Bybit's Bear Necessities: The Ultimate Bear Market Trading Guide

The bear market may seem dark and full of peril, especially with the recent events brought about by the FTX saga. But it’s important to bear in mind that just like the four seasons, the bear market is a natural phenomenon in the larger market cycle.

We’ve heard your concerns about the bear market — feelings of doubt, not knowing what steps to take; or, on the flip side, wanting to gear up in preparation for the next bull run. Uncertain as things may be, fear not, as Bybit is here!

In line with our philosophy of “Listen, Care, and Improve,” we present Bybit’s Bear Necessities: The Ultimate Bear Market Trading Guide. This guide sheds light on bear market trading strategies — equipping you with knowledge and skills, while illuminating your way forward to safely navigate the wilderness of the bear market.

Are you ready to embrace bear market trading?

Read on to find out more!

What Is a Crypto Bear Market?

A crypto bear market is a period when the value of major crypto assets like Bitcoin fall by at least 20% from their previous highs, remaining there due to fear and pessimism.

Crypto bear markets usually play out in the following four stages:

Recognition → Panic → Stabilization → Anticipation

How to Spot Crypto Bear Markets

Although it can be difficult to tell when a crypto bear market is starting, here are some telltale signs pointing toward the start of one:

- Low volume, due to extreme fear

- Bearish technicals and charting patterns

- Fall of major crypto projects

5 Handy Crypto Winter Tips

The most important tip veteran investors often give is not to fear crypto bear markets. While it might seem natural to stay out of the market during such volatile times, crypto bear markets often present some of the best buying opportunities for long-term investors. For beginners, we recommend:

- Diversifying your overall portfolio by investing in blue-chip cryptos and projects with solid fundamentals.

- Dollar-cost averaging into your investments to mitigate the risk of timing the market.

Keen on learning more crypto winter survival tips? Read our beginner’s guide to investing in crypto bear markets. Alternatively, you can also give low-risk strategies like Bybit Savings, Bybit Shark Fin and Liquidity Mining a shot.

A Bear Market Analysis

During a crypto bear market, emotions can run high as investors and traders panic-sell positions in fear of sudden slumps. Thus, it’s important to gain a sense of the overall market sentiment — as well as where the market is expected to head. For example, did you know that as of the time of this writing (Nov. 23,2022), ETH is now gaining market share at the expense of other smaller chains? Could this be a sign that consolidation is taking place in the Layer 1 space?

In our bear market report, we offer our take, based on notable trends taking place in the crypto space. From revealing on-chain and off-chain activities, to exploring how investors can weather the bear market with DeFi, our analysis of the current bear market will help you better gauge the market’s health — and aid you in your decision-making process during the crypto bear market.

Beat the Bear: Stories and Tips from Daniel Chart Champions

We spoke to crypto bear veteran and Bybit affiliate Daniel from Chart Champions to weigh in on the current bear market environment. With more than a decade of stock and crypto trading experience, Daniel advocates the use of essential tools such as Fibonacci Retracement, while breaking down key concepts like leveraged trading.

Check out Bybit Bear Stories to find out more about Daniel’s bear market trading strategies and words of wisdom for newer traders!

Safer, Smarter Ways You Can Invest in Crypto Bear Markets

Bearish seasons may seem bleak, but every cloud has a silver lining. Even in this downturn market, there are always windows of trading opportunities that allow you to safely grow your crypto assets. Fortunately, we’ve got you covered with not one, but three Bybit Earn trading products that will help you invest and trade smarter!

Bybit Savings

Has the idea of competitive and guaranteed APY caught your interest? With Bybit Savings, users can earn stable yields by staking coins and tokens including USDT, BTC and more. Flexible and fixed terms are supported so you can generate maximum returns based on your investment time horizon.

Keen on learning more? Check out our guide to Bybit Savings that will teach you everything you need to know about staking with us.

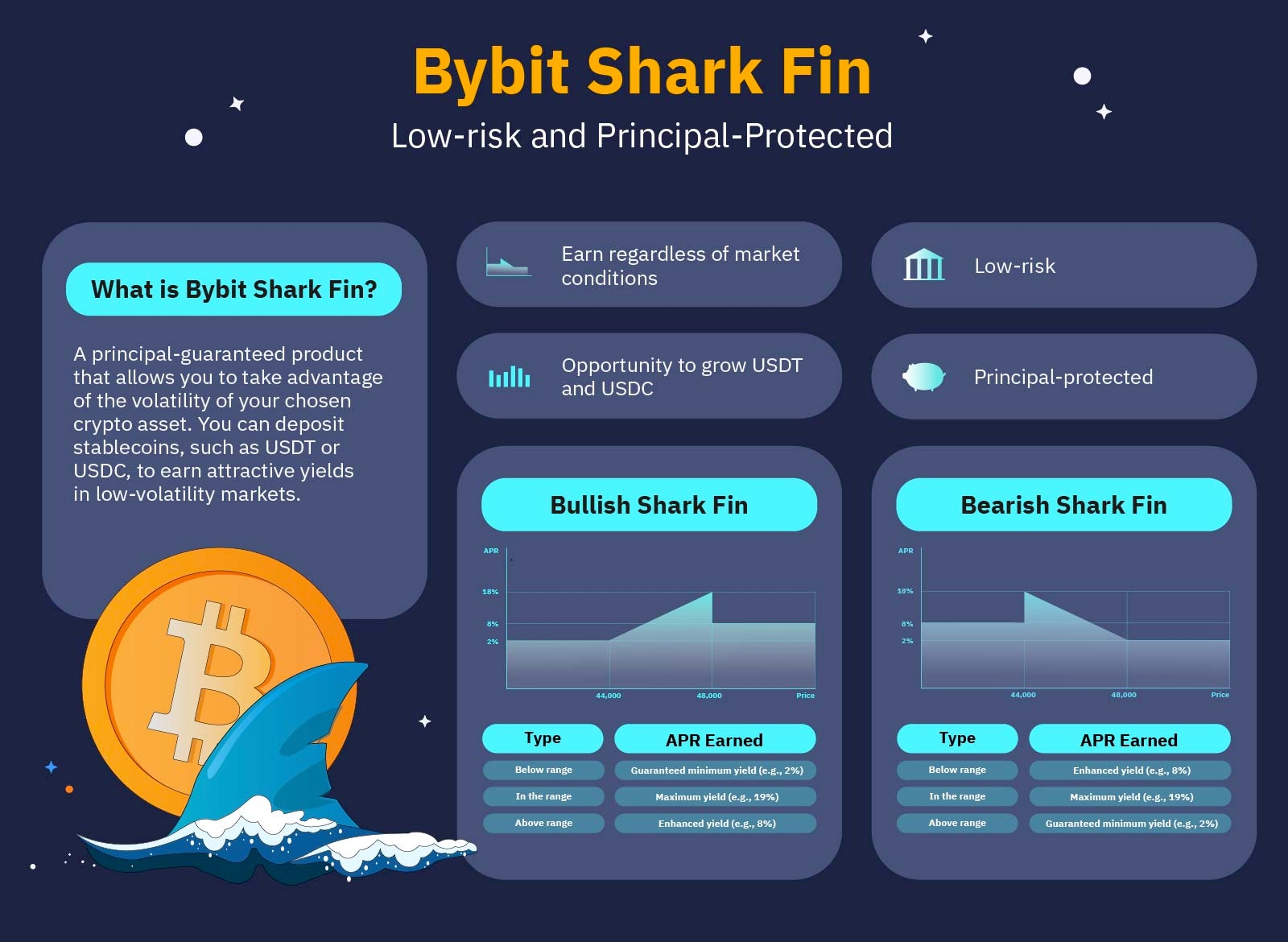

Bybit Shark Fin

If you’re looking for something that’s not only low-risk but also guarantees your principal, look no further than Bybit Shark Fin’s guaranteed-principal structured product. Bybit Shark Fin helps traders earn yields, no matter how volatile the crypto market gets. Its potential for yield enhancement is also a nice touch for low-risk investors to earn more profits, should the price of their chosen asset lie within their preset boundaries. And even if the price falls outside of your preset range, you’ll still be able to earn a profit, making this a win-win.

Find out more by reading up on our guide to Bybit Shark Fin.

Liquidity Mining

Interested in growing your holdings without risking any of your hard-earned cryptocurrency? Consider Liquidity Mining, a product that allows you to earn substantial yields simply by staking coins in liquidity pools. With Bybit’s Liquidity Mining, you can multiply your earnings with up to 50% APY. You can choose to stake more tokens to give you more leverage and increase your yields substantially, or unstake your coins at any time. This gives you the flexibility to increase your stakes or unstake completely based on your comfort level and crypto portfolio.

Excited to discover more about how Bybit’s Liquidity Mining works? Check out our guide for more details.