Manage loans like a pro: Bybit's new unified borrowing experience

Cryptocurrency loans are among the key instruments in a crypto trader's toolbox. Depending upon your trading strategy and market conditions, borrowing your preferred crypto asset against collateral could be a more efficient and profitable move than buying it with your existing funds. Bybit's crypto borrowing system offers a rich variety of flexible and fixed rate loans that allow you to do just that.

Traders on Bybit’s platform have long used its flexible rate Crypto Loans and fixed-rate loan products to borrow various coins for short- and medium-term trading. Now, Bybit has made the entire crypto borrowing experience even more efficient, flexible and secure by unifying its flexible and fixed-rate loans into one interface and system. This change, effective since May 8, 2025, isn't just about a single user interface for both types of loans: borrowers can now benefit from unified cross-margin risk management, shared collateral options, fair collateral valuation and clear-cut interest rate tracking across all of the loan types Bybit offers on its platform.

Key Takeaways:

Since early May 2025, Bybit has implemented a new, integrated loan system that unifies the interface and certain key rules applicable to both flexible and fixed-rate crypto loans.

In addition to the unified interface, both loan types now have the same loan-to-value requirements, collateral pool, tiered system for collateral valuation and hourly interest compounding mechanism.

Crypto Loans vs. Fixed Rate Loan

Bybit's crypto borrowing products include flexible rate and fixed-rate loans. The former allows you to borrow crypto funds based on competitive, variable interest rates. At the same time, the latter type have set interest rates for loans — offered for 7, 14, 30, 60, 90 or 180 days — depending upon your preference.

Flexible rate loans provide the advantage of early repayment without any charges incurred. On the other hand, Fixed Rate Loan's key advantage is that it gives you the ability to access preset interest rates for the duration of the loan, eliminating any sudden fluctuations — and letting you plan your trading activity with complete certainty.

Fixed Rate Loan is a peer-to-peer (P2P) lending service on Bybit. Crypto lenders post their offers on the platform, specifying amounts, duration and preferred lending rates. Borrowers can choose from existing orders or create their own with preferred conditions. The system matches lending and borrowing offers, finding the optimal orders for both sides.

Flexible rate loans — known as Bybit Crypto Loans — work somewhat differently. Unlike Fixed Rate Loan, Crypto Loans are based on borrowing funds directly from the Bybit platform.

In the past, the two loan types featured separate interfaces, collateral rules and loan-to-value (LTV) thresholds, in addition to other differences. Since May 8, 2025, Bybit users have benefited from the unification of the two loan systems, with a single interface to manage all of their loan positions, whether fixed or flexible.

Naturally, certain differences remain between the two loan types. The key differences remaining between the fixed and flexible loans following the integration are summarized in the table below.

| Fixed Rate Loan | Flexible Rate Loan |

Loan supplier | Crypto lender via P2P | Platform |

Interest rate | Set by the borrower or lender within the platform's specified range | Variable interest rate |

Loan term | 7, 14, 30, 60, 90 or 180 days | Flexible |

Loan repayment | Auto and manual repayment; early repayment is accepted, but the interest paid is nonrefundable | Manual repayment |

Grace period | 24 hours Interest rate: 3x hourly interest rate applies | Not applicable to flexible loans |

Benefits of integrated Crypto Loans and Fixed Rate Loan

The integrated system of fixed and flexible Bybit loans is based on the unification of interfaces and rules for LTV calculation, collateral valuation and interest compounding, thus improving capital efficiency, control and flexibility for borrowers. To clarify, this upgrade won’t affect your existing loans and orders. All of your current positions for flexible and fixed-rate loans will still follow the loans’ original terms and conditions.

1. Single interface for easier borrowing decisions

The single interface for both loan types creates a user-friendly experience so borrowers can manage their loans easily and flexibly. Additionally, it improves analysis of existing overall borrowing activities for users.

2. Unified cross-margin risk management

The integrated system introduces a unified cross-margin risk management system. Additionally, both loan types are subject to the same LTV thresholds. Before the upgrade, the two loan varieties had potentially different liquidation and other thresholds. Now, the key LTV levels apply uniformly to all loans.

The initial margin limit (Initial LTV) applicable to all your loans is 80%. This means you can borrow up to 80% of your collateral value. The system tracks your LTV levels to ensure the stability of both your account and the overall platform.

If your Margin Call LTV ratio rises to 85%, you’ll receive an email or in-app notification prompting you to either add more collateral to drop below this level, or repay your loan.

If your Liquidation LTV ratio reaches 95%, your position will be liquidated, with your collateral used to repay the outstanding loan and interest.

In general, while higher LTV ratios provide better capital efficiency, they also pose higher risks in the case of adverse market developments. To stay in the lower-risk territory, it’s recommended that you keep your LTV ratios well below the maximum limits (e.g., at 60–70%).

3. Shared collateral pool for more flexibility

You can now use the same collateral across all of your loans (both Flexible and Fixed Rate). This allows for quicker reallocation of your collateral funds in order to keep your loan positions safe and more responsive to unexpected market developments. Moreover, you can easily adjust your collateral in your dashboard.

If you wish to reduce liquidation risk, you can opt to increase your collateral to lower your LTV ratio. There’s no limit to the amount of collateral you can add. Conversely, you can only decrease your collateral if your current LTV ratio is below the Initial LTV.

4. Fair collateral valuation across all loans

System unification also results in fairer collateral valuation across all of your loans. Previously, Bybit's tiered collateral valuation mechanism applied only to Fixed Rate Loan. Now, it applies to both loan varieties. The valuation mechanism assigns a specific proportion, based on a supplied coin that counts toward your collateral value calculation. For instance, both USDT and USDC stablecoins have a value of 100%, meaning that the full amount supplied in these cryptocurrencies counts toward your collateral.

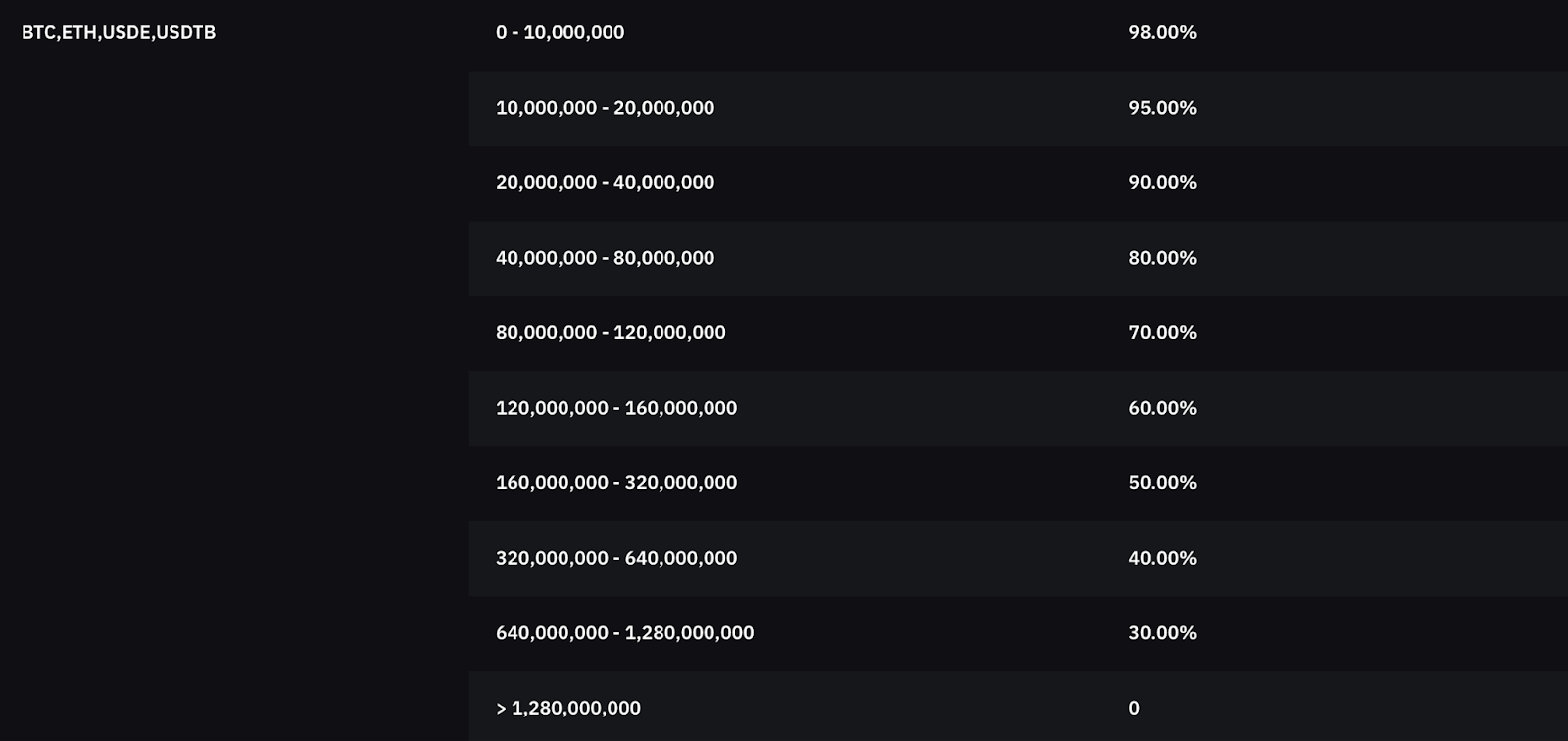

Other coins have lower value proportions that change based on the amount supplied. The image below shows the collateral value proportions for Bitcoin (BTC), Ethereum (ETH), Ethena USDe (USDE) and USDtb (USDTB).

Bybit accepts dozens of different coins — high-, mid- and low-cap — as acceptable collateral. Of course, riskier coins usually have lower collateral value proportions that fairly reflect their real risk levels.

The unified collateral valuation system also improves predictability during market turbulence and reduces the risk of unexpected liquidation of your loan positions.

5. Clear, precise interest tracking

Naturally, the two loan varieties have different interest rate types — variable for flexible loans, and preset for fixed-rate loans. However, the integrated system has also unified the interest rate calculation mechanism, and interest for both loan types is now compounded hourly, giving both short-term and high-volume borrowers better control over cost forecasting.

The table below summarizes the differences between the old loan system and the unified one.

| Old system | New integrated system |

User interface | Separate | Unified |

LTV liquidation ratio | Fixed: 92%; Flexible: 95% | 95% |

Collateral |

|

|

Tiered collateral valuation system | Applicable only to fixed loans | Applicable to both loan types |

Interest rate compounding | Hourly for flexible loans; no compounding for fixed loans | Hourly compounding for both loan types |

Closing thoughts

Bybit’s new integrated system provides numerous benefits for borrowers, whether they prefer fixed-rate or flexible loans. Its unified interface is designed to make your crypto borrowing experience easier and more productive, with easy loan management, consistent LTV thresholds, shared collateral to flexibly mitigate liquidation risks, a fair collateral valuation mechanism and uniform hourly interest compounding. Manage your crypto loans like a pro with Bybit's new unified borrowing experience.

#LearnWithBybit