What is Bybit Spot Margin trading?

Spot trading enables you to buy and sell cryptocurrencies directly at market prices with immediate settlement. It provides a way to own the underlying crypto asset being traded, and is an excellent way for beginning traders to start their careers. Experienced traders who prefer the relatively lower-risk profile of Spot trading compared to Derivatives also use it extensively.

One key limitation of the standard Spot trading is the absence of leverage. This is where Bybit Spot Margin trading fits into the picture: it’s a part of the Bybit platform that lets you use your own capital as collateral to borrow additional amounts and conduct leveraged Spot trades.

Key Takeaways:

With Bybit’s Spot Margin trading, you can take advantage of leverage opportunities to place long and short Spot trades.

Bybit offers more than 200 cryptocurrencies for Spot Margin collateral and borrowing, leverage ratios of up to 10x and generous maximum borrowing limits.

What Is Spot Margin trading on Bybit?

Spot Margin trading on Bybit allows you to use your own funds as margin to borrow more from the platform and place leveraged Spot trades. You can access leverage of up to 10x. For instance, if you commit 100 Tether (USDT) as collateral, you could borrow another 900 USDT to place Spot orders, multiplying your trading power by 10.

Standard crypto Spot trades, unlike Derivatives, don’t feature leverage opportunities, which makes Bybit Spot Margin a great choice for those who’d like to stay within the realm of the Spot market while boosting their position sizes through borrowing.

Spot Margin trading can potentially amplify your gains. For instance, a 1% increase in the price of an asset you plan to sell turns into a 10% return-on-investment (ROI) if you use the maximum leverage ratio of 10x. Naturally, trading Spot on margin also amplifies the risks involved. Assuming the leverage of 10x, any 1% decline in price means an effective 10% negative ROI. If your overall position drops below a certain minimum level, you risk liquidation.

How does Spot Margin trading work?

Borrowing funds

To borrow funds for Spot Margin trades, you’ll need to put up your own capital as collateral. There are more than 200 high-cap and small-cap cryptos available for borrowing, including all of the major assets: USDT, USDC (USDC), Bitcoin (BTC), Ether (ETH), Solana (SOL) and many more. The vast majority of these coins can be used both to meet the margin/collateral requirements and to borrow.

Depending upon your VIP level on the platform, there’s a certain maximum amount that you’re allowed to borrow. For example, traders who haven’t yet reached a VIP grade can borrow up to 8 million USDT or 300 BTC. You’ll pay interest on any amount you borrow from the platform until you close your position and repay the borrowed funds. The interest rate varies by coin.

When you place your Spot Margin trades, you can use Manual Borrow to borrow funds directly from your Unified Trading Account (UTA) page, or the Spot Margin trading page. Alternatively, you can also use the Auto Borrow function, which automatically borrows the necessary funds when you place a trade that exceeds your available balance.

Leverage

You can use up to 10x leverage for your Spot Margin orders, which magnifies both your potential earnings and risks. Let’s say you use 100 USDT of your own money as margin and borrow 900 USDT, allowing you to place an order worth 1,000 USDT (10x leverage). You buy a coin that trades at 1,000 USDT, and it later jumps in price by 5% to 1,050 USDT. If you sell it at the new price for a profit of 50 USDT, you effectively realize a 50% ROI, since:

Profit (50 USDT) / your initial investment (100 USDT) = 50%

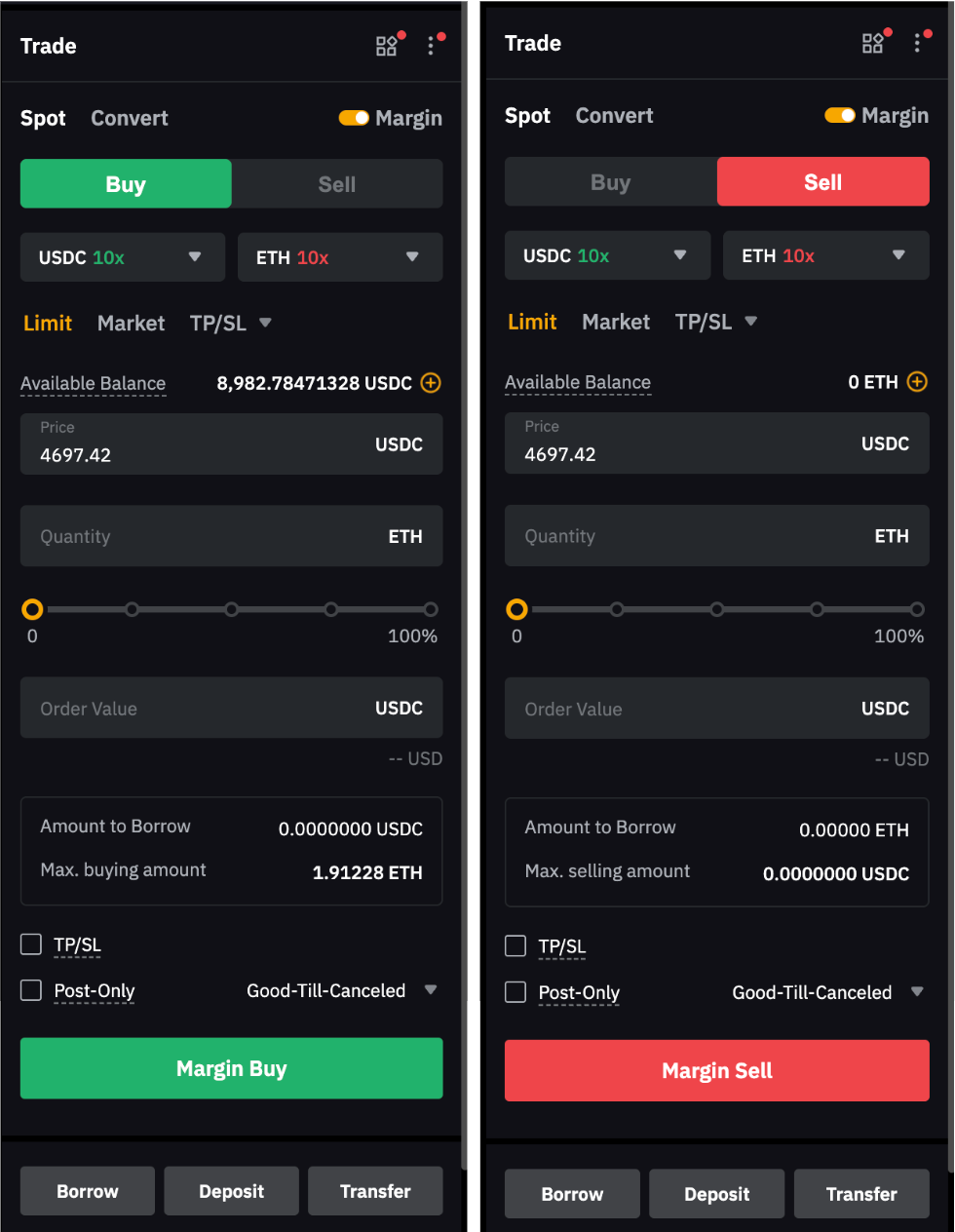

Long vs. short

With Spot Margin trades, you can place long (Margin Buy) or short (Margin Sell) orders:

Long trades allow you to buy the target asset and later sell it for profit. You should use these orders if you expect that the asset’s price will increase in the future.

Conversely, use short orders when you believe that an asset’s price will decline in the future. Short orders allow you to borrow funds to sell the target asset, and later repurchase it to capitalize on its price drop.

The example above is a long order, in which you bought the asset for 1,000 USDT using only 100 USDT of your own funds, and later sold it for 1,050 USDT, realizing a 50% ROI.

Let’s consider a short order example now: You invest 100 USDT of your own money and borrow another 900 USDT for a total of 1,000 USDT to conduct your trade. Using the funds, you borrow a token worth 1,000 USDT and sell it on the Spot market. After a while, the token's price drops by 2%, and it’s now trading at 980 USDT.

You buy back the coin at the new price of 980 USDT. After the transaction, you’re left with an additional 20 USDT, which represents your profit from the short-selling operation. Since you originally invested 100 USDT of your own money, your ROI is:

Profit (20 USDT) / your original investment (100 USDT) = 20%

Using the short-sell operation on leverage of 10x, you realize an ROI of 20% from just a 2% drop in the asset’s price.

Key concepts

While conducting Spot Margin operations, it’s crucial to keep in mind the following key concepts:

Leverage — The numeric multiplier of your own capital (margin) to the total amount you can place an order for after margin borrowing. For example, leverage of 10x means that one unit of your own capital can be used to borrow nine more units, for a total order value of 10 units.

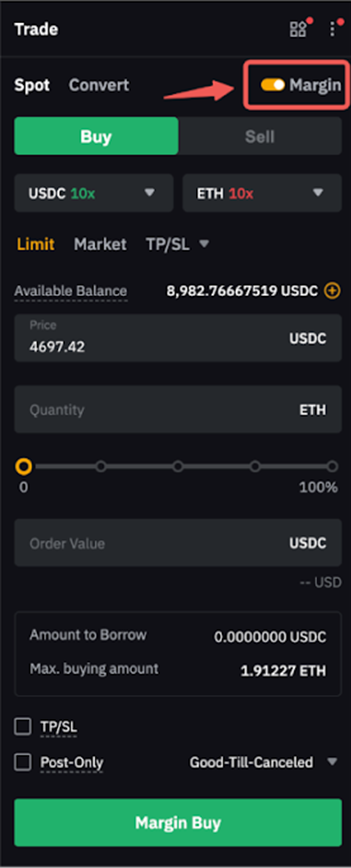

Available balance — The total amount you can allocate to trades, which includes the available balance in your account plus the maximum amount you can borrow.

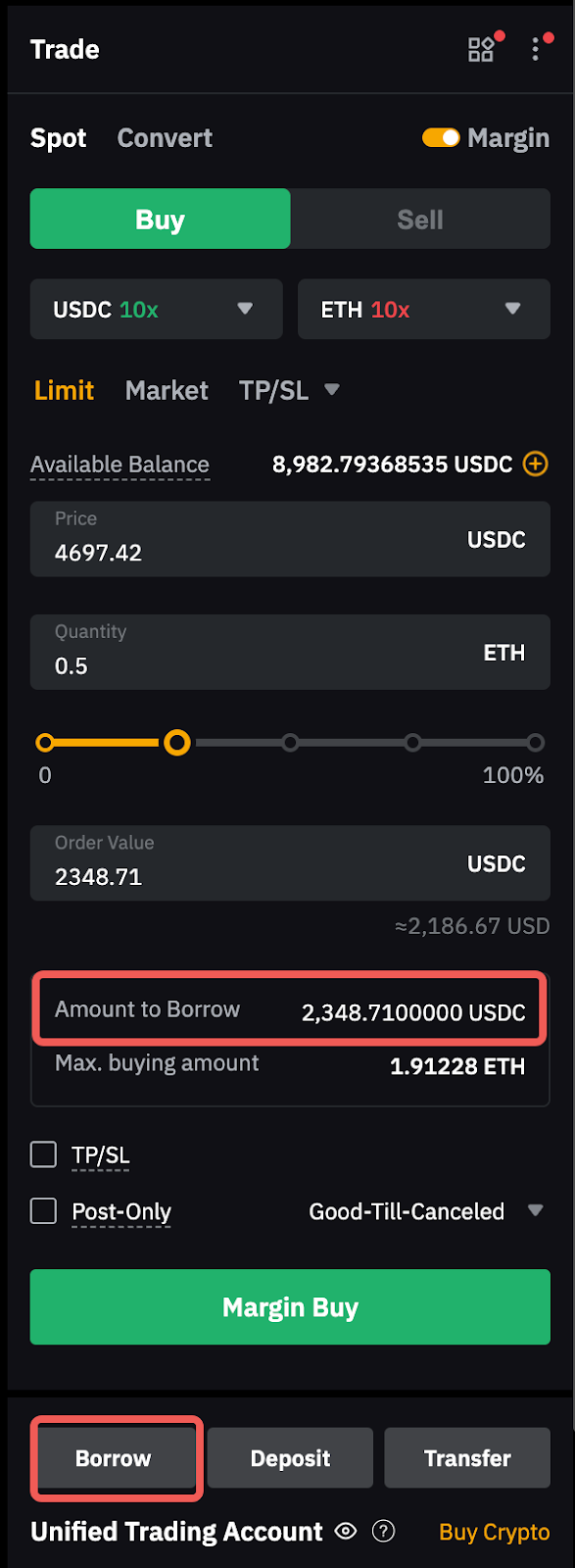

Amount to borrow — The amount that you’ll borrow for the specific order.

Initial Margin vs. Maintenance Margin — Initial Margin (IM) means your own funds committed to your margin trades. For example, in our examples above, your IM is 10% (100 USDT) of the total trade size. Maintenance Margin (MM) is the amount of your own funds that must be kept in your account in order to avoid liquidation. The minimum MM on Bybit is typically between 2% and 4% of your borrowed funds. If your margin drops below the requisite minimum MM, your position will be liquidated.

Wallet balance vs. available balance — Wallet balance is the total value of your account, made up of all the assets you hold, including any open positions and bonuses. On the other hand, available balance means the maximum amount you can currently allocate to your trades.

Fees in Spot Margin trading

Trading fee

Trading fee = filled order quantity × Spot trading fee rate

For non-VIP users, the standard Spot trading fee rate is 0.1%. The higher your VIP level, the lower the trading fee rate you’ll pay.

Interest fee

The interest fee on borrowed amounts accrues hourly from the moment an order is placed, regardless of whether or not it’s immediately filled.

Interest fee = amount borrowed × daily interest rate/24 × hours

Daily interest rates in the formula above differ depending upon the coin.

As an example of the interest fee calculation, let’s say you borrow 10,000 USDT at 8:05AM UTC and repay at 10AM UTC. Let’s also assume that the daily interest rate for the asset is 0.02%.

Thus, the interest paid will be:

Interest = 10,000 USDT × 0.02%/24 × 2 = 0.167 USDT

Note that a penalty interest fee will apply if your borrowing amount exceeds 100% of the maximum borrowing limit.

Penalty interest = borrowing amount × hourly interest rate × (utilization ratio) × 3

So, if you borrow 10,000 USDT and your borrowing exceeds 100% of the maximum limit, your utilization ratio will be 1.2 (120%). The daily interest rate is 0.02%, so the hourly interest rate is 0.02% ÷ 24. If you keep up this borrowing level for two hours while above the limit, the penalty interest will be:

Penalty interest = 10,000 USDT × 0.02%/24 × (1.2) × 3 × 2 = 10,000 USDT × 0.0002/24 × 1.728 × 2 = 0.288 USDT

In this case, you would pay approximately 0.288 USDT in penalty interest for those two hours, on top of the regular interest.

Liquidation fee

As noted above, if your MM drops below a certain threshold, your open position will be liquidated in order to bring your account above the threshold. If liquidation is triggered, your position will automatically be sold (for longs) or bought back (for shorts) by the platform, and your account will be charged a 2% fee on the liquidated amount.

Liquidation is triggered when your maintenance margin ratio (MMR) reaches or surpasses 100%, which usually happens when your MM drops below 2% to 4% of your borrowed funds.

Understanding liquidation risk

The calculation of the critical MMR rate is slightly different, depending upon the margin mode selected (Cross or Portfolio), per the formulas below:

Cross Margin = total maintenance margin/(margin balance − haircut loss + order loss)

Portfolio Margin = total maintenance margin/(equity − haircut loss + order loss)

In the formulas above, the haircut loss is the reduction in the asset's value when it’s used as collateral. If only a proportion of the asset’s market value is used for collateral, e.g., 25%, then only that proportion will count. The difference between the asset's full market value and its collateral value is then considered the haircut loss.

When your position is liquidated, the 2% liquidation fee is sent to the Margin Insurance Fund pool. If the liquidation renders your account bankrupt, and you can’t cover the outstanding liabilities, the Margin Insurance Fund is used to repay your debts.

To reduce the risk of liquidation, monitor your positions and balances carefully, inject funds to stay well clear of the lowest thresholds of the MM, keep extra margin in your account and avoid maximum leverages during times of high market volatility.

How to begin Spot Margin trading (step-by-step)

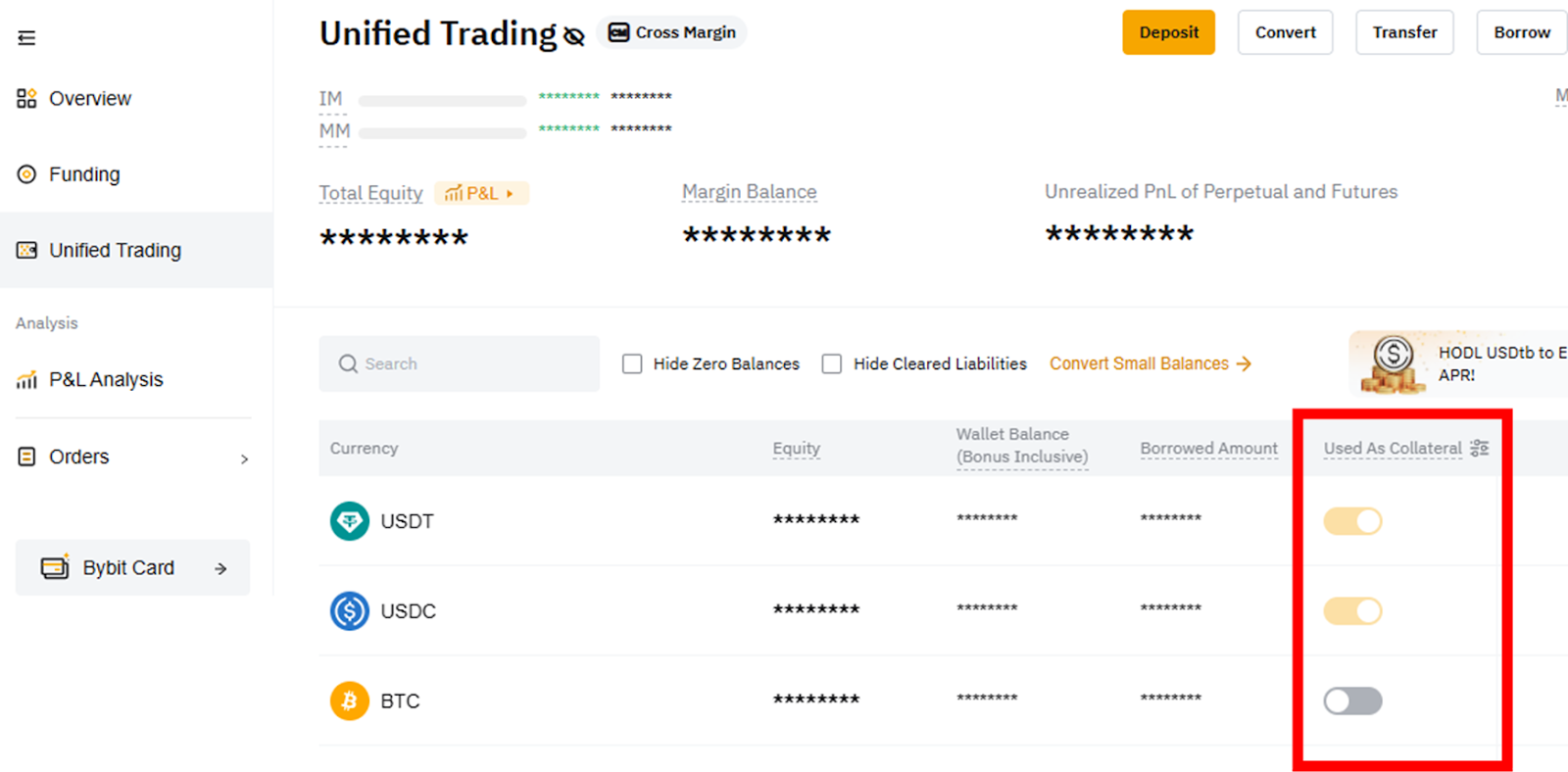

Bybit Spot Margin trading is supported in two margin modes, Cross and Portfolio. Please note that it’s not available in the Isolated mode. Ensure that you have also turned on Used as Collateral for each coin in your UTA that you’d like to use for your trades.

To begin Spot Margin trading:

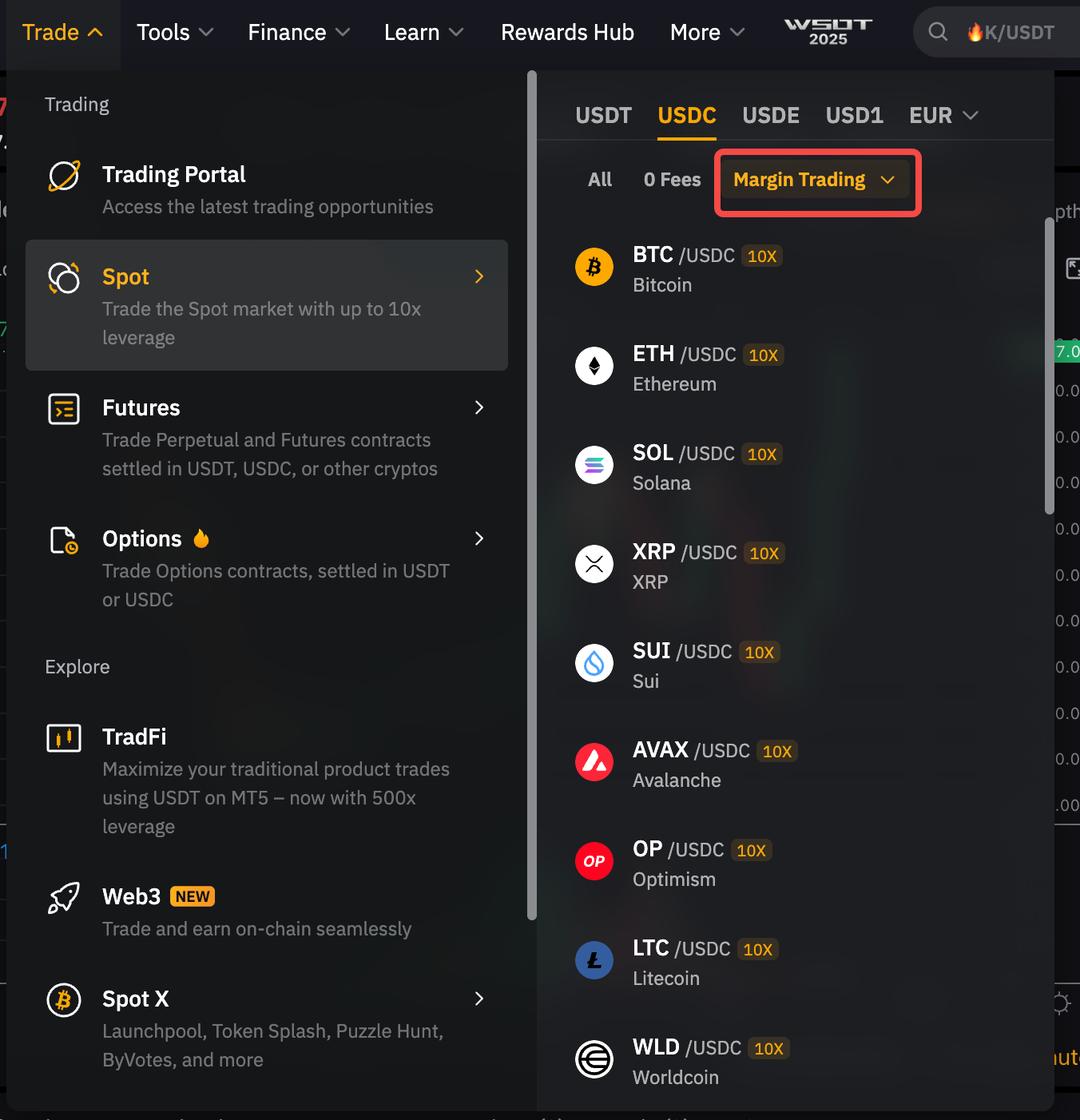

Step 1: On Bybit’s home page, go to the Trade top menu item and click on Spot, then the USDC tab, and click on a pair you’d like to trade.

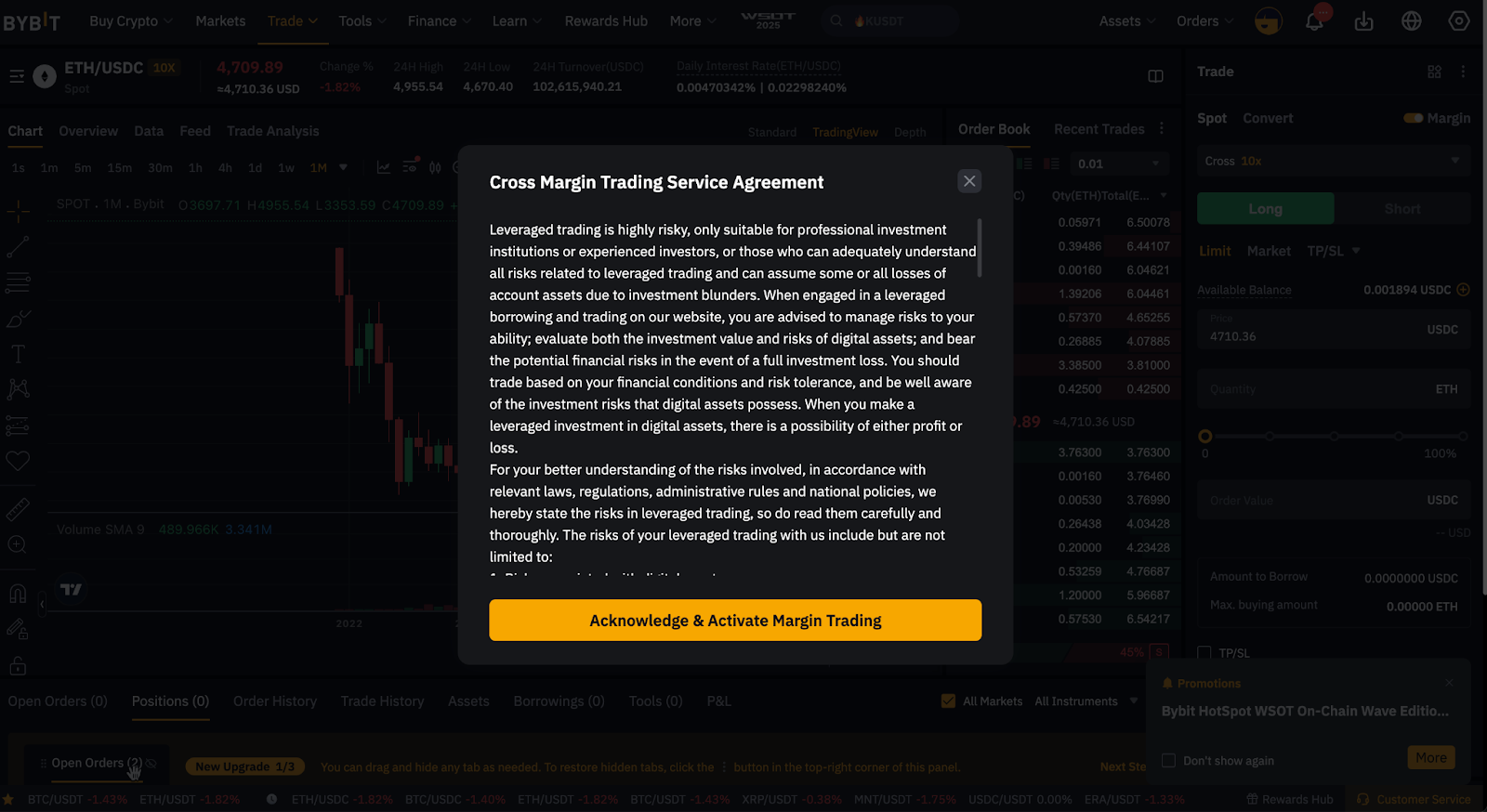

Step 2: If this is your first time using Spot Margin trading, acknowledge and activate the Margin Trading agreement.

Step 3: On your trading page, in the order pane on the right, toggle the Margin switch on.

Step 4: Set your order details, such as the order type (e.g., Market or Limit), leverage ratio, direction (Buy or Sell), amount and price. When ready, click on Margin Buy or Margin Sell to place your order.

If you haven’t enabled Auto Borrow, you can manually borrow by clicking on the Borrow button before placing your order.

Manual Borrow vs. Auto Borrow

Auto Borrow is recommended for users who prefer simplicity, convenience and fast order placement, while Manual Borrow is ideal for those who want full control over their margin trades. When using Manual Borrow, borrowed funds will first appear in your wallet balance, and will be used to offset any Derivatives liabilities. In contrast, Auto Borrow immediately applies borrowed funds to your trade without reflecting it in your balance.

| Manual Borrow | Auto Borrow |

Mode of borrowing | Borrow manually for each trade | The platform auto-borrows any required amounts |

Execution flow | Funds first appear in your wallet balance, offsetting Derivatives liabilities before being used for the Spot Margin order | Funds are directly applied to the requested Spot Margin trade |

Best for: | Tight control of borrowing; a unified strategy for Derivatives and Spot Margin | Convenience and fast execution of trades; keeping strategies for Derivatives and Spot Margin separate |

How to repay borrowed funds

Spot Margin liabilities can be repaid via the Borrowings tab on your trading page. You can choose to repay your position borrowings separately or all at once.

Solving borrowing and margin issues

Below are some issues you might encounter when using Spot Margin trading, along with some ways to resolve them.

The borrowed amount shows zero or borrowing fails — There are three possibilities: You've reached your individual borrowing limit (note that penalty interest will apply), there isn't enough liquidity in the lending pool, or the base or quote asset of the trading pair hasn't been enabled as a collateral asset. You’ll need to enable both the base and quote tokens as collateral assets in order to trade them. For instance, if you wish to trade BTC/USDC, you’ll need to enable both BTC and USDC as collateral assets.

Not enough collateral — Add more funds to your account to be used for margin

You’ve hit your account tier limits — Repay some of your liabilities, increase your collateral, or try to achieve higher trading volumes to qualify for higher VIP levels.

Closing thoughts

Bybit's Spot Margin trading allows you to use leverage of up to 10x for Spot trades in order to amplify your gains. It may be a valuable tool for traders who are both familiar with and comfortable using leverage, but who still want to remain in the relatively less risky and less complex environment of the Spot market instead of using the Derivatives platform. At the same time, when using Spot Margin trading, keep in mind the primary risk involved — namely, the use of leverage, which can result in substantial losses and position liquidations for traders who aren’t sufficiently skilled in this area.

#LearnWithBybit