How to open a trade in Bybit

Can’t wait to start your trading journey? Here’s a detailed process guide to help you start your first trade on Bybit.

Bybit offers you two primary types of trading products: Spot trading and Derivatives trading.

Key Takeaways:

Bybit offers two primary types of trading products — Spot trading and Derivatives trading.

Under Derivatives trading, you may choose between USDT and USDC Perpetuals, Inverse Perpetuals, USDT and USDC Futures, Inverse Futures and USDT and USDC Options. (Note: Bybit has stopped issuing new USDC Options as of Feb 26, 2025. Existing contracts can be traded until expiration.)

Spot trading

Select Trading Pairs

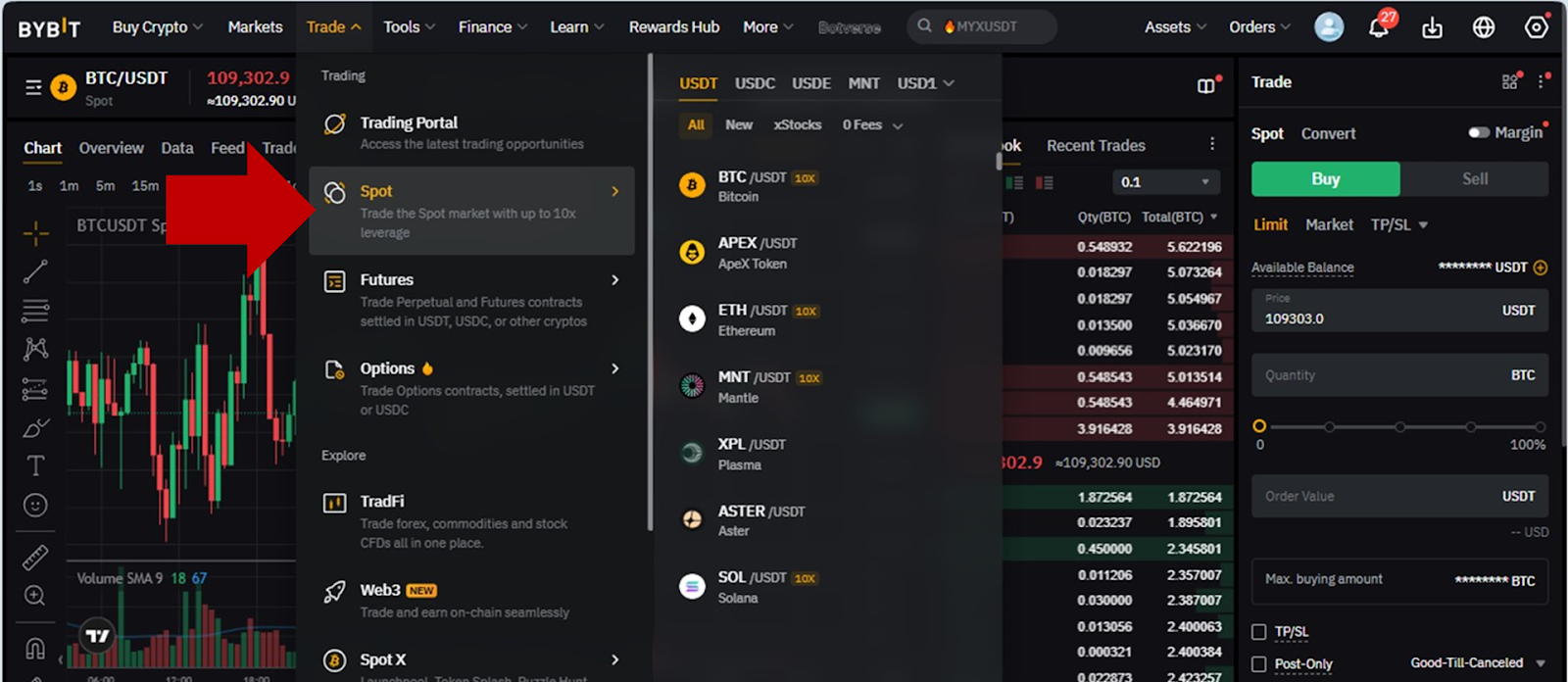

Step 1: Once you are logged in to your Bybit account, hover your cursor over the Trade button on the navigation bar and click on Spot.

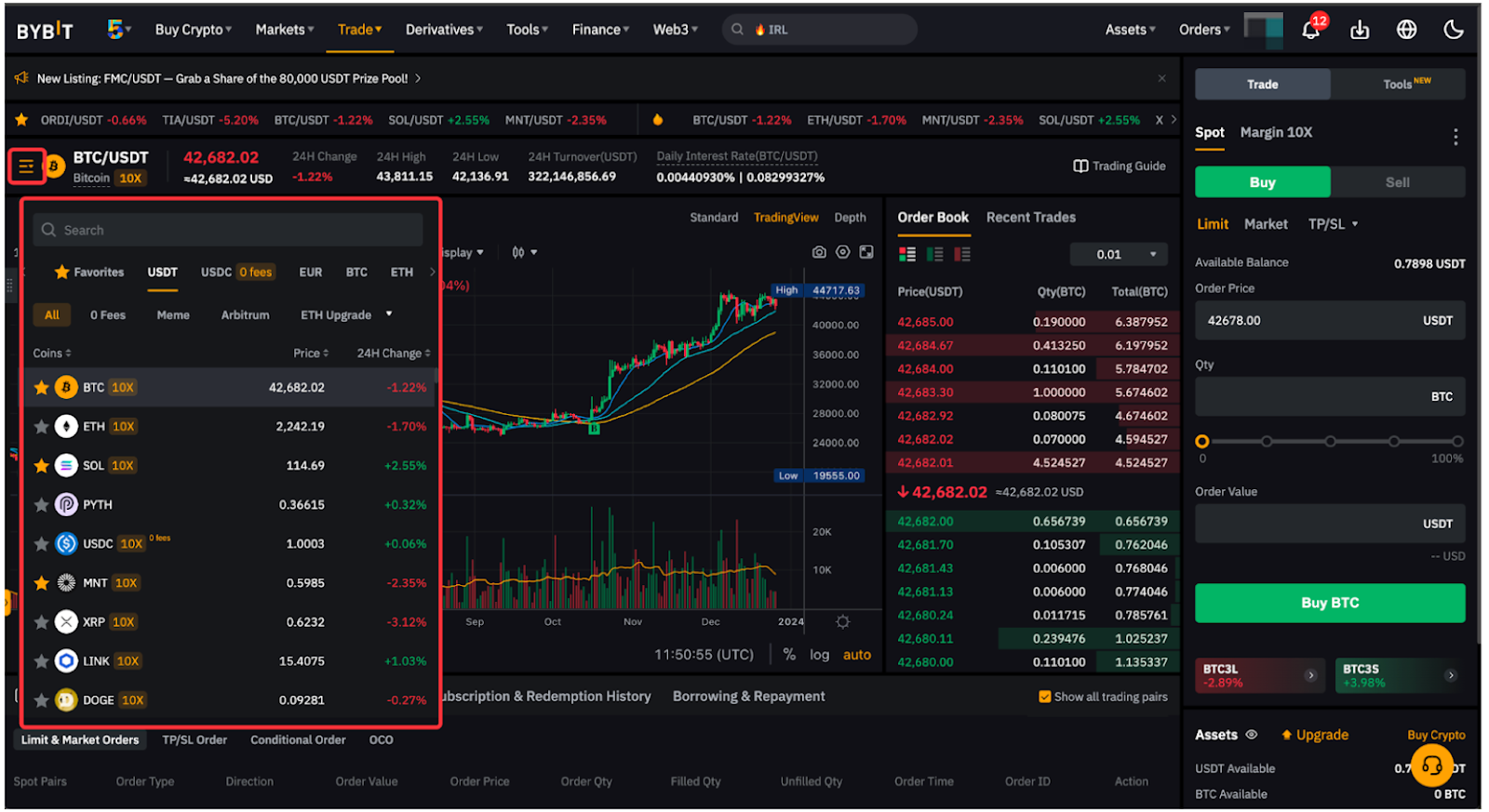

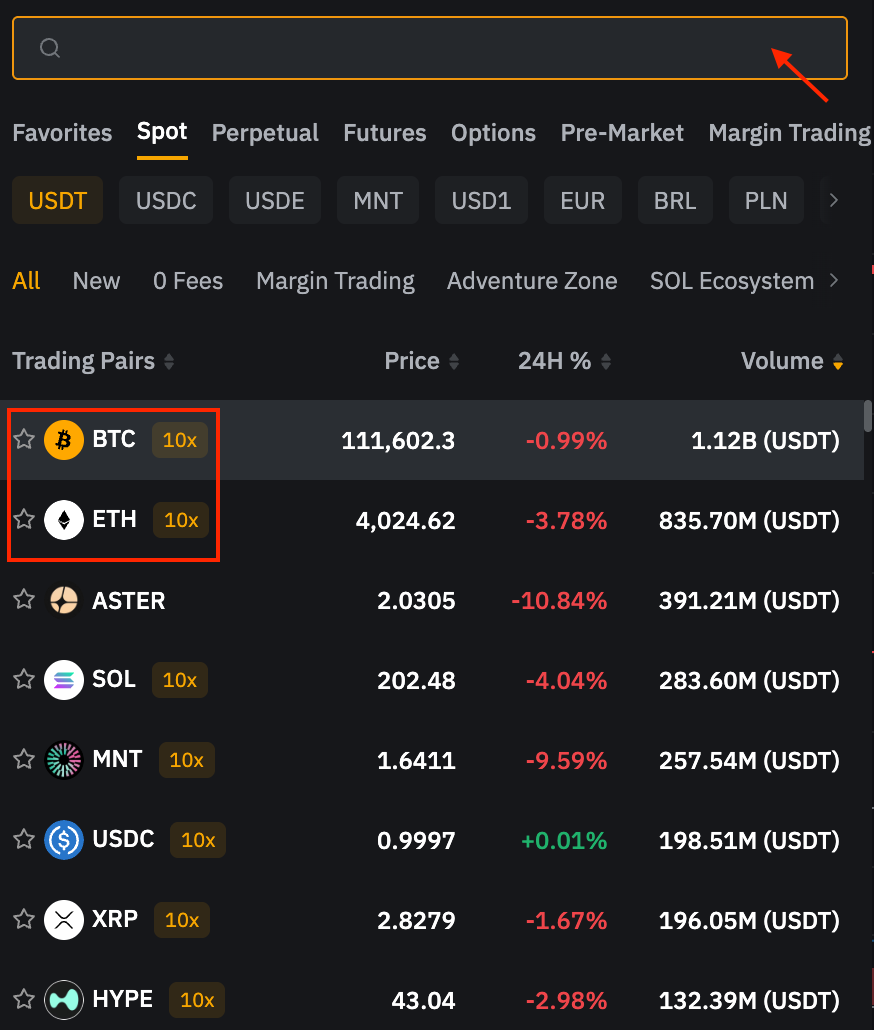

Step 2: Choose your preferred trading pair on the left side of the page by hovering your cursor over the dropdown. You can also see the Last Traded Price and 24-Hour Change Percentage of the corresponding trading pairs. If you would like to enter the trading pair you want to view, simply type it into the Search Box.

Tip: Click on the Star icon to place frequently viewed trading pairs in the Favorites column.

If you see a 10x label beside a certain trading pair, it indicates that the trading pair is supported in Spot Margin Trading.

Place Your Order

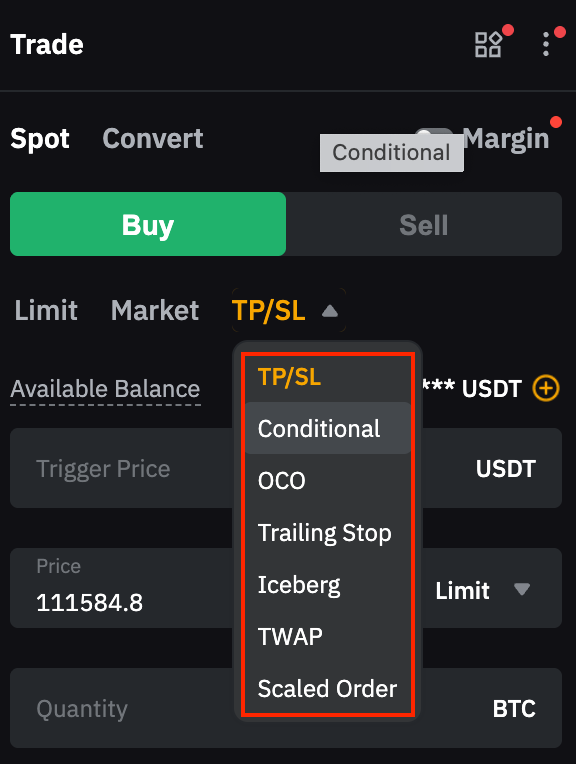

There are various types of orders available with Bybit Spot trading. Learn more here.

Using Market Order as an illustration, create a Spot Order with the following steps.

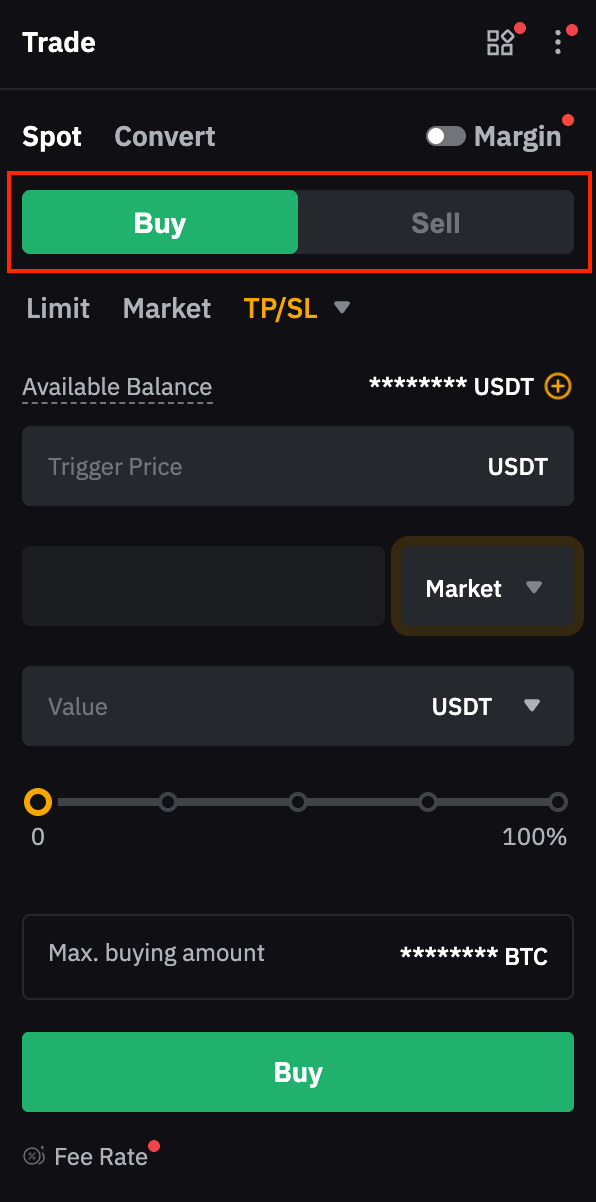

Step 1: Ensure that you’re in the Spot tab. Then, choose to Buy or Sell an asset.

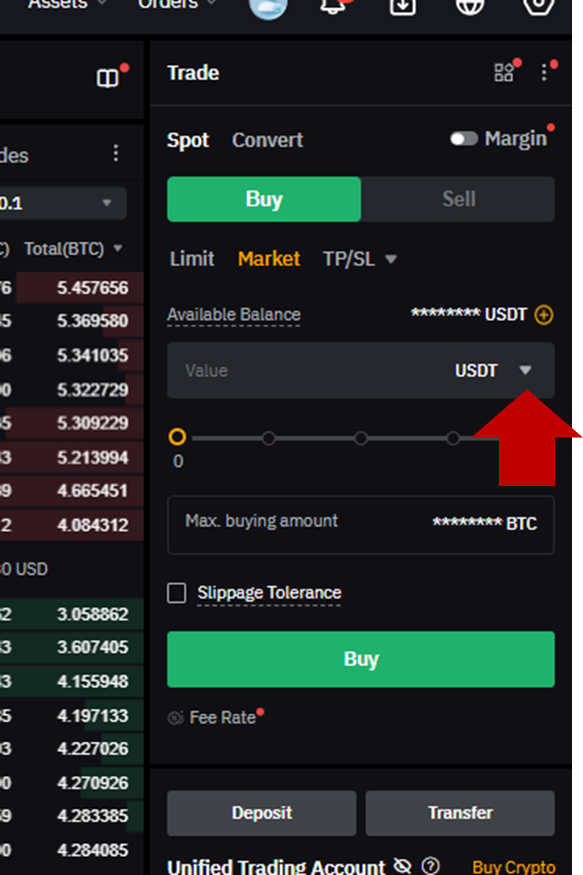

Step 2: Input your order value or quantity. If you place your order through other order types, such as Limit Order and Conditional Order, you will need to enter your order price or trigger price.

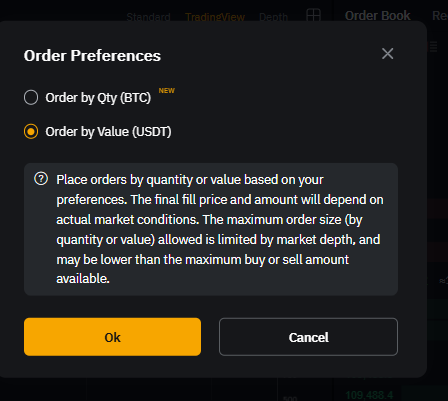

For market buy and sell orders, the default is to place an order by value (market buy) and by quantity (market sell). You can choose Order by Value or Order by Qty to switch your order placement preferences by clicking on the drop-down arrow in the Value field.

Please note that when you select 100% of your available balance to place a market buy or market sell order, there may be a slight difference between the maximum amount or quantity displayed and the value or quantity calculated by our system. This difference acts as a buffer against potential market price changes, ensuring that your order will be placed smoothly even if the price fluctuates slightly.

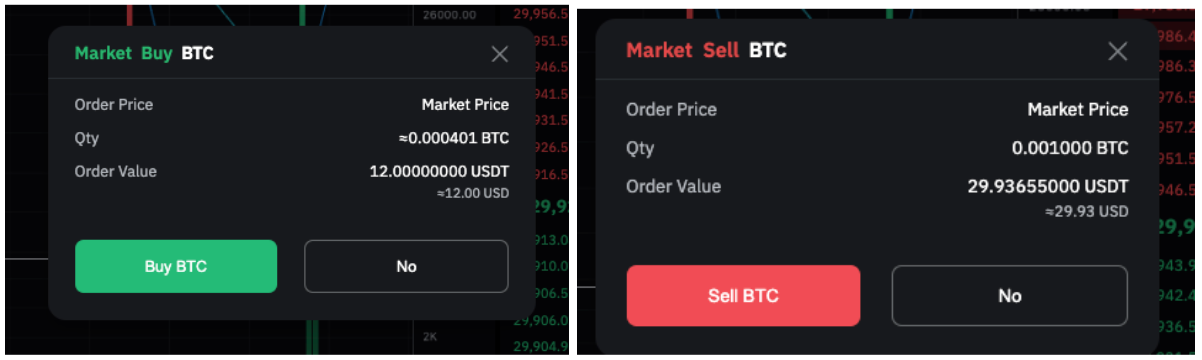

Step 3: A confirmation window will pop up. Once you’ve verified your order details, click on Buy or Sell.

Congratulations! Your order has been successfully placed.

View Your Order

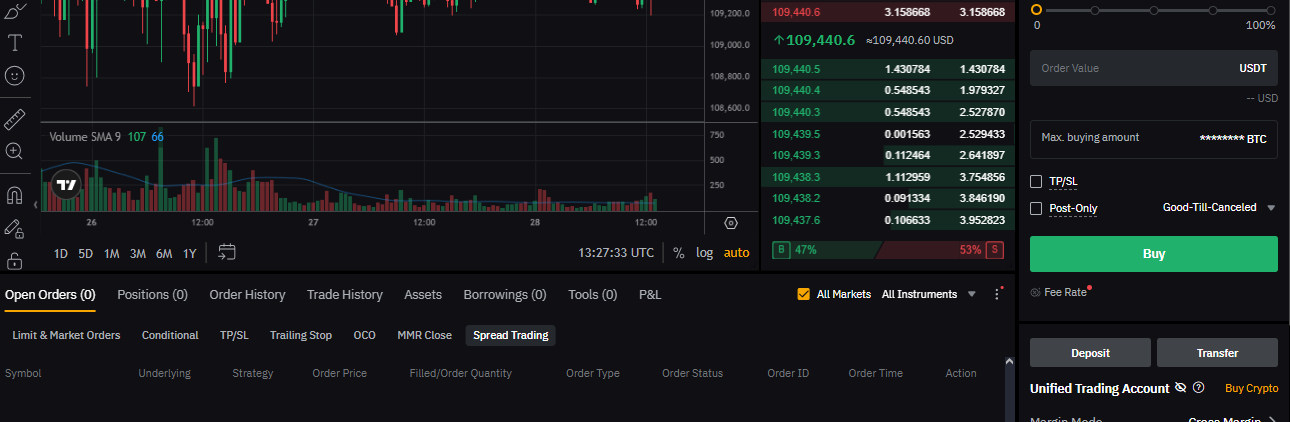

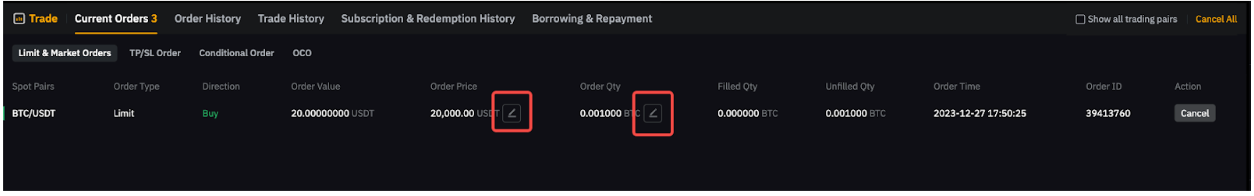

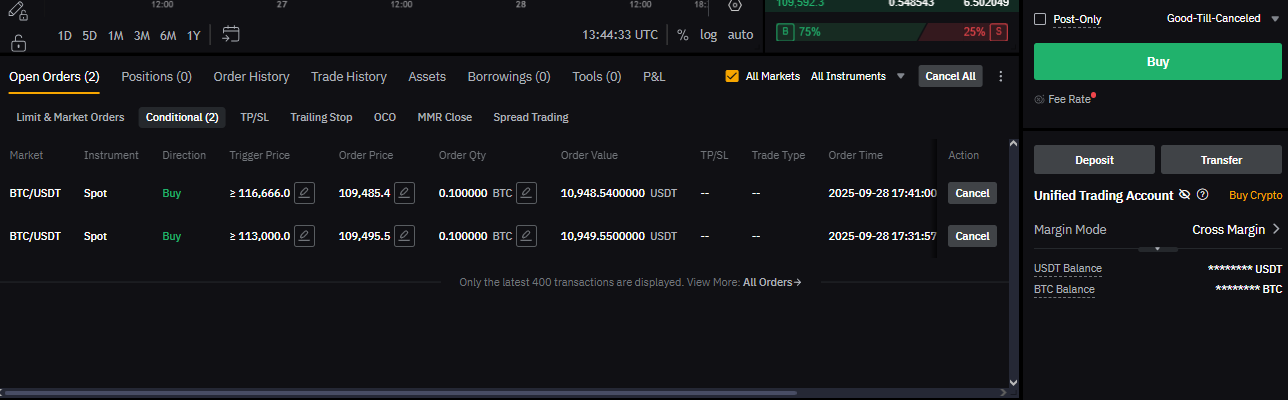

You can view your current unfilled or untriggered orders on the Open Orders tab. If you would like to view all current orders across all trading pairs, simply check the All Markets box.

To edit details such as your Order Price, Trigger Price, or Order Quantity, click on the pencil icon beside your order parameter.

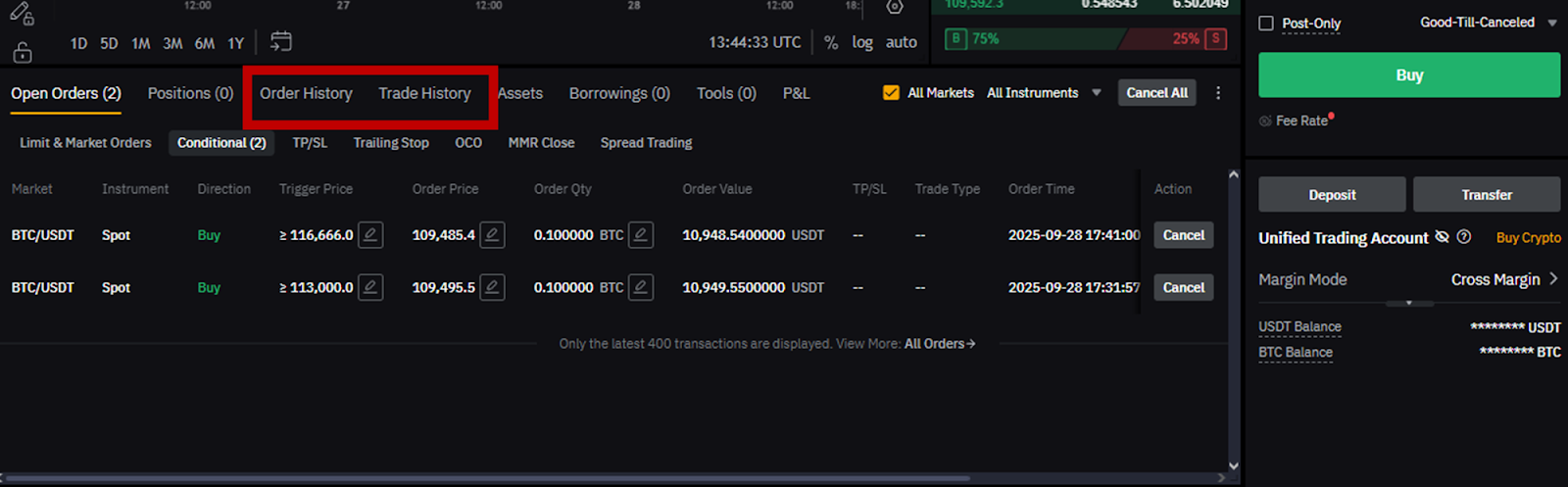

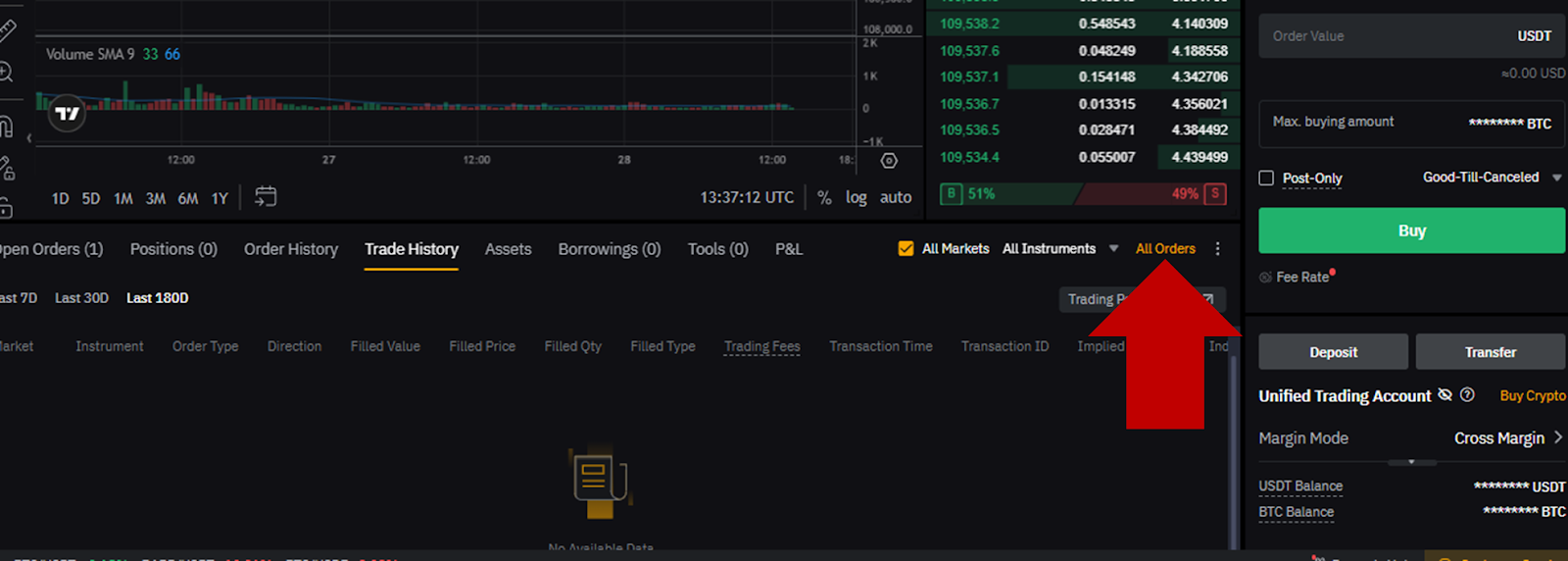

Switch to the Order History or Trade History tab on the Spot Trading page to view up to 50 records from the last six (6) months. Similar to Open Orders, you can check the Show all trading pairs box to view order history or trade history from all trading pairs.

To view records for more than the last six (6) months, click on the All Orders tab to be taken to the All Orders page.

Cancel Your Order

If you would like to cancel Spot orders, navigate to the Open Orders tab and click on Cancel.

Alternatively, you can choose to Cancel All orders from the upper right corner. It's important to note that if you have selected the Show all trading pairs option, clicking on Cancel All will cancel orders from all trading pairs.

Derivatives trading

Bybit allows you to trade Futures, Options and Perpetual Contracts with up to 100x leverage.

For Futures trading

How to place an order/Open a position

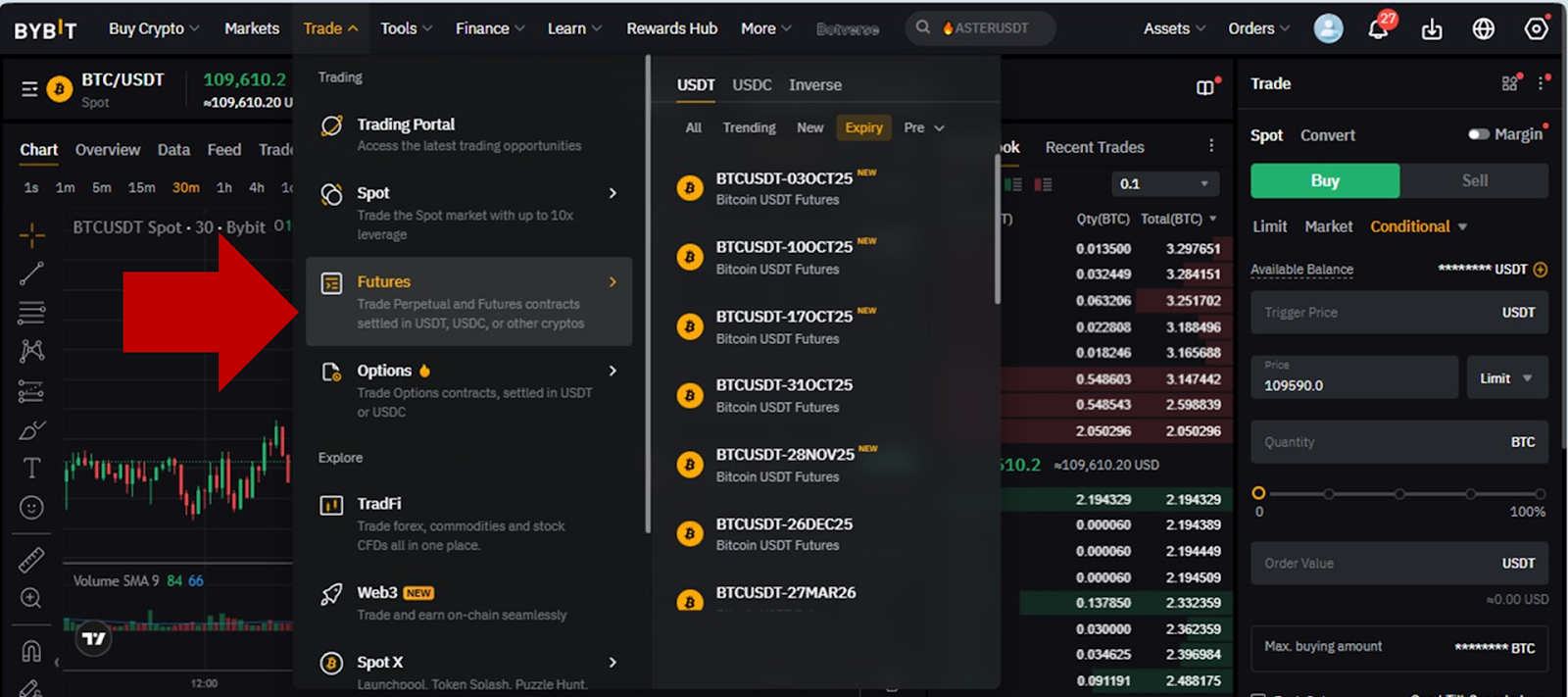

Step 1: From your trading portal page, hover your cursor over the Trade tab and then click on Futures. You’ll be taken to the main Derivatives trading portal.

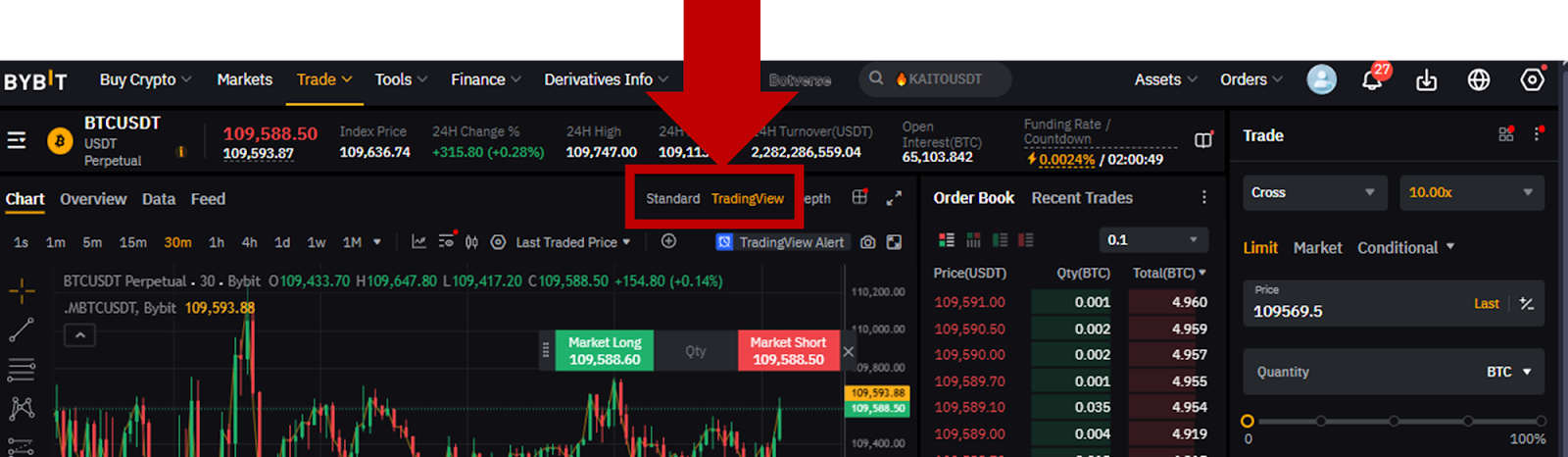

On the trading screen, you can choose between two different main views for your charts, Standard and TradingView.

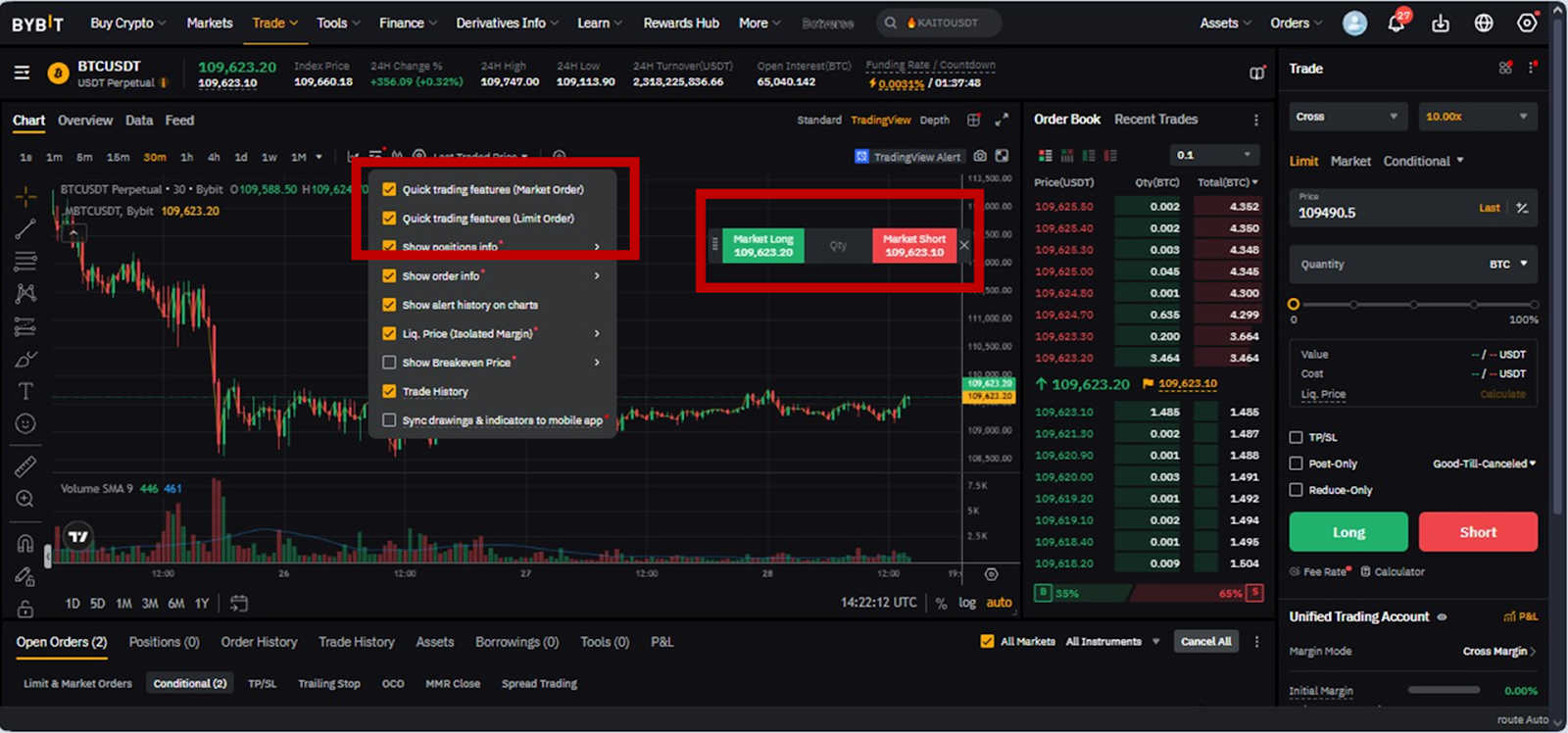

Step 2: You can open a position in two (2) different ways.

You can use the Quick Trading functions on the Trading Chart to quickly place Limit or Market orders.

Alternatively, you can place basic and advanced orders in the order zone on the right, and also personalize the setting for each order based on your trading strategy.

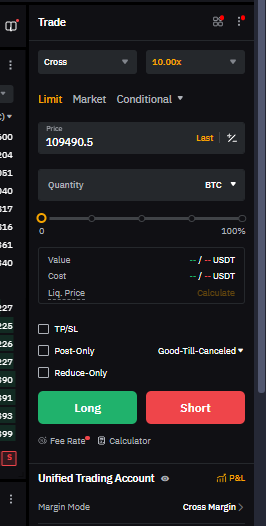

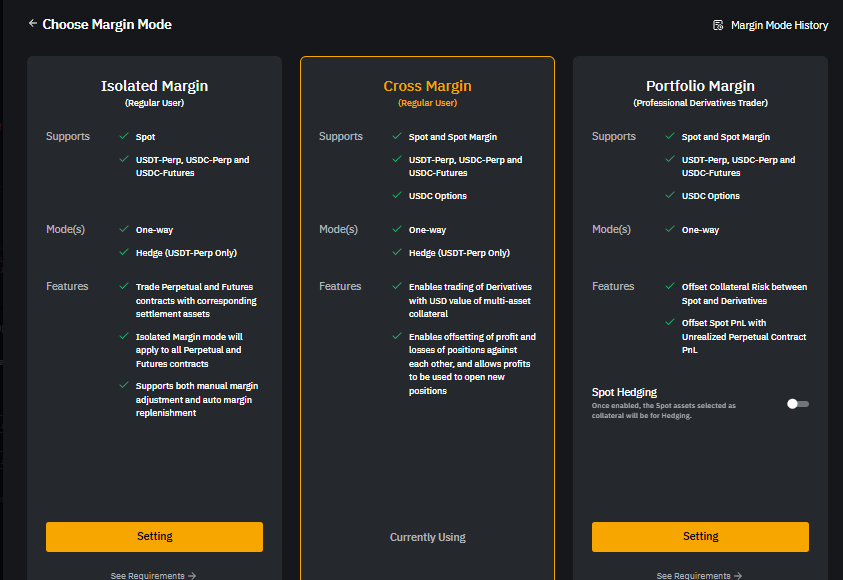

Margin Mode and Leverage

Set the Margin Mode and Leverage that you would like to use for your order. The default order will use Cross Margin with 10x leverage in One-Way Mode. Besides Cross Margin, which is enabled by default, you can also use Isolated Margin and Portfolio Margin. The maximum allowable leverage differs according to different risk limit tier. Once you change the leverage, the initial margin and maintenance margin occupied to the position will be changed accordingly. Click here for more information on the different Margin Modes.

Order Type

Select the type of order you wish to place, and the order zone will show the relevant fields to fill accordingly.

Price Settings

You will need to set up various prices, such as the order price and trigger price, depending on your order type.

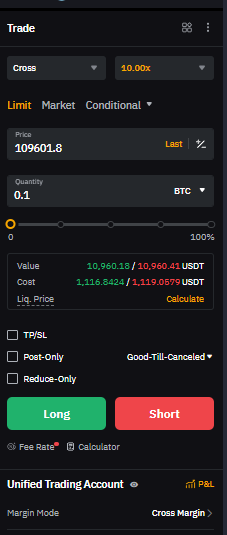

Order Amount

Input your order amount. You can place your order by the quantity, by cost (calculated as Initial Margin + Trading Fees to Open and Close), or by order value (derived from the required margin and selected leverage). Based on the order placement preference selected, you will see the order amount in the other two (2) options and both directions in the box below.

TP/SL

Set up a TP/SL for your order by selecting this option. Once your order is filled, the system will auto-place the pre-set TP/SL order. If you would like to make modifications, you can go to your Open Orders tab to update the TP/SL of your unfilled Limit orders or go to the Positions tab to update the TP/SL of your open position.

Order Settings

For Limit and Conditional orders, additional order settings can be selected to better accommodate your trading strategy:

You can select the order’s execution strategy between GTC (Good-Till-Canceled), IOC (Immediate-Or-Canceled) and FOK (Fill-Or-Kill). The default time in force will be Good-Till-Canceled.

You can select the Post-Only option to avoid Limit orders being filled as a taker order. Please note that by default, Market orders will be executed as taker orders so the Post-Only option will not be available.

If you’re trading in One-Way Mode, you can place a Limit order with the Reduce-Only option or a Conditional order with the Close On Trigger option to ensure that your order will act as a closing or partial closing order.

Position direction

After setting up your order and verifying the entered information, you can proceed to click on the Long/Short buttons to complete the order.

Then, the order will either enter the system or wait to be triggered. It’s not possible to cancel an order that is executed immediately, but you can modify or cancel a pending order by going to the Open Orders tab in your position table.

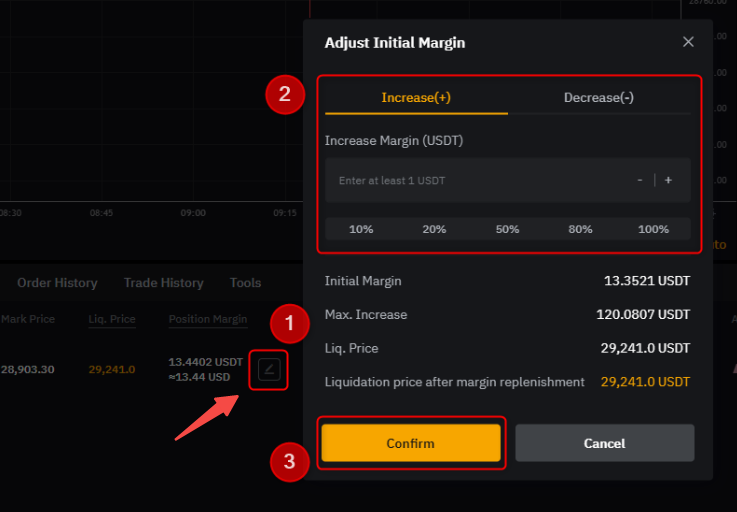

How to adjust Margin on your position

When you’re under Isolated Margin Mode, you can add or reduce the margin of a position. To do so, click on the pencil icon under the Positions tab and enter the new initial margin to be used for the position.

When additional margin is added to the position, the leverage used for opening the position and the leverage in the order zone will not be affected. The liquidation price of the position will be recalculated based on the new position margin. Traders can preview the adjusted liquidation price before confirming the adjustment.

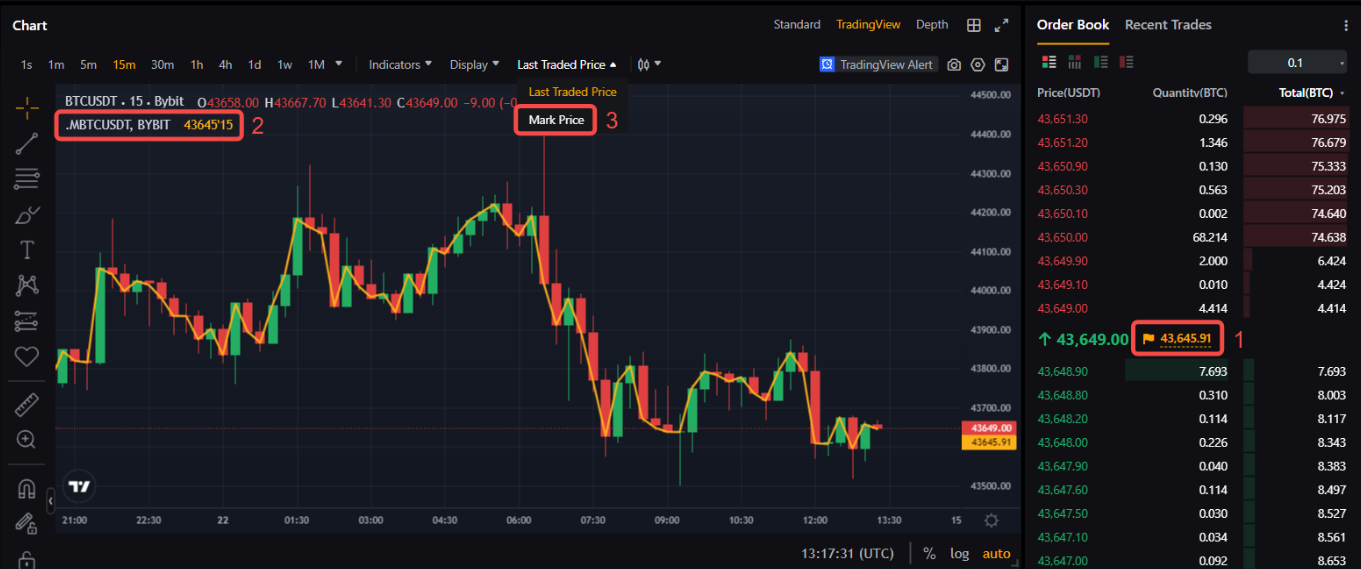

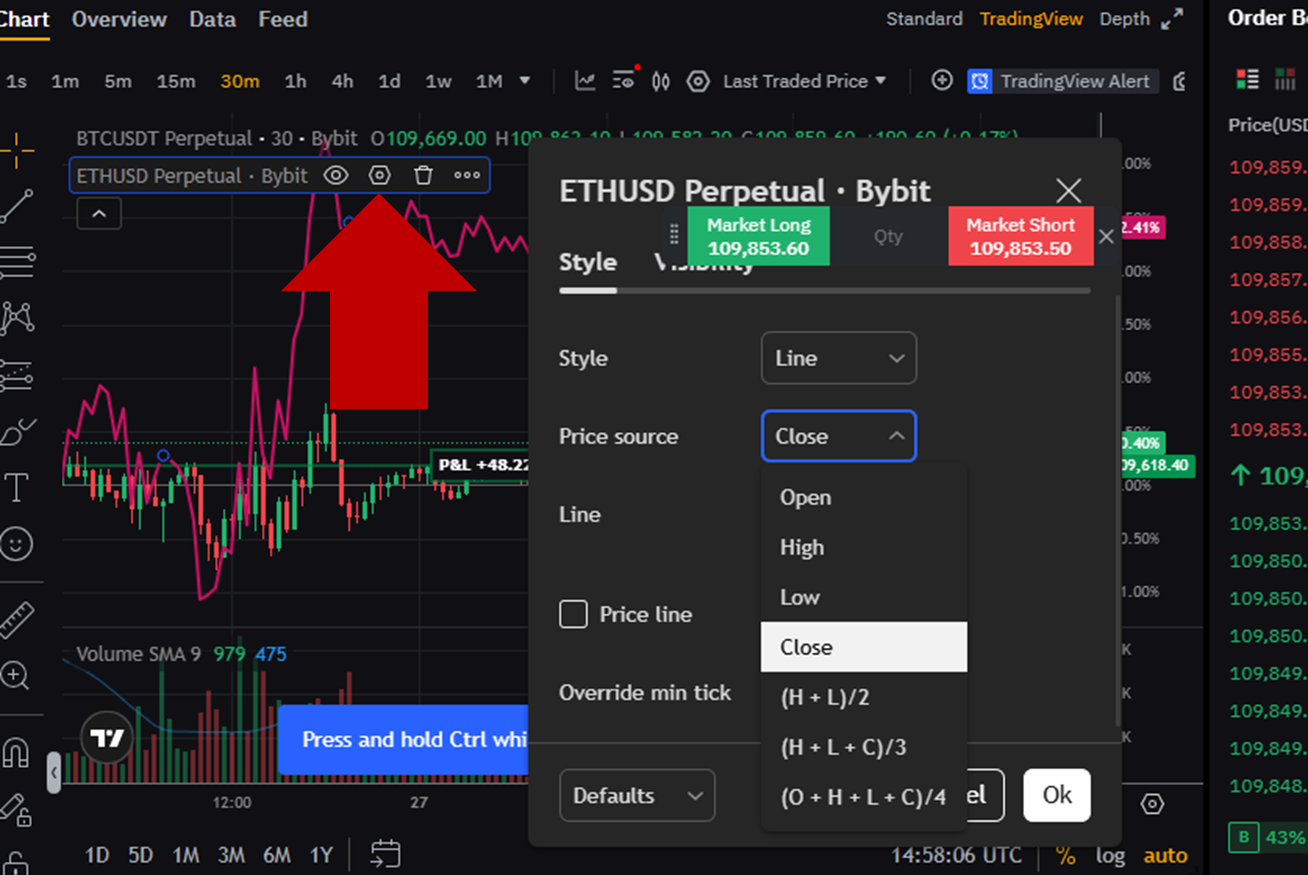

How to check the Mark Price

The Mark Price refers to a global Spot price index along with a decaying funding basis rate. It serves as a reflection of the real-time Spot price observed across major exchanges. Bybit uses Mark Price as a trigger for liquidation and to measure unrealized profit and loss.

Switch your chart from the Last Traded Price chart to the Mark Price chart to view Mark Price.

You may also find the Mark Price displayed in the order book, indicated by the yellow price located to the right of the current Last Traded Price.

On the Last Traded Price chart, you can also see a yellow line representing the changes in the Mark Price. By default, it shows the closing Mark Price. Click on the Settings icon located on the Mark Price bar for a more accurate representation of the Mark Price depending on the direction of your position.

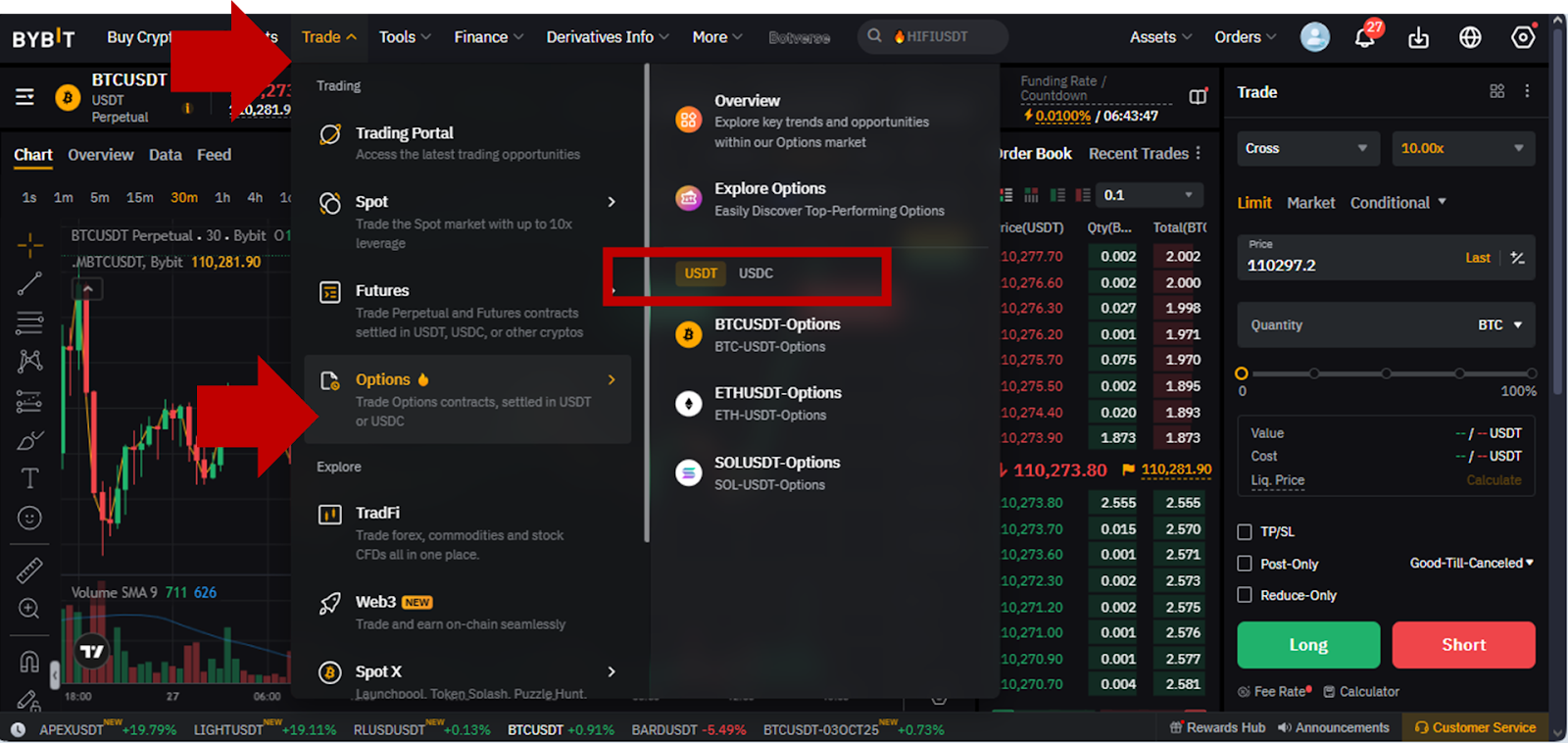

For Options trades

How to place an order/Open a position

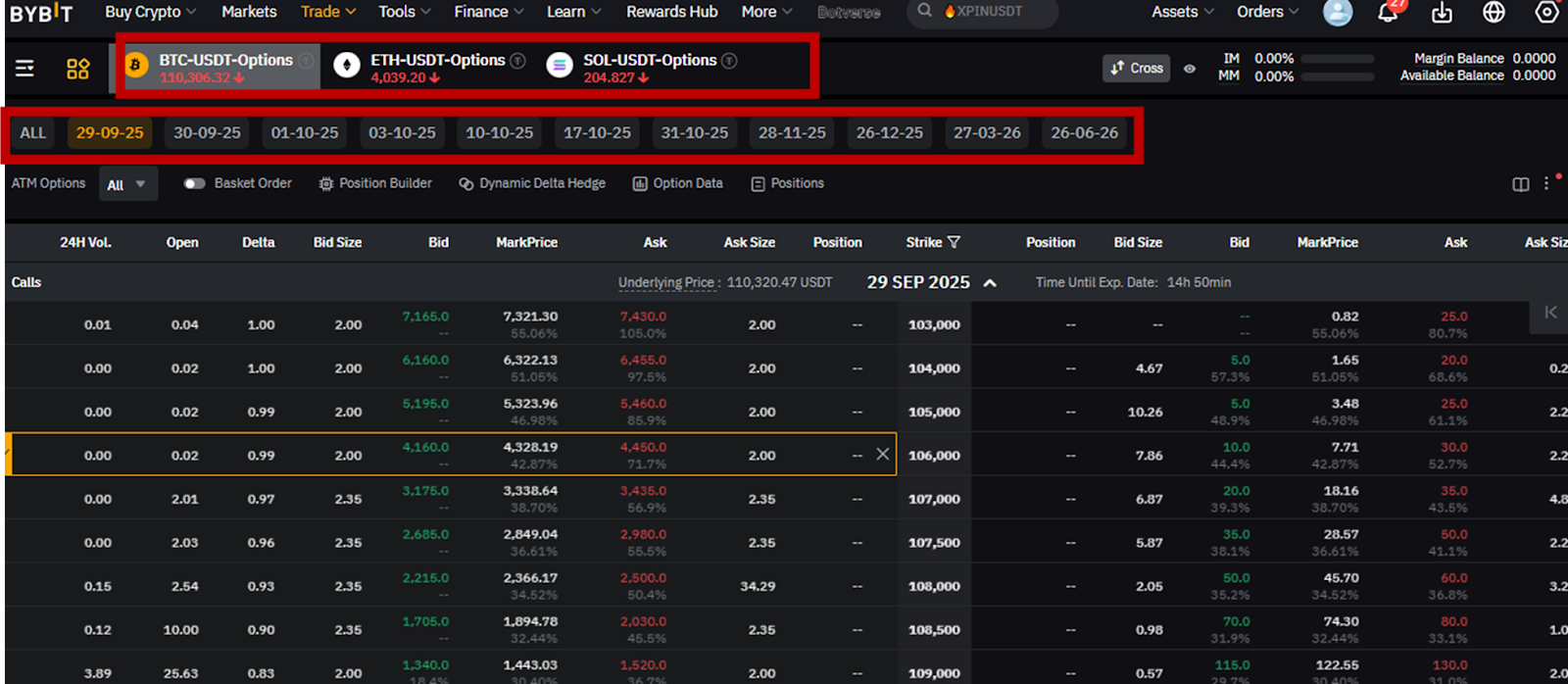

Step 1: From your trading portal page or homepage, hover your cursor over the Trade tab, then Options, then choose if you’d like to see USDT or USDC Options and click on a preferred product (you can always change it later to a different Options contract in the main interface).

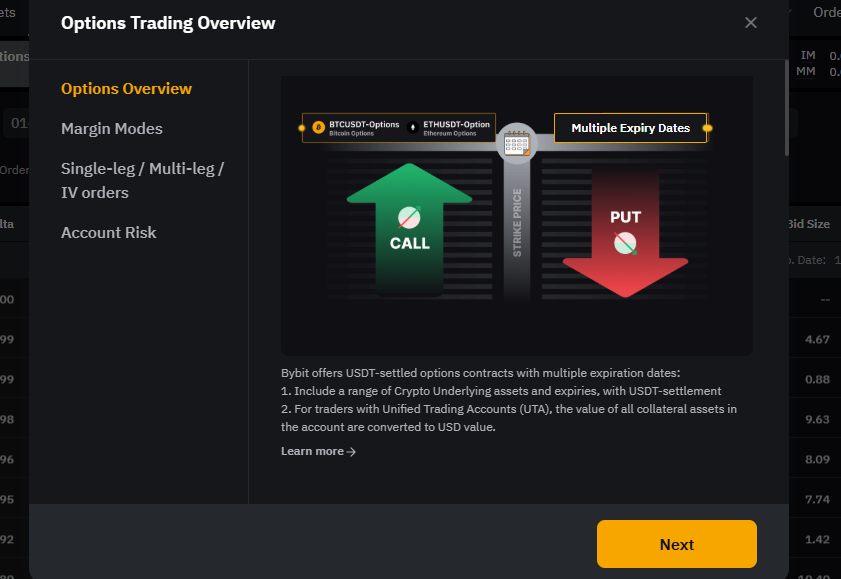

Step 2: If this is your first time using the interface, you may see a window that provides an explanation of Bybit’s Options. Click on Next at each explanation step to proceed to the platform’s main Options chain.

Step 3: In the main Options chain interface, select a specific contract, expiration date, and Call (on the left) or Put (on the right).

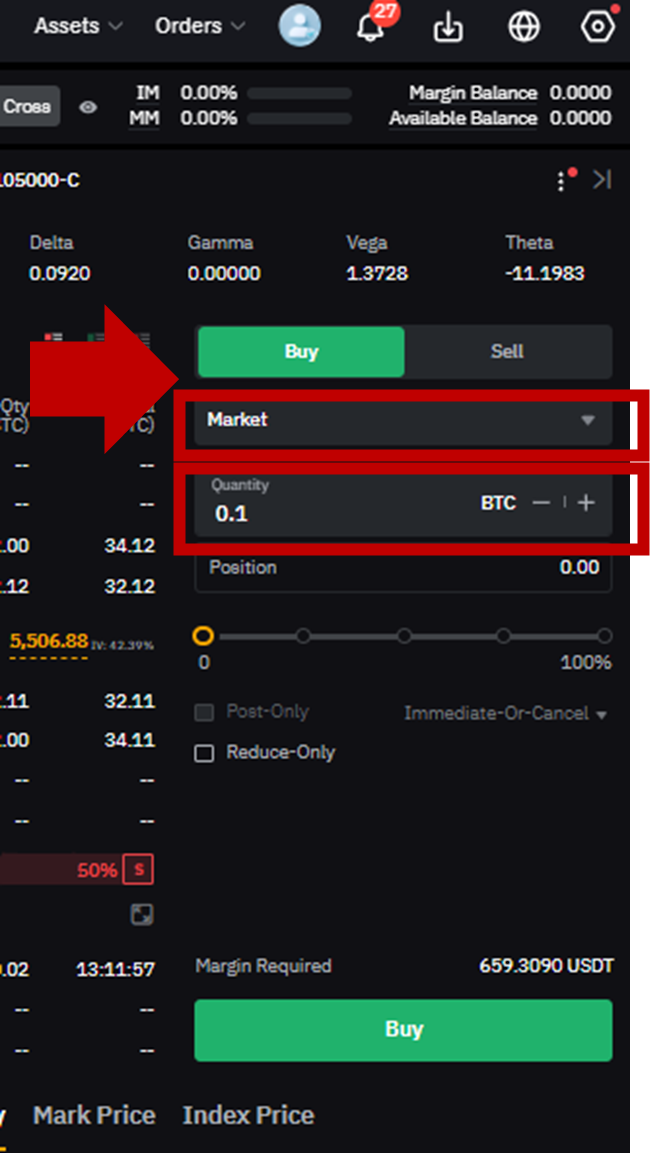

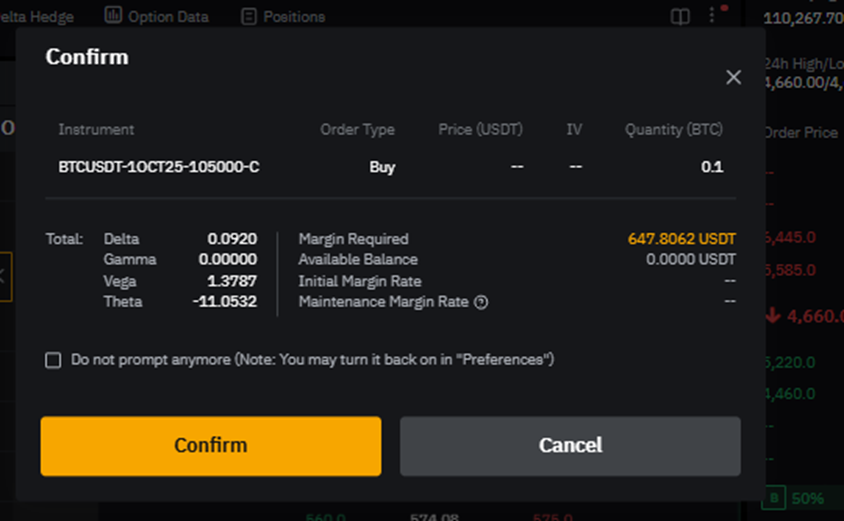

Step 4: After you’ve selected a Call or Put Options order from the chain, an order screen will appear on the right. Specify your Options order details here (Market or Limit order, and Quantity for Market orders OR Quantity & (Limit) Price for Limit orders). Also choose Buy or Sell.

Step 5: After specifying your order details, click on the Buy/Sell button located in the lower part of the order panel. You’ll see a screen asking you to confirm your order details. Review your order, and click on Confirm. Your Options order will be created.

Opening trades on the Bybit App mobile application

You can also use Bybit’s Spot and Derivatives products with the Bybit App mobile application. If you don’t have it yet, first download the App from the Bybit website, App Store or Google Play, and install it on your mobile device. The Bybit App allows you to access all of the main trading products and services on the platform, just as on the desktop version.

Opening Spot trades on the Bybit App

Step 1: After opening the App, tap on Trade in the bottom menu.

Step 2: You’ll be taken to your trading page with the Spot section activated by default. If you’re not in the Spot section, tap on Spot in the top menu.

Step 3: Tap on the green Buy or red Sell button in the screen above to place your order. You’ll be directed to the Spot order interface, where you can provide your order details, check your existing orders, cancel them and perform all the other operations (just as in the desktop version, as described in the relevant section above).

Opening Derivatives trades on the Bybit App

For Futures trades

Step 1: After opening the App, tap on Trade in the bottom menu.

Step 2: Tap on the Futures tab in the top menu.

Step 3: Tap on the green Long or red Short button to place your order. You’ll be taken to the Futures order page, where you can specify your order details, check your existing orders, cancel them and perform all the other operations (just as in the desktop version).

For Options trades

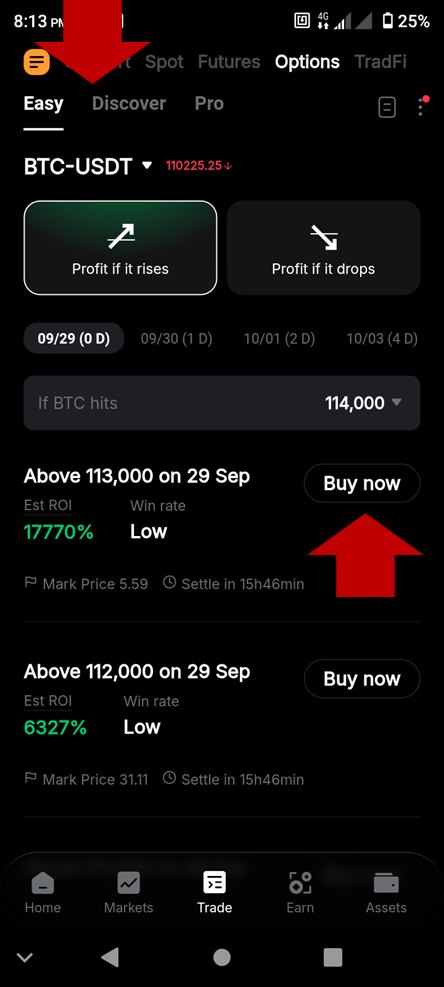

Step 1: After opening the App, tap on Trade in the bottom menu.

Step 2: Tap on the Options tab in the top menu.

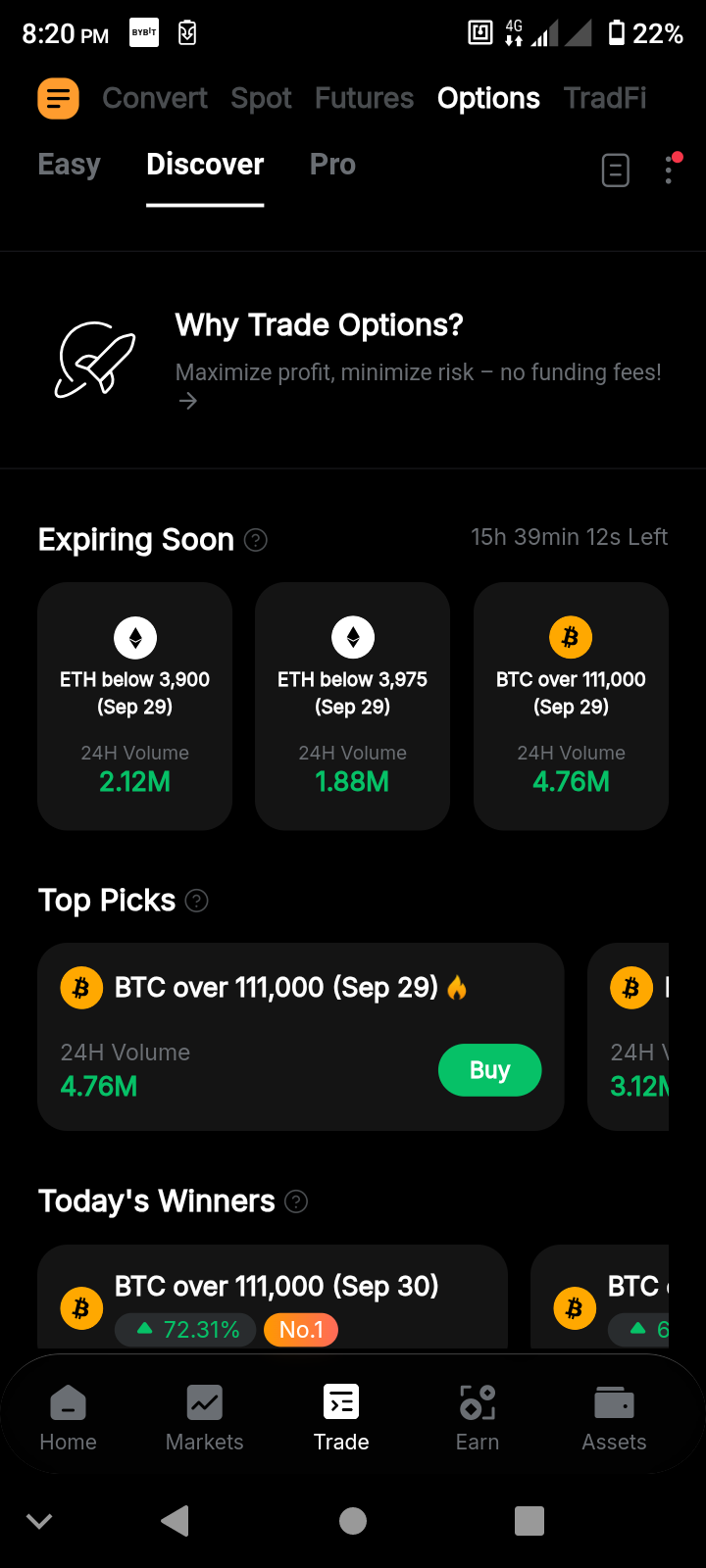

Step 3: In the main Options screen, you can choose from three interface modes: Easy, Discover and Pro. You can change the mode by tapping on a preferred choice.

The Easy mode is designed for beginners, in order to let them quickly choose from popular Options products. You can view the available choices and tap on Buy now next to your preferred Options contract. You’ll be taken to a screen where you can specify the amount you’d like to place an order for, and tap on the Buy button to activate the contract.

Discover mode shows a selection of trending, expiring-soon and other notable Options contracts. Tap on your preferred contract, specify the quantity you wish to buy, and tap on the Buy button to activate the contract.

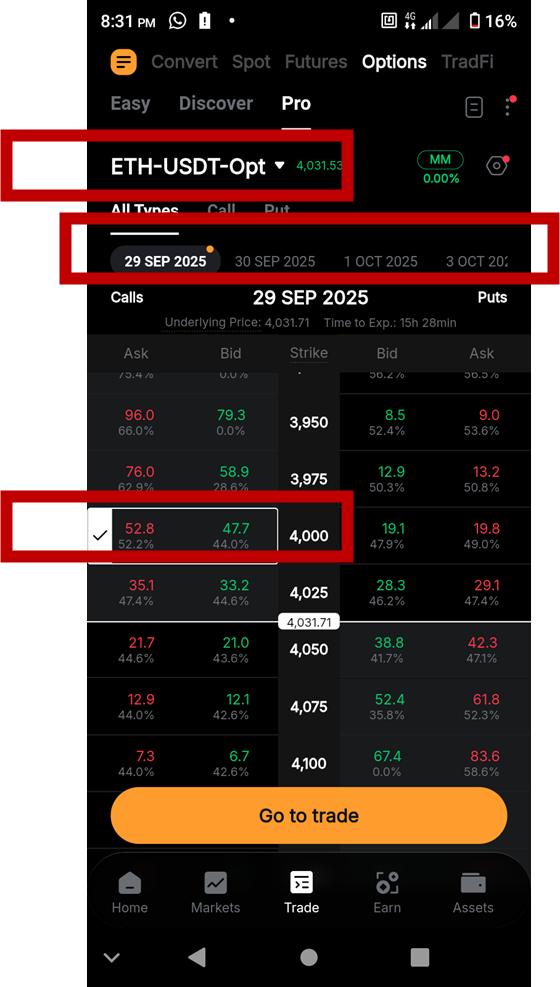

Pro mode is designed for experienced Options traders. It displays the complete Options chain, including all available Call and Put contracts and their corresponding expiration dates. In the Options grid, select your preferred contract, expiration date and Call Option (on the left) or Put Option (on the right). After you tap on your selection, the Go to trade button will appear. Tap on this button and you’ll be led to the order page, where you can specify your order details and buy/sell the Options contract.

Now that you know how to open a trade in Bybit, you can proceed to kick-start your trading and investing journey. If you’re ever unsure or need assistance, you can contact our 24/7 customer support, or check out our Bybit Learn page for more guides.

#LearnWithBybit