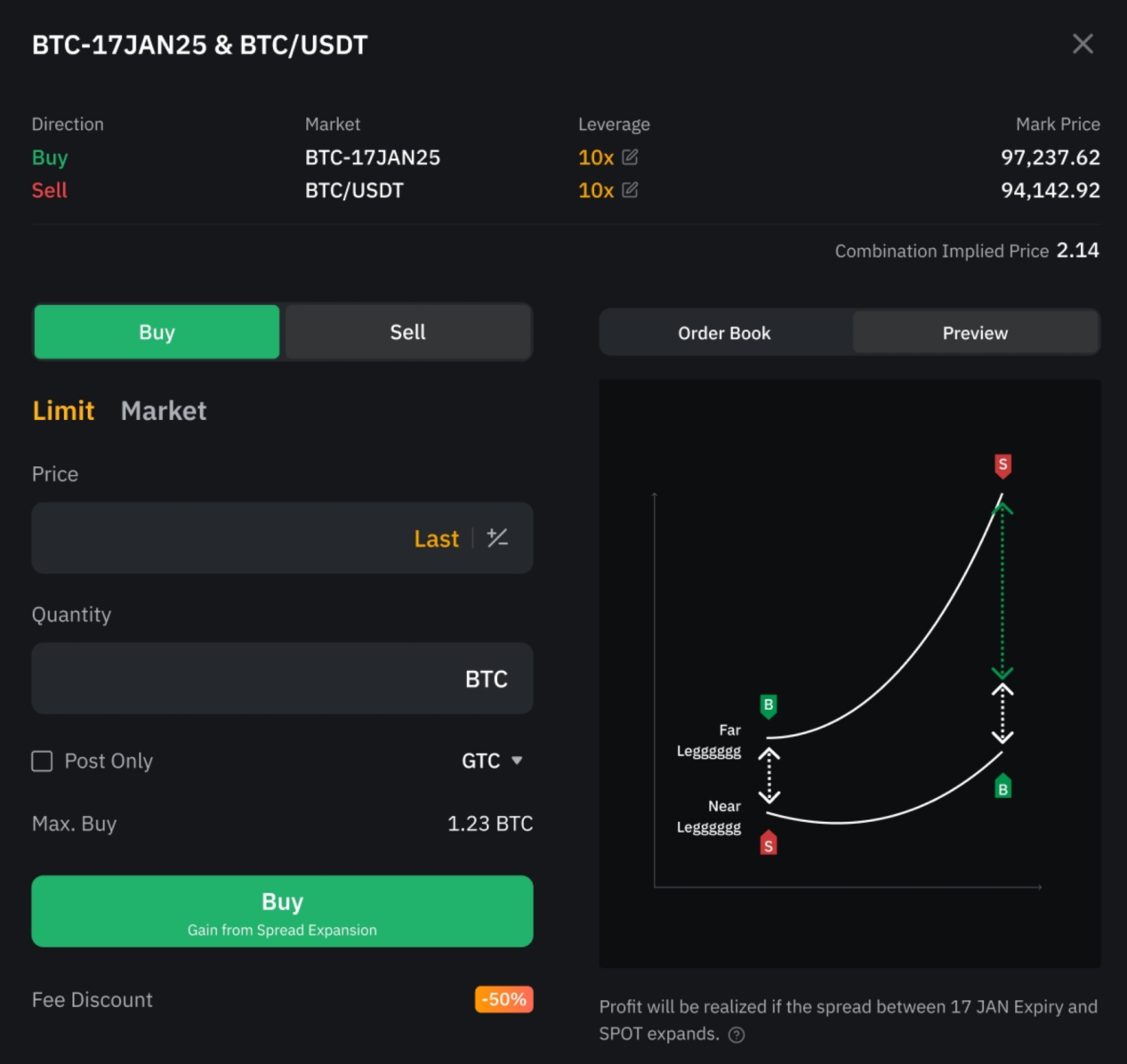

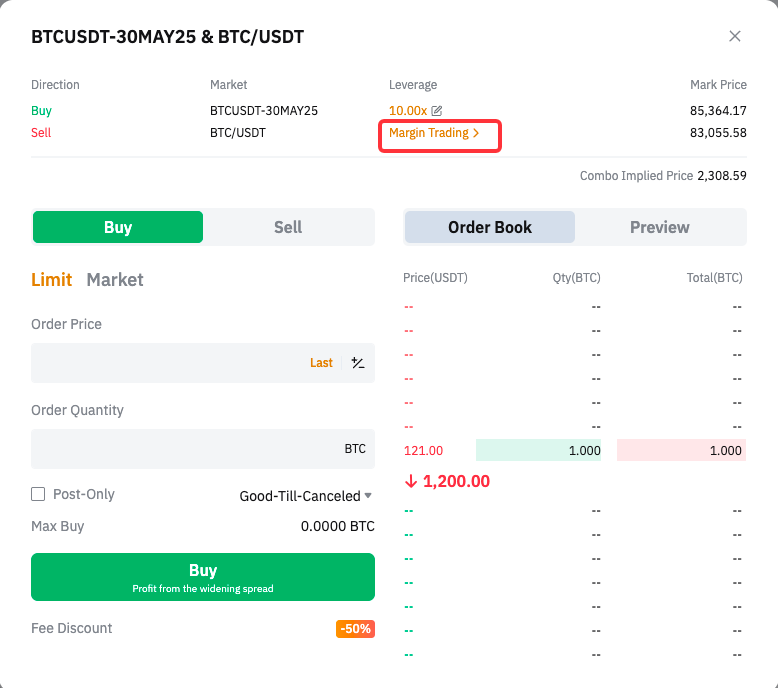

Step 3: On the order placement page, set up your order with the following parameters:

Direction: Choose Buy or Sell. The far leg shows the direction of the combo.

Order Type: Choose your preferred order type — Limit or Market order.

Price: Indicate the spread you would like to trade. This represents the difference between the entry prices of the two legs. Please note that this value can be positive, negative or zero.

Quantity: Set your combo size. A value of 1 means that each leg will have a quantity of 1 if the order is fully filled. Please note that partial fills may occur, but both legs are always filled in matching quantities, or not at all.

Max Buy/Sell: This refers to the maximum quantity you can trade, based on your available balance, considering both legs.

Leverage: Click on the pencil icon if you’d like to trade with leverage. You can trade up to 10x for Spot, and up to 100x for Futures.

Order Book: Spread Trading has its own independent order book, in which trades are executed against spreads, rather than against underlying assets.

Preview: This provides a visualization of the potential profit scenario.

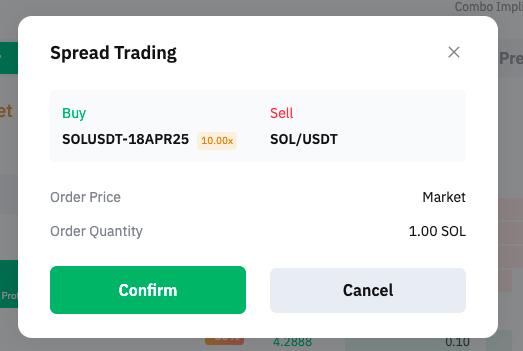

Step 4: Click on Buy or Sell to place your order. A pop-up window will appear for you to confirm your order details. Then, click on Confirm to proceed.

Congratulations — you’ve successfully placed an order!

Notes:

If a Perpetual contract is involved, the funding rate will be displayed on the order placement page to help you make more informed decisions.

If Spot trading is involved, leverage can only be set if Margin trading is enabled. You can enable or disable Margin trading from the Spot trading order zone.

How to view your Spread Trading order

You can view your Spread Trading orders from any trading page (Spread Trading, Spot and Futures), as they all share the same order data.

Active orders

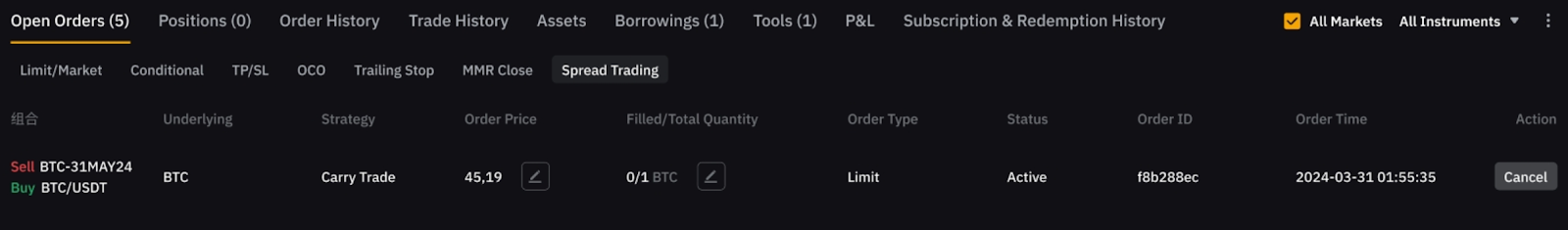

Under the Open Orders tab, click on Spread Trading to view your active orders. You’ll be able to view the combo, underlying asset, order price and more.

If you would like to adjust your order parameters, you may click on the pencil icon under Order Price or Filled/Total Quantity. To cancel your order, simply click on the order’s corresponding Cancel button.

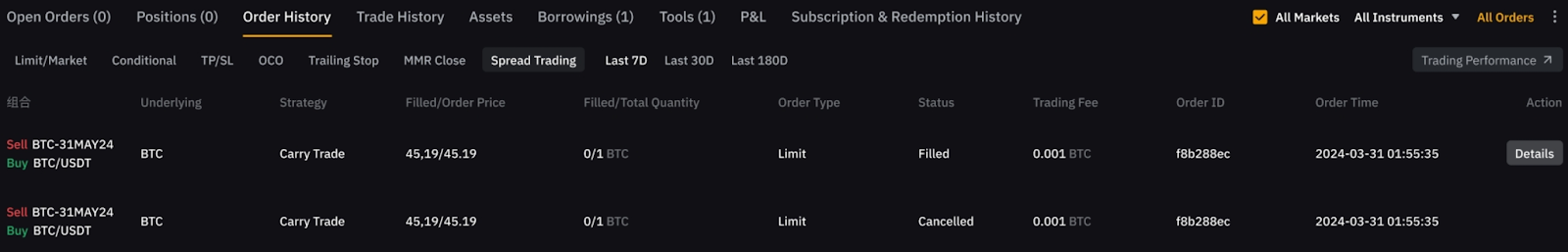

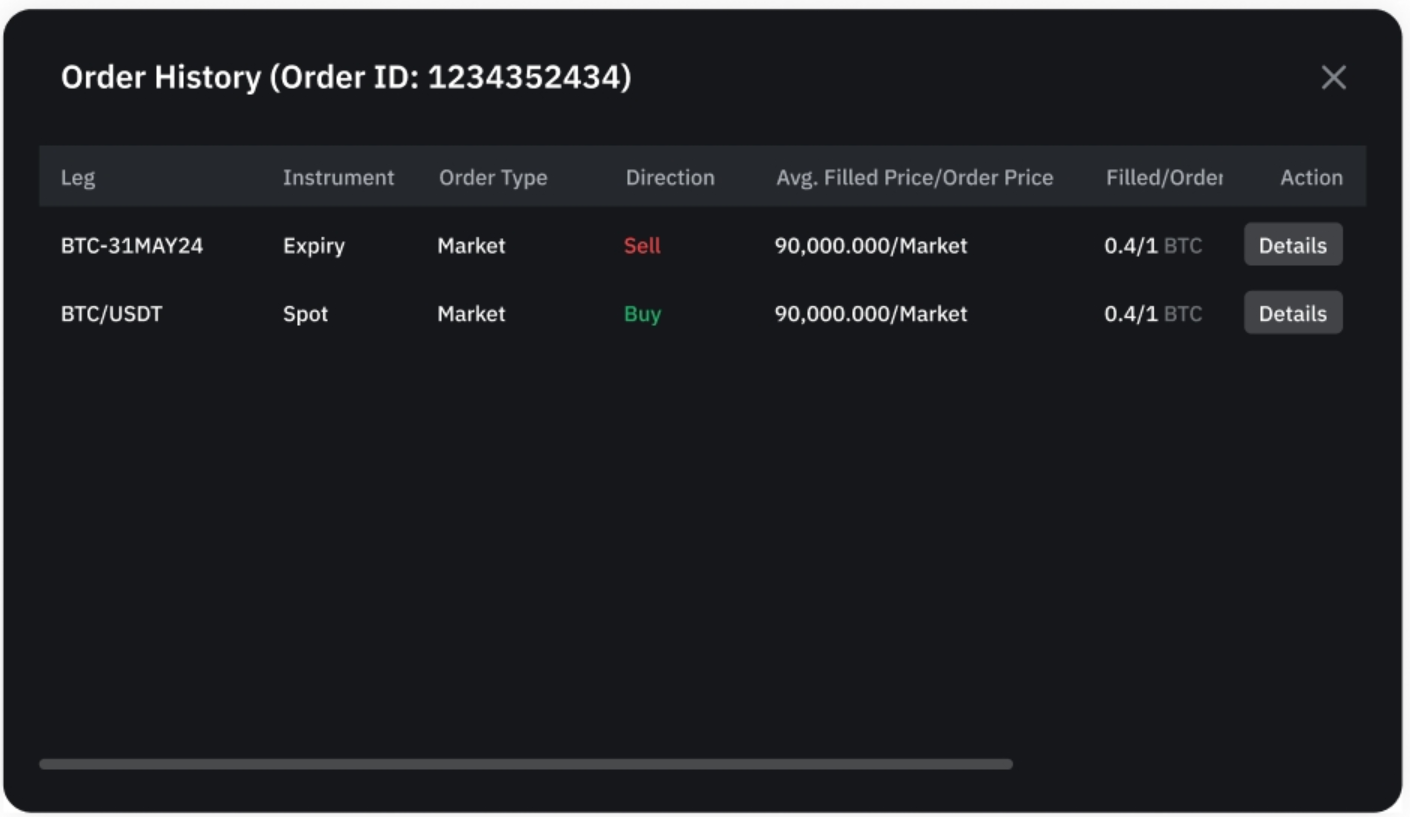

Completed orders

Under the Order History tab, click on Spread Trading to view your completed orders. To view each order’s information on each leg, click on the order’s corresponding Details button. For additional insights, click on Details.

Should you try Bybit Spread Trading?

Spread trading isn’t for everyone — but if you’re someone who enjoys strategic trading, hedging or arbitrage, it’s a tool worth adding to your arsenal. It appeals to traders who are less interested in taking a directional bet, and more focused on capitalizing on inefficiencies in the market.

You don’t have to be a pro trader to benefit, either. The simplified execution and intuitive UI mean even intermediate users can explore advanced strategies without being overwhelmed. As long as you understand how spreads work, and how your P&L is affected by their movement, you’re already halfway there.

More importantly, in times of market uncertainty or low volatility — when price action feels sluggish — spread trading gives you an alternative way to profit. It keeps you in the game — even when momentum plays aren’t cutting it.

The bottom line

Bybit Spread Trading is a powerful tool that combines simplicity with sophistication. Whether you're looking to hedge, save on fees or experiment with delta-neutral strategies, it offers a clean and user-friendly way to do so. With lower risk, lower costs and plenty of flexibility, Bybit Spread Trading is a smart move for any trader looking to level up their game — especially when markets get messy.

#LearnWithBybit