What is Bybit Card and how to use it

Curious about crypto debit cards and how to use them? Enter a whole new world of spending your crypto on the go with the Bybit Card. Not only is using this crypto debit card convenient and reliable, but it’s also a secure and fast way to make the most use of your crypto assets.

Let’s explore more on the Bybit Card and the limitless opportunities that it unlocks.

Key Takeaways:

The Bybit Card is a crypto debit card available in both virtual and physical versions that allows you to spend your crypto easily and securely.

Enjoy benefits like up to 10% cashback, loyalty rewards, no annual fees, and multi-cryptocurrency support to enhance the integration of crypto into your daily life.

The Bybit Card's user-friendly dashboard and 24/7 multilingual customer support help you manage your funds effortlessly for a seamless crypto spending experience.

What is the Bybit Card?

The Bybit Card is a crypto debit card that lets you access your crypto funds quickly and easily, allowing you to spend your crypto wherever and whenever. It comes in both virtual and physical versions, and is currently available to users in EEA and CH regions, AIFC, Australia, Brazil, Argentina, Mexico and APAC, with more regions coming soon.

Brought to you by Bybit and Mastercard, two of the leading innovators in fintech, a Bybit Card is the perfect way to ensure that you’re always digital-ready for everything crypto.

As a reliable and convenient way to off-ramp your crypto and spend on the go, the Bybit Card helps you to maximize and fully integrate crypto into your daily life. With it, you can utilize your earnings from Bybit's full suite of trading products and pay for your shopping — instantly.

As you make purchases, you can enjoy between 2–10% cashback, depending upon your Bybit VIP level. Users who sign up for a new Bybit Card are eligible for a full 10% cashback within the first month, and earn up to $150 if they fund the card with at least 100 USDT (or the equivalent in other currencies) to unlock their promo eligibility and spend crypto across five purchase categories: travel, transportation, fashion, restaurants, and beauty & wellness.

But that's not all. Unlock a world of exclusive perks with the Bybit Card Rewards Program — including rewards from partners, such as unique offers and special experiences. Plus, you can automatically earn interest on your idle crypto assets—even without making purchases, along with other exciting benefits.

Additionally, the Bybit Card is easy and affordable to maintain. It’s valid for three years and its virtual version comes with auto-renewal after expiration. There are no annual or dormancy fees, although there may be a minimal 5 EUR/USDT issuance fee for the physical card based on your region.

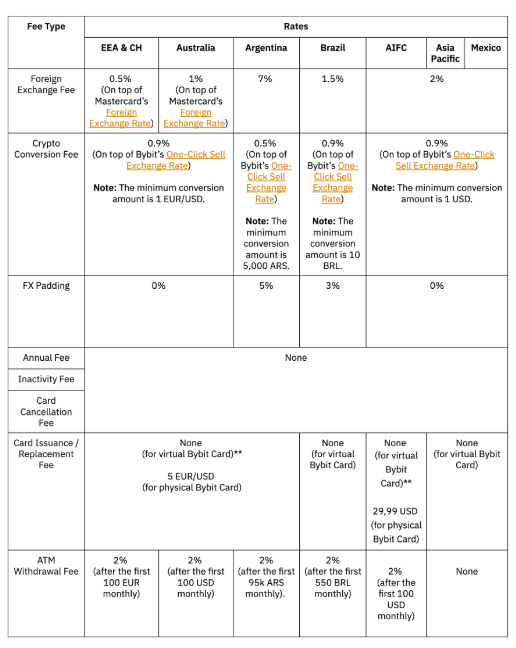

For the virtual version of the card, you won’t be charged any issuance or account closure fees. The only chargeable fees are the foreign exchange and crypto conversion fees for certain countries, as well as 2% ATM withdrawal fees after the first free monthly limit: 100 EUR in EEA and CH, 100 USD in Australia in AIFC, 95K ARS in Argentina and 550 BRL in Brazil.

Advantages of using Bybit Card

Transacting using your crypto assets shouldn’t be complicated. As such, Bybit has created a way to make life easier for its users through this crypto debit card. The following are some of the unique selling points of the Bybit Card:

Widely accepted

Over 90 million merchants accept the Bybit crypto debit card. All you need is to shop and pay at stores that display the Mastercard logo. As one of the leading global electronic payment providers, Mastercard has an expansive merchant network around the world.

Bybit’s strategic partnership with Mastercard provides a secure platform for its users to conveniently pay for goods and services using cryptocurrencies.

Wide variety of crypto options

Currently, you can select and pay anytime, with one of the following eight cryptocurrencies using your Bybit Card — Bitcoin (BTC), Ether (ETH), Mantle (MNT), Tether (USDT), USD Coin (USDC), XRP (XRP), BNB (BNB) and Toncoin (TON).

The transaction process is fast and straightforward since it is done directly from your Bybit account through an intuitive and user-friendly dashboard. We're also adding more crypto options and allowing multi-asset spending in a single transaction in the future, so stay tuned for the upcoming developments!

3D secure EMV

At Bybit, keeping our customers' funds safe is a priority. For that reason, we saw Mastercard as a perfect fit, since their platform observes strict security standards to prevent loss of funds and customer information.

The Bybit crypto debit card is EMV 3D Secure-enabled which is a cutting-edge fraud prevention technology that allows for consumer authentication when making online payments. When using your Bybit Card, you can comfortably shop knowing that there’s an additional layer of security present to keep fraudsters at bay.

24/7 multilingual customer service

As a customer-centric platform, Bybit provides 24/7 multilingual customer support for all its products, including the Bybit Card. We have a team of dedicated live agents to address any questions, concerns or inquiries related to your Bybit Card.

Loyalty Rewards Program

Bybit Card’s exciting Loyalty Rewards Program lets you earn Bybit Card Loyalty points every time you pay using our crypto debit card. Depending upon the Loyalty points accumulated, you can redeem them for different rewards. You can also activate the Auto Cashback function to automatically receive cashback on all purchases conducted with fiat and crypto in USDT, to be credited to your Funding Account every day between 00:00 and 01:00 UTC.

Bybit uses a tiered system that determines the multiplier applied to your reward points and your cashback rate. Under this system, the more you spend via your Bybit Card per month, the higher your tier will be — and the more points and better cashback rates you can enjoy. The table below outlines the tiers of the reward program, including the minimum spend, cashback rates and limits applicable to each tier.

Tier | Base Tier Regular Cardholders | Beta (VIP1 & VIP2) | Alpha (VIP3) | Apex (VIP4) | Omega (VIP5) | Infinite (Supreme) |

Cashback rate | 2% | 2% | 4% | 6% | 8% | 10% |

Monthly spend required (USD equivalent) | - | 500 | 3,500 | 9,500 | 12,500 | 25,000 |

Monthly point limit | 2,500 | 25,000 | 75,000 | 125,000 | 200,000 | 300,000 |

Convenient off-ramping

Bybit has over 20 trading products available on its exchange, including Spot Trading, Derivatives, Bybit Earn and Margin Trading. With the Bybit Card, you can easily and quickly off-ramp your earnings and spend them to make online payments.

Sign up for Bybit Card to unlock rewards

More ways to earn

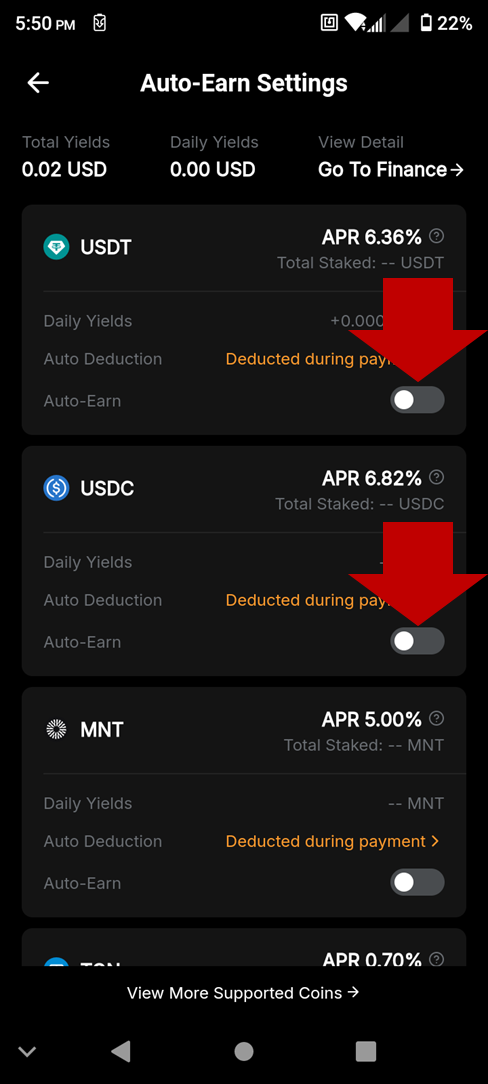

Bybit Card also creates additional ways to earn rewards on the platform. One of these is Auto Earn, a service that automatically allocates idle funds in your Funding Account to Bybit’s Flexible-Term savings plans. This allows you to earn a daily yield from funds that would otherwise remain unutilized. When enabled for Bybit Card, Auto Earn takes a snapshot of your account funds at 10AM UTC every day. Any eligible funds are allocated to Flexible-Term plans, subject to minimum and maximum limits applicable to Auto Earn. If your Funding Account has less than the minimum required for a savings plan, the allocation will fail for that day.

Another valuable service available to Bybit Card users is the Referral Program. Under the Bybit Card Referral Program, cardholders can generate a referral link or code, and share it with their friends to invite them to Bybit. For every qualified referee, the referrer can earn a 20 USDT reward. A qualified referee is an invited user who spends at least 100 USDT or equivalent.

How to use Bybit Card

You can use the Bybit Card with online retailers and merchants all across the globe. With a Virtual Bybit Card, you can make online payments once you’ve applied successfully, while a physical Bybit Card allows you to make online payments, as well as contactless payments in retail stores using point-of-sale (POS) terminals that support contactless payments. You can add Bybit Card to Google Pay (available for EEA and CH, APAC, Argentina, Brazil and Australia), Apple Pay (EEA, Argentina and Brazil) and Samsung Pay (EEA & CH and AIFC).

Activating your Bybit Card

Your virtual Bybit Card is activated automatically and is available for immediate use once your application is successful. In addition, you don’t need to activate foreign transactions separately. Your Bybit Card tier follows your Bybit account's VIP level. Please refer to this link for more information on Bybit Card benefits for different VIP levels.

You can also apply for the physical version of the card and have it delivered to you within 30 days. The physical Bybit Card can be activated upon receiving it.

Managing funds

Managing funds on your Bybit Card is straightforward. It is, however, important to understand how your funds are deducted during payments, especially during times when you have insufficient fiat in your account.

Adding funds

The Bybit Card doesn’t have a separate wallet. As such, it uses the balance in your Bybit Funding Account. To add funds to your Funding Account, you can use the Buy Crypto option or deposit crypto from other platforms/wallets.

Fund deductions during payments

When making a transaction using the Bybit Card, the fiat currency is automatically denominated based on the Proof of Address (POA) you’ve indicated during your Know Your Customer (KYC) process.

Once you pay using your crypto debit card and the transaction is authorized, the amount you’ve spent will be frozen in your Funding Account, and then it will be deducted once the merchant completes the transaction.

Should the merchant cancel (i.e., reverse) prior authorization or refund the transaction, the frozen amount will be returned to your Funding Account’s Available Balance.

In a situation where there’s not enough fiat in your Funding Account to complete a transaction, your chosen crypto in your account will be converted to fiat to cover the deficit. Note that there’s a minimum crypto conversion fee of 1 EUR/USD, 5,000 ARS or 10 BRL.

Payments will automatically be denominated in the currency on your card, even if you’re making foreign transactions. If you purchase a product that’s charged in foreign currency, your funds will be deducted according to Mastercard's foreign exchange rate, plus the Bybit Card foreign exchange fee of 0.5% for EEA, 1% for Australia, 7% for Argentina, 1.5% for Brazil and 2% for AIFC, APAC and Mexico. For more information on exchange rate, refer here.

Insufficient funds

When there are insufficient crypto and fiat funds in your Funding Account, the transaction will be declined. You can top off your Funding Account either through the Buy Crypto feature, or the direct deposit of crypto from external platforms or wallets via the Bybit dashboard.

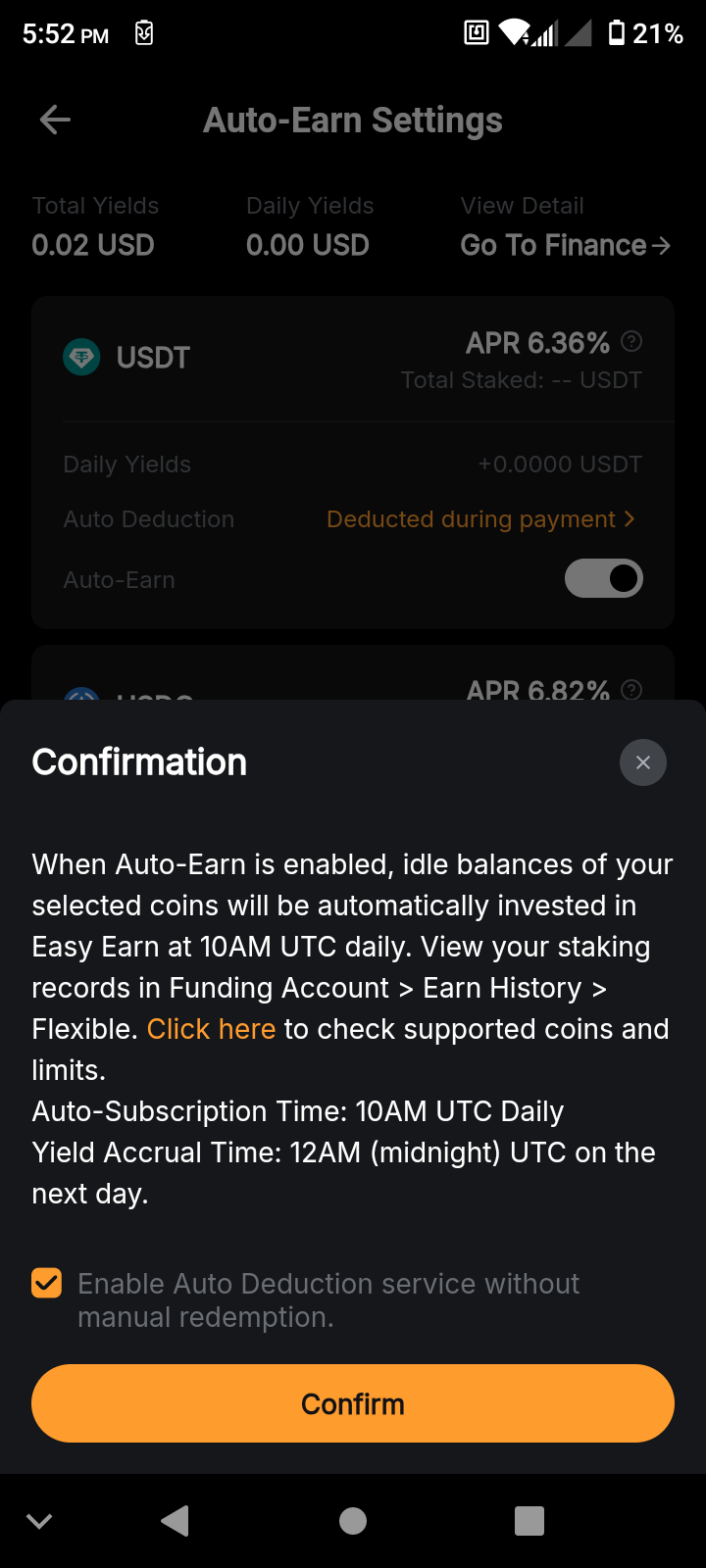

Enable Auto-Earn function

To enable the Auto Earn function via the Bybit App:

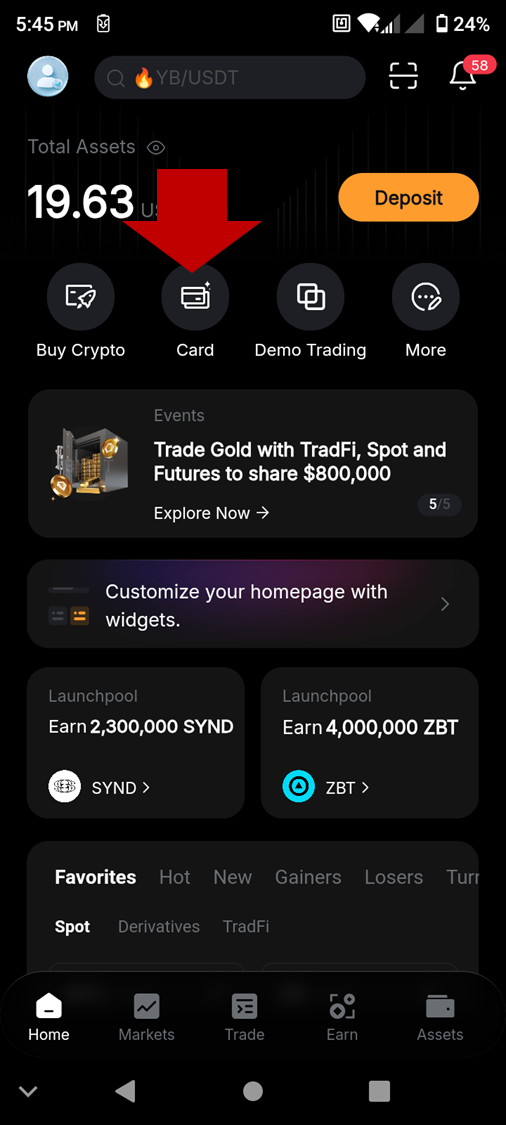

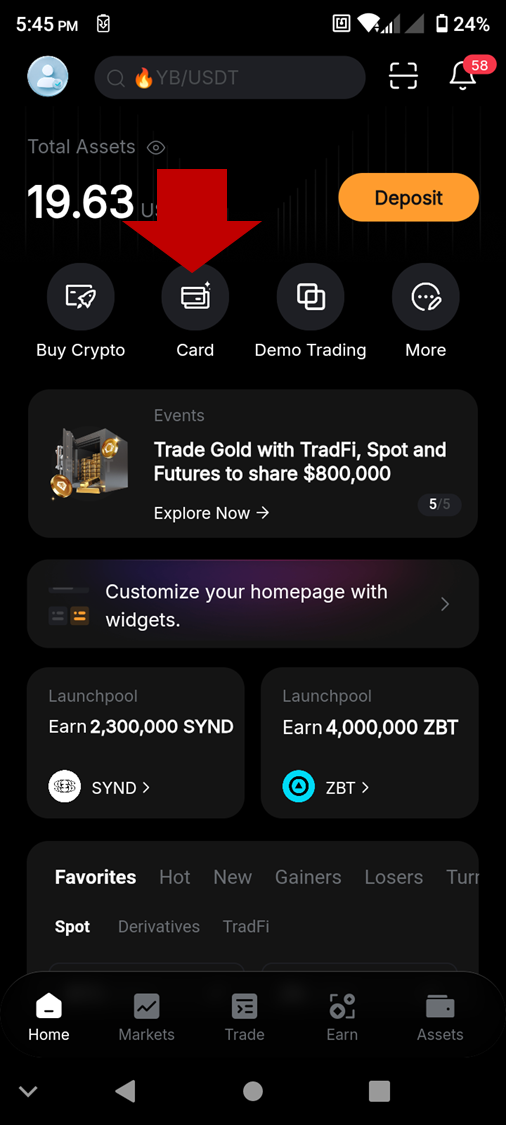

Step 1: Open the Bybit App and tap on Card on the home screen.

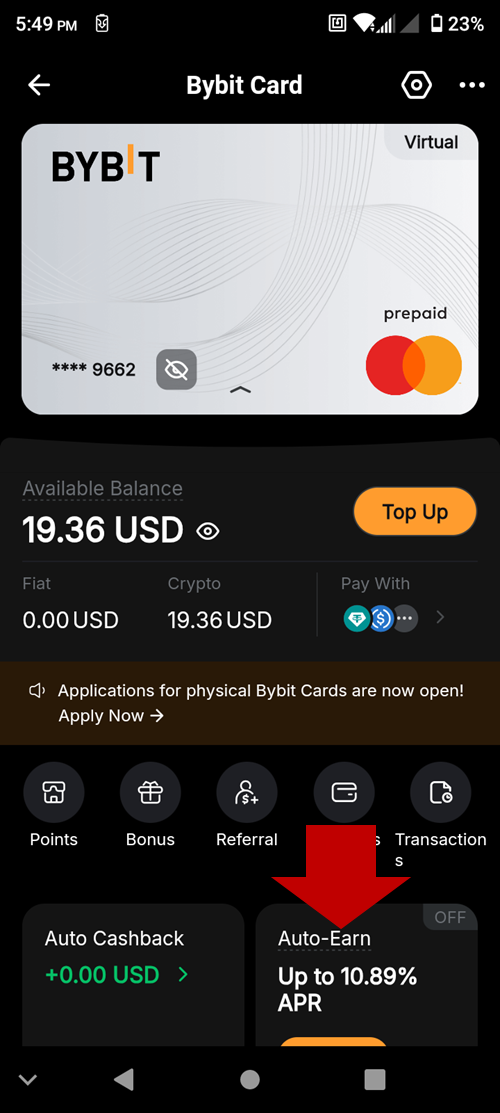

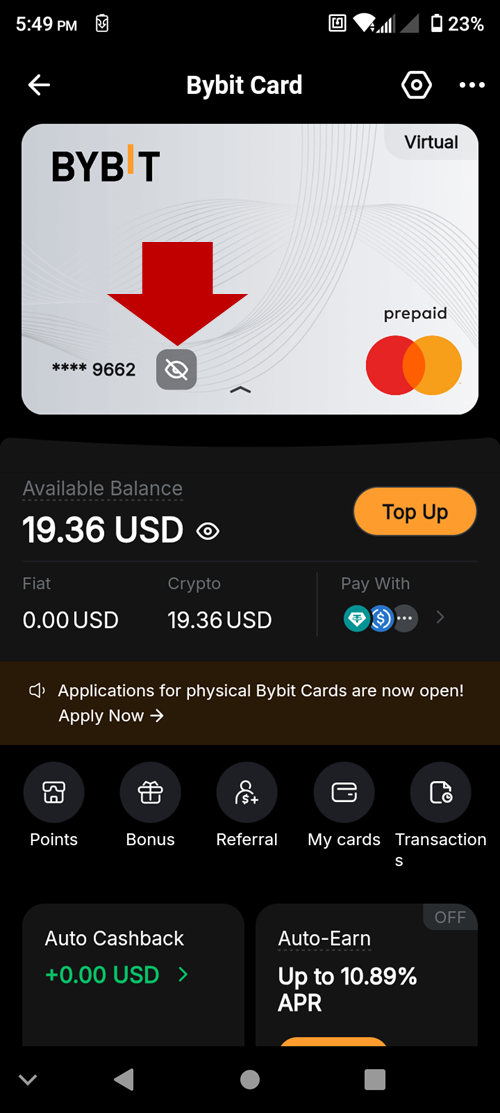

Step 2: Tap on Auto Earn (usually displayed near the bottom of the screen on the Bybit Card page).

Step 3: For any coin for which you’d like to enable the service, toggle the Auto Earn switch on.

Step 4: Provide the final confirmation by tapping on the Confirm button.

Using the Virtual Card

Follow these simple steps on your Bybit App to pay using the Bybit Virtual Card:

Step 1: Open the Bybit App and tap on Card.

Step 2: On the Bybit Card screen, tap the visibility icon directly on the card image to reveal your card details. You may be asked to enter a two-factor authentication (2FA) password from your authenticator app before the card details are displayed on the screen.

Step 3: Make a note of the card details on your screen so that you can use them on any website that supports Mastercard.

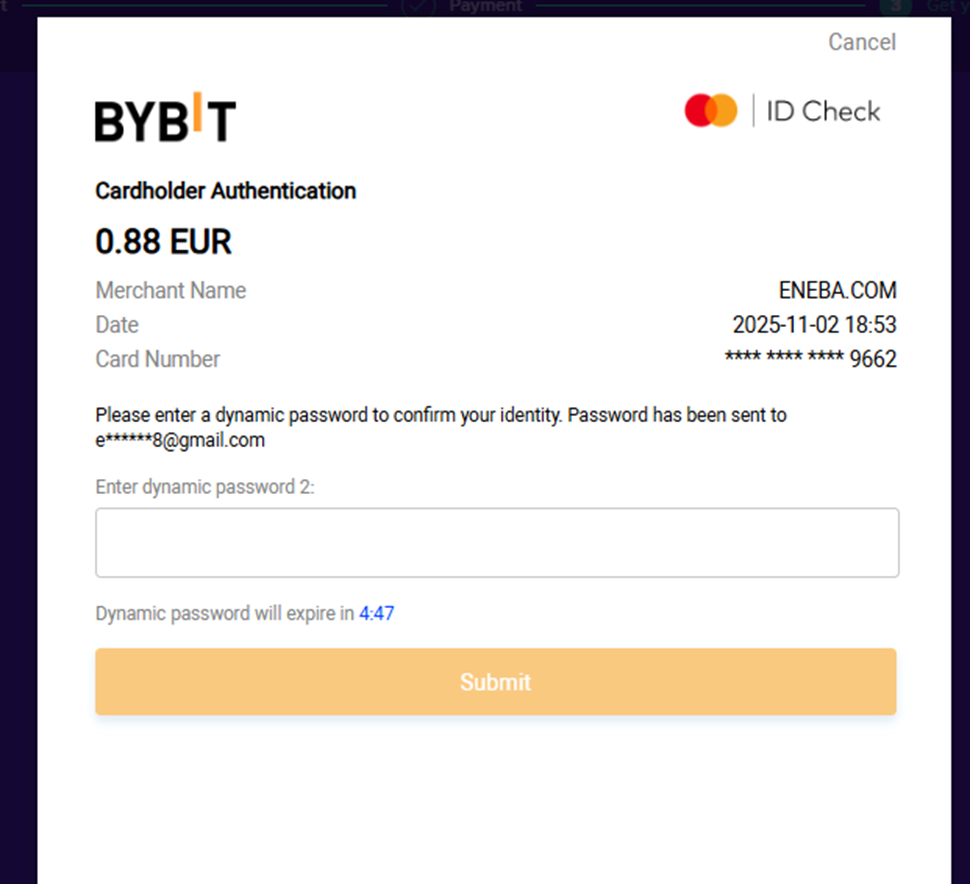

Please note that you might be asked for additional verification steps when paying with Bybit Card, depending upon the merchant used. For instance, you might be required to enter a second password sent to your registered email address.

Using the Bybit Physical Card

You can use the Bybit Physical Card for both online and offline transactions. To make payment for online purchases, you can obtain your physical card details (i.e. card number, CVV and expiration date) either from the Card Dashboard in your Bybit Account, or the physical card itself. The Bybit Physical Card can be used for any in-store payments that support contactless chip and PIN purchases.

Disputing transactions

In case of a dispute regarding a transaction you’ve made, we highly recommend that you reach out directly to the merchant involved if you wish to request a refund.

If you don’t recognize any particular transaction, or you otherwise suspect that your card credentials may have been compromised, you can choose either to freeze your crypto debit card immediately or replace it, and then contact our Customer Support within 45 days of the transaction for further assistance.

How to protect yourself from debit card frauds

As cybersecurity crimes continue to become more sophisticated, it’s important to learn how to detect them — and how to protect yourself from debit card fraud. It’s easy to detect suspicious activity on your Bybit Card, since you’ll notice funds missing in your Funding Account balance.

Because your Bybit Card is available virtually, you need to stay alert for any fraudulent activities. Here are some ways to help you prevent fraudulent activities on your Bybit Card:

Avoid saving your passwords and credentials on your personal or work gadgets

Avoid installing apps that give third parties remote access to your device

Conduct all transactions over a secured network

Enable authentication prompts and push notifications to ensure that you’re authorizing the correct transaction

Don’t share your card information with anyone, especially on social media

Beware of online phishing scams

Regularly check your transaction history to keep track of them

Contact Bybit Card Customer Care if you suspect any suspicious account activity

Conclusion

Using a crypto debit card increases the liquidity of your digital assets and provides you the convenience of spending cryptocurrency in your daily life. Whether you’re paying bills or buying goods online, the Bybit Card helps you maximize your crypto usage while keeping your funds safe. It’s issued in partnership with Mastercard, so you can spend your preferred cryptocurrencies anywhere a merchant displays the Mastercard logo. Easy to use with its intuitive mobile app, the Bybit Card gives you an efficient way to manage your digital assets on the go!

#LearnWithBybit